To apply for health insurance, research available plans and gather necessary documents. Then, complete an online or paper application.

Health insurance is crucial for managing medical costs and ensuring access to necessary healthcare services. Various plans and providers offer different benefits, so understanding your options is vital. Start by assessing your healthcare needs and budget. Compare plans based on coverage, premiums, and deductibles.

Gather essential documents such as identification, income proof, and previous medical records. You can apply directly through insurance company websites or marketplaces like Healthcare. gov. Pay attention to enrollment periods to avoid missing deadlines. Consulting with an insurance broker can also simplify the process. Taking these steps ensures you select a plan that best suits your needs and safeguards your health.

Choosing The Right Plan

Choosing the right health insurance plan can be overwhelming. This guide will help you make an informed decision. We’ll cover assessing your needs and comparing plan types.

Assess Your Needs

Start by evaluating your healthcare needs. Consider your medical history and family needs. Do you visit doctors often? Are you on medications? Do you need specialist care?

- Medical History: Review past medical treatments.

- Family Needs: Consider your family’s health requirements.

- Doctor Visits: Calculate how often you visit the doctor.

- Medications: List your current medications.

- Specialist Care: Think about any specialist care you might need.

After assessing your needs, set a budget. Determine how much you can spend on premiums and out-of-pocket costs. This will help narrow down your options.

Compare Plan Types

Next, compare different health insurance plans. There are several types of plans, each with its own benefits and drawbacks. Here are some common plan types:

| Plan Type | Description | Benefits | Drawbacks |

|---|---|---|---|

| HMO | Health Maintenance Organization | Lower cost, requires primary care doctor | Limited to in-network providers |

| PPO | Preferred Provider Organization | More provider options, no referrals needed | Higher premiums, out-of-network costs higher |

| EPO | Exclusive Provider Organization | Lower premiums, no referrals needed | Limited to in-network providers |

| POS | Point of Service | More provider options, primary care doctor required | Higher out-of-pocket costs |

Review the benefits and drawbacks of each plan type. Choose a plan that aligns with your healthcare needs and budget. Don’t forget to consider the network of doctors and hospitals.

By carefully assessing your needs and comparing plan types, you can find the right health insurance plan for you and your family.

Credit: familycarepa.com

Gathering Necessary Documents

Applying for health insurance can feel overwhelming. Gathering the right documents makes the process smoother. This section will help you collect the necessary documents for your health insurance application.

Personal Identification

You need to prove your identity. This can be done using several types of documents.

- Driver’s License: This is commonly used.

- Passport: Another valid option.

- State ID Card: Useful if you don’t drive.

Ensure these documents are up to date. Expired IDs may cause delays.

Income Verification

Proving your income is crucial for health insurance. These documents will help:

- Pay Stubs: Collect your recent pay stubs.

- Tax Returns: Your last tax return is important.

- Bank Statements: Show regular deposits to your account.

Self-employed? Use your business records. Consistent documentation can streamline your application.

Understanding Key Terms

Applying for health insurance can be confusing. Understanding key terms helps. This section explains important health insurance terms. Knowing these terms makes the process easier.

Premiums And Deductibles

Premiums are what you pay monthly for insurance. Think of it as a subscription fee. You must pay this amount every month.

Deductibles are what you pay before insurance helps. This is an annual amount. After paying the deductible, insurance covers more costs.

Here’s a quick comparison of premiums and deductibles:

| Term | Definition |

|---|---|

| Premium | Monthly payment for insurance |

| Deductible | Annual amount paid before insurance covers costs |

In-network Vs. Out-of-network

In-Network means doctors and hospitals that work with your insurance. They offer lower rates. Insurance covers more costs.

Out-of-Network means doctors and hospitals not working with your insurance. They cost more. Insurance covers less.

Here’s a summary:

- In-Network:

- Lower costs

- More coverage

- Out-of-Network:

- Higher costs

- Less coverage

Understanding these terms helps you make better choices. Choose wisely to save money and get good care.

Credit: www.uhnj.org

Filling Out The Application

Applying for health insurance can seem overwhelming, but it doesn’t have to be. The key to a smooth application process is understanding how to fill out the forms correctly. This section will guide you through the steps of completing your health insurance application.

