Are you wondering if your cryptocurrency is taxable?

The simple answer is, yes.

Just like other income, the IRS looks at crypto.

Why Is Cryptocurrency Taxed?

The IRS sees crypto as property, not currency.

This means crypto gets taxed like stocks or real estate.

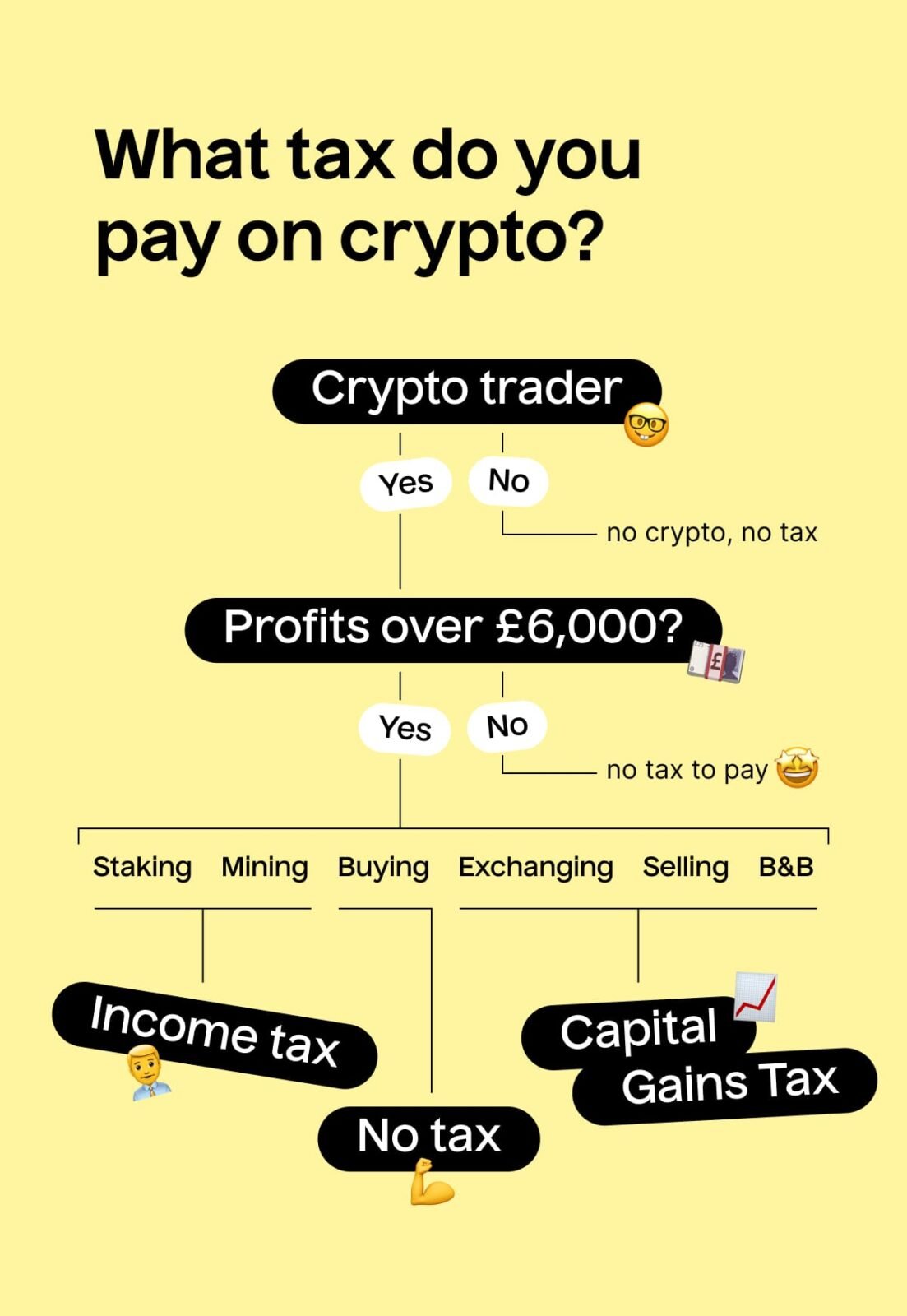

Types of Taxable Crypto Transactions

Crypto taxes happen with certain transactions. Let’s see them.

| Type of Transaction | Is It Taxable? |

|---|---|

| Buying Crypto with USD | No |

| Selling Crypto for USD | Yes |

| Using Crypto to Buy Goods and Services | Yes |

| Exchanging One Crypto for Another | Yes |

| Earning Crypto from Mining | Yes |

| Receiving Crypto as Payment | Yes |

How Does the IRS Tax Cryptocurrency?

It depends on how long you’ve held it.

- Held under a year? Short-term capital gains.

- Held over a year? Long-term capital gains.

Reporting Crypto on Your Tax Returns

You must report crypto on IRS Form 1040.

Failure to report can lead to penalties.

Credit: www.coinbase.com

Record Keeping for Crypto Transactions

Keep good records of all your crypto activities.

You’ll need details like dates, amounts, and values.

How to Calculate Your Crypto Taxes

Calculate taxes based on capital gains or losses.

The equation is simple: proceeds minus cost.

Credit: koinly.io

Tips for Crypto Tax Planning

- Understand the tax rules.

- Keep detailed records.

- Use tax software or a CPA.

- Stay informed on law changes.

Frequently Asked Questions On Do We Need To Pay Tax On Cryptocurrency?

Is Cryptocurrency Taxable Income?

Cryptocurrencies are considered property by the IRS and are subject to capital gains tax when sold or exchanged at a profit.

How Is Crypto Tax Calculated?

Crypto tax is calculated by taking the difference between the selling price and the cost basis, which often includes the purchase price plus any transaction fees.

Can Tax Be Avoided On Crypto?

Legally avoiding crypto tax requires strategic planning, such as holding assets long-term for favorable tax rates or participating in retirement accounts like a crypto IRA.

Are Bitcoin Transactions Taxable Events?

Yes, selling Bitcoin or using it for purchases are taxable events, triggering a capital gains tax calculation by the IRS.

Conclusion

Crypto taxes can seem hard but are a must.

Do the right thing and avoid trouble.

And remember, always consult a tax pro for help.