To apply for a secured loan online, start by researching lenders and comparing rates. Next, gather required documents and submit your application through the lender’s website.

Securing a loan online has become a streamlined process. With a stable internet connection, prospective borrowers can access a variety of lending options. Begin by identifying reputable online lenders or financial institutions offering secured loans. Essential to the process is a thorough comparison of interest rates, loan terms, and fees.

This ensures a financially sound decision tailored to your needs. Preparing necessary documentation is crucial; typically, this includes proof of income, identification, and collateral details. Lenders have made their application platforms user-friendly, guiding applicants through each step. Once you submit your application, await approval, which may come with additional instructions or requests for information. Embrace this modern convenience, but remain vigilant about online security and privacy.

Introduction To Secured Loans

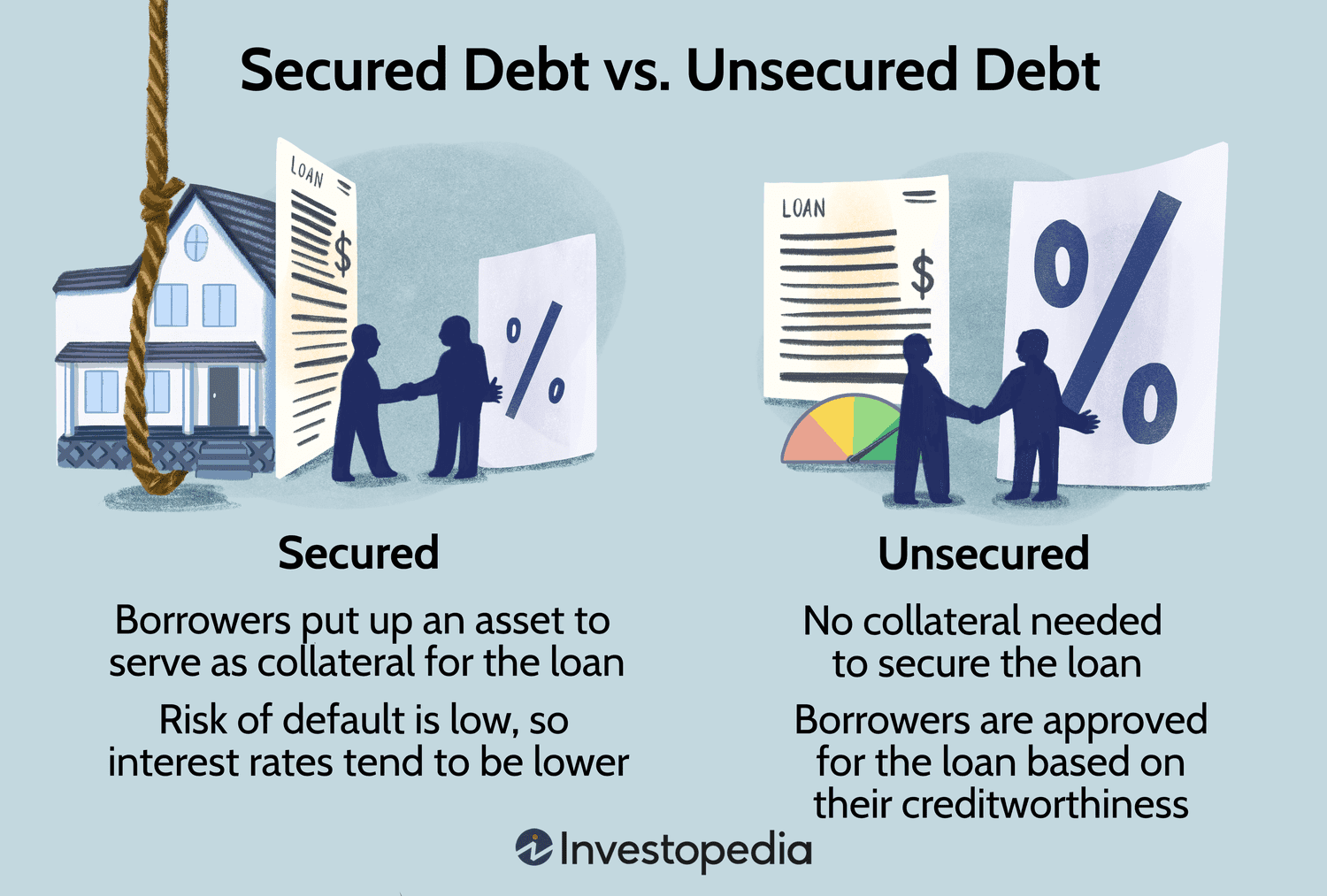

Understanding secured loans is key when considering borrowing options. These loans are backed by collateral. This means borrowers pledge assets to the lender as security. Secured loans often come with lower interest rates. They also offer larger borrowing amounts. This introduction explores what secured loans are. It also highlights their benefits.

