Are you a new driver looking for the cheapest car insurance? You’re in the right place. Finding affordable car insurance as a new driver can be tough. But don’t worry, we have tips and tricks to help you save money.

Why is Car Insurance Expensive for New Drivers?

New drivers often face high insurance costs. This is because they have little or no driving history. Insurance companies see them as high-risk drivers. Here are some reasons why:

- New drivers have less experience.

- They are more likely to get into accidents.

- They may not know all the traffic rules yet.

Tips to Find Cheap Car Insurance

Here are some tips to help you find cheap car insurance:

- Shop Around: Don’t settle for the first quote. Compare prices from different companies.

- Ask for Discounts: Many companies offer discounts for students, good grades, and safe driving courses.

- Choose a Safe Car: Cars with safety features often have lower insurance rates.

- Increase Your Deductible: A higher deductible can lower your premium.

- Bundle Policies: If you have other types of insurance, like home or renters, bundle them to save money.

Best Companies for Cheap Car Insurance

Here are some of the best companies offering cheap car insurance for new drivers:

| Company | Average Annual Premium | Discounts |

|---|---|---|

| Geico | $1,200 | Good Student, Multi-Car, Safe Driver |

| State Farm | $1,350 | Good Student, Safe Driver, Driver’s Ed |

| Progressive | $1,400 | Snapshot, Good Student, Multi-Policy |

| Allstate | $1,500 | Good Student, TeenSMART, Safe Driving Bonus |

Understanding Different Types of Coverage

There are different types of car insurance coverage. It’s important to know what each one means:

- Liability Insurance: This covers damages you cause to others.

- Collision Insurance: This covers damages to your car from accidents.

- Comprehensive Insurance: This covers non-accident damages like theft or weather.

- Personal Injury Protection: This covers medical expenses for you and your passengers.

- Uninsured Motorist Coverage: This covers you if the other driver doesn’t have insurance.

Why Discounts Matter

Discounts can make a big difference in your insurance costs. Many companies offer various discounts:

- Good Student Discount: If you have good grades, you can save money.

- Safe Driver Discount: If you have a clean driving record, you get a discount.

- Multi-Car Discount: Insuring more than one car can save you money.

- Driver’s Ed Discount: Completing a driver’s education course can lower your rates.

How to Compare Insurance Quotes

Comparing quotes is crucial to finding cheap car insurance. Here’s how you can do it:

- Get quotes from at least three different companies.

- Make sure the coverage levels are the same for each quote.

- Look at the discounts each company offers.

- Check the customer service reviews of each company.

- Choose the company that offers the best value, not just the lowest price.

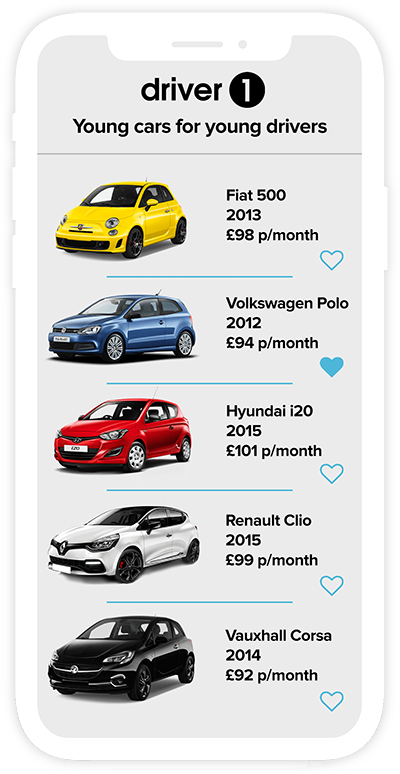

Credit: www.ingenie.com

How Your Driving Record Affects Your Insurance

Your driving record is very important. If you have tickets or accidents, your rates will be higher. Here are some tips to keep your record clean:

- Always follow traffic rules.

- Avoid speeding.

- Don’t use your phone while driving.

- Take a defensive driving course.

Why Location Matters

Your location also affects your insurance rates. Some areas have higher rates due to more accidents or thefts. Here’s how to deal with it:

- Park your car in a safe place.

- Install anti-theft devices.

- Consider moving to a safer area if possible.

