Car insurance is a must for every vehicle owner. But what if you have more than one car? This guide will help you understand car insurance for multiple vehicles.

Why Insure Multiple Vehicles?

Having car insurance for multiple vehicles is important. It protects all your cars from accidents, theft, and damages. You also save money with multi-car discounts.

Multi-car Insurance Discounts

Many insurance companies offer discounts for insuring multiple vehicles. This means you can save money by combining all your cars under one policy.

How Does Multi-Car Insurance Work?

Multi-car insurance is simple. You add all your vehicles to one insurance policy. This way, you have one policy with several cars listed.

Benefits Of Multi-car Insurance

- Cost Savings: Multi-car insurance often costs less than separate policies.

- Convenience: Manage all your car insurance needs in one place.

- Flexibility: Different coverage options for each vehicle.

How to Get Multi-Car Insurance

Getting multi-car insurance is easy. Follow these steps to get started:

- List all vehicles you want to insure.

- Contact your insurance company or use their website.

- Ask about multi-car discounts and policies.

- Provide information about each vehicle.

- Choose the best coverage options for each car.

- Review your policy and make sure all details are correct.

- Pay your premium and get your insurance documents.

Choosing The Right Coverage

Each car might need different coverage. Here are some types of coverage to consider:

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damages you cause to others. |

