Driving in the USA can be an exciting experience. But if you are a non-US citizen, you need to know about car insurance. This guide will help you understand car insurance for non-US citizens. Let’s dive in!

Why Non-US Citizens Need Car Insurance

Car insurance is important for everyone. It protects you and others on the road. Here are a few reasons why non-US citizens need car insurance:

- Legal Requirement: Most states in the USA require car insurance.

- Financial Protection: It covers expenses if you have an accident.

- Peace of Mind: You can drive without worrying about accidents.

Types of Car Insurance for Non-US Citizens

There are different types of car insurance. Here are the main types:

| Type of Insurance | Description |

|---|---|

| Liability Insurance | Covers damages to others if you cause an accident. |

| Collision Insurance | Covers damages to your car in an accident. |

| Comprehensive Insurance | Covers non-accident-related damages like theft or weather. |

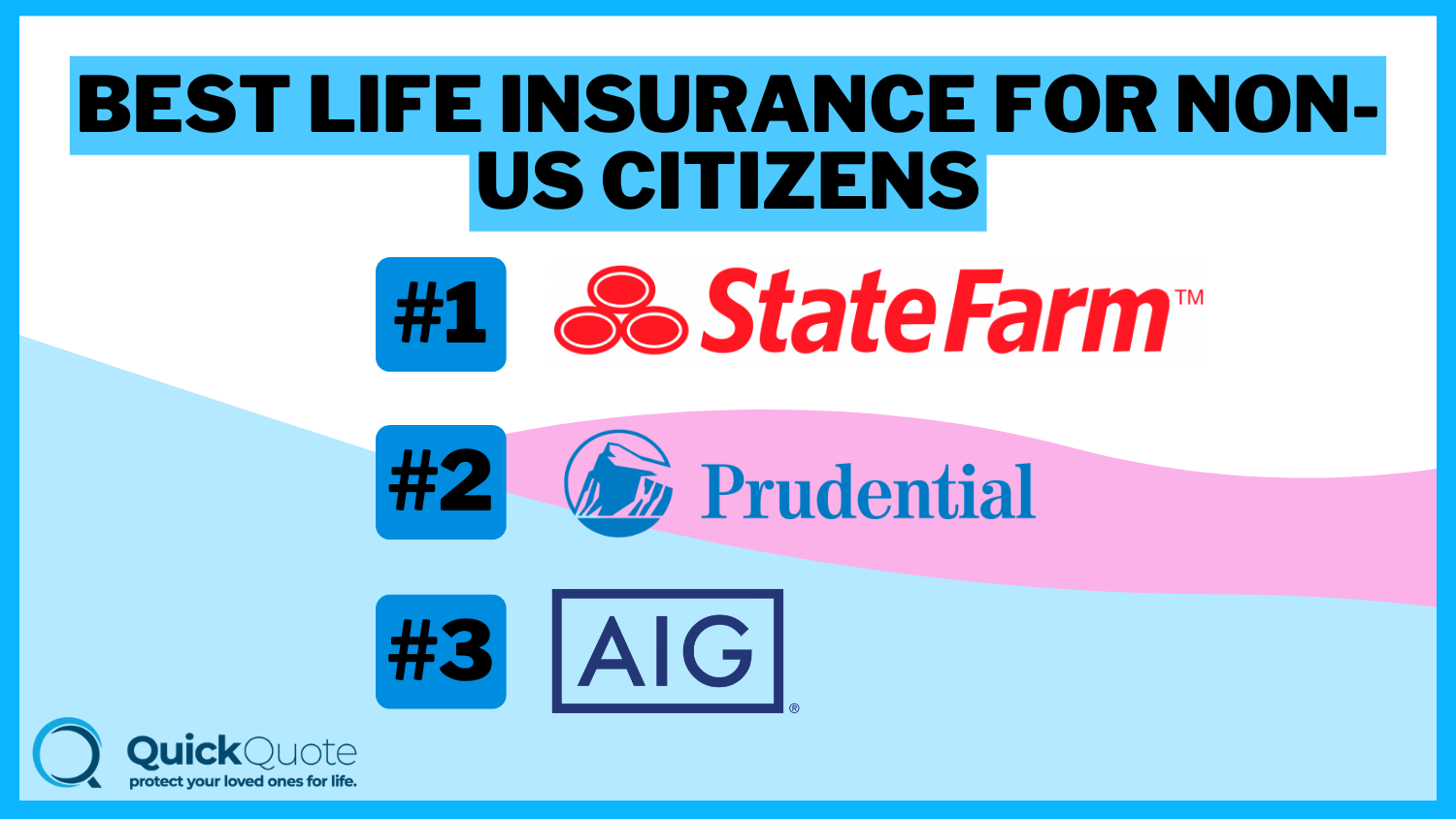

Credit: www.quickquote.com

Credit: www.generalinsurance.com

How to Get Car Insurance as a Non-US Citizen

Getting car insurance might seem hard, but it is not. Follow these steps to get car insurance:

- Check Your Visa Status: Some visas may have restrictions.

- Get a Driver’s License: You need a valid driver’s license.

- Compare Quotes: Compare prices from different companies.

- Choose the Right Coverage: Pick the coverage that suits your needs.

- Purchase the Policy: Buy the insurance policy and make payments.

Documents Needed for Car Insurance

Insurance companies will ask for certain documents. Here is a list of what you might need:

- Valid driver’s license

- Passport or visa

- Proof of residence

- Vehicle registration

- Driving history (if available)

Tips for Non-US Citizens to Save on Car Insurance

Car insurance can be expensive. Here are some tips to save money:

- Drive Safely: A clean driving record can lower your rates.

- Choose a Higher Deductible: This can reduce your premium.

- Bundle Policies: Combine car insurance with other policies.

- Take a Defensive Driving Course: Some companies offer discounts for this.

- Shop Around: Compare different insurance companies.

Frequently Asked Questions (FAQs)

Here are some common questions non-US citizens have about car insurance:

- Can I get car insurance with an international driver’s license?

- Yes, some companies offer this. But it is better to get a US driver’s license.

- Do I need car insurance if I am a tourist?

- Yes, if you plan to drive, you need insurance.

- Will my foreign car insurance cover me in the USA?

- Most likely not. You need a policy from a US insurance company.

Frequently Asked Questions

Can Non-us Citizens Get Car Insurance?

Yes, non-US citizens can obtain car insurance in the U. S. with a valid driver’s license and necessary documentation.

What Documents Are Needed For Car Insurance?

Non-US citizens need a valid driver’s license, visa or passport, and proof of residency to get car insurance.

Is An International Driver’s License Accepted?

Yes, many insurance companies accept international driver’s licenses. Check with your provider for specific requirements.

How To Find Affordable Car Insurance?

Compare quotes from multiple insurers online. Look for discounts and consider your coverage needs to find the best rate.

Can Non-us Citizens Get Full Coverage?

Yes, non-US citizens can get full coverage, including liability, collision, and comprehensive, depending on the insurer’s policies.

Conclusion

Car insurance for non-US citizens is very important. It helps you stay safe and legal on the road. Follow this guide to get the right car insurance. Enjoy your time driving in the USA!