To apply for a personal loan online, start by selecting a reputable lender and completing their application form. Ensure that you have all necessary documents, like proof of income and identity, ready for upload.

Navigating the financial waters of personal loans can be straightforward with the right approach. The journey begins by choosing a trusted online lender, which is crucial for a secure transaction. With the vast array of financial institutions available, it’s essential to research and compare interest rates, fees, and repayment terms.

Once you’ve settled on a lender, the application process typically involves filling out an online form with personal and financial details. Being prepared with the necessary documentation, such as bank statements, payslips, and government-issued ID, can expedite the process. Most lenders also require a credit check to assess your loan eligibility and determine the terms of the loan. After submitting your application, you can often expect a prompt decision, thanks to the efficiency of online systems. If approved, the loan amount is usually deposited directly into your bank account, sometimes within a day or two, making the online personal loan application process a convenient option for quick financial needs.

Introduction To Online Personal Loans

Introduction to Online Personal Loans has reshaped borrowing. Gone are the days of waiting in bank lines. Online loans offer convenience and speed. With a few clicks, one can apply for a loan from home.

Rising Popularity Of Digital Lending

Digital lending is on the rise. It’s because of its simplicity and quick service. More people are choosing online loans over traditional bank loans.

Benefits Of Online Loan Applications

- Quick Access: Get loan options fast.

- Simple Process: Fill forms easily online.

- Less Paperwork: Say goodbye to huge paper stacks.

- Compare Options: See different lenders in one place.

- Secure Transactions: Your data stays safe.

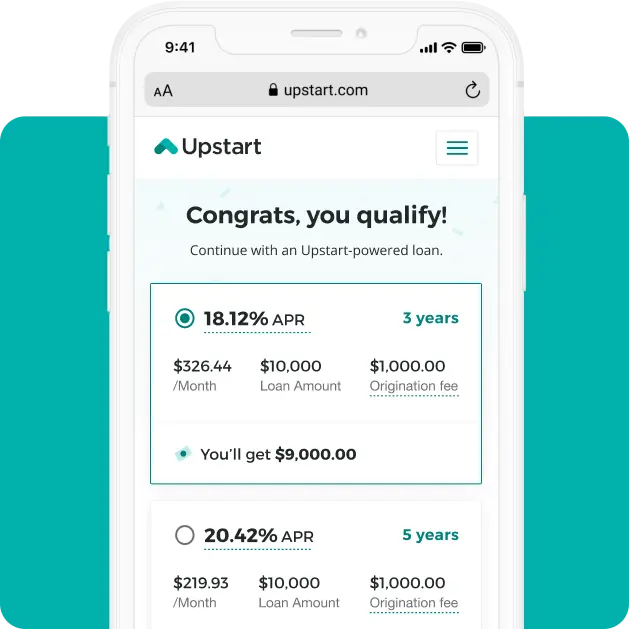

Credit: www.upstart.com

Eligibility Criteria For Online Personal Loans

Before applying for a personal loan online, know the rules. These rules are called eligibility criteria. They help banks decide if they can give you a loan. Let’s look at these rules closely.

Basic Requirements To Qualify

To get a loan, you must meet some basic needs. Here they are:

- Age: You must be at least 18 years old.

- Income: You need a regular source of money.

- Job: A steady job helps. It shows you can pay back.

- Documents: ID proof, address proof, and income proof are needed.

Importance Of Credit Score In Eligibility

Your credit score shows how good you are with money. A high score means you pay bills on time. Banks like this. It makes getting a loan easier.

| Credit Score Range | Loan Approval Chance |

|---|---|

| 750 and above | High |

| 650 – 749 | Medium |

| Below 650 | Low |

To improve your score, pay bills on time and keep debt low. A good score helps get a loan with better terms.

Documents Required For Personal Loan Application

Before applying for a personal loan online, gather key documents. These documents prove your identity, address, and income. Lenders need these to process your application.

Identification And Address Proof

For a smooth application, you’ll need valid ID and proof of where you live. Banks and lenders accept certain documents.

- Passport: Widely accepted for photo and birthdate.

- Driver’s License: Shows your photo and address.

- Aadhaar Card: A must-have for Indian residents.

