Health insurance for domestic partners provides coverage similar to that of married couples. It includes medical, dental, and vision benefits.

Domestic partners often face challenges in securing health insurance. Many companies now offer inclusive policies for unmarried couples. Coverage varies by provider, so it’s crucial to review specific plans. Typically, proof of partnership is required, such as a shared lease or joint bank account.

This ensures eligibility for benefits. Employers may also extend these benefits, promoting equality and inclusivity. Always compare different plans and read the fine print. Understanding the terms can prevent unexpected costs. Consult with an HR representative or insurance advisor for personalized advice. Proper planning ensures you and your partner receive the necessary health coverage.

Credit: blog.stridehealth.com

Introduction To Domestic Partner Health Insurance

Health insurance for domestic partners provides essential coverage. It ensures that both partners can access medical care. This type of insurance is vital for unmarried couples.

Importance Of Coverage

Domestic partner health insurance offers many benefits. It gives access to necessary medical services. Both partners can enjoy preventive care and emergency services.

Access to health insurance reduces medical costs. It provides peace of mind and financial stability. Ensuring coverage is a responsible choice for couples.

Eligibility Criteria

Eligibility for domestic partner health insurance varies. Each insurance provider has different requirements. Common criteria include:

- Both partners must be at least 18 years old.

- Partners must live together.

- Proof of a committed relationship.

- Neither partner should be married to someone else.

Some providers require a domestic partnership agreement. This document proves the relationship’s legitimacy. Check with your insurer for specific requirements.

Types Of Health Insurance Plans

Understanding the types of health insurance plans for domestic partners is essential. These plans can help you and your partner stay healthy and manage medical costs. Here, we explore the main types of health insurance plans available.

Employer-sponsored Plans

Many companies offer health insurance to their employees and their domestic partners. These plans often include a variety of benefits.

- Lower premiums

- Comprehensive coverage

- Access to a wide network of doctors and hospitals

Employer-sponsored plans usually have shared costs between employer and employee. This can make them an affordable option. Some employers also offer additional benefits like dental and vision coverage.

Individual Health Plans

If your employer doesn’t offer health insurance, you can buy an individual health plan. These plans are available through the health insurance marketplace or directly from insurance companies.

Individual plans offer:

- Flexibility in choosing coverage

- Variety of plan options

- Customizable benefits

Individual health plans might have higher premiums compared to employer-sponsored plans. But they provide specific benefits tailored to your needs. You can choose plans with higher deductibles for lower monthly costs or vice versa.

| Plan Type | Benefits | Drawbacks |

|---|---|---|

| Employer-Sponsored | Lower premiums, comprehensive coverage | Less flexibility in choosing doctors |

| Individual Health Plans | Customizable, flexible coverage | Higher premiums, out-of-pocket costs |

Choosing the right health insurance plan for you and your domestic partner is crucial. Consider your health needs and financial situation to make the best decision.

Key Benefits And Coverage

Health insurance for domestic partners ensures that both partners get the care they need. This coverage helps in reducing medical costs and provides peace of mind. Understanding the key benefits and coverage areas is essential.

Preventive Care

Preventive care is crucial for maintaining good health. Health insurance for domestic partners often covers annual check-ups, vaccinations, and screenings. This helps in detecting health issues early. Early detection can save lives and reduce medical expenses.

- Annual physical exams

- Vaccinations

- Screenings for blood pressure, cholesterol, and diabetes

By covering these services, insurance ensures both partners stay healthy. Regular check-ups also provide opportunities for doctors to offer health advice.

Emergency Services

Emergencies can happen anytime. Health insurance for domestic partners includes coverage for emergency services. This ensures quick and effective treatment during critical times.

| Service | Description |

|---|---|

| Emergency Room Visits | Immediate care for severe injuries or illnesses |

| Ambulance Services | Transportation to the nearest hospital |

| Urgent Care Visits | Quick care for non-life-threatening conditions |

Having these services covered can save lives. It also reduces financial strain during emergencies. This coverage ensures that both partners receive timely and necessary care.

Credit: blog.healthsherpa.com

Cost And Premium Considerations

Health insurance for domestic partners can be complex. Understanding the cost and premium is crucial. Costs can vary based on many factors. Let’s explore what affects premiums and how to save money.

Factors Affecting Premiums

Several factors can influence your health insurance premiums:

- Age: Older individuals often face higher premiums.

- Health Status: Pre-existing conditions can increase costs.

- Location: Premiums differ by state and region.

- Coverage Level: More coverage usually means higher costs.

Ways To Save On Premiums

Saving on health insurance premiums is possible with these strategies:

- Shop Around: Compare plans from different providers.

- Preventive Care: Use preventive services to stay healthy.

- Higher Deductibles: Choose a plan with a higher deductible.

- Employer Plans: Check if your employer offers better rates.

- Healthy Lifestyle: Maintaining a healthy lifestyle can lower costs.

| Factor | Effect on Premium |

|---|---|

| Age | Higher age, higher premium |

| Health Status | Pre-existing conditions increase premiums |

| Location | Varies by state and region |

| Coverage Level | More coverage, higher cost |

Legal And Documentation Requirements

Navigating the landscape of health insurance for domestic partners can be complex. Understanding the legal and documentation requirements is crucial. These requirements help ensure that domestic partners receive proper health coverage.

