Health insurance for pre-existing conditions ensures coverage for medical issues diagnosed before the start of a new health plan. It provides vital financial protection and access to necessary treatments.

Pre-existing conditions include chronic illnesses like diabetes, asthma, and heart disease. These conditions often require ongoing medical care and can lead to significant healthcare costs. Health insurance plans that cover pre-existing conditions help individuals manage these expenses and maintain their health.

They prevent the denial of coverage based on past medical history, which is crucial for those needing consistent treatment. This type of insurance promotes better health outcomes and financial stability by ensuring that all individuals receive the care they need without facing prohibitive costs.

Credit: www.plancover.com

Introduction To Pre-existing Conditions

Understanding health insurance for pre-existing conditions is vital. These conditions can impact your insurance options and costs. This section will provide an introduction to pre-existing conditions.

What Are Pre-existing Conditions?

A pre-existing condition is a health issue you had before your health insurance starts. Insurance companies often use this term. Knowing what qualifies can help you plan better.

Common Examples

Common pre-existing conditions include:

- Diabetes

- Asthma

- Heart Disease

- Arthritis

- High Blood Pressure

These conditions can affect your insurance costs and coverage. Each condition has its own challenges.

| Condition | Impact on Insurance |

|---|---|

| Diabetes | May increase premiums |

| Asthma | Can lead to higher costs |

| Heart Disease | Often requires more coverage |

| Arthritis | May limit coverage options |

| High Blood Pressure | Can increase policy costs |

Understanding these conditions is the first step. It helps you make informed decisions about your health insurance.

