Health insurance typically covers prenatal care, childbirth, and postnatal care. Coverage varies by plan and provider.

Health insurance for pregnancy includes essential services. Plans usually cover prenatal visits, ultrasounds, and lab tests. Many policies also include labor and delivery costs, whether for a hospital birth or a birthing center. Postnatal care for both mother and baby is often part of the package.

It’s crucial to check your specific plan for details. Understanding your coverage helps avoid unexpected expenses. Ensure you know which providers are in-network to maximize benefits. Early research and planning can ease financial stress during pregnancy. With the right information, you can focus more on your growing family and less on medical bills.

.jpg)

Credit: myleavebenefits.nj.gov

Introduction To Pregnancy Health Insurance

Pregnancy is a crucial time. Health insurance can help you manage costs. It is essential to understand how it works. This ensures you get the care you need.

Importance Of Coverage

Coverage for pregnancy is very important. It helps cover the high costs of prenatal care. Prenatal care includes doctor visits, tests, and screenings. These are all essential for a healthy pregnancy.

Without insurance, these costs can be very high. Health insurance can reduce these costs significantly. It can also cover hospital stays and delivery. This includes both vaginal deliveries and C-sections.

Common Misconceptions

Many people think pregnancy is not covered by insurance. This is a misconception. Most health insurance plans do cover pregnancy. It is important to check your specific plan.

Another misconception is that only married women get coverage. This is not true. Health insurance covers pregnancy for all women. This includes single women and those in partnerships.

Some believe that only employer-provided insurance covers pregnancy. This is false. Many individual plans also offer coverage. Always review your plan details.

Credit: myfamilylifeinsurance.com

Types Of Health Insurance Plans

Understanding the types of health insurance plans available is crucial for expecting parents. Different plans offer varying coverage and benefits for pregnancy. This section will help you navigate through the main types of health insurance plans.

