Health insurance for people between jobs can be obtained through COBRA, short-term plans, or ACA marketplace options. These alternatives ensure continuous coverage.

Losing a job often means losing health insurance benefits. During this transition, finding the right health insurance plan becomes crucial. COBRA allows you to keep your previous employer’s health plan for a limited time. Short-term health insurance plans can provide temporary coverage and are usually more affordable.

The ACA marketplace offers various plans based on your income and needs. Each option has its pros and cons, making it essential to understand which plan best fits your situation. Staying insured helps avoid unexpected medical expenses and ensures access to necessary healthcare services.

Importance Of Health Insurance Between Jobs

The Importance of Health Insurance Between Jobs cannot be overstated. Being between jobs can be a stressful period. Ensuring you have health insurance during this time is crucial. Health issues can arise unexpectedly. Without coverage, medical expenses can quickly accumulate. Let’s explore why having health insurance between jobs is essential.

Financial Security

Health insurance provides financial security. Medical bills can be expensive. Without insurance, these costs can drain your savings. Health insurance helps cover these costs. This means you won’t have to pay out-of-pocket. It protects your finances during a transition period.

Insurance covers a wide range of services. This includes doctor visits, hospital stays, and prescriptions. It even covers preventive care. This can save you money in the long run. Consider the costs of an emergency room visit. These can easily reach thousands of dollars. Health insurance shields you from these high costs.

Access To Care

Health insurance ensures access to care. Without it, many people avoid seeking medical help. They fear the high costs. Insurance makes it easier to see a doctor. It also provides access to specialists. This is vital for maintaining your health.

Regular check-ups are important. They help catch issues early. Early treatment is often less expensive and more effective. With insurance, you can get the care you need. This keeps you healthy and reduces long-term costs.

| Benefit | Description |

|---|---|

| Financial Security | Protects your savings from high medical costs. |

| Access to Care | Ensures you can see doctors and specialists. |

| Coverage | Includes doctor visits, hospital stays, and prescriptions. |

| Preventive Care | Covers check-ups and early treatments. |

Having health insurance between jobs is a smart move. It provides financial security and access to care. It covers essential medical services and preventive care. Don’t risk your health or finances during job transitions.

Credit: sgicinsurance.com

Short-term Health Insurance Options

Health insurance is crucial, especially when you are between jobs. You need coverage to protect yourself from unexpected medical expenses. There are several short-term health insurance options available. These can provide temporary relief until you secure new employment.

Cobra Continuation

COBRA allows you to continue your previous employer’s health plan. This federal law applies to employers with 20 or more employees. You keep the same benefits and network. But, you pay the full premium yourself.

| Feature | Details |

|---|---|

| Eligibility | Employees from companies with 20+ employees |

| Duration | Up to 18 months |

| Cost | Full premium + 2% admin fee |

| Coverage | Same as previous employer plan |

Short-term Plans

Short-term plans are another option for temporary coverage. These plans are not as comprehensive as COBRA. But, they are more affordable. They cover basic medical needs and emergencies.

- Low monthly premiums

- Flexible term lengths (1-12 months)

- Quick approval process

- Limited coverage for pre-existing conditions

Short-term plans are ideal if you need immediate coverage. They are easy to obtain and provide basic protection. But, they might not cover everything you need. Always read the plan details carefully.

Both COBRA and short-term plans have their pros and cons. Choose based on your needs and budget. Stay covered to avoid unexpected medical bills.

Marketplace Insurance Plans

People between jobs often need health insurance. Marketplace insurance plans provide a good option. These plans offer coverage without employer dependency.

Enrollment Periods

Open Enrollment Period: This is the yearly time to enroll in a health plan. Missing this period means waiting for the next year.

Special Enrollment Period: Qualifying life events allow enrollment outside open periods. Examples include job loss, marriage, or birth of a child.

Subsidies And Tax Credits

Premium Tax Credits: These help lower monthly premium costs. Based on income and family size.

Cost-Sharing Reductions: These reduce out-of-pocket costs. Available for Silver plans only.

| Subsidy Type | Eligibility | Benefits |

|---|---|---|

| Premium Tax Credits | Income 100%-400% of the Federal Poverty Level | Lower monthly premiums |

| Cost-Sharing Reductions | Income 100%-250% of the Federal Poverty Level | Lower out-of-pocket costs |

Use the table above to understand the benefits. Ensure you check your eligibility. Always compare plans for the best fit.

