Thinking about buying a home but worried about how to finance it without compromising your religious beliefs? You’re not alone.

Many people like you want a home loan that respects Islamic principles—meaning no interest and full compliance with Sharia law. But how exactly does a home loan in Islamic banking work? Is it really different from conventional loans? And can you find such options right here in the U.

S. , including Austin, Texas? You’ll discover simple explanations of Islamic home financing models, how they help you own your dream home without riba (interest), and what challenges you might face along the way. Keep reading to learn how Islamic banking can open the door to your new home while honoring your values.

Credit: www.guidanceresidential.com

Islamic Home Loans Basics

Islamic home loans follow Sharia law, avoiding interest or riba. They use unique methods to help buyers own homes. These methods are fair and transparent. Many Muslims prefer these options for home financing.

Popular Islamic mortgage types include Musharaka, Ijara, and Murabaha. Each model has distinct rules and benefits. Understanding these helps choose the right mortgage type.

Musharaka: Co-ownership Model

Musharaka means partnership. The bank and buyer jointly buy the house. The buyer slowly buys the bank’s share over time. Monthly payments reduce the bank’s ownership. The buyer fully owns the home at the end. This method shares risk and reward fairly.

Ijara: Lease-to-own Approach

Ijara works like renting with a purchase plan. The bank buys the property and leases it to the buyer. The buyer pays rent monthly. Part of the rent goes toward owning the home. After all payments, ownership transfers to the buyer. This plan avoids interest and ensures clear terms.

Murabaha: Cost-plus Sale

Murabaha means cost plus profit. The bank buys the house and sells it to the buyer. The sale price includes the bank’s cost plus a fixed profit. The buyer pays in installments without interest. The price and payments are clear from the start. This method provides certainty and fairness in payment.

Credit: www.hbl.com

Popular Islamic Mortgage Types

Islamic home loans in the USA offer a unique path for Muslims seeking to own a home without violating Sharia law. These loans avoid interest, using alternative financing structures. They help buyers invest in property while adhering to Islamic principles. Understanding their availability, support, and challenges is key for interested borrowers.

Availability And Market Growth

Islamic home loans are gradually becoming more available in the USA. Financial institutions offer models like Musharaka, Ijara, and Murabaha. These options serve Muslim communities and others wanting ethical financing. The market for Islamic mortgages is growing slowly but steadily. Some banks and credit unions now provide these products. Online platforms also increase access to halal home financing.

Government Support And Regulations

US government agencies like Fannie Mae and Freddie Mac support Islamic home loans. They help integrate Sharia-compliant financing into mainstream markets. Regulations ensure these loans meet legal and financial standards. Islamic lenders comply with federal and state laws to protect borrowers. This support improves trust and encourages more lenders to offer Islamic mortgages.

Challenges Faced By Borrowers

Borrowers may face limited choices due to fewer lenders offering Islamic loans. Some products have higher fees or stricter terms than conventional loans. Lack of awareness about Islamic financing options can slow demand. Documentation and approval processes might take longer. Still, many find these loans valuable for ethical and religious reasons.

How Islamic Home Loans Work

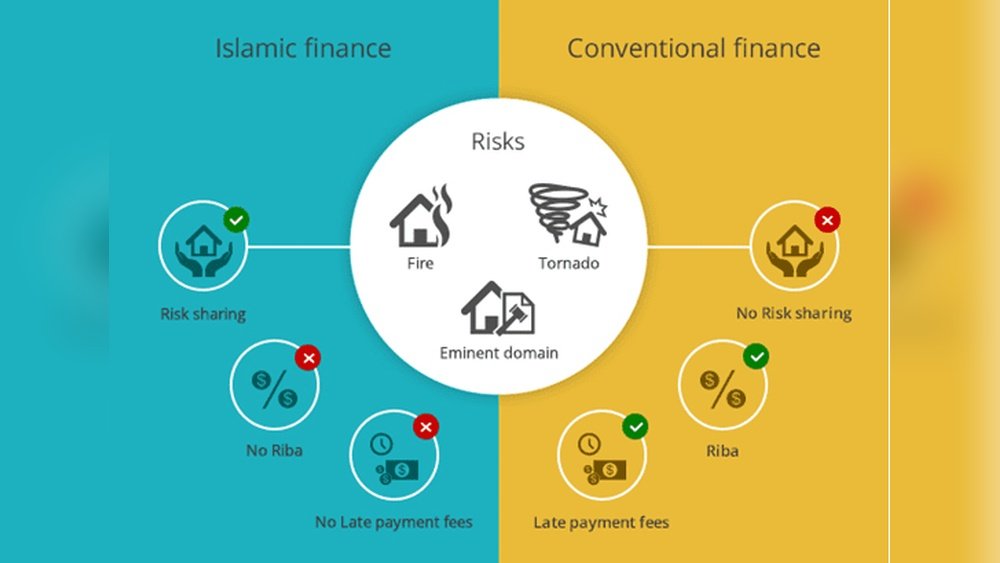

Comparing Islamic and conventional mortgages reveals key differences in how home loans are structured and managed. Islamic mortgages follow Shariah law principles, avoiding interest, which is forbidden in Islam. Conventional mortgages charge interest on the loan amount over time. Understanding these differences helps buyers choose the right option for their financial and ethical needs.

