Peer-to-peer lending, also known as P2P lending, has emerged as a popular alternative investment option in recent years. It offers individuals the opportunity to lend money directly to other individuals or businesses through online platforms, bypassing traditional financial institutions. If you’re considering venturing into P2P lending, one of the key questions that may arise is how much money you need to get started. In this article, we’ll explore the factors that determine the amount of money you need for peer-to-peer lending and provide useful insights for potential investors.

Minimum Investment Requirements:

Most peer-to-peer lending platforms have a minimum investment requirement, which can vary depending on the platform. The minimum investment amount typically ranges from $25 to $1,000. This means that you can get started with P2P lending with a relatively small sum of money, making it an accessible investment option for many individuals. It’s important to research different P2P lending platforms to find one that aligns with your investment budget.

Loan Diversification and Risk Management:

When determining how much money you need for P2P lending, it’s crucial to consider the concept of loan diversification. Diversifying your investment across multiple loans can help mitigate risks associated with borrower defaults. By spreading your investment across various loans, you can potentially minimize the impact of any individual loan defaulting. As a result, you may need a larger sum of money to create a well-diversified P2P lending portfolio.

Platform Fees and Charges:

It’s essential to factor in platform fees and charges when calculating the amount of money you need for P2P lending. Different P2P lending platforms may have varying fee structures, including fees for loan servicing, account management, and transaction processing. These fees can impact the overall returns on your investment. Therefore, it’s advisable to account for these expenses when determining the initial investment amount.

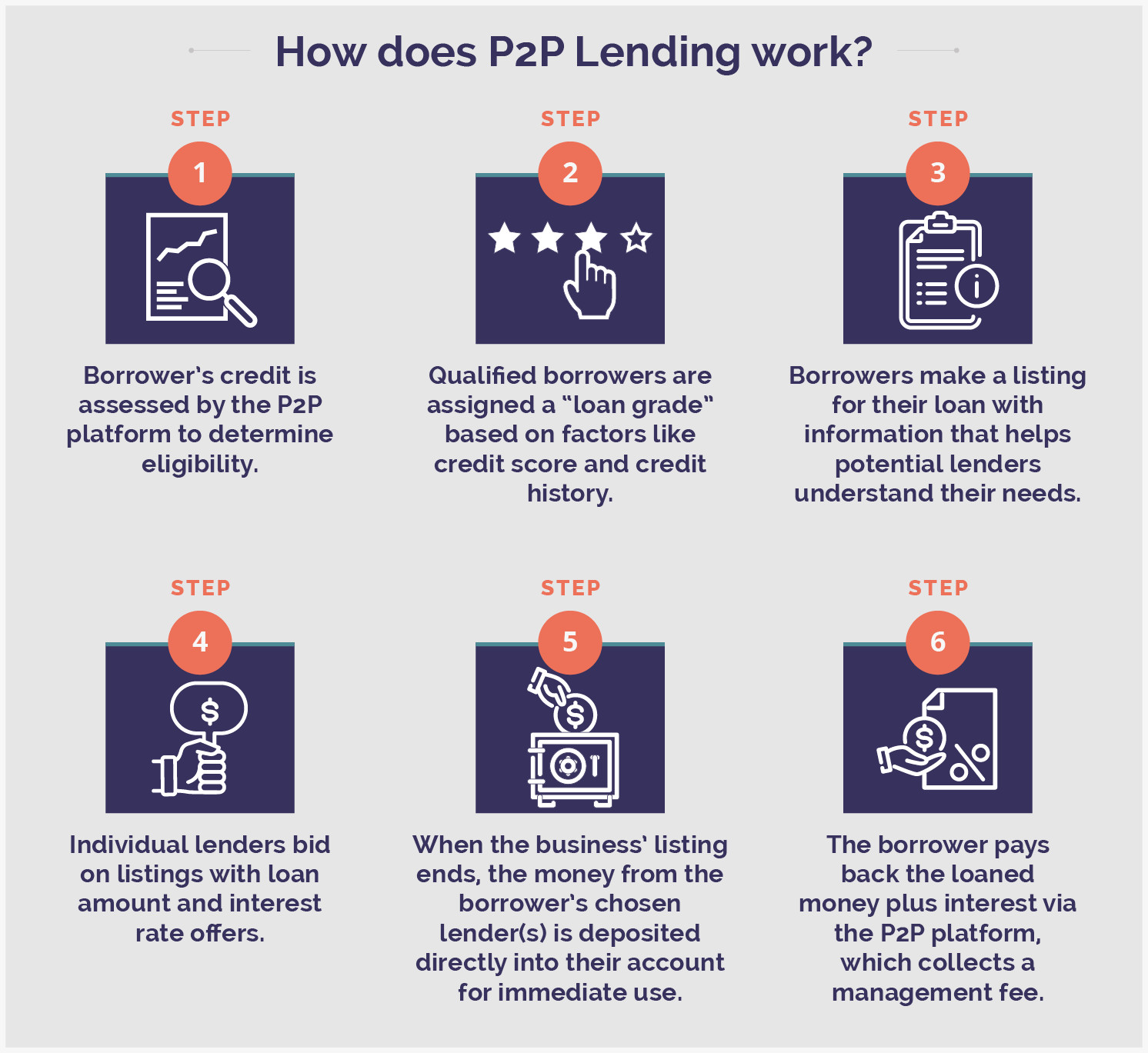

Credit: lanterncredit.com

Risk Appetite and Investment Goals:

Your risk appetite and investment goals play a significant role in deciding how much money you need for P2P lending. If you have a higher risk tolerance and seek potentially higher returns, you might consider allocating a larger sum of money to P2P lending. On the other hand, if you prefer a more conservative approach, you may start with a smaller initial investment and gradually increase your exposure based on your comfort level.

Credit: corporatefinanceinstitute.com

Return Expectations and Liquidity:

Understanding your return expectations and liquidity needs is paramount when determining the required investment amount for P2P lending. While P2P lending can offer attractive returns compared to traditional investments, it’s essential to assess your financial objectives and liquidity requirements. Consider how much money you can comfortably allocate to P2P lending without jeopardizing your overall financial stability and cash flow needs.

Conclusion:

In conclusion, the amount of money you need for peer-to-peer lending can vary based on multiple factors, including minimum investment requirements, loan diversification, platform fees, risk appetite, investment goals, return expectations, and liquidity considerations. By carefully evaluating these factors and conducting thorough research, you can determine an appropriate investment amount that aligns with your financial capacity and investment objectives. Remember to assess the potential risks and rewards associated with P2P lending and seek professional advice if needed before making investment decisions.

Frequently Asked Questions For How Much Money Do You Need For Peer To Peer Lending?

How Much Money Do You Need For Peer To Peer Lending?

Peer to peer lending platforms typically have a minimum investment requirement ranging from $25 to $1,000.

Can You Invest In Peer To Peer Lending With A Small Budget?

Yes, peer to peer lending allows you to invest with a small budget, with some platforms allowing investments as low as $25.

What Is The Average Return On Investment In Peer To Peer Lending?

The average return on investment in peer to peer lending varies, but it can range from 5% to 12% annually, depending on the platform and the type of loans you invest in.

Are There Any Risks Involved In Peer To Peer Lending?

Yes, there are risks involved in peer to peer lending. These risks include borrower default, platform bankruptcy, and economic downturns affecting loan repayments.