To change health insurance plans, review your current coverage and compare new options during the open enrollment period. Submit your application for the new plan before the deadline.

Switching health insurance plans can be a daunting task, but it’s essential for ensuring you have the right coverage. Each year, providers update their plans and prices, making it crucial to evaluate your current policy. You might find a better deal or improved benefits that fit your needs more closely.

The open enrollment period is the primary time to make these changes, typically occurring once a year. By acting during this window, you can avoid penalties and ensure continuous coverage. Be proactive, compare plans thoroughly, and choose the one that best suits your healthcare needs and budget.

Credit: www.redirecthealth.com

Assess Your Current Coverage

Before switching health insurance plans, evaluate your current coverage. This helps you understand what you need. It also helps identify what you don’t need. This process ensures your new plan meets your needs.

Identify Gaps

First, review your existing policy documents. Look for any coverage gaps. These could be services not covered. Or they could be higher out-of-pocket costs.

- Check if your current plan covers prescription drugs.

- See if mental health services are included.

- Verify coverage for specialist visits and hospital stays.

- Make sure preventive care is part of your plan.

Write down any services you need but aren’t covered. These gaps will guide your new plan search.

Evaluate Costs

Next, assess the costs of your current plan. This includes premiums, deductibles, and co-pays. Compare these costs to the benefits you receive.

| Cost Type | Current Amount |

|---|---|

| Monthly Premium | $200 |

| Annual Deductible | $1,500 |

| Co-Pay per Doctor Visit | $20 |

| Co-Pay per Specialist Visit | $40 |

Consider if the benefits justify the costs. If they don’t, note these down. This will help you find a more cost-effective plan.

Research New Plans

Choosing the right health insurance plan can be daunting. Researching new plans helps you find the best fit. This section guides you on what to consider.

Compare Providers

Not all insurance providers are the same. Compare different providers to find the best one.

- Customer Reviews: Read reviews to gauge customer satisfaction.

- Financial Stability: Check the financial health of the provider.

- Plan Options: Some providers offer more plans than others.

| Provider | Customer Rating | Number of Plans |

|---|---|---|

| Provider A | 4.5/5 | 10 |

| Provider B | 4.0/5 | 8 |

| Provider C | 3.8/5 | 12 |

Check Network Availability

Ensure your preferred doctors and hospitals are in-network. This can save you money.

- Make a list of your preferred healthcare providers.

- Check if they are in-network for each plan.

- Confirm the network size and availability.

Use the insurance company’s website to check network availability. Some plans have a larger network than others.

Smaller networks might limit your options. Larger networks offer more choices.

Determine Eligibility

Changing health insurance plans can seem tough. The first step is to determine your eligibility. This step is important. It helps you know if you can switch plans now or need to wait.

Open Enrollment Periods

The Open Enrollment Period is a set time each year. During this time, everyone can change their health insurance plans. This period usually happens in the fall. It lasts for a few weeks.

Here are the common dates:

- Starts: November 1

- Ends: December 15

If you change your plan during this time, it will start on January 1 of the next year.

Special Enrollment Qualifiers

Sometimes, you can change your plan outside the Open Enrollment Period. This is called a Special Enrollment Period. You need a special reason, like a life event, to qualify.

These life events can include:

- Getting married

- Having a baby

- Moving to a new area

- Losing other health coverage

If you have one of these events, you can change your plan. You usually have 60 days from the event to do so.

| Life Event | Special Enrollment Period |

|---|---|

| Marriage | 60 days from the event |

| Birth of a Child | 60 days from the event |

| Move to a New Area | 60 days from the event |

| Loss of Coverage | 60 days from the event |

Always check if you qualify for a Special Enrollment Period. This can help you switch plans when needed.