Differences In Contractual Terms

Islamic mortgages use unique contracts like Murabaha, Ijara, or Musharaka. These contracts involve the bank buying the property and selling or leasing it to the buyer. The buyer pays rent or buys shares gradually, avoiding interest payments. Conventional mortgages lend money directly to the buyer with interest charged on the loan. The contract terms focus mainly on repayment schedules and interest rates.

Benefits Of Shariah Compliance

Shariah compliance ensures the mortgage avoids riba (interest), which is prohibited in Islam. It promotes fairness and shared risk between buyer and bank. Islamic home loans emphasize ethical investing and social responsibility. Buyers can own homes without compromising religious beliefs. This compliance offers peace of mind and aligns financial decisions with faith.

Potential Limitations

Islamic mortgages may have higher upfront costs due to complex contract structures. Availability can be limited, especially in some regions like Austin, Texas. These loans may require more paperwork and longer approval times. Flexibility in repayment or refinancing might be less than conventional loans. Buyers should weigh these factors before choosing an Islamic mortgage.

Islamic Home Loans In The Usa

The eligibility and application process for a home loan in Islamic banking is clear and straightforward. It ensures buyers meet specific criteria to comply with Sharia principles. Understanding these steps helps you prepare better and increases your chances of approval.

Islamic home loans avoid interest and follow different financial structures. These require transparency and full documentation. The process involves selecting a lender that fits your needs and submitting all necessary documents for review.

Documentation Requirements

Applicants must provide valid identification such as a passport or driver’s license. Proof of income, including salary slips or bank statements, is essential. Property details and a sales agreement are also needed. Some lenders may ask for a credit report or proof of residence. Ensuring these documents are complete reduces delays during processing.

Selecting The Right Islamic Lender

Choose a lender that offers Sharia-compliant financing models like Musharaka or Ijara. Compare their terms carefully, including fees and repayment plans. Check for lenders with good customer reviews and clear policies. Some lenders specialize in Islamic home loans, making them more experienced in handling your application. Consider their customer service and transparency before deciding.

Tips For A Smooth Approval

Submit all required documents accurately and on time. Maintain a stable income and avoid excessive debts. Communicate clearly with your lender and respond quickly to requests. Understanding the lender’s requirements helps you meet them easily. Patience and preparation improve your chances of a smooth approval process.

Comparing Islamic And Conventional Mortgages

Many people have wrong ideas about home loans in Islamic banking. These misconceptions can stop them from exploring this option. Understanding the truth helps buyers make better choices. Below are some common myths that need clearing up.

Is Islamic Financing Only For Muslims?

Islamic home loans are not just for Muslims. Anyone can apply for them. These loans follow specific rules to avoid interest, which some find ethical. People from any background can benefit from this system.

Concerns About Higher Costs

Some think Islamic loans cost more than regular loans. This is not always true. The total amount paid can be similar or sometimes less. The key difference is the structure, not just the price.

Myths About Ownership And Control

People often believe the bank owns the house until the loan ends. In reality, ownership is shared and changes over time. The buyer gains more control with every payment made. This process is clear and fair to both sides.

Credit: www.guidanceresidential.com

Frequently Asked Questions

How Does An Islamic Home Loan Work?

An Islamic home loan avoids interest by using models like co-ownership, lease-to-own, or cost-plus sale. The bank buys the property and profits through rent or a markup. Buyers repay in installments, gradually gaining full ownership while complying with Sharia law.

Can I Take A Home Loan In Islam?

Islam forbids interest-based loans, but halal home loan alternatives exist. Islamic mortgages use rent, co-ownership, or cost-plus models without interest. These Sharia-compliant options help Muslims buy homes while adhering to Islamic law. Availability varies by location and lender.

Is Mortgage Halal In The Usa?

Yes, halal mortgages exist in the USA. They avoid interest using models like Musharaka, Ijara, or Murabaha. These Sharia-compliant loans offer home financing without riba, supported by some banks and government entities. Availability is growing but remains limited and complex compared to conventional mortgages.

Can I Get A Mortgage From An Islamic Bank?

Yes, Islamic banks offer Sharia-compliant mortgages without interest. They use models like Musharaka, Ijara, or Murabaha for halal home financing. These loans avoid riba and involve shared ownership, lease-to-own, or cost-plus sales. Availability is growing but options remain limited compared to conventional mortgages.

Conclusion

Choosing a home loan in Islamic banking offers a clear, interest-free way to buy a house. These loans follow Sharia rules, avoiding traditional interest charges. Models like Musharaka, Ijara, and Murabaha provide flexible options for buyers. Though less common than regular loans, they suit many seeking halal financing.

Understanding each model helps make the best choice. With growing support, Islamic home loans become easier to access. Owning a home while respecting faith is now more achievable than ever.