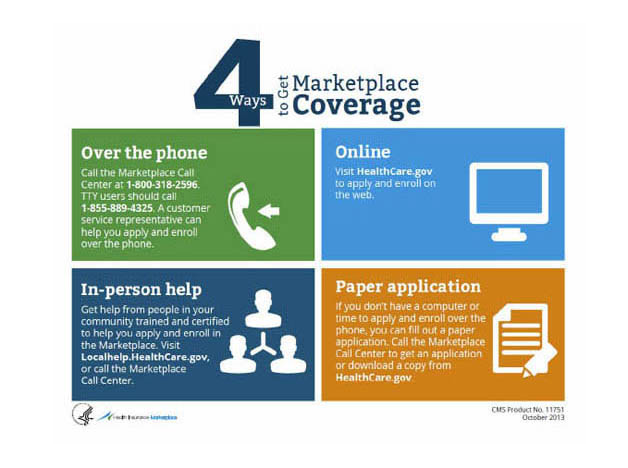

Online Vs. Paper Forms

When applying for health insurance, you have two options: online forms or paper forms. Each has its own advantages.

| Online Forms | Paper Forms |

|---|---|

|

|

Common Mistakes To Avoid

Filling out health insurance forms can be tricky. Here are some common mistakes to avoid:

- Missing Information: Ensure all required fields are filled.

- Incorrect Details: Double-check names, dates, and numbers.

- Skipped Sections: Some sections might seem optional but are not.

- Unreadable Handwriting: For paper forms, write clearly.

- Ignoring Deadlines: Submit your application before the deadline.

By paying attention to these details, you can avoid delays and ensure a smoother application process.

Submitting Your Application

Applying for health insurance can be simple. Once you’ve chosen your plan, it’s time to submit your application. This step is crucial. Ensure you follow guidelines and provide accurate information.

Tracking Your Submission

After submitting your application, tracking it is essential. Many insurance companies offer tracking tools. Use these tools to monitor your application’s status.

Here’s a quick guide to tracking:

- Log in to your insurance account.

- Navigate to the application section.

- Look for the tracking option.

- Check your application’s status regularly.

Confirmation And Follow-up

Once your application is submitted, you’ll receive a confirmation. This confirmation usually comes via email or SMS. Save this confirmation for future reference.

Follow these steps for a smooth follow-up:

- Check your email for confirmation.

- Save the confirmation number.

- Contact customer support if you don’t receive confirmation within a week.

- Keep your documents organized and handy.

Pro tip: Always double-check your application before submission. This reduces errors and speeds up the process.

| Step | Action |

|---|---|

| 1 | Submit your application online. |

| 2 | Track your submission status. |

| 3 | Receive and save confirmation. |

| 4 | Follow up if necessary. |

.png)

Credit: www.healthforcalifornia.com

Post-application Steps

You’ve submitted your health insurance application. Now, it’s time for the next steps. These steps are crucial for ensuring you get the most out of your new plan. Let’s dive into what comes after applying.

Receiving Your Insurance Card

Your insurance card is your key to healthcare services. Expect to receive your card within 7-10 business days. Keep an eye on your mail. It might come in a plain envelope.

Once you get your card, review it carefully. Verify all information is correct. Check your name, policy number, and plan details.

| What to Check | Why It’s Important |

|---|---|

| Name | Ensure it matches your ID for smooth service. |

| Policy Number | Needed for all claims and inquiries. |

| Plan Details | Understand your coverage and benefits. |

First Steps With Your New Plan

Start by familiarizing yourself with your plan. Read the benefits booklet provided by your insurer. This booklet explains what is covered and what is not.

Next, choose a primary care physician (PCP). Your PCP will be your main point of contact for healthcare. Check the provider directory for in-network doctors.

- Log in to your insurance portal.

- Search for doctors within your network.

- Select a PCP and schedule your first appointment.

Don’t forget to set up an online account with your insurer. This account lets you manage your plan, view claims, and download forms.

- Visit your insurer’s website.

- Click on “Register” or “Create Account”.

- Follow the instructions to complete your setup.

These initial steps ensure you’re well-prepared. Take the time to understand your benefits. Choose the right doctor. Manage your plan online. Doing so will help you make the most of your health insurance.

Frequently Asked Questions

What Documents Are Needed To Apply?

You’ll need identification, proof of residency, and income details. Check specific insurer requirements for any additional documents.

Can I Apply For Health Insurance Online?

Yes, most insurers offer online applications. Visit their website, fill out the form, and submit required documents.

When Is The Open Enrollment Period?

Open enrollment typically occurs annually. Specific dates vary, so check your insurer or marketplace for exact timing.

How Long Does Approval Take?

Approval time varies by insurer. Generally, it can take from a few days to a couple of weeks.

Are Pre-existing Conditions Covered?

Many plans cover pre-existing conditions. Always review the policy details to understand specific coverage and exclusions.

Conclusion

Applying for health insurance doesn’t have to be daunting. Follow the steps outlined to simplify the process. Make sure to compare options, understand your needs, and gather required documents. This ensures you get the best coverage. Stay informed and proactive to secure your health and financial future.