Have you ever wondered how Islamic banks make a profit without charging interest? If you think all banks earn money by piling up interest on loans, you’re not alone.

But Islamic banks operate differently—they follow strict rules that forbid interest, yet they still manage to thrive financially. How do they do it? By partnering with you in business ventures, trading real assets, and sharing both profits and risks in ways that align with Islamic principles.

You’ll discover the smart, ethical methods these banks use to generate income, and how their unique approach could change the way you think about banking and investing. Keep reading to uncover the fascinating world of Islamic finance and what it means for your money.

Credit: www.youtube.com

Profit-sharing Models

Profit-sharing models form the core of Islamic banking profit generation. These models follow Islamic law, which forbids interest. Instead, banks and customers share both profits and risks equally. This approach supports fairness and transparency in financial dealings.

Islamic banks invest in real economic activities. They avoid speculation and focus on asset-backed ventures. Profit-sharing ensures that the bank earns only from genuine trade and investment activities.

Equity Participation

Equity participation means the bank takes part in the ownership of a business or project. The bank provides capital and becomes a partner. Profits and losses are shared according to pre-agreed ratios. This method aligns the bank’s success with the customer’s success.

Equity participation encourages careful project selection. Banks conduct thorough checks to reduce risk. This model promotes cooperation and trust between the bank and its clients.

Investment Partnerships

Investment partnerships involve joint ventures between the bank and customers. Both parties contribute funds for a specific project. Profits are divided based on the amount invested or agreed terms. Losses, if any, are also shared fairly.

This model motivates all partners to work towards the project’s success. Islamic banks act as active investors, not just lenders. This participation strengthens the relationship and ensures transparency.

Credit: alts.co

Asset-based Transactions

Islamic banks earn profits mainly through asset-based transactions. These transactions involve real assets rather than money lending with interest. The bank buys or leases assets and sells or rents them to customers at a profit. This method follows Islamic law, which forbids charging interest. It creates a fair and transparent way for banks and customers to share risks and rewards.

Murabaha Sales

Murabaha is a common Islamic finance method. The bank buys an asset requested by the customer. Then, it sells the asset to the customer at a higher price. The price includes a known profit margin agreed in advance. The customer pays this price in installments or in full. This sale is based on a real asset, making the profit halal.

Ijarah Leasing

Ijarah means leasing in Islamic banking. The bank buys an asset and leases it to the customer. The customer pays rent for using the asset over a fixed period. At the lease end, the asset may be returned or transferred to the customer. This method generates income from the rent, which is a permissible profit source.

Salam Forward Contracts

Salam is a forward contract where the bank pays in advance for goods to be delivered later. The bank agrees to buy specific goods at a future date. The price is paid upfront, supporting producers with immediate funds. When goods arrive, the bank sells them to customers at a profit. This helps farmers and traders while earning halal returns.

Fee-based Income

Islamic banks generate income through various methods that comply with Shariah law. One significant source is fee-based income. These fees come from services provided to customers without involving interest. This approach ensures fairness and transparency in financial dealings. Islamic banks charge fees for specific services and asset management. These fees help cover operating costs and create profit.

Service Fees

Islamic banks charge customers for services like account maintenance and fund transfers. These fees are fixed and clear upfront. Customers pay for document processing, issuing letters of credit, and other banking operations. This method avoids interest and adheres to Islamic principles. Service fees provide steady income without risk from market fluctuations. They also encourage banks to improve customer experience and efficiency.

Asset Management Charges

Islamic banks manage assets such as investment portfolios and real estate on behalf of clients. They earn fees based on the value of assets managed or profits generated. These charges align with Islamic finance rules, ensuring investments are Shariah-compliant. Asset management fees incentivize banks to optimize returns for clients. They also diversify income sources beyond traditional financing activities.

