Health insurance premiums are calculated based on factors like age, health status, location, and coverage level. Insurers also consider lifestyle and family history.

Understanding how health insurance premiums are determined can help you make informed decisions. Insurance companies assess various personal factors to set your premium. Age is a significant factor; older individuals often face higher premiums. Health status plays a crucial role; pre-existing conditions can lead to increased costs.

Location affects premiums due to varying healthcare costs in different areas. The type and amount of coverage you choose also impact the premium. Lifestyle choices, such as smoking, can raise your rates. Family medical history is another consideration. By knowing these factors, you can better navigate the complexities of health insurance.

Factors Influencing Premiums

Understanding how health insurance premiums are calculated can save you money. Various factors influence your premium costs. Knowing these can help you make informed decisions.

Age And Gender

Age is a significant factor in determining health insurance premiums. As you age, premiums increase. Older people generally require more medical care. This increases the risk for insurance companies.

Gender also plays a role. Typically, women pay higher premiums during childbearing years. This is due to potential pregnancy and childbirth costs. Men may face higher premiums as they age, particularly for conditions like heart disease.

Medical History

Your medical history can greatly impact your premiums. A history of chronic diseases, like diabetes or heart disease, increases your risk. Insurers might charge higher premiums to cover these risks.

Even if you are healthy now, past illnesses can affect your premiums. Regular check-ups and maintaining a healthy lifestyle can help manage these costs.

| Factor | Impact on Premiums |

|---|---|

| Age | Older age generally means higher premiums. |

| Gender | Women’s premiums can be higher during childbearing years. |

| Medical History | Chronic diseases and past illnesses can increase premiums. |

By understanding these factors, you can better navigate health insurance options. Stay informed to keep your premiums manageable.

Credit: www.onsurity.com

Role Of Lifestyle Choices

Understanding how health insurance premiums are calculated can be complex. One significant factor is your lifestyle choices. These choices directly impact your health and, consequently, your insurance costs. Let’s explore how smoking, alcohol, exercise, and diet play a role.

Smoking And Alcohol

Smoking and alcohol consumption are critical factors. Smokers tend to face higher insurance premiums. This is due to the increased risk of lung cancer, heart disease, and other health issues. Insurers consider these risks when calculating premiums.

Alcohol consumption also affects premiums. Heavy drinkers may pay more. This is because of the higher likelihood of liver disease, accidents, and other health problems. Even moderate drinking can influence your premiums.

Exercise And Diet

Exercise and diet are equally important. Regular exercise can lower your premiums. It reduces the risk of chronic diseases like diabetes and heart disease.

A healthy diet also plays a role. Eating balanced meals can improve your overall health. This can lead to lower insurance costs.

Insurers often offer discounts for healthy lifestyles. Maintaining a good exercise routine and diet can save you money.

Impact Of Geographic Location

The impact of geographic location on health insurance premiums is significant. Where you live can change how much you pay. This section dives into the reasons why.

Urban Vs. Rural

Location affects health insurance premiums in many ways. Urban areas often have more healthcare options. This can mean lower costs for some services. But cities can also have higher living costs. This can lead to higher premiums.

In rural areas, there may be fewer healthcare providers. This can increase costs for insurance companies. Fewer options can mean higher premiums for residents.

| Urban Areas | Rural Areas |

|---|---|

| More healthcare options | Fewer healthcare options |

| Higher living costs | Lower living costs |

| Potentially lower service costs | Potentially higher service costs |

Regional Healthcare Costs

Regional healthcare costs also play a big role. Some areas have more advanced healthcare facilities. These areas might have higher costs for treatments.

Insurance companies look at these costs. They adjust premiums based on regional expenses. More expensive regions mean higher premiums.

Here are some factors that affect regional healthcare costs:

- Availability of specialists

- Cost of medical procedures

- Local medical technology

- Rates of chronic diseases

In regions with high costs, insurance premiums will be higher. In regions with lower costs, premiums will be lower.

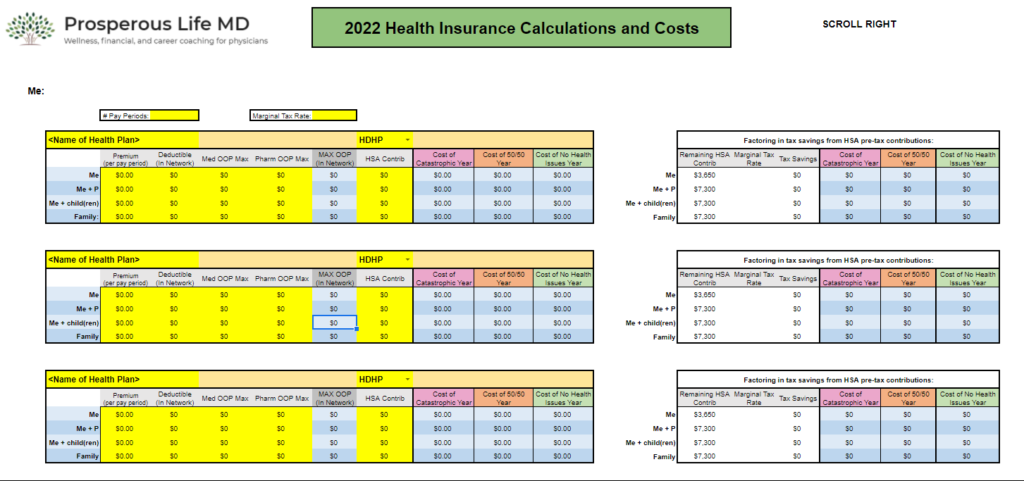

Credit: prosperouslifemd.com

Type Of Health Plan

Understanding how health insurance premiums are calculated can be complex. One key factor is the type of health plan you choose. Different plans offer different coverage and cost structures. Let’s explore some of the types and how they affect your premiums.