What Is A Secured Loan?

A secured loan requires collateral. Borrowers offer assets like property or cars. The lender holds the asset until the loan is repaid. If borrowers default, lenders can seize the asset. This reduces the risk for lenders. It allows them to offer more favorable terms to borrowers.

Benefits Of Opting For Secured Loans

- Lower Interest Rates: Collateral reduces lender risk. This leads to lower rates for borrowers.

- Higher Loan Amounts: Lenders feel more secure. They offer larger loans against collateral.

- Longer Repayment Periods: Secured loans can have extended repayment terms.

- Available to Those with Lower Credit Scores: Collateral makes these loans accessible. Even those with less-than-perfect credit can qualify.

Eligibility Criteria For Secured Loans

Before applying for a secured loan online, know the eligibility criteria. This helps you prepare. We will discuss credit score requirements and income and employment verification.

Credit Score Requirements

Your credit score shows your loan repayment ability. Most lenders prefer a score above 620. Yet, some accept lower scores with higher interest rates. Always check the lender’s requirements before applying.

- Excellent Credit: 720 and above

- Good Credit: 690-719

- Fair Credit: 630-689

- Poor Credit: Below 630

Income And Employment Verification

Lenders check your income and job to ensure you can repay the loan. They may ask for:

- Recent pay stubs

- Bank statements

- Tax returns from the past two years

- Employment verification letter

This process proves your financial stability. It increases your chances of loan approval.

Determining Your Loan Needs

Before diving into the application process for a secured loan, it’s essential to understand your financial requirements. This step ensures you apply for the right loan amount without overborrowing. Let’s break down how to assess your financial situation and calculate the amount you need.

Assessing Your Financial Situation

First, take a close look at your finances. Check your monthly income against expenses. List down all your debts. This exercise shows how much you can afford to repay. Use this information to decide on a loan amount that fits your budget.

- Review recent bank statements.

- Note your monthly income and spending.

- Include all current debt obligations.

Calculating The Required Loan Amount

Next, define the purpose of your loan. Are you consolidating debt or funding a home renovation? Knowing the purpose helps to pinpoint the exact amount needed. Use an online calculator to estimate your loan amount. Remember to factor in any existing savings you might use.

| Loan Purpose | Estimated Cost |

|---|---|

| Debt Consolidation | $X,XXX |

| Home Renovation | $XX,XXX |

| Other Expenses | $X,XXX |

Sum up the costs for a clear loan amount target. A precise figure ensures you borrow only what you need. This approach keeps repayments manageable and your finances secure.

Choosing The Right Lender

Finding a secured loan involves research. The lender you choose affects your finances. Key factors matter. These include interest rates, loan terms, and lender reputation. Below, we discuss these factors in detail.

Interest Rates And Terms Comparison

Interest rates influence monthly payments. Lower rates mean lower payments. Always compare rates. Use online tools for comparison. Look for flexible loan terms. Terms affect loan cost over time. Shorter terms often mean higher payments but lower total interest. Longer terms spread out payments but increase total interest. Consider your budget. Choose what suits your financial situation best.

| Lender | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|

| Lender A | 5% | 10 years | $530 |

| Lender B | 4.5% | 15 years | $760 |

Online Lender Reviews And Reputation

Research lender reputation before deciding. Read online reviews. Check ratings on financial websites. Look for customer feedback. Positive reviews often mean reliable service. Beware of lenders with many negative reviews. Trusted lenders have a strong online presence. Check their website. Ensure they offer clear information. Transparency is key. Trustworthy lenders list contact details. They offer customer support.

- Read customer testimonials

- Check financial forums

- Verify lender credentials

- Look for transparency in fees

Preparing Your Documentation

Preparing Your Documentation is a crucial step before applying for a secured loan online. It involves gathering all necessary paperwork. This process ensures a smooth and fast loan application.

Necessary Paperwork For Application

Before you start, know what documents you need. Here is a list:

- Proof of Identity: Passport or Driver’s License

- Proof of Income: Recent payslips or tax returns

- Proof of Address: Utility bill or bank statement

- Asset Documentation: Details about the property or item you are using as collateral

- Credit History: Your credit report

Gather these documents early to avoid delays.

Understanding Collateral Valuation

Collateral is what you offer a lender to secure a loan. It can be a car, house, or other valuable items. The lender will assess its value. This is known as collateral valuation.

The value of your collateral affects how much you can borrow. It is important to know its current market value.

| Collateral Type | Documents Needed | Valuation Process |

|---|---|---|

| Property | Property deeds, recent tax bill | Professional appraisal |

| Vehicle | Vehicle title, insurance | Online valuation tools, dealership appraisal |

Always check your collateral’s documents are up to date. This helps in a faster valuation process.

