Health insurance for retirees is crucial for managing healthcare expenses post-retirement. It ensures financial security and access to necessary medical care.

Retirees often face increased healthcare needs and costs. Navigating health insurance options can be challenging but essential for maintaining well-being. Medicare is a primary resource for those aged 65 and older, offering various plans to cover hospital visits, medical services, and prescriptions.

Some retirees may also consider supplemental insurance to fill gaps in Medicare coverage. Private insurance options and employer-sponsored retiree plans can provide additional support. Understanding these options helps retirees make informed decisions, ensuring they receive the care they need without compromising their financial stability. Proper planning and research are key to securing adequate health insurance in retirement.

Choosing The Right Plan

Health insurance is crucial for retirees. Choosing the right plan ensures you get the care you need. Let’s explore how to pick the best plan for you.

Assessing Your Needs

Start by looking at your health status. Do you have chronic conditions? Are you on regular medications? Make a list of your doctors and specialists. Think about your lifestyle. Do you travel often? Do you need coverage out of your home state?

Next, consider your budget. How much can you afford in premiums? Think about out-of-pocket costs like co-pays and deductibles. Don’t forget to factor in any additional benefits you might need, like dental or vision coverage.

Comparing Options

Once you know your needs, compare different plans. Look at the coverage each plan offers. Does it cover your medications? Are your doctors in the network? Check the plan’s star rating. Higher ratings often mean better quality.

Use the following table to compare key features:

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Premium | $200/month | $250/month | $180/month |

| Deductible | $1,000 | $1,500 | $800 |

| Co-pay | $20 | $30 | $15 |

| Doctor Network | Wide | Moderate | Narrow |

Consider using online tools to compare plans. Many websites offer side-by-side comparisons. This helps you see differences clearly.

Remember, the right plan for you fits your health needs and budget. Take your time and choose wisely.

Medicare Basics

Understanding Medicare basics is crucial for retirees. Medicare is a federal health insurance program. It offers coverage to people aged 65 and older. Knowing the essentials can help you make better decisions.

Eligibility Criteria

To qualify for Medicare, you must meet certain eligibility criteria:

- You must be 65 years or older.

- You must be a U.S. citizen or permanent resident.

- Under 65, you qualify if you have a disability.

- People with End-Stage Renal Disease are also eligible.

Enrollment Process

The enrollment process for Medicare is straightforward:

- First, sign up during your Initial Enrollment Period (IEP).

- The IEP starts three months before your 65th birthday.

- It ends three months after your 65th birthday.

- If you miss this window, you can enroll during the General Enrollment Period.

- The General Enrollment Period runs from January 1 to March 31 each year.

There are also Special Enrollment Periods for specific situations:

- For example, if you still work and have employer coverage.

- Another example is if you move out of your plan’s service area.

Remember, late enrollment can lead to penalties.

| Enrollment Period | When It Occurs |

|---|---|

| Initial Enrollment Period (IEP) | 3 months before to 3 months after turning 65 |