Credit: mcstitt.com

Challenges In Getting Coverage

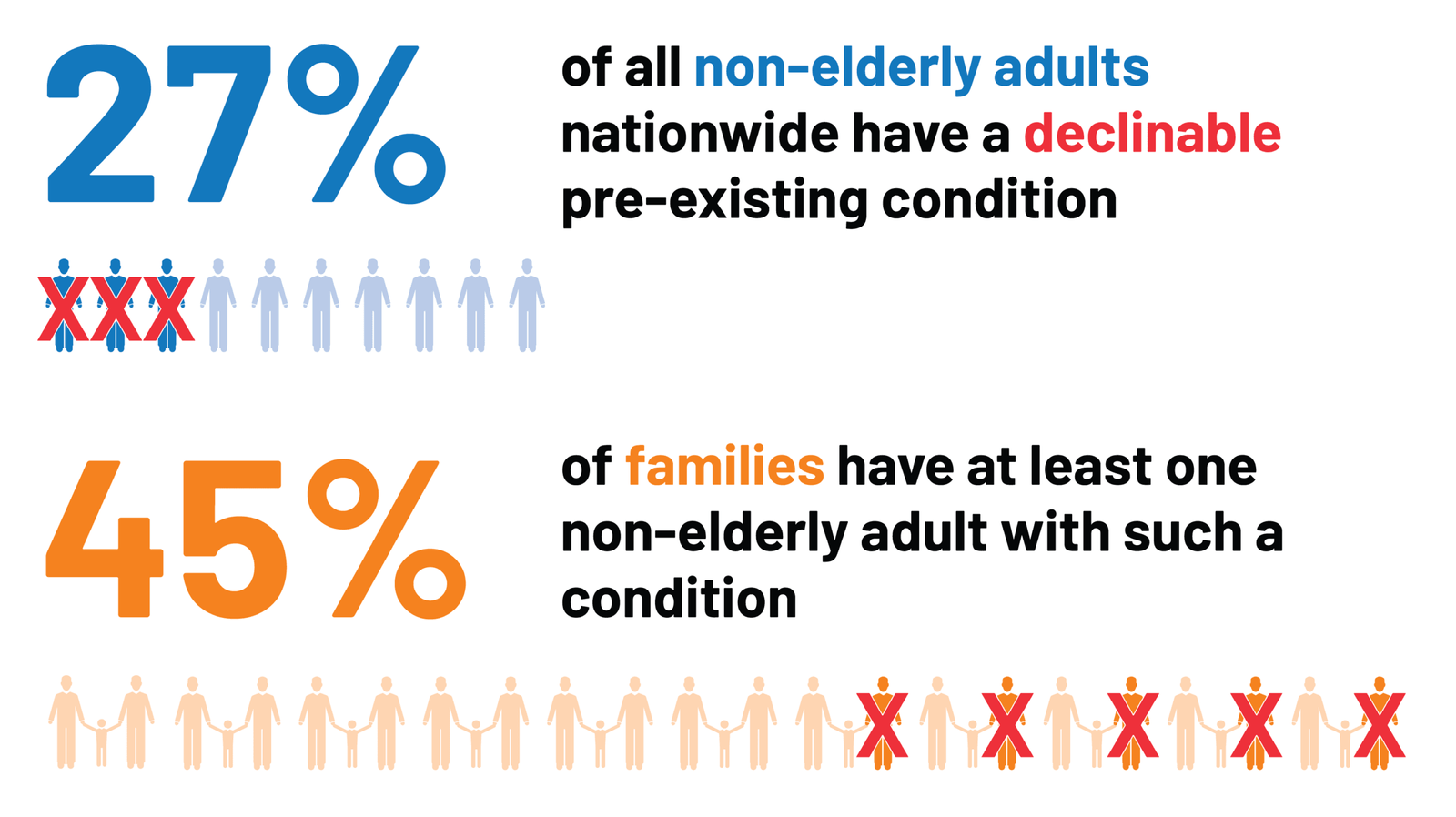

Getting health insurance with pre-existing conditions can be tough. Many face obstacles in securing coverage. Let’s explore the main challenges.

Insurance Denials

Many insurers deny applications from people with pre-existing conditions. They see them as high-risk clients. This means they might need more medical care. Insurers want to avoid paying high costs. They reject these applications to save money. This makes it hard for many to get the coverage they need.

Higher Premiums

Some insurers offer coverage but at a higher price. People with pre-existing conditions often face higher premiums. Insurers charge more because they expect more medical claims. This can make insurance unaffordable. Many struggle to pay these high premiums.

| Challenge | Impact |

|---|---|

| Insurance Denials | Many cannot get coverage. |

| Higher Premiums | Insurance becomes too expensive. |

Understanding these challenges is important. It helps in seeking the right solutions.

Types Of Health Insurance Plans

Understanding the types of health insurance plans for pre-existing conditions is vital. Different plans offer varying levels of coverage and benefits. This section will explore the most common types of health insurance plans available.

Employer-sponsored Plans

Many people get their health insurance through their job. These are called employer-sponsored plans. Employers often pay a part of the premium. This makes these plans more affordable for employees. Some benefits of employer-sponsored plans include:

- Lower cost due to employer contributions

- Comprehensive coverage options

- Access to a wide network of doctors and hospitals

These plans often cover pre-existing conditions. Employees can enroll during the open enrollment period.

Individual Plans

Some people buy health insurance on their own. These are individual plans. They are purchased through the marketplace or directly from an insurance company. Key benefits of individual plans include:

- Personalized coverage based on individual needs

- Flexibility to choose your own provider

- Availability of subsidies based on income

These plans are designed to cover pre-existing conditions. You can choose a plan during the open enrollment period or a special enrollment period.

| Plan Type | Source | Benefits |

|---|---|---|

| Employer-Sponsored Plans | Through your job | Lower cost, comprehensive coverage, wide network |

| Individual Plans | Marketplace or insurance company | Personalized coverage, flexible provider choice, income-based subsidies |

Regulations And Protections

Health insurance for pre-existing conditions has improved. Regulations and protections ensure coverage for everyone. Key laws protect patients from discrimination and high costs.

Affordable Care Act

The Affordable Care Act (ACA) offers significant protections. It prohibits insurers from denying coverage due to pre-existing conditions. This applies to all health plans in the marketplace.

Under the ACA:

- Insurers cannot charge higher premiums based on health status.

- Coverage cannot be limited or excluded for pre-existing conditions.

- Essential health benefits must be included in all plans.

These rules ensure that everyone gets the care they need. Families and individuals are more secure with these protections.

State-level Protections

Many states offer additional protections beyond the ACA. These state-level protections ensure even greater security for patients.

