Are you curious about how crowdfunding fits within the principles of Islamic finance? If you’re wondering whether raising funds through a community effort aligns with Sharia law, you’re not alone.

Crowdfunding has become a popular way to support projects and businesses, but when it comes to Islamic finance, there are unique rules and values that guide what’s acceptable. You’ll discover how crowdfunding can be structured to respect Islamic principles, what types of crowdfunding are considered halal, and how you can participate confidently while supporting ethical and socially just ventures.

Keep reading to unlock the key insights that will help you navigate crowdfunding in a way that aligns with your faith and financial goals.

Basics Of Crowdfunding

Crowdfunding is a popular way to raise money for projects or businesses. It gathers small amounts from many people. This method fits well with Islamic finance principles. It promotes fairness and shared risk among participants.

Understanding the basics helps in choosing the right crowdfunding model. It also ensures compliance with Sharia law. The main idea is pooling funds to support ventures with clear benefits.

Types Of Crowdfunding

There are four common types of crowdfunding. Each serves different needs and goals.

- Donation-based: People give money without expecting returns. It suits charitable and social projects.

- Reward-based: Backers get a product or service in return. Ideal for creative or product launches.

- Equity-based: Investors receive shares in the company. Best for startups seeking growth capital.

- Debt-based: Lenders provide funds and expect repayment with profit. Often structured as loans.

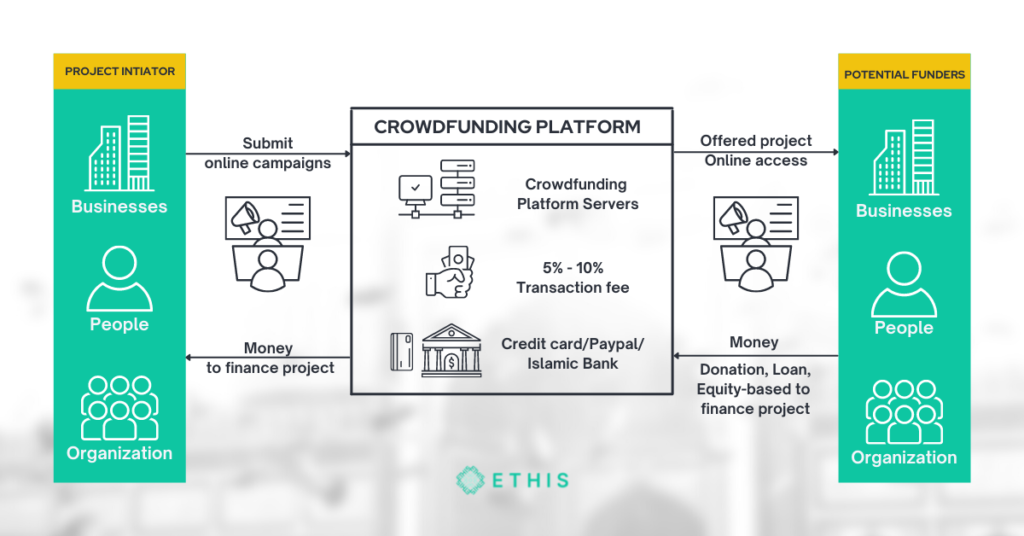

How Crowdfunding Works

Project owners set a funding goal and deadline. They present their idea on a platform. People interested in the project contribute money.

If the goal is reached, funds are transferred to the project. Contributors receive rewards or returns based on the type. If the goal is not met, money may be returned.

This process allows many to support projects without large individual risks. It creates a community around shared interests and goals.

Credit: www.researchgate.net

Principles Of Islamic Finance

Islamic finance follows unique principles that ensure financial activities align with Islamic law, or Shariah. These principles guide all transactions, including crowdfunding, to be fair, ethical, and socially responsible. Understanding these rules helps investors and entrepreneurs participate in crowdfunding without violating Islamic values.

The principles emphasize transparency, fairness, and respect for community welfare. They avoid harm and promote positive social impact. Islamic crowdfunding must meet these standards to be considered legitimate and beneficial.

Ethical Investment Guidelines

Investments in Islamic finance must follow strict ethical guidelines. Projects that harm society or involve forbidden industries like alcohol, gambling, and pork are not allowed. Investors focus on businesses that promote health, education, and community development.

Transparency is key. Investors must know where their money goes and how it is used. This builds trust and aligns with Islamic values of honesty and accountability.

Prohibition Of Interest And Speculation

Charging or earning interest (riba) is strictly forbidden in Islamic finance. Crowdfunding models avoid interest-based returns. Instead, profit and loss sharing methods are used.

Speculation (gharar) is also prohibited. Transactions must be clear and certain. This reduces risk and protects investors from unfair deals.