Credit: www.halaltimes.com

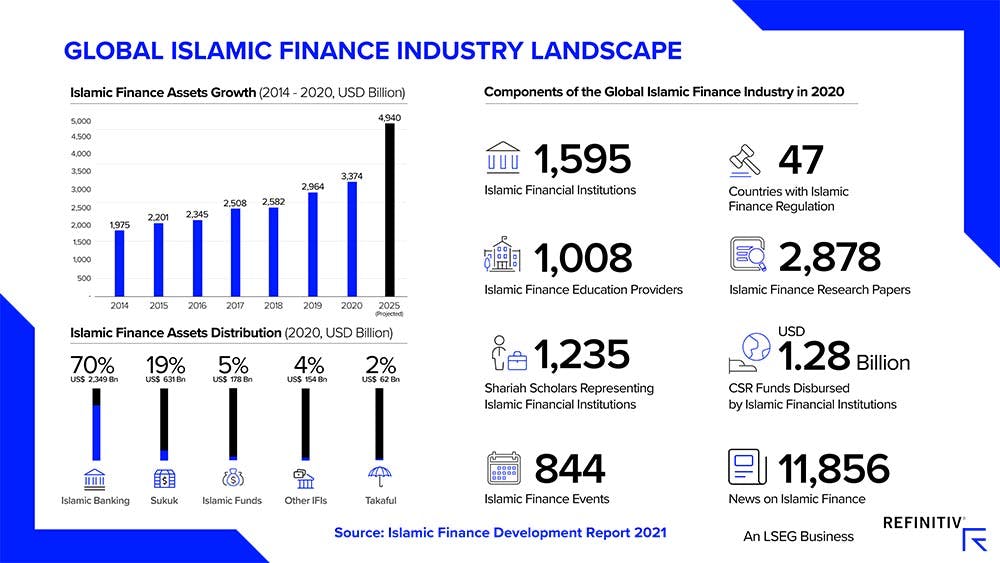

Sukuk And Capital Raising

Sukuk play a key role in how Islamic banks raise capital. These are Islamic financial certificates similar to bonds. Unlike conventional bonds, sukuk do not pay interest. They represent ownership in tangible assets, projects, or investment businesses. Investors earn returns from the profits generated by these assets.

Islamic banks issue sukuk to gather funds from investors. They use these funds to finance projects or expand their operations. The returns paid to investors depend on the actual profit made by the underlying asset. This profit-sharing aligns with Islamic finance principles.

Capital raising through sukuk allows Islamic banks to grow without violating Shariah law. It offers a transparent, ethical way to fund business activities. Investors benefit from asset-backed returns rather than fixed interest payments.

Sukuk Structure And Types

Sukuk structures vary but share the goal of asset ownership. Common types include Ijarah (leasing), Musharakah (joint venture), and Murabaha (cost-plus sale). Each type follows specific Shariah rules. These structures ensure that investments are backed by real economic activity.

Benefits Of Sukuk For Islamic Banks

Sukuk provide liquidity and improve balance sheets. They attract a wider range of investors interested in ethical finance. Islamic banks diversify funding sources beyond traditional deposits. This strengthens financial stability and supports business growth.

How Sukuk Generate Profit

Profits come from the performance of the underlying assets. Islamic banks share these profits with sukuk holders. The returns reflect real economic gains, not fixed interest. This profit-sharing model reduces risk and promotes fairness in finance.

Capital Raising Strategies Using Sukuk

Islamic banks plan sukuk issues to match funding needs. They target specific projects that generate steady income. Careful asset selection ensures consistent profit for investors. These strategies help maintain investor confidence and support long-term growth.

Profit Calculation Methods

Islamic banks earn profits through methods that comply with Shari’ah law. These methods focus on fairness and transparency in profit calculation. The goal is to share risks and rewards between the bank and its customers. This approach avoids interest, which is not allowed in Islamic finance.

Profit calculation methods play a key role in how Islamic banks operate. They help determine the bank’s earnings in a clear and agreed-upon way. Customers know how profits are calculated before entering any contract. This builds trust and ensures all parties benefit fairly.

Pre-agreed Profit Rates

Islamic banks set profit rates before starting any transaction. These rates are agreed upon by both the bank and the customer. This agreement removes uncertainty and protects both sides. The profit rate is based on expected returns from the investment or sale.

For example, in a Murabaha contract, the bank buys an asset and sells it to the customer at a higher price. The extra amount includes the pre-agreed profit margin. This method ensures that the bank’s profit is clear and lawful.