Required Paperwork

To secure health insurance for domestic partners, certain documents are needed. These documents verify the relationship and ensure eligibility. Below is a list of common paperwork required:

- Affidavit of Domestic Partnership

- Proof of Co-Residence (lease agreement, utility bills)

- Joint Financial Accounts (bank statements, credit card statements)

- Joint Ownership Documents (mortgage, car title)

- Identification Documents (driver’s licenses, passports)

Each document serves to confirm the partnership. Ensure all documents are up-to-date and accurate.

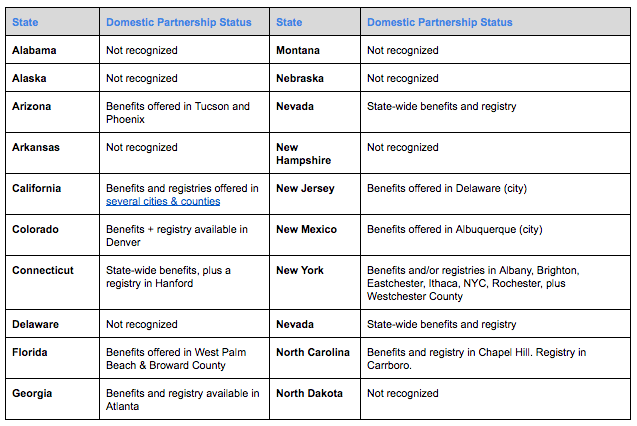

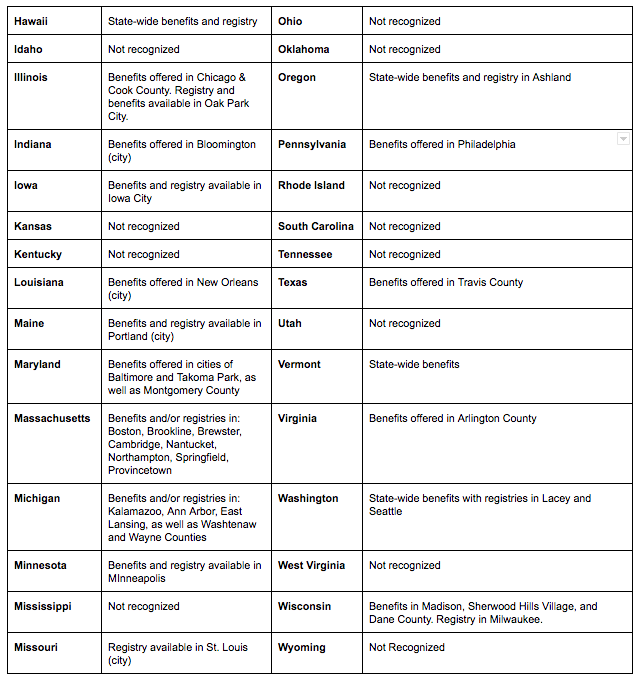

State-specific Regulations

Health insurance regulations for domestic partners vary by state. It’s important to understand your state’s specific rules. Some states have more stringent requirements than others. Here is a breakdown of state-specific considerations:

| State | Documentation Requirements | Additional Notes |

|---|---|---|

| California | Domestic Partnership Registration, Proof of Co-Residence | Offers broad coverage for domestic partners. |

| New York | Affidavit of Domestic Partnership, Joint Financial Accounts | Requires extensive proof of partnership. |

| Texas | Joint Ownership Documents, Identification Documents | Limited health insurance options for domestic partners. |

Check your state’s official website for detailed information. Always stay informed about any updates or changes.

Navigating The Enrollment Process

Health insurance for domestic partners can be complex. Understanding the enrollment process is crucial. This section will guide you through the key steps.

Open Enrollment Periods

The Open Enrollment Period is a specific time each year. You can sign up for health insurance during this period. Missing this window means waiting another year.

Most companies hold open enrollment in the fall. It typically lasts a few weeks. Prepare your documents early. This ensures a smooth process.

| Action | Timeframe |

|---|---|

| Review plans | First week |

| Gather documents | Second week |

| Submit application | Third week |

- Mark the dates on your calendar.

- Set reminders for key steps.

- Double-check all your information.

Special Enrollment Periods

The Special Enrollment Period allows you to enroll outside the open period. Qualifying life events trigger this period.

Examples of these events include:

- Getting married

- Having a baby

- Moving to a new area

- Loss of other coverage

You typically have 60 days from the event to enroll. Always keep proof of the event handy.

Follow these steps to navigate successfully:

- Contact your HR department.

- Provide necessary documents.

- Complete the enrollment forms.

Understanding these periods helps secure your health coverage.

Credit: www.alliancehealth.com

Frequently Asked Questions

What Is A Domestic Partner?

A domestic partner is a live-in partner in a committed relationship but not legally married.

Can Domestic Partners Share Health Insurance?

Yes, many health insurance plans offer coverage for domestic partners, similar to spouses.

How To Add A Domestic Partner To Insurance?

To add a domestic partner, contact your insurance provider and submit required documentation proving your relationship.

Are Domestic Partner Benefits Taxable?

Yes, health benefits for domestic partners are generally considered taxable income by the IRS.

Do All States Recognize Domestic Partnerships?

No, not all states recognize domestic partnerships. Check your state’s laws for specific regulations.

Conclusion

Securing health insurance for domestic partners is essential for peace of mind and financial stability. It ensures access to necessary medical care. Research various plans to find the best fit for your needs. Always check policy details and eligibility requirements.

Protect your health and future with the right insurance coverage.