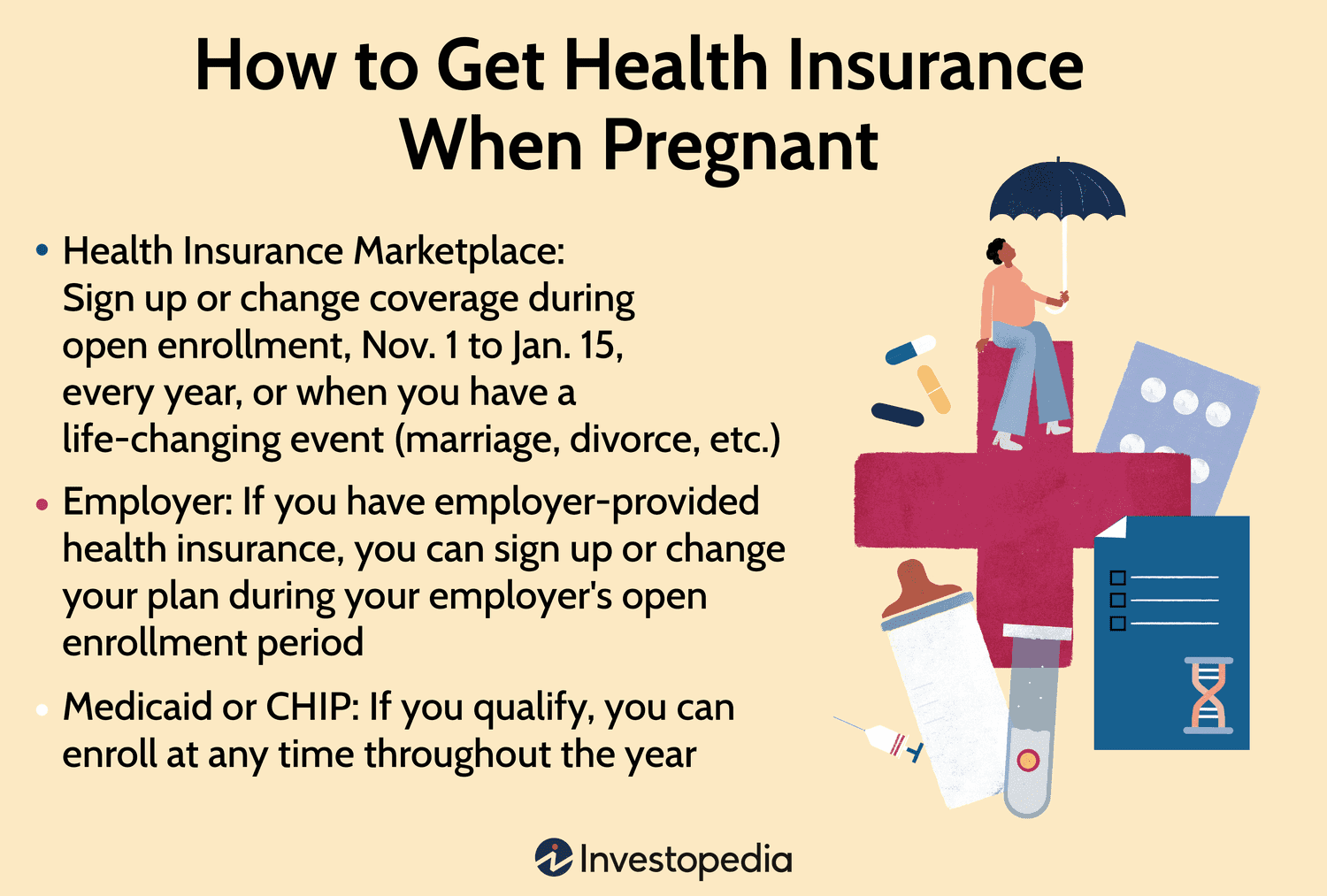

Employer-sponsored Plans

Many people get health insurance through their employer-sponsored plans. These plans often provide comprehensive coverage for pregnancy-related services. They typically include prenatal visits, hospital stays, and postnatal care.

- Lower premiums due to employer contributions

- Access to a broader network of doctors and hospitals

- Possible additional benefits like maternity leave and wellness programs

Check with your HR department for specific details about your plan’s pregnancy coverage.

Individual Plans

For those without employer coverage, individual plans are another option. These plans are purchased directly from insurance providers or through the Health Insurance Marketplace.

- Choose from a variety of plans with different coverage levels

- Can include essential benefits like prenatal and postnatal care

- Potentially higher premiums compared to employer-sponsored plans

Review the plan’s details carefully to ensure it covers all necessary pregnancy-related services.

Both types of plans have their pros and cons. Assess your needs and budget to make the best choice for your pregnancy.

Prenatal Care Coverage

Expecting a baby is an exciting journey. Health insurance plays a crucial role during this time. Prenatal care coverage helps ensure the well-being of both mother and baby. It covers various essential services needed throughout pregnancy.

Routine Checkups

Routine checkups are vital for monitoring the health of the mother and baby. Health insurance typically covers monthly visits during the first six months. These visits become bi-weekly during the seventh and eighth months. In the last month, visits are usually weekly.

During these visits, doctors check the baby’s growth, heart rate, and position. They also monitor the mother’s weight, blood pressure, and overall health. Routine checkups help in detecting any potential issues early.

Specialized Tests

Sometimes, doctors recommend specialized tests to ensure everything is on track. Health insurance often covers many of these tests. Some common specialized tests include:

- Ultrasound Scans: These help in checking the baby’s development and position.

- Blood Tests: These help in detecting conditions like anemia or gestational diabetes.

- Amniocentesis: This test checks for genetic abnormalities.

- Non-Stress Tests: These monitor the baby’s heartbeat.

Each test has a specific purpose and is usually recommended based on individual needs. Insurance coverage for these tests ensures that you receive the best care without financial strain.

Credit: www.careinsurance.com

Labor And Delivery Costs

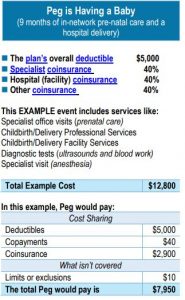

Understanding labor and delivery costs is vital for expecting parents. Health insurance can cover many of these expenses. Knowing what to expect helps in planning.