Credit: www.educba.com

The Online Application Process

Applying for a secured loan online can be straightforward. A secured loan requires collateral, such as property or a car, to back the loan. This guide walks you through the necessary steps from the comfort of your home.

Step-by-step Guide To Apply

Start with research. Compare lenders, interest rates, and terms. Use a loan calculator to estimate repayments.

- Select a lender with competitive rates and favorable terms.

- Fill out the application form on the lender’s website. Provide basic personal and financial details.

- Choose the loan amount and repayment plan that suits your budget.

- Submit required documents. These may include proof of income, identification, and details about your collateral.

- Review your application before submitting to ensure all information is correct.

- Wait for the lender’s approval, which may take a few hours to a few days.

Protecting Your Personal Information Online

Online security is crucial when applying for a loan. Follow these steps to keep your information safe.

- Use secure websites. Look for “https” in the URL and a padlock symbol.

- Create strong passwords with a mix of letters, numbers, and symbols.

- Never share your login credentials or personal information over email or phone.

- Install reputable antivirus software on your device.

- Ensure your Wi-Fi network is secure and avoid using public Wi-Fi for financial transactions.

- Regularly check your credit report for any unusual activity.

Tips For Quick Approval

Seeking a secured loan online can be straightforward. Yet, a few tips can ensure quick approval. Follow these guidelines to streamline the process.

Accuracy In Application Details

First, check your details for precision. Lenders verify the information you provide. Any mismatch can delay the process. Double-check your input before submission. Use these points to guide you:

- Personal Information: Confirm your full name, date of birth, and address.

- Financial Details: Cross-verify your income, expenses, and existing debts.

- Loan Amount: Be clear about how much you need and why.

- Collateral: Describe what asset you’re using as security.

Responding Promptly To Lender Inquiries

Be ready to answer lender questions. They may contact you for more details. Quick responses can speed up approval. Consider these points:

- Keep documents on hand for quick sharing.

- Check your email and phone often.

- Be clear and concise in your replies.

Post-approval Actions

Congratulations on your secured loan approval. Now, focus on what comes next. Understand the steps to finalize the loan process. Stay ahead with smart planning.

Loan Agreement Review

Read your loan agreement carefully. Confirm all details match your understanding. Look for the interest rate, repayment terms, and any fees. Note the due dates for payments. Ask questions if anything is unclear. Make sure you agree before signing.

Planning For Repayment

Start your repayment journey on the right foot. Set a budget to manage monthly payments. Consider automatic deductions to never miss a due date. Explore options for early repayment. Keep a log of all transactions related to your loan.

Stay on track with these steps:

- Set reminders for due dates.

- Review your budget monthly.

- Keep emergency funds for unexpected events.

- Check your loan balance regularly.

Following these steps ensures a smooth repayment experience.

Managing Your Secured Loan

Once you secure a loan, managing it wisely is key. A well-managed loan means you stay in control of your finances. This can lead to better credit scores. Let’s dive into how you can stay on top of your payments and understand the consequences of default.

Staying On Top Of Payments

- Set reminders for due dates to never miss a payment.

- Automate payments if possible, for convenience and reliability.

- Review statements monthly to check for errors or unexpected changes.

- Extra payments can reduce interest and shorten loan terms.

Consequences Of Default

Defaulting on a loan can have serious effects.

| Consequence | Impact |

|---|---|

| Credit Score Drop | Lower credit scores affect future borrowing. |

| Asset Loss | The lender may seize your collateral. |

| Legal Action | You could face lawsuits or wage garnishment. |

Stay proactive and communicate with your lender if you face payment challenges.