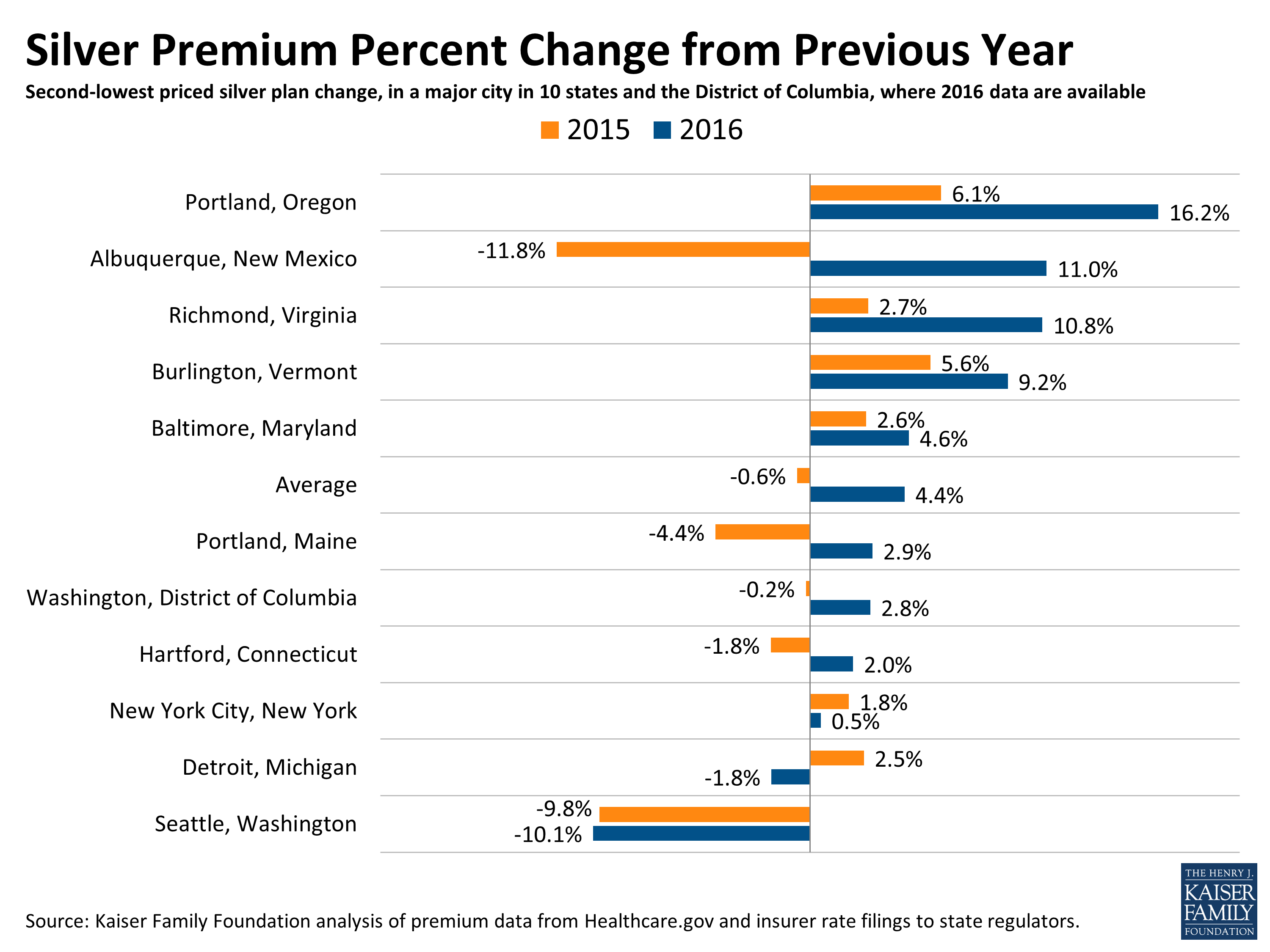

Credit: www.kff.org

Calculate Potential Savings

Switching health insurance plans can save you money. To know how much, calculate potential savings. This involves understanding premiums, deductibles, and out-of-pocket maximums. Let’s break it down.

Premiums And Deductibles

Premiums are the monthly cost of your health insurance. Deductibles are the amount you pay before insurance starts covering costs. Compare these two for each plan.

| Plan | Monthly Premium | Annual Deductible |

|---|---|---|

| Plan A | $200 | $1,000 |

| Plan B | $150 | $2,000 |

Plan A has a higher premium but a lower deductible. Plan B has a lower premium but a higher deductible. Decide which is better based on your health care needs.

Out-of-pocket Maximums

The out-of-pocket maximum is the most you pay in a year. After reaching this limit, the insurance covers 100% of costs.