Hospital Stays

A hospital stay is common for childbirth. Health insurance usually covers a portion of the costs.

| Item | Covered by Insurance |

|---|---|

| Room and Board | Yes |

| Labor and Delivery | Yes |

| Medications | Sometimes |

| C-Section | Yes |

Insurance often covers hospital stays, but there may be limits. Room and board and labor and delivery are generally included. Medications might have partial coverage.

Home Births

Some families choose to have a home birth. Health insurance coverage for home births varies.

- Midwife services may be covered.

- Supplies for home birth might not be covered.

- Emergency transfers to hospitals are often covered.

Check your policy to see what is covered. Having a midwife can be beneficial and often covered. Supplies needed for a home birth are usually an out-of-pocket expense. If there is an emergency, emergency transfers to hospitals are typically covered.

Postpartum Care And Newborn Coverage

Understanding postpartum care and newborn coverage is crucial for new parents. Health insurance plays a vital role during this period. Let’s explore how insurance supports both the mother and the baby.

Mother’s Health

Postpartum care ensures the mother recovers well after childbirth. Health insurance often covers:

- Postnatal checkups

- Mental health support

- Physical therapy

These services help the mother regain strength. Insurers may also cover lactation consultations and breastfeeding supplies.

Baby’s First Year

Newborn coverage is essential for a healthy start. Health insurance typically includes:

- Well-baby visits

- Vaccinations

- Screenings and tests

These visits track the baby’s growth and development. Early detection of health issues is possible with regular checkups.

| Service | Coverage |

|---|---|

| Postnatal Checkups | Yes |

| Well-Baby Visits | Yes |

| Vaccinations | Yes |

| Screenings and Tests | Yes |

Ensure your insurance plan covers these essential services. This way, both mother and baby receive the best care.

Navigating Insurance Claims

Health insurance can be confusing, especially for pregnancy. Understanding how to navigate insurance claims is crucial. It ensures you get the coverage you need. This section will guide you through filing claims and appealing denials.

Filing Claims

Filing insurance claims for pregnancy involves several steps:

- Collect your medical bills: Gather all your bills from prenatal visits, tests, and delivery.

- Fill out claim forms: Your insurance provider will have specific forms. Fill them out accurately.

- Submit the forms: Send the completed forms and medical bills to your insurance company.

- Follow up: Keep track of your claim status. Contact your insurer if you need updates.

Ensure all information is correct. Mistakes can delay your claim processing.

Appealing Denials

Sometimes, insurance claims get denied. Don’t panic. You can appeal the decision:

- Understand the denial: Read the denial letter carefully. Note the reasons for denial.

- Gather evidence: Collect documents that support your case. Include medical records and doctor’s notes.

- Write an appeal letter: Explain why the claim should be approved. Attach all evidence.

- Submit your appeal: Send the appeal letter and documents to your insurance company.

- Follow up: Keep track of your appeal status. Contact your insurer if you need updates.

Be persistent. Insurance appeals can take time. Make sure to follow up regularly.

Frequently Asked Questions

What Does Pregnancy Health Insurance Cover?

Pregnancy health insurance typically covers prenatal visits, labor, delivery, and postnatal care for both mother and baby.

Does Health Insurance Cover Prenatal Vitamins?

Most health insurance plans do not cover prenatal vitamins. However, some plans might cover them if prescribed by a doctor.

Is Childbirth Covered By Health Insurance?

Yes, most health insurance plans cover childbirth, including hospital stay, labor, delivery, and necessary medical procedures.

Can I Get Health Insurance While Pregnant?

Yes, you can get health insurance while pregnant. Many plans offer maternity coverage regardless of pregnancy status.

Do I Need Special Insurance For Pregnancy?

No, you don’t need special insurance for pregnancy. Regular health insurance plans often include maternity and prenatal care.

Conclusion

Understanding health insurance for pregnancy is crucial for expecting parents. It helps manage medical costs and reduces financial stress. Ensure your policy covers prenatal, delivery, and postnatal care. Always review your plan’s specifics and consult your provider. With the right information, you can focus on a healthy pregnancy journey.