Balloon payments on loans require borrowers to pay a large sum at the end of the loan term. This final payment is much larger than the preceding installment payments.

Understanding balloon payments is crucial for borrowers considering this type of loan structure. Typically, a loan with a balloon payment has lower monthly payments during the term, but concludes with this single large payment. This can be appealing for individuals or businesses expecting a future increase in income or planning to refinance before the balloon payment is due.

Such loans are common in commercial real estate or business lending, where cash flow may be variable. It’s essential to assess financial stability before committing to a loan with a balloon payment, as the final lump sum can be substantial.

Credit: corporatefinanceinstitute.com

Introduction To Balloon Payments

Balloon payments are unique features of certain loans. They involve large, lump-sum payments due at the end of a loan term. This post explains the basics of balloon payments and contrasts them with regular loan installments.

The Basics Of Balloon Payments

A balloon payment is a one-time, large payment. It’s made at the end of a loan’s term. Loans with balloon payments often have lower monthly installments. This is because the bulk of the debt is deferred to the final payment. Borrowers should plan ahead for this large expense.

Contrast With Regular Loan Installments

Regular loans spread the cost evenly over the loan term. Each payment includes principal and interest. Over time, the loan balance decreases until it’s fully paid off. With balloon payments, the balance reduces slowly. The final balloon payment covers the remaining principal and any leftover interest.

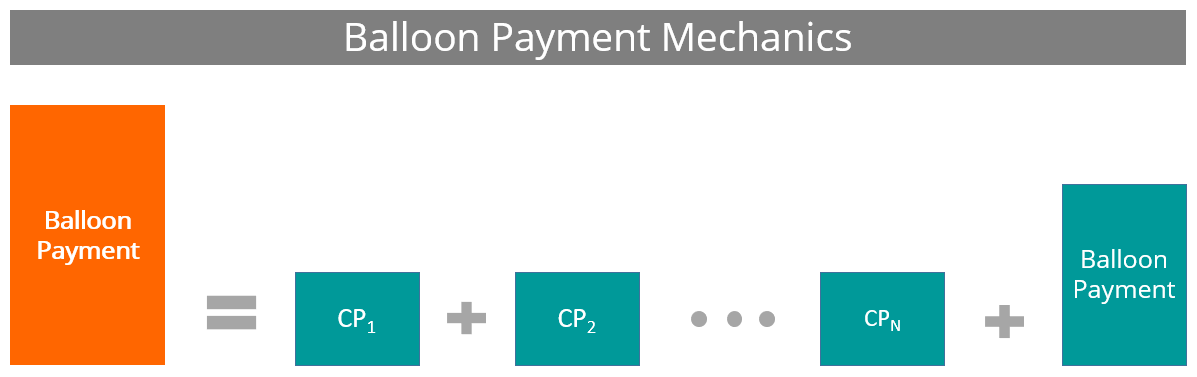

The Mechanics Of Balloon Payments

Understanding balloon payments on loans can seem tricky. But, it’s simple once you break it down. This part of your loan deals with a large, one-time payment at the end of your loan term. Let’s dive into the mechanics of balloon payments and make it easy to understand.

Calculating The Lump Sum

To figure out the lump sum of a balloon payment, lenders use a formula. This formula considers your loan’s interest rate, term, and the amount borrowed. The goal is to pay off the loan’s interest with regular, smaller payments. Then, you cover the original borrowed amount with the balloon payment.

- Loan amount: The total money you borrowed.

- Interest rate: The cost of borrowing money, shown as a percentage.

- Loan term: How long you have to pay back the loan.

Let’s say you borrow $10,000 at a 5% interest rate for 5 years. Your regular payments will cover the interest. The balloon payment will cover the remaining $10,000 at the end.

Scheduling The Payment

Planning for the balloon payment is critical. You must know when it’s due and how much it will be. This lets you prepare without surprises. Your loan agreement will outline the due date. Make sure to mark it on your calendar.

- Check your loan agreement for the balloon payment’s due date.

- Set reminders a few months before the due date.

- Start saving for the balloon payment early.