| General Enrollment Period (GEP) | January 1 to March 31 |

| Special Enrollment Period (SEP) | Varies based on specific situations |

Supplemental Insurance

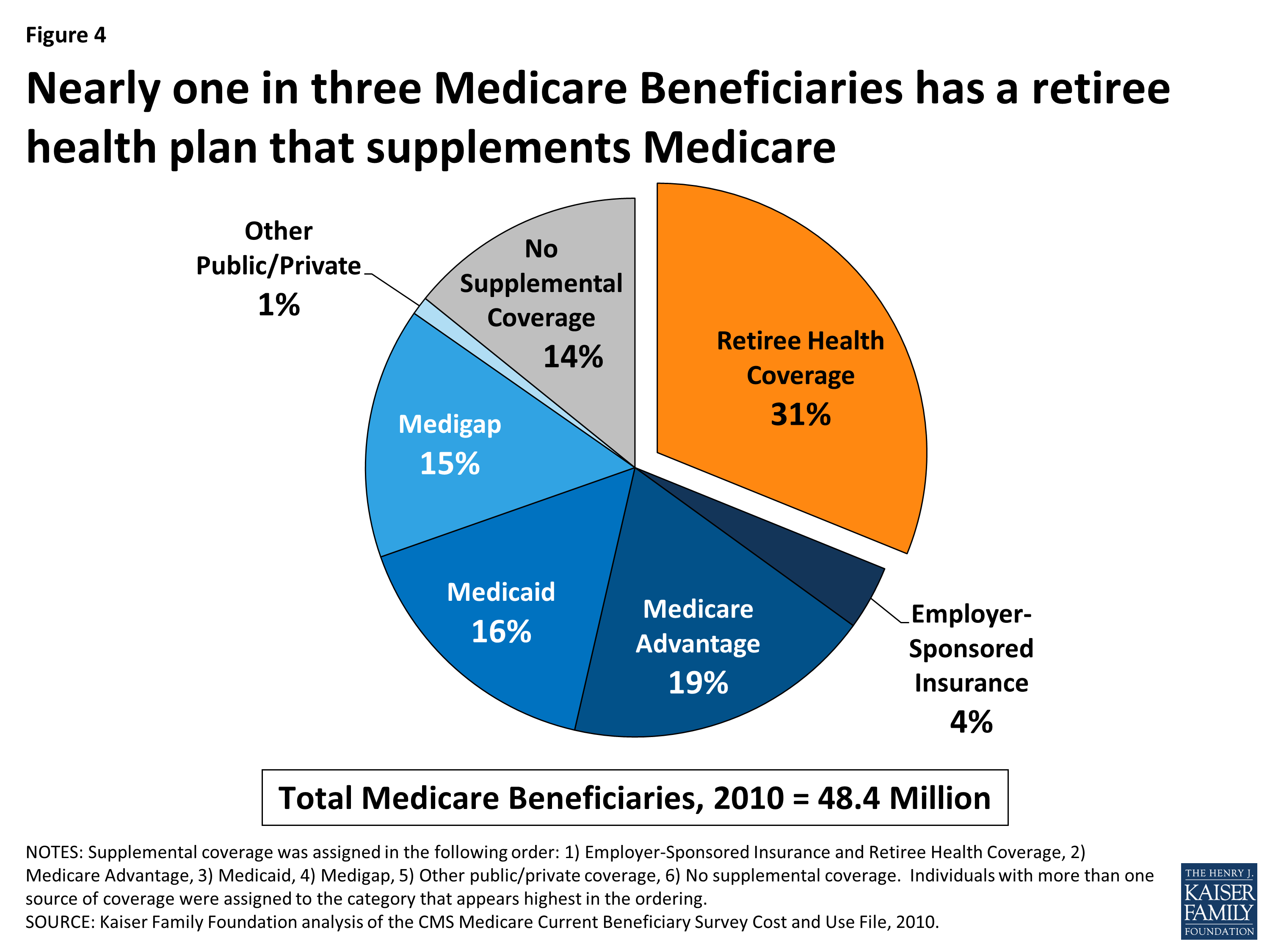

As retirees, having a robust health insurance plan is crucial. Supplemental insurance helps cover the gaps in your primary health coverage. These plans ensure you have the necessary financial protection for unexpected medical expenses. Let’s explore some supplemental insurance options available to retirees.

Medigap Policies

Medigap policies are designed to fill the “gaps” in Medicare. These policies help cover out-of-pocket costs such as copayments, coinsurance, and deductibles.

Here are some key benefits of Medigap policies:

- Covers additional costs not included in Medicare Parts A and B.

- No network restrictions, allowing you to choose any doctor or hospital that accepts Medicare.

- Predictable out-of-pocket expenses which help in better budgeting.

Medigap plans are standardized across most states. This means the benefits for each plan type (A, B, C, D, F, G, K, L, M, and N) remain the same, regardless of the insurance company.

| Plan Type | Covered Benefits |

|---|---|

| Plan A | Basic benefits including coinsurance for hospital and medical services |

| Plan F | Most comprehensive, covering all gaps in Medicare |

| Plan G | Similar to Plan F but does not cover Medicare Part B deductible |

Additional Coverage Options

Besides Medigap, retirees can consider other supplemental insurance options. These plans offer additional protection beyond traditional Medicare benefits.

Here are some additional coverage options:

- Dental and Vision Insurance: Covers routine check-ups and procedures.

- Prescription Drug Plans (Part D): Helps cover the cost of medications.

- Long-Term Care Insurance: Provides coverage for extended care needs.

Dental and Vision Insurance is essential for maintaining overall health. Regular dental and eye exams can detect early signs of other health issues.

Prescription Drug Plans (Part D) ensure you have access to necessary medications without financial strain. These plans can be tailored to fit your specific medication needs.

Long-Term Care Insurance is crucial for those who may need extended care. It helps cover the costs of nursing homes, assisted living, and in-home care.

Each of these options provides specific benefits tailored to different health needs. By understanding these choices, retirees can select the right supplemental insurance to ensure comprehensive health coverage.

Credit: www.azasrs.gov

Cost-saving Strategies

Retirees often find themselves concerned about health insurance costs. Reducing these expenses can significantly ease financial pressure. Here are some cost-saving strategies.

Understanding Premiums

Premiums are the monthly payments for health insurance. They vary based on coverage and provider. It’s vital to understand what affects these premiums.