Examples of state-level protections include:

| State | Protection |

|---|---|

| California | Guaranteed issue for all health plans. |

| New York | Community rating to prevent high premiums. |

| Massachusetts | Comprehensive coverage for chronic conditions. |

State-level protections vary widely. Check your state’s laws to understand your rights.

These laws provide a safety net for people with pre-existing conditions. Everyone deserves fair treatment and access to health care.

Tips For Finding The Right Plan

Finding the right health insurance plan for pre-existing conditions can be tricky. You need to consider many factors to ensure you get the best coverage. Below are some tips to help you navigate through the process.

Comparing Plans

Comparing different health insurance plans is crucial. Look at the benefits each plan offers. Check if they cover your specific pre-existing condition. Here are some points to compare:

- Monthly Premiums: How much will you pay each month?

- Out-of-Pocket Costs: What are the deductibles and copayments?

- Coverage Limits: Does the plan have annual or lifetime limits?

- Network Providers: Are your preferred doctors in the network?

Make a table to compare these factors side by side. This will help you see the differences clearly.

| Plan Name | Monthly Premium | Out-of-Pocket Costs | Coverage Limits | Network Providers |

|---|---|---|---|---|

| Plan A | $200 | $1,000 | $500,000 | Yes |

| Plan B | $250 | $1,200 | No Limit | No |

Consulting Experts

Consulting experts can provide valuable insights. Insurance brokers and healthcare advisors can help you understand complex terms. They can also help you find the best plan for your needs. Here are some reasons to consult experts:

- Expert Knowledge: They know the ins and outs of various plans.

- Tailored Advice: They can offer advice based on your specific needs.

- Time-Saving: They can save you time by narrowing down your options.

- Cost-Effective: They may find plans you wouldn’t consider.

By consulting experts, you can make an informed decision. This ensures you get the best coverage for your pre-existing condition.

Credit: www.generalandmedical.com

Managing Costs

Health insurance for pre-existing conditions can be expensive. But, there are ways to manage these costs effectively. Understanding your options can help you save money and get the care you need.

Choosing High-deductible Plans

High-deductible health plans (HDHPs) can lower your monthly premiums. These plans have higher deductibles, which means you pay more out-of-pocket before insurance kicks in. Here is a simple comparison:

| Plan Type | Monthly Premium | Deductible |

|---|---|---|

| HDHP | $150 | $3,000 |

| Standard Plan | $300 | $1,000 |

Choosing a high-deductible plan can save you money each month. This option is good if you don’t need frequent medical care. It is also beneficial for emergencies, as it protects you from very high costs.

Utilizing Health Savings Accounts

A Health Savings Account (HSA) helps you save money for medical expenses. HSAs offer tax benefits, which make them an attractive option. Here are some key benefits:

- Tax-free contributions

- Tax-free withdrawals for medical expenses

- Funds roll over year to year

To open an HSA, you must have an HDHP. Here is a brief overview:

| HSA Feature | Benefit |

|---|---|

| Tax-free contributions | Lower taxable income |

| Tax-free withdrawals | Save on medical costs |

| Yearly rollover | Build savings over time |

HSAs are a smart way to manage healthcare costs. They provide financial relief and flexibility. Use the funds for doctor visits, prescriptions, and other medical needs.

Frequently Asked Questions

What Are Pre-existing Conditions In Health Insurance?

Pre-existing conditions are medical issues that exist before buying a health insurance policy.

Can You Get Insurance With Pre-existing Conditions?

Yes, many insurance providers offer coverage for pre-existing conditions, but terms vary.

Do Pre-existing Conditions Affect Premiums?

Yes, pre-existing conditions can lead to higher premiums due to increased risk.

How Do Insurers Define Pre-existing Conditions?

Insurers define pre-existing conditions as any illness diagnosed or treated before policy activation.

Is There A Waiting Period For Pre-existing Conditions?

Yes, some policies have a waiting period before covering pre-existing conditions, usually ranging from 6 months to 2 years.

Conclusion

Navigating health insurance for pre-existing conditions can be challenging. It’s vital to understand your options and rights. Research and compare plans to find the best coverage. Stay informed about any policy changes. This ensures you have the protection you need.

Your health and peace of mind are worth the effort.