The Importance of a Clean Credit Score

Your credit score can also affect your insurance rates. A higher score usually means lower rates. Here’s how to keep your score high:

- Pay your bills on time.

- Don’t max out your credit cards.

- Check your credit report for errors.

- Keep old accounts open to build credit history.

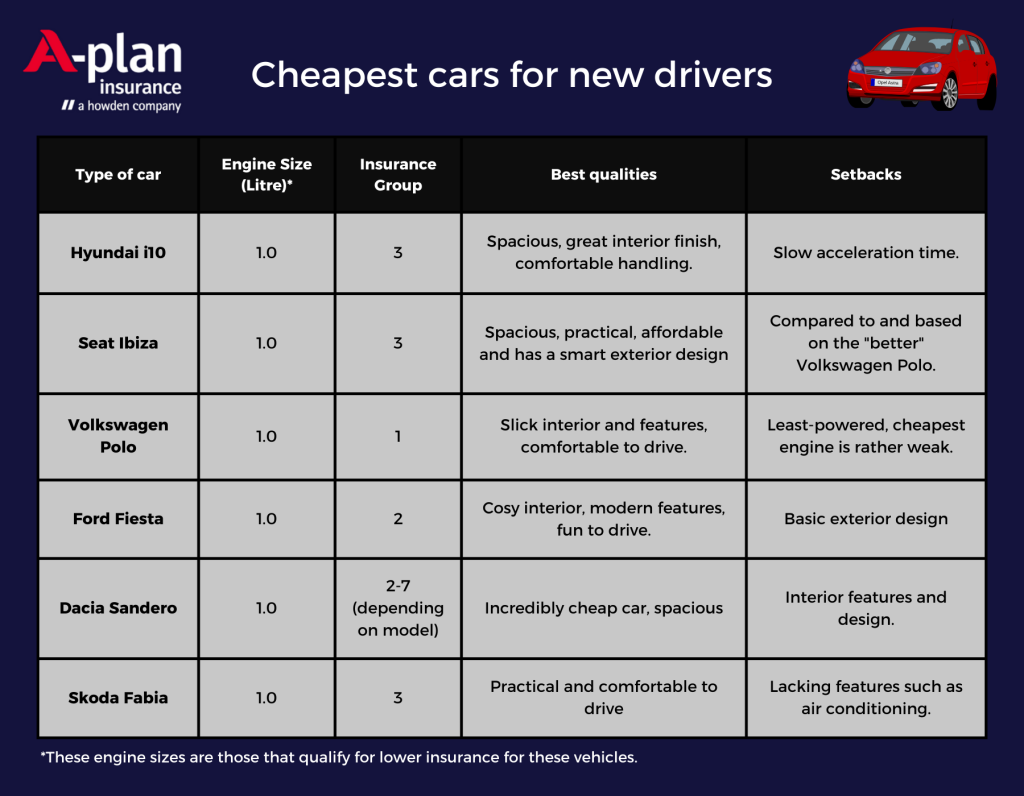

Credit: blog.howdeninsurance.co.uk

How to Lower Your Insurance Costs Over Time

As you gain more experience, your insurance costs will go down. Here are some ways to help lower your costs:

- Keep a clean driving record.

- Take advantage of discounts.

- Review your policy every year.

- Consider dropping unnecessary coverage as your car ages.

Frequently Asked Questions

What Is The Cheapest Car Insurance For New Drivers?

The cheapest car insurance for new drivers often includes discounts for good grades and safe driving courses.

How Can New Drivers Reduce Insurance Costs?

New drivers can reduce costs by maintaining a clean driving record and opting for higher deductibles.

Are There Discounts For Student Drivers?

Yes, many insurers offer discounts for student drivers with good academic performance.

Is Telematics Insurance Beneficial For New Drivers?

Yes, telematics insurance can lower premiums by monitoring and rewarding safe driving habits.

Do Car Types Affect Insurance Premiums?

Yes, car types affect premiums. Generally, safer and less expensive cars have lower insurance costs.

Conclusion

Finding the cheapest car insurance for new drivers can be challenging. But with the right tips and strategies, you can save money. Remember to shop around, ask for discounts, and drive safely. Over time, your rates will go down as you gain more experience. Happy driving!