Going to college is an exciting time. You get to meet new people and learn new things. But, if you have a car, you also need car insurance. Car insurance can be expensive. But don’t worry! We are here to help you find the best car insurance for college students.

Credit: www.policygenius.com

Why Do College Students Need Car Insurance?

Car insurance is important for everyone. It helps pay for damages if you have an accident. It also helps if your car is stolen. Without car insurance, you could end up paying a lot of money. College students often have tight budgets. So, having car insurance can save you a lot of trouble.

Credit: www.ramseysolutions.com

Types of Car Insurance Coverage

There are different types of car insurance coverage. Let’s look at the main ones:

- Liability Insurance: This pays for damages you cause to others.

- Collision Insurance: This pays for damages to your car from an accident.

- Comprehensive Insurance: This pays for non-accident damages like theft or fire.

- Personal Injury Protection (PIP): This pays for medical bills if you get hurt.

- Uninsured/Underinsured Motorist Insurance: This helps if the other driver has no insurance.

How to Save Money on Car Insurance

College students can save money on car insurance. Here are some tips:

- Good Student Discount: If you get good grades, you might get a discount.

- Safe Driver Discount: If you have no accidents, you can save money.

- Bundle Insurance: If you have renters or life insurance, bundle it with car insurance.

- Low Mileage Discount: If you don’t drive much, you might get a discount.