Remember, missing this payment can lead to trouble. It might harm your credit score or lead to loan default. Always communicate with your lender if you think you’ll have trouble paying.

Types Of Loans With Balloon Payments

Exploring different loan options reveals balloon payments are not one-size-fits-all. They are part of various loan structures. Understanding these can help borrowers make informed decisions.

Mortgages With Balloon Payments

Mortgage loans often use balloon payments. Borrowers pay low monthly amounts. The final payment includes the loan’s remaining balance. This setup is common in short-term mortgages. Consider the following:

- Five-Year Balloon Mortgage: Small payments for five years, then pay off the balance.

- Seven-Year Balloon Mortgage: Similar structure, with seven years of initial payments.

These mortgages suit those expecting large future income. They can refinance before the balloon payment is due.

Personal And Business Loans

Balloon payments are not exclusive to mortgages. Personal and business loans also feature them. Details include:

| Loan Type | Structure |

|---|---|

| Personal Loans | Fixed initial payments, large final payment. |

| Business Loans | Lower payments during loan term, payoff balance at end. |

Personal loans with balloon payments can fund big purchases. Business loans assist in managing cash flow. Balloon payments are set at the loan’s conclusion. Both loan types require careful planning to manage the final lump sum.

Pros And Cons Of Balloon Payment Loans

Understanding the ‘Pros and Cons of Balloon Payment Loans’ is crucial. A balloon payment loan can seem attractive. It offers lower monthly installments with a large final payment. Yet, borrowers should weigh the benefits against potential risks.

Benefits For Borrowers

- Lower Monthly Payments: Initial installments are often less.

- Flexibility: Useful for short-term financing.

- Accessibility: Easier qualification for some borrowers.

- Liquidity: Frees up cash for other investments.

Risks And Drawbacks

- Large Final Payment: The balloon payment can be hefty.

- Refinancing Risk: Future financial conditions may hinder refinancing.

- Interest Rate Risk: Rates may rise, increasing costs.

- Asset Depreciation: The asset may lose value over time.

Preparing For A Balloon Payment

A balloon payment is a large, lump-sum payment made at the end of a loan term. Understanding how to prepare for this payment is crucial for financial stability. Let’s explore effective strategies to tackle a balloon payment.

Financial Planning Strategies

Early preparation is key. Here are steps to ensure readiness:

- Save regularly to build a fund for the balloon payment.

- Create a budget that includes a separate category for this saving.

- Use online calculators to estimate the balloon payment amount.

- Consider investing to grow your balloon payment fund faster.

These steps help manage the large payment without financial strain.

Refinancing Options

If saving isn’t enough, refinancing is a viable option. Consider these points:

- Research different lenders for the best refinancing rates.

- Understand the new terms and how they affect your finances.

- Ensure the new monthly payments are manageable.

- Look for options with no early payoff penalties.

Refinancing can spread the cost over more time, making it easier to handle.

Impact On Loan Amortization

Impact on Loan Amortization can be quite significant when dealing with balloon payments. These unique loan structures can alter the typical process of paying down debt. Let’s dive into how this impacts the amortization of a loan.

Understanding Amortization With Balloon Payments

Amortization refers to the gradual reduction of a loan balance through payments over time. With balloon payments, this process looks a bit different. A portion of the loan remains unpaid until the end of the term. This results in a larger final payment, known as the balloon payment.

- Monthly payments are often lower than traditional loans.

- The majority of the loan remains unpaid for the term.

- A significant lump sum is due at the end of the amortization period.

Comparing To Traditional Amortization

In traditional amortization, monthly payments are calculated to pay off the entire loan, including interest, by the end of the term. With balloon payments, the calculation differs.

| Traditional Loan | Balloon Payment Loan |

|---|---|

| Even payments until loan completion | Lower payments with a final large payment |

| Interest and principal paid down regularly | Interest primarily paid, less principal reduction |

| No large payment at the end | Large balloon payment concludes the loan |

The balloon payment model can affect financial planning. Borrowers need to prepare for the sizable end payment. This contrasts with the predictable nature of traditional loan payments.