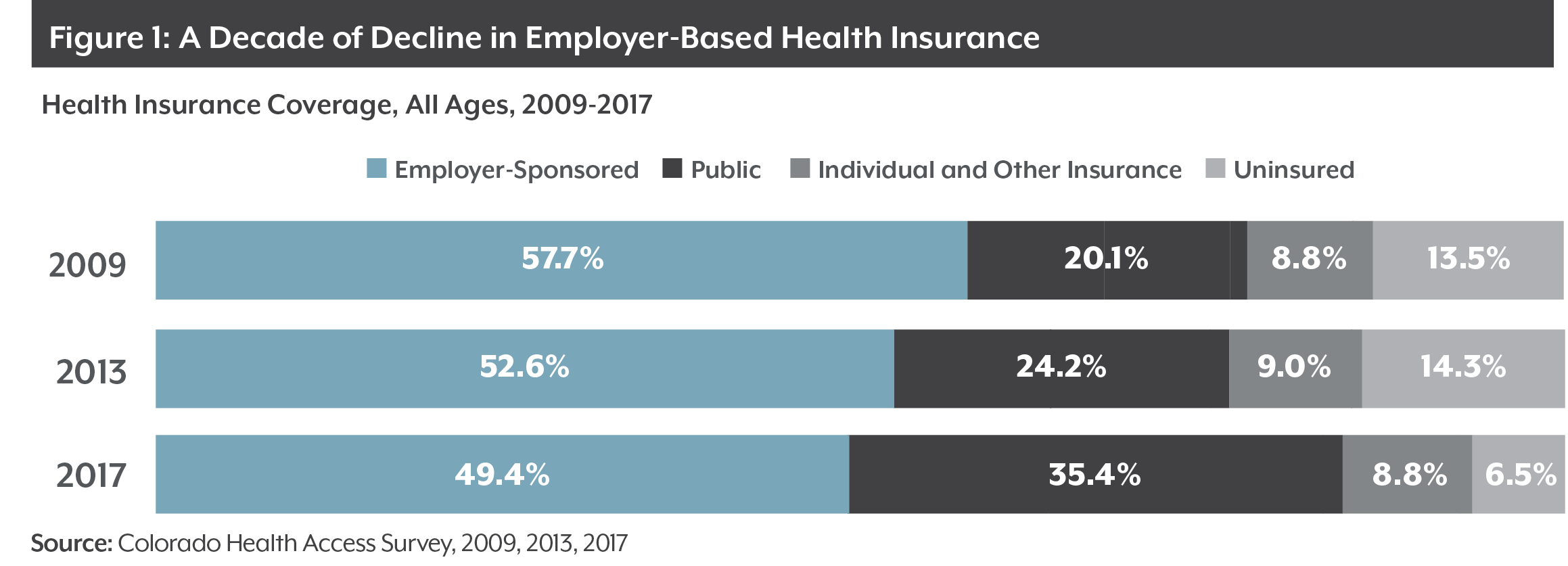

Credit: www.coloradohealthinstitute.org

Medicaid And Chip

If you’re between jobs, health insurance is crucial. Medicaid and the Children’s Health Insurance Program (CHIP) offer valuable coverage options. These programs provide affordable healthcare for eligible individuals and families. Understanding these options can ease your transition period.

Eligibility Criteria

To qualify for Medicaid, you must meet specific income requirements. Each state has different rules, but generally, your income should be low. For CHIP, children under 19 are eligible if their family’s income is too high for Medicaid but too low for private insurance.

| Program | Income Limit | Age Requirement |

|---|---|---|

| Medicaid | Varies by state, typically low-income | No age limit |

| CHIP | Higher than Medicaid limits | Under 19 |

Application Process

Applying for Medicaid and CHIP is simple. Follow these steps:

- Visit your state’s Medicaid website.

- Fill out the online application form.

- Submit required documents like proof of income.

- Wait for your eligibility determination.

For CHIP, the process is similar. Some states have combined Medicaid and CHIP applications. This makes it easier to apply for both at once. Always check your state’s guidelines for specific instructions.

These programs offer a lifeline during tough times. Ensure you understand the requirements and application steps.

Health Sharing Ministries

Health Sharing Ministries can be a great option for those between jobs. These organizations offer a community-based approach to managing medical expenses. They are not traditional insurance but provide similar benefits. Members share healthcare costs among the group, making it affordable and accessible.

How They Work

Health Sharing Ministries operate on a simple principle. Members pay a monthly fee, known as a share amount. This money goes into a communal pool. When a member has a medical need, they submit a request for sharing. The ministry then distributes funds from the pool to cover the costs.

Each ministry has specific guidelines for what expenses can be shared. Commonly covered items include doctor visits, hospital stays, and prescriptions. Some ministries also offer preventive care and wellness programs.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Health Sharing Ministries can be a viable option for many. They offer a community-focused approach to healthcare. Understanding the pros and cons can help you decide.

Tips For Choosing The Right Plan

Health insurance is essential, even when you’re between jobs. Choosing the right plan can be challenging. Follow these tips to make an informed decision. This guide will help you pick the best health insurance plan for your needs.

Assessing Your Needs

Before selecting a plan, you need to understand your health needs. Make a list of any current medical conditions or prescriptions. Think about how often you visit the doctor. Consider any planned medical procedures or upcoming appointments.

- Do you have any chronic conditions?

- How many prescriptions do you take?

- Do you have any planned surgeries?

- How often do you visit the doctor?