Social And Economic Justice

Islamic finance promotes social and economic justice. Crowdfunding supports projects that reduce poverty and create jobs. It encourages fair distribution of wealth.

Helping the community and supporting small businesses aligns with Islamic goals. Crowdfunding becomes a tool for positive social change and economic growth.

Islamic Crowdfunding Models

Islamic crowdfunding models offer unique ways to raise funds while complying with Sharia principles. These models focus on fairness, transparency, and avoiding interest (riba). They create opportunities for individuals to support projects ethically. Each model serves different needs and types of contributors. Understanding these models helps investors and entrepreneurs choose suitable options.

Donation-based Crowdfunding

Donation-based crowdfunding involves giving money without expecting any return. Supporters donate to charitable or social causes. This model suits projects like building mosques or funding education. It aligns well with Islamic values of charity (sadaqah) and helping the community. Donors contribute purely to do good and support others.

Reward-based Crowdfunding

Reward-based crowdfunding offers a non-financial return to backers. Contributors receive products, services, or special perks. This model works well for new products or creative projects. It encourages support by giving something in return without interest. It follows Islamic rules by avoiding profit through fixed interest rates.

Equity-based Crowdfunding

Equity-based crowdfunding lets investors own shares in a company. Backers share in the company’s profits and losses. This model fits startups with growth potential seeking capital. It complies with Sharia by avoiding guaranteed returns or interest. Investors become partners, sharing risks and rewards fairly.

Debt-based Crowdfunding

Debt-based crowdfunding involves lending money with agreed profit-sharing. Instead of fixed interest, lenders receive a share of profit or rent. This complies with Islamic finance rules that ban interest. It suits businesses needing capital while sharing earnings with lenders. Transparency and fairness are key in this model.

Aligning Crowdfunding With Sharia

Crowdfunding in Islamic finance must follow strict Sharia rules to be accepted. This ensures that all investments and activities comply with Islamic law. Aligning crowdfunding with Sharia protects both investors and entrepreneurs. It also guarantees that funds are used ethically and responsibly.

Ensuring Halal Investment

Halal investment means the money is used in lawful and pure ways. Crowdfunding platforms screen projects to confirm they meet Sharia standards. Investors only support ventures that avoid interest (riba) and gambling (maysir). This careful selection keeps the investment clean and free from forbidden elements.

Avoiding Prohibited Activities

Islamic finance prohibits certain activities, like alcohol, pork, and adult entertainment. Crowdfunding projects must avoid these sectors to comply with Sharia. Platforms regularly check projects to ensure no forbidden business is involved. This prevents investors from unknowingly funding haram activities.

Role Of Sharia Supervisory Boards

Sharia Supervisory Boards guide and oversee crowdfunding platforms. They review contracts and business models to ensure compliance with Islamic law. Their approval is essential before launching any crowdfunding campaign. These boards build trust and confidence among Muslim investors.

Benefits Of Islamic Crowdfunding

Islamic crowdfunding offers unique benefits that align with Sharia principles. It creates a platform for ethical and inclusive financial participation. This method supports projects that avoid interest and unethical practices. Investors find opportunities that respect their values and encourage community growth.

Access To Ethical Investment Opportunities

Islamic crowdfunding allows investors to fund projects that follow Sharia law. It excludes businesses involved in gambling, alcohol, or interest-based lending. This ensures all investments are free from forbidden activities. Investors can support ventures that promote fairness and transparency. It provides a clear, ethical choice for those seeking halal investments.

Supporting Small And Medium Enterprises

Small and medium enterprises (SMEs) often face challenges in getting funds. Islamic crowdfunding opens new funding channels for these businesses. It helps them grow without relying on traditional banks. Investors share profits and losses, following Islamic finance rules. This support boosts local economies and creates jobs.

Promoting Social Impact Projects

Many Islamic crowdfunding projects focus on social good. They fund initiatives like education, healthcare, and clean energy. These projects aim to improve community welfare and reduce poverty. Islamic crowdfunding encourages investments that make a positive difference. It aligns financial goals with social responsibility.

Credit: www.youtube.com

Challenges In Islamic Crowdfunding

Crowdfunding in Islamic finance faces unique challenges that affect its growth and adoption. These challenges stem from the need to comply with Sharia principles and maintain trust among investors. Understanding these obstacles helps stakeholders improve the system and attract more participants.

Regulatory And Compliance Issues

Islamic crowdfunding must follow strict Sharia rules and national laws. Different countries have varied regulations, which can confuse platform operators. Obtaining licenses and approvals is often slow and costly. Ensuring all projects meet Islamic finance criteria requires constant oversight. This complexity limits the speed and scale of crowdfunding initiatives.