Balloon Payments And Interest Rates

Understanding balloon payments means exploring how interest rates affect them. A balloon payment is a large, lump-sum payment due at the end of a loan term. It’s different from regular loan payments. This section breaks down the basics.

Interest Rate Effects On Payments

Interest rates directly influence balloon payments. Higher rates mean higher overall costs. Loans with balloon payments often start with lower monthly payments. Yet, the final balloon payment can be quite substantial.

Fixed Vs. Variable Rates

Loans can have fixed or variable interest rates. This impacts the balloon payment.

- Fixed rates keep payments predictable.

- Variable rates can change the payment size.

With fixed rates, borrowers know the exact balloon payment amount from the start. Variable rates can lead to an unexpected balloon payment size. It’s important to consider this when choosing a loan.

Credit: www.investopedia.com

Legal And Regulatory Considerations

Understanding balloon payments on loans requires knowledge of legal and regulatory considerations. These rules protect consumers. They ensure lenders provide clear information. Let’s explore these considerations.

Consumer Protection Laws

Laws guard borrowers from unfair practices. They provide rights and set rules for lenders. These laws vary by country and region.

- Truth in Lending Act (TILA): This U.S. law mandates clear loan term disclosures.

- Consumer Credit Acts: These acts in the UK outline borrower rights.

- National Consumer Credit Protection Act: This Australian law demands transparent lending.

Lender Disclosure Requirements

Lenders must follow strict disclosure rules. They need to inform borrowers about all loan aspects. This includes balloon payments.

| Disclosure Item | Details Required |

|---|---|

| Payment Schedule | Includes all monthly payments and the balloon payment. |

| Interest Rates | Clear explanation of the rate applied. |

| Total Cost of Loan | Must show the total amount repayable with interest. |

| Penalties | Details any fees for late or missed payments. |

Clear lender disclosures help borrowers make informed decisions. They can better understand loan obligations.

Real-life Scenarios

Understanding balloon payments on loans can be tricky. Real-life scenarios often clarify how they work. Let’s dive into some case studies and gather tips from financial experts.

Case Studies Of Balloon Payments

John’s Auto Loan: John took a five-year auto loan. For four years, he paid low monthly amounts. In year five, he owed a large balloon payment.

Susan’s Business Loan: Susan’s start-up had a loan with a three-year term. Small payments were made initially. A sizable payment was due at the end.

| Name | Loan Type | Term | Balloon Payment |

|---|---|---|---|

| John | Auto Loan | 5 Years | $10,000 |

| Susan | Business Loan | 3 Years | $15,000 |

Tips From Financial Advisors

- Plan Ahead: Save monthly for the balloon payment.

- Understand Terms: Know your loan agreement well.

- Refinance Options: Explore before the payment is due.

Advisors stress the importance of preparing for the final lump sum. They suggest setting aside funds regularly. This prevents financial stress later.

:max_bytes(150000):strip_icc()/balloonloan.asp-final-adc4ed58300e4c13a8497d3afd9fd46d.png)

Credit: www.investopedia.com

Frequently Asked Questions

What Is A Balloon Payment On A Loan?

A balloon payment on a loan is a large, lump-sum payment due at the end of a loan term. It pays off the remaining balance, typically after a series of smaller, regular payments.

How Does A Balloon Payment Affect Loan Terms?

Balloon payments can lead to shorter loan terms and possibly lower regular payments. However, the final lump-sum payment is significantly larger than the preceding installments.

Who Should Consider A Balloon Payment Loan?

A balloon payment loan is suitable for borrowers expecting a future cash windfall, such as a bonus or investment return, to cover the large end-term payment.

What Are The Risks Of Balloon Payments?

The main risk of balloon payments is the potential inability to pay the large sum at loan maturity, which could lead to refinancing or default.

Conclusion

Understanding balloon payments is crucial for any loan agreement. This method can offer lower initial payments, but requires a significant sum at the end. Before opting for such a plan, assess your financial stability and future income. Smart planning and consultation with financial advisors ensure you’re making an informed choice.

Always aim for a loan strategy that aligns with your long-term financial goals.