Transparent Profit Distribution

Transparency is vital in Islamic banking profit sharing. Banks disclose how profits and losses are divided between the bank and customers. This process is open and easy to understand. Customers see exactly what portion of profits they will receive.

Profit distribution depends on the type of contract used. In investment partnerships, profits are shared according to the agreed ratio. Losses, if any, are also shared fairly. This transparency helps maintain trust and aligns with Islamic values of justice.

Risk Sharing Principles

Islamic banks operate on unique principles that differ from conventional banking. Central to their profit-making is the concept of risk sharing. This principle ensures that both the bank and its customers share the risks and rewards of financial activities. It promotes fairness and ethical dealings in financial transactions.

Risk sharing aligns the interests of the bank and its clients. It encourages responsible investment and discourages speculation. This system supports economic growth while adhering to Islamic law, or Shari’ah, which prohibits certain activities like charging interest.

Joint Profit And Loss Sharing

Islamic banks enter into partnerships with their clients. They invest money in business ventures or projects together. Both parties agree to share profits based on a pre-set ratio. If the venture suffers losses, the bank shares them too.

This approach means the bank’s income depends on real economic activity. It promotes transparency and trust. Customers and banks work as partners, sharing successes and setbacks fairly.

Avoidance Of Interest (riba)

Islamic banks do not charge or pay interest, known as riba. This practice is forbidden by Islamic law because it leads to unfair gain. Instead, banks earn money through trade and investment activities.

Profits come from selling goods, leasing assets, or investing in projects. This way, the bank’s earnings are linked to actual business performance. Avoiding interest helps maintain justice and equality in finance.

Compliance With Shariah

Islamic banks must follow strict rules called Shariah law. This law guides all their financial activities. It ensures banks make profits fairly and ethically. Compliance with Shariah is central to their business model. It builds trust with customers and the community. Islamic banks avoid interest and risky investments. They focus on clear and honest transactions. This way, profits come from real economic activities that benefit everyone involved.

Halal Profit Sources

Islamic banks earn profits from halal, or lawful, sources only. They use trade, leasing, and partnerships to generate income. For example, they buy and sell goods with a markup. Leasing assets to customers also brings profit. Another method is sharing profits in business ventures. All these activities must comply with Shariah rules. This means no interest or gambling is involved. The bank and customer share risks and rewards fairly.

Prohibited Transactions

Certain transactions are forbidden under Shariah law. Charging or paying interest is strictly prohibited. This is called riba and is considered unfair. Islamic banks avoid investing in businesses that sell alcohol, pork, or weapons. They also avoid speculation and gambling activities. These restrictions protect customers and society from harm. Banks use a Shariah board to review all transactions. This ensures every deal meets ethical and religious standards.

Frequently Asked Questions

How Do Islamic Banks Earn Profit?

Islamic banks earn profit by sharing business risks and profits with customers through asset-based sales, partnerships, and investments. They avoid interest by engaging in Shari’ah-compliant trading and investment activities, ensuring profits come from real economic transactions.

How Is Profit Calculated In Islamic Banking?

Islamic banks calculate profit by sharing returns from Shari’ah-compliant investments. Profit rates are agreed upon transparently. They earn through asset-based sales, partnerships, and equity participation without charging interest.

How Does Islamic Banking Handle Profit Distribution?

Islamic banks share profits with customers based on pre-agreed ratios in asset-backed or partnership investments. They avoid interest, ensuring fair risk and reward distribution.

Is Islamic Bank Profit Halal?

Islamic bank profit is halal because it comes from trade, profit-sharing, and asset-based transactions, not from interest (riba). These profits comply with Shariah law by linking earnings to real economic activities and shared risks.

Conclusion

Islamic banks earn profit through fair trade and shared risks. They avoid interest and focus on real assets. Profit comes from partnerships and business ventures. This approach supports ethical and transparent finance. Customers and banks both share success and losses.

Islamic banking promotes justice and economic balance. It offers an alternative to conventional banking systems. Understanding this helps appreciate how Islamic banks grow.