- Voter ID Card: Another option for voters.

- Utility Bills: Confirm your current address.

- Lease Agreement: If you’re renting your place.

Income Verification Documents

Lenders want to see your earnings. This helps them decide on your loan. Prepare these papers in advance.

| Document Type | Description |

|---|---|

| Salary Slips | Last three months’ slips for salaried individuals. |

| Bank Statements | Last six months’ statements showing salary credits. |

| Income Tax Returns | Latest ITR for self-employed or business owners. |

| Form 16 | Issued by employers as a tax and income proof. |

Ensure all documents are current and clear. This speeds up the loan process.

Choosing The Right Lender For Your Needs

Finding the right lender is crucial when applying for a personal loan online. Your choice will affect your financial health. It is important to consider interest rates, fees, and lender reputation. Start by comparing options carefully.

Comparing Interest Rates And Fees

Interest rates and fees can make a big difference in your total loan cost. Look for low-interest rates and minimal fees to save money over time. Use comparison tables to review different lenders’ offerings side by side.

| Lender | Interest Rate | Origination Fee | Late Fee |

|---|---|---|---|

| Lender A | 5% | $100 | $15 |

| Lender B | 6% | $150 | $20 |

Reading Reviews And Checking Ratings

Customer reviews and ratings give insight into a lender’s service quality. Check verified reviews for real customer experiences. High ratings usually mean better reliability and customer satisfaction. Consider these before deciding.

- Search for online reviews on trusted platforms.

- Look for recurring comments about customer service.

- Check for comments about loan processing times.

- Notice any frequent issues other borrowers faced.

Understanding Loan Terms And Conditions

Before you click “apply” for a personal loan online, understanding the loan terms and conditions is crucial. This knowledge can save you from unexpected costs. Let’s dive into the details to make sure you know what you’re signing up for.

Interest Rates And Repayment Terms

The interest rate of your loan affects how much you’ll pay back. It’s the cost of borrowing money. Repayment terms define how long you have to pay back the loan. Together, these factors determine your monthly payment.

- Fixed interest rates stay the same throughout the loan period.

- Variable interest rates can change, affecting your payments.

Choose a loan with terms that fit your budget. A shorter repayment period means higher monthly payments but lower total interest. A longer period lowers monthly payments but increases total interest.

Prepayment Penalties And Late Fees

Some loans charge a fee if you pay them off early. This is a prepayment penalty. Know if your loan has one. Late fees are extra costs for missing a payment deadline. Avoid these fees by paying on time.

| Fee Type | Description | How to Avoid |

|---|---|---|

| Prepayment Penalty | Fee for early loan repayment | Check loan terms before signing |

| Late Fees | Fee for missing a payment deadline | Set reminders for due dates |

Understanding these terms helps you choose the right loan and avoid extra costs.