- Plan A: $3,000

- Plan B: $5,000

Plan A has a lower out-of-pocket maximum. Plan B has a higher limit. Lower out-of-pocket maximums can save you money if you need lots of care.

Considering premiums, deductibles, and out-of-pocket maximums helps you choose the best plan. Calculating these can lead to big savings.

Complete The Application

Changing your health insurance plan can be a smooth process. One of the most crucial steps is to complete the application. This ensures you get the coverage you need. Let’s dive into the key steps to achieve this.

Gather Required Documents

To complete your application, you need essential documents. These include:

- Your Social Security Number

- Proof of income (pay stubs, tax returns)

- Health insurance policy numbers

- Citizenship or immigration status documents

Make sure all documents are current. Organize them in a folder for easy access.

Submit Application Online

Most health insurance applications can be completed online. Follow these steps:

- Visit the health insurance marketplace website.

- Create an account using your email.

- Fill in your personal details.

- Upload the required documents.

- Review your application for accuracy.

- Submit the application.

After submission, you will get a confirmation email. Keep this for your records.

Completing the application is a vital step in changing your health insurance plan. Ensure you gather all required documents and submit your application online. This will help you get the best coverage possible.

Confirm Enrollment

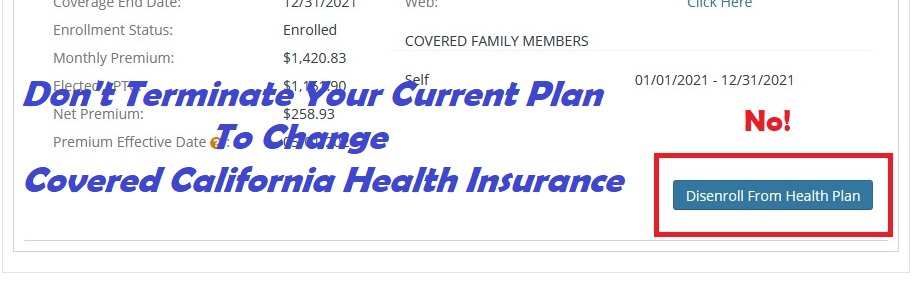

Switching health insurance plans can be daunting. After selecting a new plan, confirm your enrollment. This step ensures you are covered and prevents any gaps in your coverage.

Receive Confirmation

After enrolling, expect a confirmation notice. This notice can arrive via email or regular mail. Ensure you receive this confirmation to avoid issues.

If no confirmation arrives, contact your insurance provider. They can verify if your enrollment was successful.

Verify Coverage Details

Once confirmed, review the coverage details. This step ensures you understand what your new plan covers.

- Check your premium amounts.

- Review the deductible and out-of-pocket limits.

- Examine covered services and medications.

Verify your primary care provider and specialists are in-network. This can help avoid unexpected costs.

| Item | Details |

|---|---|

| Premium | Monthly payment for the insurance plan |

| Deductible | Amount you pay before insurance starts covering costs |

| Out-of-Pocket Limit | Maximum amount you pay for covered services in a year |

| Covered Services | Medical services and treatments included in the plan |

| In-Network Providers | Doctors and hospitals that accept your insurance |

Credit: insuremekevin.com

Frequently Asked Questions

How Do I Change My Health Insurance Plan?

Contact your current insurer. Compare new plans and enroll during the open enrollment period or a qualifying event.

When Can I Switch Health Insurance Plans?

You can switch during the open enrollment period or after a qualifying life event like marriage or job loss.

What Documents Are Needed To Change Plans?

You’ll need identification, proof of residence, income information, and any documents related to a qualifying life event.

Can I Change Plans Outside Open Enrollment?

Yes, but only if you experience a qualifying life event such as birth, marriage, or job loss.

How Long Does It Take To Switch Plans?

Switching plans typically takes a few weeks, depending on the enrollment process and verification of documents.

Conclusion

Switching health insurance plans can feel daunting, but it’s manageable with the right steps. Research thoroughly, compare options, and consult experts. Stay informed about deadlines and necessary documents. Making an informed decision ensures you get the best coverage for your needs.

Stay proactive, and you’ll navigate this process smoothly.