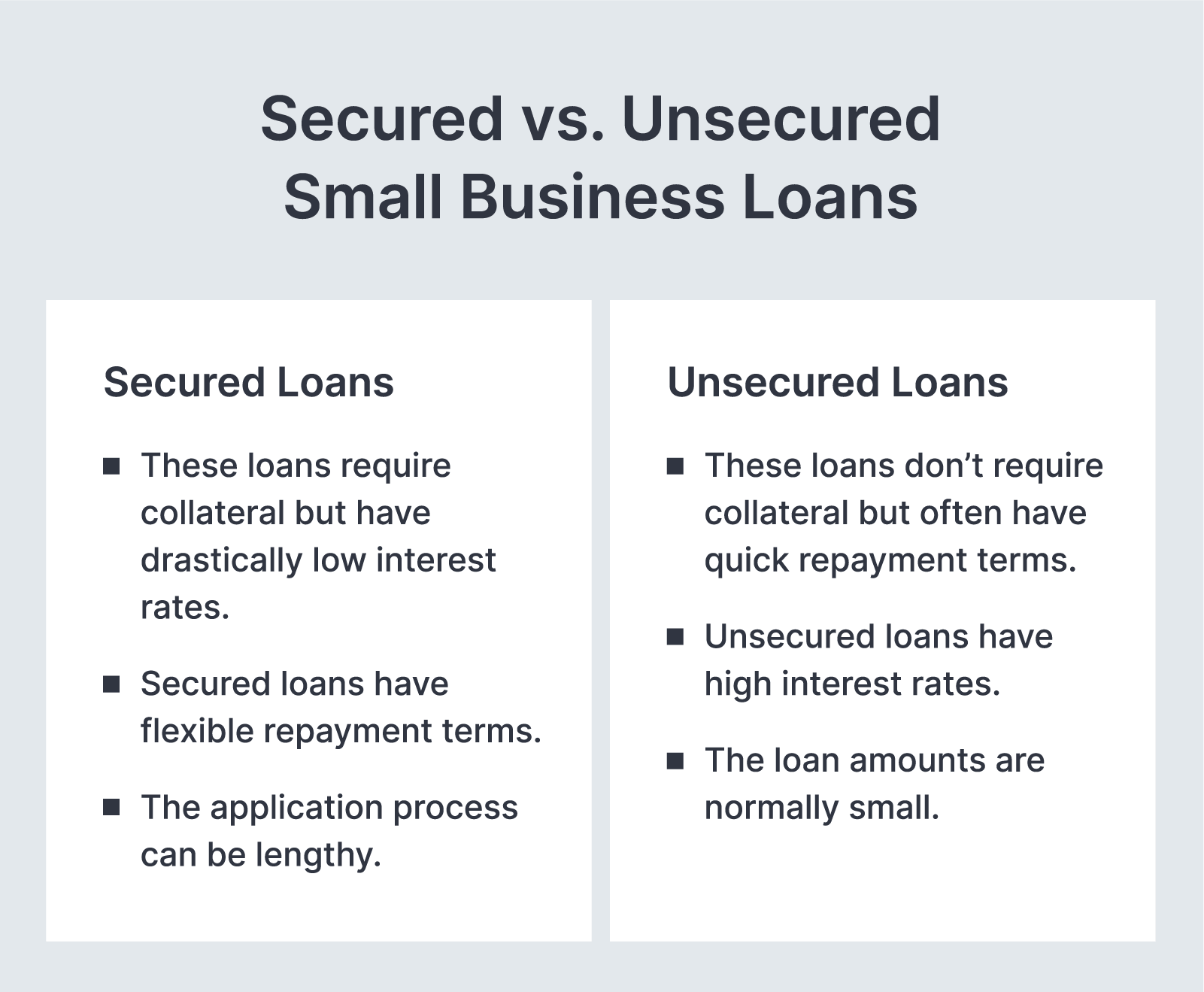

Credit: clarifycapital.com

Refinancing And Loan Consolidation

Refinancing and Loan Consolidation are smart ways to manage your debt. They can lower payments and combine multiple loans into one. This makes your financial life simpler and more manageable. Let’s dive deeper into when to refinance and the benefits of loan consolidation.

When To Consider Refinancing

Refinancing can be a game-changer for your finances. Here are key times to consider it:

- Lower Interest Rates: When rates drop, refinancing can save money.

- Better Credit Score: A higher score can secure lower rates.

- Change in Financial Situation: More income means you might pay off loans faster.

- Need Lower Payments: Spreading loans over time reduces monthly costs.

Benefits Of Consolidating Loans

Combining several loans into one has many advantages:

- Simpler Payments: One loan means one monthly payment.

- Potentially Lower Rates: Consolidation might offer better terms.

- Improved Credit Score: Managing one loan effectively can boost your score.

- Stress Reduction: Fewer payments to track means less worry.

:max_bytes(150000):strip_icc()/secured-loans-2386169_final-cbd3a613da25474fa240c59185879183.jpg)

Credit: www.thebalancemoney.com

Frequently Asked Questions

What Is A Secured Loan?

A secured loan is a type of credit backed by collateral. This means the borrower pledges an asset, such as a house or car, which the lender can seize if the loan isn’t repaid.

How Do I Apply For A Secured Loan Online?

To apply for a secured loan online, start by researching lenders. Then, complete their online application form, providing personal and financial details, and submit any required documentation.

What Documents Are Needed For A Secured Loan?

Typically, lenders require proof of identity, income, and collateral ownership. This can include a government-issued ID, pay stubs, and property or vehicle documents.

Can I Get A Secured Loan With Bad Credit?

Yes, secured loans are often available to those with bad credit. The collateral reduces the lender’s risk, making it easier to obtain the loan even with a lower credit score.

Conclusion

Applying for a secured loan online simplifies the borrowing process. With the right preparation and research, you can navigate this journey smoothly. Remember, understanding your needs and comparing options are key steps. Start your application today, and move closer to achieving your financial goals.

Take control of your finances with confidence.