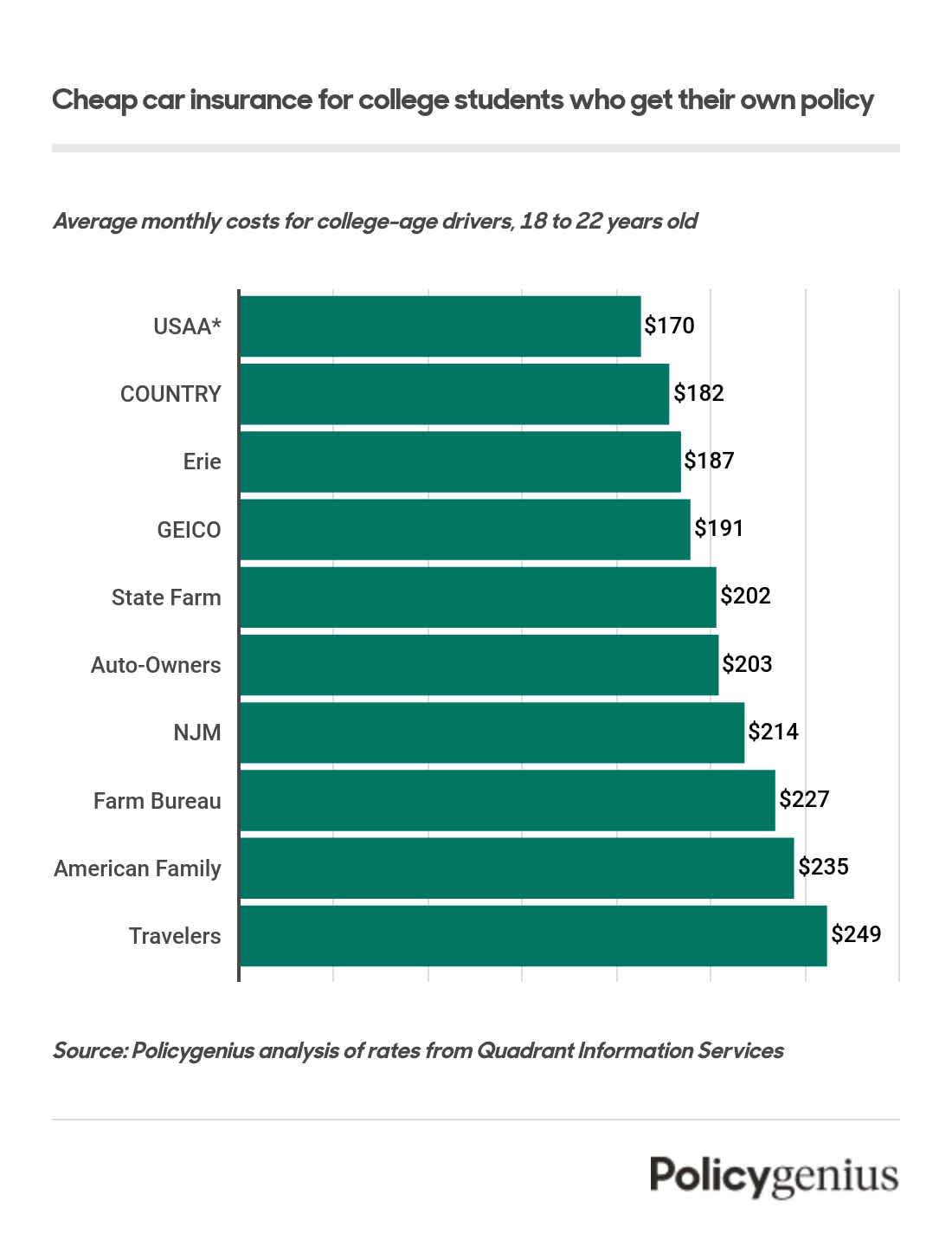

- Shop Around: Compare different insurance companies to find the best deal.

How to Choose the Right Insurance Company

Choosing the right insurance company is important. You want a company that is reliable and offers good customer service. Here are some steps to help you choose:

- Research: Look for reviews and ratings online.

- Ask for Recommendations: Ask friends and family for their opinions.

- Compare Quotes: Get quotes from different companies.

- Check for Discounts: See if the company offers student discounts.

- Read the Fine Print: Make sure you understand the policy details.

What to Do After Getting Car Insurance

Once you have car insurance, there are some things you should do:

- Keep Your Insurance Card: Always keep your insurance card in your car.

- Know Your Coverage: Understand what your policy covers.

- Report Changes: Inform your insurance company if you move or get a new car.

- Pay Your Premiums: Make sure to pay your insurance premiums on time.

Common Mistakes to Avoid

College students often make mistakes when getting car insurance. Here are some common mistakes to avoid:

- Not Comparing Quotes: Always compare quotes from different companies.

- Choosing the Cheapest Option: The cheapest option might not be the best.

- Ignoring Discounts: Always ask about available discounts.

- Not Understanding the Policy: Make sure you understand what is covered.

- Letting Coverage Lapse: Never let your coverage lapse. Always renew on time.

FAQ: Car Insurance for College Students

Here are some common questions about car insurance for college students:

| Question | Answer |

|---|---|

| Can I stay on my parents’ insurance? | Yes, you can. It might be cheaper. |

| Do I need car insurance if I don’t drive? | No, but you should have insurance if you drive occasionally. |

| What happens if I get into an accident? | Your insurance will help pay for damages. |

| How can I lower my premiums? | Ask for discounts and drive safely. |

| Do I need full coverage? | It depends. Full coverage is more expensive but offers more protection. |

Frequently Asked Questions

What Is Car Insurance For College Students?

Car insurance for college students provides coverage for accidents, theft, and damages while they are away at school.

How Can College Students Save On Car Insurance?

College students can save by maintaining good grades, taking defensive driving courses, and comparing multiple insurance quotes.

Does Car Insurance Cost More For College Students?

Yes, car insurance can be more expensive for college students due to their age and limited driving experience.

Are There Discounts For College Students?

Yes, many insurance providers offer discounts for good grades, safe driving records, and bundling policies.

Do College Students Need Their Own Car Insurance?

Not always. Some students can remain on their parents’ policy, especially if they live at home or only use the car occasionally.

Conclusion

Car insurance is important for college students. It helps protect you and your car. Make sure to choose the right coverage. Look for ways to save money. Always compare different insurance companies. Follow our tips to find the best car insurance for college students.