Knowing these details helps you choose a plan that covers your specific needs. If you have a family, assess their health needs as well.

Comparing Costs

After assessing your needs, compare the costs of different health insurance plans. Look at the monthly premiums, deductibles, and out-of-pocket maximums. Below is a table to help you compare costs:

| Plan | Monthly Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Plan A | $300 | $1,000 | $5,000 |

| Plan B | $250 | $1,500 | $6,000 |

| Plan C | $200 | $2,000 | $7,000 |

Choose a plan that fits your budget and covers your health needs. High deductible plans usually have lower premiums but higher out-of-pocket costs.

Remember to check if the plan covers your preferred doctors and hospitals. If you have specific healthcare providers, ensure they are in-network.

Emergency coverage is another critical aspect. Ensure the plan covers emergency care without excessive costs.

Using these tips, you can choose the right health insurance plan while between jobs. Stay covered and protect your health.

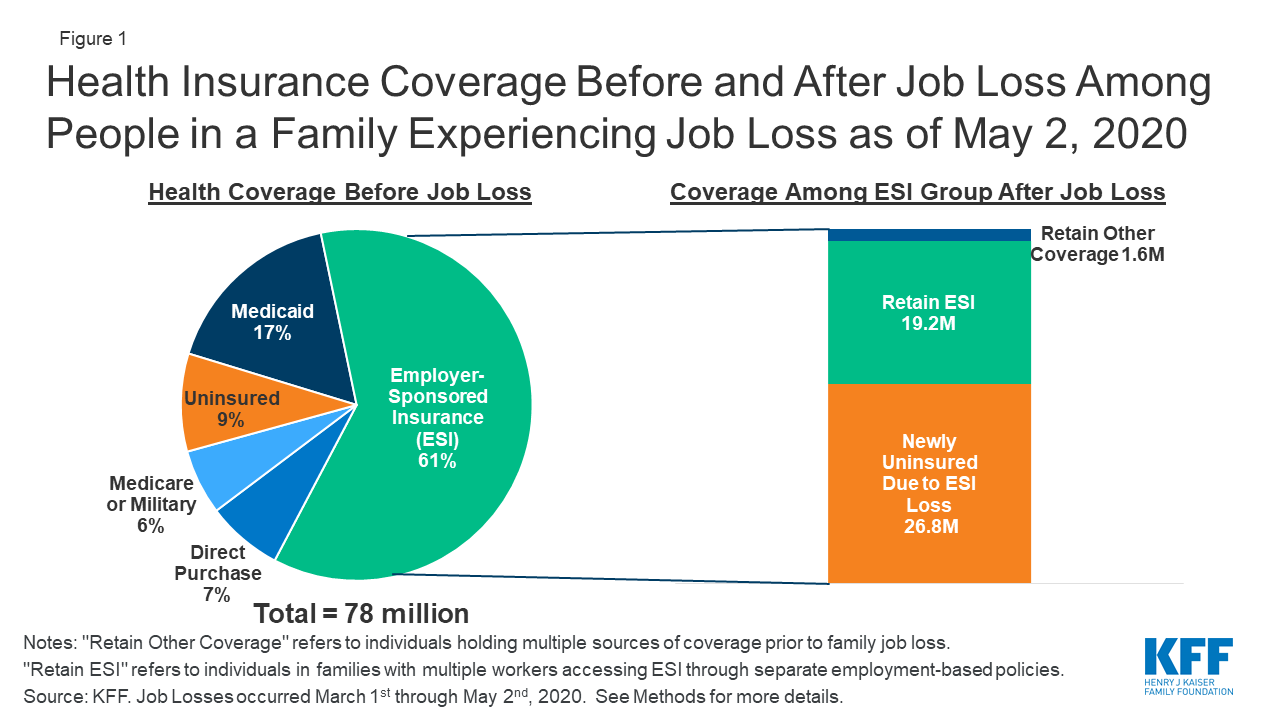

Credit: www.kff.org

Frequently Asked Questions

What Is Health Insurance For Unemployed?

Health insurance for unemployed covers medical costs when you’re jobless. Options include COBRA, ACA Marketplace, and Medicaid.

How To Get Health Insurance Without A Job?

Apply through the ACA Marketplace, COBRA, or Medicaid. Short-term plans are also available for temporary coverage.

Can Unemployed Get Medicaid?

Yes, unemployed individuals can qualify for Medicaid. Eligibility depends on income and state-specific guidelines.

What Is Cobra Insurance?

COBRA allows you to continue your previous employer’s health insurance plan for a limited time after leaving your job.

Are Short-term Health Plans A Good Option?

Short-term health plans offer temporary coverage but may have limited benefits. They’re useful between jobs but check limitations.

Conclusion

Navigating health insurance between jobs is crucial for maintaining coverage. Explore COBRA, short-term plans, or marketplace options. Don’t let a job change risk your health security. With careful planning, you can ensure continuous coverage. Prioritize your health and stay protected during employment transitions.

Remember, securing health insurance is essential for peace of mind.