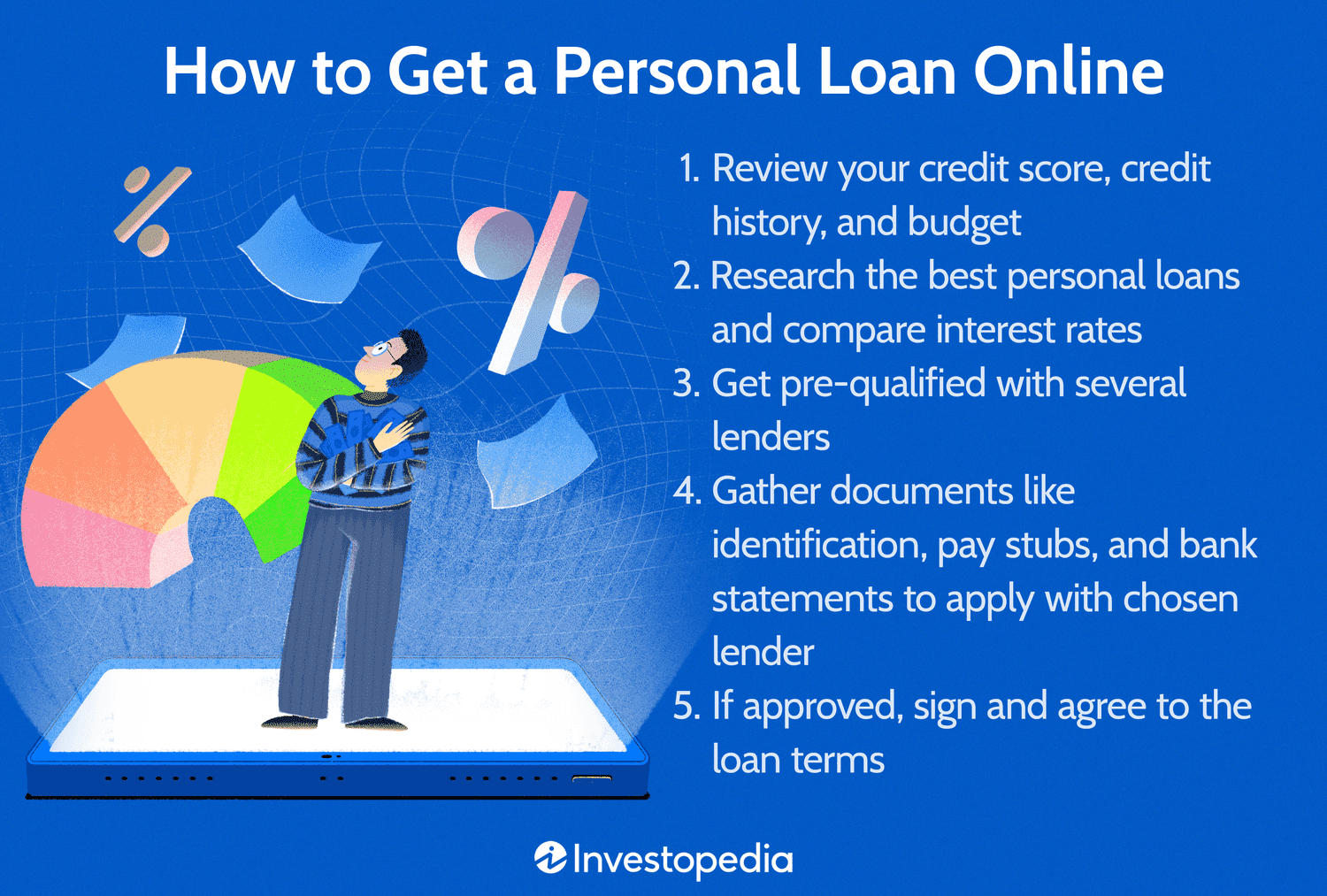

The Application Process Step By Step

Understanding the steps to apply for a personal loan online is crucial. The process is fast and simple. Follow these steps to secure a loan from the comfort of your home.

Online Form Filling

Start by finding a reputable lender’s website. Look for the application section.

- Click the ‘Apply Now’ button.

- Enter personal details accurately.

- Provide employment and income information.

- Select the desired loan amount and repayment term.

- Review all data before submitting.

Filling out the form takes minutes. Ensure all information is current and correct.

Document Upload And Verification

After form submission, you must verify your identity and income.

- Prepare required documents.

- Scan or take clear photos of each document.

- Upload files using the lender’s secure portal.

The lender will then check your documents. This step confirms your eligibility for the loan.

Common documents include:

| Document Type | Description |

|---|---|

| ID Proof | Passport, Driver’s License, or ID Card |

| Address Proof | Utility Bill or Lease Agreement |

| Income Proof | Bank Statements or Pay Slips |

Wait for the lender’s approval. This can take a few hours to a few days.

Tips For A Successful Loan Application

Preparing to apply for a personal loan online requires attention to detail. Follow these tips to boost your chances of approval.

Ensuring Accurate Information

Accuracy is critical when filling out your loan application. Lenders verify every detail. Double-check your form for any errors. Incorrect information can lead to rejection.

- Personal details: Confirm your name, address, and date of birth match your documents.

- Employment info: State your job title, salary, and employer accurately.

- Financial data: Report all incomes and debts. Include side hustles or part-time jobs.

Improving Credit Score Before Applying

A higher credit score means better loan terms. Work on your credit before applying. It shows lenders you’re responsible with credit.