Hmo Vs. Ppo

Health Maintenance Organizations (HMO) and Preferred Provider Organizations (PPO) are popular health plans. They differ in several ways:

| Feature | HMO | PPO |

|---|---|---|

| Network Flexibility | Limited to network doctors | More flexibility, can see out-of-network doctors |

| Primary Care Physician (PCP) | Required | Not required |

| Referrals for Specialists | Required | Not required |

| Cost | Typically lower premiums | Usually higher premiums |

HMOs usually have lower premiums due to restricted networks. PPOs often cost more but offer greater flexibility.

Deductibles And Co-pays

Deductibles and co-pays also impact your health insurance premiums. These terms refer to out-of-pocket costs:

- Deductible: The amount you pay before insurance starts covering costs.

- Co-pay: A fixed fee you pay for specific services or medications.

Plans with higher deductibles usually have lower premiums. Lower deductible plans tend to have higher premiums.

Consider your health needs and financial situation. Choose a plan that balances cost and coverage.

Employer-sponsored Plans

Employer-sponsored plans are a common way for employees to get health insurance. These plans offer many benefits and often come with lower costs.

Group Rates

Employer-sponsored plans benefit from group rates. Insurers provide lower rates because they cover a large group of people. This means each employee pays less than they would for an individual plan. Group rates depend on factors like the number of employees and the overall health of the group.

Employers often negotiate these rates with insurance companies. They aim to get the best deal for their employees. The larger the group, the better the rates usually are. Healthy employees can also lower the group rate. Insurers see less risk and offer better prices.

Employee Contributions

In these plans, employee contributions are a key part. Employees pay a portion of the insurance premium. The employer covers the rest. This shared cost makes it affordable for employees.

Contribution amounts can vary. Some employers pay a larger share, reducing the employee’s cost. Others may require a higher employee contribution. Employers often offer different plan levels. Employees can choose a plan that fits their needs and budget.

| Plan Type | Employer Contribution | Employee Contribution |

|---|---|---|

| Basic Plan | 70% | 30% |

| Standard Plan | 80% | 20% |

| Premium Plan | 90% | 10% |

Employers may also offer extra benefits. These can include wellness programs and health screenings. These benefits help keep employees healthy and can lower overall costs.

:max_bytes(150000):strip_icc()/InsurancePremium_Final_4194539-49c5df26fba746b0b9d16de6e302fdf5.jpg)

Credit: www.investopedia.com

Government Regulations

Understanding how health insurance premiums are calculated can be complex. One important factor is government regulations. These rules ensure that insurers follow fair practices. Two key areas of regulation include ACA guidelines and state-specific rules.

Aca Guidelines

The Affordable Care Act (ACA) sets standards for health insurance. Insurers must follow these guidelines to determine premiums. The ACA requires that premiums cannot vary based on gender. Age and smoking status can affect premiums, but only within set limits. Insurers also must spend a specific percentage of premiums on healthcare services. This rule helps control costs and ensures value for policyholders.

| Factor | Impact on Premiums |

|---|---|

| Age | Older adults may pay up to three times more |

| Smoking Status | Smokers may face higher premiums |

| Gender | No impact due to ACA |

State-specific Rules

Each state can set its own rules for health insurance premiums. These rules can vary widely from state to state. Some states have stricter regulations than others. For example, some states limit how much premiums can vary based on age. Others may have rules about coverage for specific health conditions.

- States may require coverage for certain treatments

- Some states limit premium increases

- Different states have unique tax credits and subsidies

State-specific rules aim to protect consumers and ensure access to healthcare. It’s important to understand your state’s rules when choosing a health insurance plan.

Frequently Asked Questions

What Factors Affect Health Insurance Premiums?

Health insurance premiums are influenced by age, location, tobacco use, plan category, and individual or family enrollment.

How Does Age Impact Premiums?

Older individuals typically face higher premiums due to increased health risks and medical needs.

Why Does Location Matter For Premiums?

Healthcare costs vary by region, affecting the premiums set by insurance companies based on local expenses.

Do Lifestyle Choices Affect Premiums?

Yes, tobacco use and other lifestyle choices can lead to higher premiums due to associated health risks.

What Is The Role Of Plan Category?

Plan categories (Bronze, Silver, Gold, Platinum) determine the cost-sharing and premium levels for different insurance plans.

Conclusion

Understanding how health insurance premiums are calculated is crucial. Factors like age, location, and health conditions all play a role. Being informed helps you make better choices. Always compare different plans to find the best one for your needs. Stay proactive about your health and insurance coverage.