- Age: Older retirees may face higher premiums.

- Location: Insurance costs differ by state.

- Plan Type: Comprehensive plans often cost more.

Consider selecting a plan that suits your health needs and budget. Avoid plans with unnecessary coverage to save on premiums.

Exploring Discounts

Many insurers offer discounts that can reduce costs. Here are some common discounts:

| Discount Type | Description |

|---|---|

| Multi-Policy Discount | Combining health with home or auto insurance. |

| Healthy Lifestyle Discount | For maintaining a healthy lifestyle, like non-smoking. |

| Early Enrollment Discount | Enrolling in a plan before a set date. |

Check with your insurer to see available discounts. Utilizing these can lower your overall health insurance costs.

Navigating Prescription Drug Plans

Retirees often face challenges with prescription drug plans. Navigating these plans can be confusing. Understanding your options helps you save money and stay healthy.

Medicare Part D

Medicare Part D covers prescription drugs. It offers plans from private insurers. These plans help retirees manage medication costs. You must choose a plan that suits your needs.

Medicare Part D plans vary in coverage. Some cover more drugs than others. Check the plan’s formulary list. This list shows the drugs covered. Look for your medications on this list.

Medicare Part D also has different cost structures. Some plans have higher premiums but lower co-pays. Others have lower premiums but higher co-pays. Compare these costs carefully.

| Plan Feature | High Premium Plan | Low Premium Plan |

|---|---|---|

| Monthly Premium | $50 | $20 |

| Co-pay per Prescription | $5 | $15 |

Choosing The Best Plan

Choosing the right plan is crucial. Follow these steps:

- Make a list of your current medications.

- Check if each drug is covered by the plan.

- Compare the total yearly cost of each plan.

- Consider the plan’s pharmacy network.

- Look for any plan restrictions or requirements.

Some plans require prior authorization for certain drugs. Others may have step therapy rules. Understand these requirements before enrolling.

Use the Medicare Plan Finder tool. It helps you compare plans. Enter your medications and see which plans cover them. This tool also shows estimated costs.

Finally, review each plan’s star rating. Higher star ratings indicate better service. Choose a plan with a good rating for better support.

:max_bytes(150000):strip_icc()/Primary-Image-best-health-insurance-for-retirees-5087266-90ef946256e74f2991b7f12e9ad4e3a0.jpg)

Credit: www.investopedia.com

Long-term Care Considerations

Health insurance for retirees often includes long-term care considerations. As we age, the need for long-term care increases. This care helps with daily activities and medical needs. Planning for long-term care is crucial for retirees. It ensures they get the support they need.

Types Of Long-term Care

There are different types of long-term care. Each type offers unique benefits and services. Understanding these types can help retirees make informed choices.

- Home Care: Assistance provided in the comfort of one’s own home. This includes help with daily activities and medical care.

- Assisted Living Facilities: These facilities offer housing, meals, and personal care. They provide a community environment.

- Nursing Homes: These provide a higher level of medical care. They are suited for those with severe health issues.

- Adult Day Care: Daytime care and activities for seniors. This helps family caregivers take a break.

Insurance Options

There are different insurance options for covering long-term care costs. Choosing the right option is essential for financial security.

| Insurance Option | Benefits | Considerations |

|---|---|---|

| Traditional Long-Term Care Insurance | Covers various types of long-term care. Flexible benefit options. | Premiums can increase over time. |

| Hybrid Life and Long-Term Care Insurance | Combines life insurance with long-term care benefits. | Higher initial cost but fixed premiums. |

| Medicaid | Provides long-term care for low-income individuals. | Requires meeting strict eligibility criteria. |

Understanding these options can help retirees plan better. It ensures they have the support they need in their golden years.

Credit: www.kff.org

Frequently Asked Questions

What Does Health Insurance For Retirees Cover?

Health insurance for retirees typically covers hospital stays, doctor visits, prescription drugs, and preventive care.

How To Choose The Best Retiree Health Plan?

Compare coverage options, costs, and network providers. Consider your specific health needs and budget.

Are Retirees Eligible For Medicare?

Yes, most retirees are eligible for Medicare starting at age 65. Enrollment details vary based on work history.

Can Retirees Get Supplemental Insurance?

Yes, retirees can purchase supplemental insurance like Medigap to cover expenses not included in Medicare.

How Much Does Retiree Health Insurance Cost?

Costs vary based on plan type, coverage level, and location. Premiums, deductibles, and co-pays should be compared.

Conclusion

Choosing the right health insurance is crucial for retirees. It ensures peace of mind and financial security. Consider your unique needs and compare plans carefully. This will help you make an informed decision. Stay healthy and enjoy your retirement years with confidence.