| Collision Coverage | Covers damages to your car in an accident. |

| Comprehensive Coverage | Covers non-collision damages like theft or weather. |

| Uninsured Motorist Coverage | Covers damages from uninsured drivers. |

| Medical Payments Coverage | Covers medical costs after an accident. |

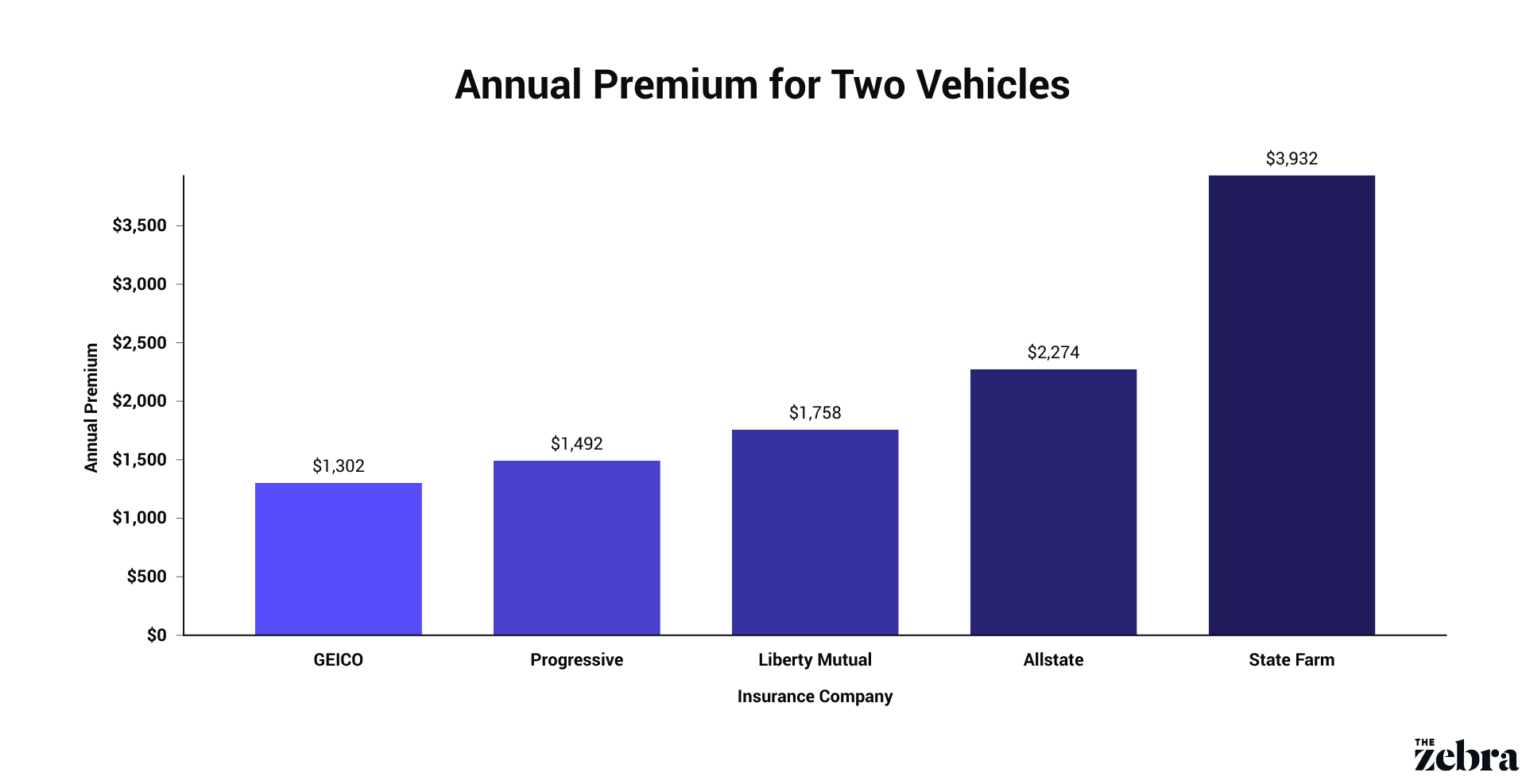

Credit: www.thezebra.com

Credit: www.amazon.com

Factors Affecting Multi-Car Insurance Rates

Several factors can affect your multi-car insurance rates. These include:

- Number of Vehicles: More cars can mean higher premiums.

- Vehicle Types: Sports cars cost more to insure than sedans.

- Driver Histories: Drivers with clean records get lower rates.

- Coverage Levels: Higher coverage means higher premiums.

- Location: Urban areas usually have higher rates.

Tips To Save On Multi-car Insurance

Here are some tips to help you save money on your multi-car insurance:

- Compare quotes from different insurance companies.

- Ask about multi-car discounts and other savings.

- Consider bundling other insurance policies, like home insurance.

- Maintain a good driving record to get lower rates.

- Choose higher deductibles to lower your premium.

Common Questions About Multi-Car Insurance

Can I Insure Different Types Of Vehicles?

Yes, you can insure different types of vehicles. This includes cars, trucks, and motorcycles. Just make sure to provide all the details to your insurance company.

Can I Add A New Car To My Existing Policy?

Yes, you can add a new car to your existing policy. Contact your insurance company to update your policy and get the new car insured.

Do All Drivers Need To Live At The Same Address?

Not always. Some insurance companies allow drivers from different addresses. Check with your insurer for their specific rules.

Final Thoughts

Car insurance for multiple vehicles is a smart choice. It offers protection and savings for all your cars. Follow this guide to get the best coverage and save money on your multi-car insurance.

FAQs

What Is Multi-car Insurance?

Multi-car insurance is a policy that covers more than one vehicle under one insurance plan.

How Do I Get A Multi-car Discount?

Contact your insurance company and ask about multi-car discounts. Provide details of all your vehicles to get a quote.

Can I Have Different Coverage For Each Car?

Yes, you can choose different coverage levels for each vehicle based on your needs.

Is Multi-car Insurance Cheaper Than Separate Policies?

Usually, multi-car insurance is cheaper due to the discounts offered by insurance companies.

What Information Do I Need To Get A Multi-car Insurance Quote?

You will need details of each vehicle, driver information, and your desired coverage levels.

Can I Add A Family Member’s Car To My Multi-car Policy?

Yes, you can add a family member’s car to your policy, depending on your insurer’s rules.

What Happens If I Sell One Of The Insured Cars?

Contact your insurance company to update your policy. They will adjust your premium accordingly.

Can I Insure A Car That I Don’t Drive Often?

Yes, you can insure a car you don’t drive often. Just choose the right coverage for its use.

Do I Need To Insure A Leased Or Financed Car?

Yes, leased or financed cars need insurance. This is usually required by the leasing or finance company.

Can I Cancel My Multi-car Policy Anytime?

Yes, you can cancel your policy anytime. Contact your insurance company to discuss cancellation options and any potential fees.

Are There Any Downsides To Multi-car Insurance?

One downside is that all drivers’ records affect the premium. If one driver has a poor record, it can raise the rates for all cars.

Frequently Asked Questions

What Is Multi-car Insurance?

Multi-car insurance covers multiple vehicles under one policy, often offering discounts and simplified management.

How Does Multi-car Insurance Work?

It combines multiple vehicles into one policy, providing a single renewal date and often a lower overall premium.

Can I Get Discounts For Multiple Cars?

Yes, most insurers offer discounts for insuring multiple vehicles, potentially saving you money.

Are All Cars On The Same Policy?

Yes, all vehicles are listed under one policy, making it easier to manage and renew.

Is Multi-car Insurance Cost-effective?

Yes, it often reduces total premiums compared to separate policies for each vehicle.