- Check your credit report: Look for any mistakes. Dispute them if you find any.

- Pay bills on time: Set reminders. Late payments hurt your score.

- Reduce debt: Pay down balances. Lower debt-to-income ratios are favorable.

- Avoid new credit: Don’t open new accounts. This can temporarily lower your score.

After Submission: What Comes Next?

Submitted your personal loan application online? Wondering what happens next?

Let’s walk through the steps after hitting the ‘submit’ button.

Application Review And Approval Timeframe

Lenders start with verifying your details.

They check credit scores and financial history.

Approval times vary from hours to a few weeks.

Keep an eye on your email and phone for updates.

Disbursement Of Loan Funds

Got the green light? Funds hit your account next.

Some lenders transfer money within 24 hours.

Others may take a few business days.

- Check the expected timeline with your lender.

- Plan your finances around the fund arrival.

Managing Your Personal Loan Responsibly

Once you secure a personal loan, managing it wisely is crucial. It ensures timely repayments and keeps your credit score healthy. Let’s dive into the best practices for keeping your loan in check.

Setting Up Automated Repayments

Automated repayments are a borrower’s best friend. They simplify your financial routine. Here’s how to set them up:

- Access your bank’s online portal.

- Select the ‘Bill Pay’ or ‘Autopay’ option.

- Link your loan account details.

- Choose a payment date that aligns with your paycheck.

- Confirm the setup and keep a record.

With autopay, you never miss a payment. This protects your credit score.

Keeping Track Of Your Loan Balance

It’s essential to monitor your loan balance. Here’s a simple strategy:

- Log in to your lender’s website monthly.

- Review your current balance and recent payments.

- Check for any fees or unexpected charges.

- Update your budget to reflect the remaining balance.

Regular checks keep you informed. You can adjust your budget as needed.

| Task | Frequency |

|---|---|

| Check Loan Balance | Monthly |

| Review Payments | After Each Due Date |

| Update Budget | As Needed |

Stay on top of your loan with these steps. You’ll ensure financial stability and peace of mind.

Credit: www.axisbank.com

Common Mistakes To Avoid

Applying for a personal loan online is easy. Yet, some mistakes can make it hard. Let’s talk about what not to do. This helps you get your loan without trouble.

Overborrowing Beyond Repayment Ability

It’s tempting to borrow more money than you need. Don’t do it. Think about what you can pay back. Borrowing too much can lead to big problems later.

- Check your monthly income.

- Figure out your expenses.

- Decide on a safe amount to borrow.

This keeps you safe from stress over money.

Ignoring Hidden Costs And Loan Terms

Loans have extra costs. Not just the interest. Read the fine print.

Here are things to watch for:

| Cost Type | What It Means |

|---|---|

| Processing Fees | Costs to set up your loan. |

| Late Payment Fees | Costs if you pay late. |

| Prepayment Penalties | Costs if you pay off early. |

Also, understand your loan’s terms. Know your interest rate and repayment schedule.

Credit: www.nbtbank.com

Frequently Asked Questions

What Is Needed To Apply For A Personal Loan Online?

To apply for a personal loan online, typically you’ll need proof of income, such as pay stubs, your Social Security number, and personal identification. It’s also important to have a good credit history and a bank account for funds transfer.

How Long Does Online Loan Approval Take?

Online personal loan approval can be instant or take up to a few business days. This varies by lender and the borrower’s creditworthiness. Some lenders offer same-day approval and funds transfer for qualified applicants.

Can I Apply For A Personal Loan With Bad Credit?

Yes, you can apply for a personal loan with bad credit. Some online lenders specialize in loans for those with poor credit histories. However, be prepared for higher interest rates and additional fees.

What Are The Interest Rates For Online Personal Loans?

Interest rates for online personal loans vary widely, often ranging from 6% to 36%. Your rate depends on your credit score, income, loan amount, and the lender’s terms. Always compare offers to find the best rate.

Conclusion

Applying for a personal loan online is simpler than ever. By following the steps outlined, you’re on track to secure your financing swiftly. Remember, selecting the right lender and understanding the terms are crucial. This guide aims to simplify your journey.

Start your application today and step closer to achieving your financial goals.