Investor Awareness And Education

Many investors lack knowledge about Islamic crowdfunding principles. Misunderstandings about profit sharing and risk can deter participation. Limited educational resources make it harder for people to trust new platforms. Raising awareness requires clear communication and simple explanations. Educated investors are more likely to support ethical and Sharia-compliant projects.

Platform Transparency And Trust

Trust is critical in Islamic crowdfunding platforms. Investors need clear information on project risks and returns. Some platforms do not disclose enough details, leading to skepticism. Transparent reporting and regular updates build investor confidence. Establishing strong governance helps ensure funds are used properly and ethically.

Global Trends And Case Studies

Crowdfunding in Islamic finance is gaining attention worldwide. It offers a way to fund projects that comply with Sharia principles. Understanding global trends helps identify how this model evolves. Real examples from different regions show its impact and challenges.

These case studies reveal how Islamic crowdfunding platforms succeed. They highlight innovations that make funding more accessible and ethical. Learning from market leaders provides insights for new platforms and investors.

Successful Platforms Worldwide

Many Islamic crowdfunding platforms have achieved success globally. Platforms like Ethis in Singapore and Beehive in the UAE lead the way. They focus on ethical investments and support small businesses.

These platforms attract investors seeking Sharia-compliant opportunities. They often fund real estate, healthcare, and social projects. Their success shows that Islamic crowdfunding meets growing market needs.

Innovations In Islamic Crowdfunding

New ideas keep shaping Islamic crowdfunding. Some platforms use blockchain to increase transparency and trust. Others combine crowdfunding with microfinance for small entrepreneurs.

Technology helps reduce costs and speed up funding processes. Platforms also create special contracts to follow Islamic finance rules. These innovations make it easier to invest without breaking Sharia laws.

Lessons From Market Leaders

Market leaders teach valuable lessons for new platforms. Clear communication about Sharia compliance builds investor confidence. Strong governance and risk management protect both investors and entrepreneurs.

Providing education on Islamic finance helps grow the investor base. Leaders also show the importance of community support and social impact. These factors lead to sustainable growth and trust in the market.

Future Of Crowdfunding In Islamic Finance

The future of crowdfunding in Islamic finance holds significant promise. This sector blends modern finance with Sharia principles, attracting many investors worldwide. Crowdfunding platforms in Islamic finance continue evolving, driven by new technology and growing demand. The coming years will see more innovation and wider adoption.

Technological Advancements

Technology plays a key role in shaping Islamic crowdfunding. Mobile apps and blockchain improve transparency and security. These tools make investing easier and faster for everyone. Artificial intelligence helps match investors with suitable projects. Technology also ensures compliance with Sharia rules automatically.

Expanding Market Reach

Islamic crowdfunding is reaching more people globally. Online platforms connect investors from different countries. Small businesses in Muslim communities gain access to funds. Cross-border investments will increase as awareness grows. This expansion helps support economic development in many regions.

Potential For Impact Investing

Impact investing fits well with Islamic finance values. Investors seek projects that offer social and economic benefits. Crowdfunding allows funding for education, health, and environment initiatives. This focus creates positive change alongside financial returns. Islamic crowdfunding can drive ethical and responsible investment worldwide.

Credit: ethis.co

Frequently Asked Questions

Is Crowdfunding Halal In Islam?

Crowdfunding is halal in Islam if it avoids interest (riba) and supports ethical, socially beneficial projects. Donation and reward-based models are generally permissible. Equity and debt crowdfunding require careful compliance with Sharia law to ensure fairness and avoid prohibited elements.

What Is The Islamic Crowdfunding Model?

The Islamic crowdfunding model raises funds from a community to support businesses, ensuring compliance with Shariah principles and promoting social justice. It avoids interest (riba) and unethical investments, focusing on profit-sharing, equity, or donation-based funding aligned with Islamic values.

What Are The 4 Types Of Crowdfunding?

The four types of crowdfunding are donation-based, reward-based, equity-based, and debt-based. Donation-based offers no return. Reward-based gives a product or service. Equity-based grants company shares. Debt-based involves loans repaid with interest.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits non-permissible income to a maximum of 30% of total earnings. This ensures compliance with Sharia law by minimizing haram income sources in investments.

Conclusion

Crowdfunding aligns well with Islamic finance principles. It supports projects without interest or unfair gain. Many investors choose this method for ethical funding. It helps small businesses grow within Sharia law. Social and economic justice play key roles here. This method promotes community support and shared success.

Understanding its types aids smarter investment decisions. Crowdfunding offers a fair way to finance ventures. It remains an accessible tool for many entrepreneurs.