To check your health insurance coverage, review your policy documents or log in to your insurer’s online portal. Contact customer service for detailed information.

Health insurance coverage is crucial for managing medical expenses. Knowing the specifics of your policy helps avoid unexpected costs. Start by examining your policy documents, which outline covered services, deductibles, and co-pays. Insurers often provide online portals where you can access this information easily.

Customer service representatives can also offer detailed explanations and clarifications. Regularly reviewing your coverage ensures you’re informed about changes or new benefits. This proactive approach helps you make better healthcare decisions and maximizes your insurance benefits. Always stay updated on your health insurance to ensure comprehensive coverage.

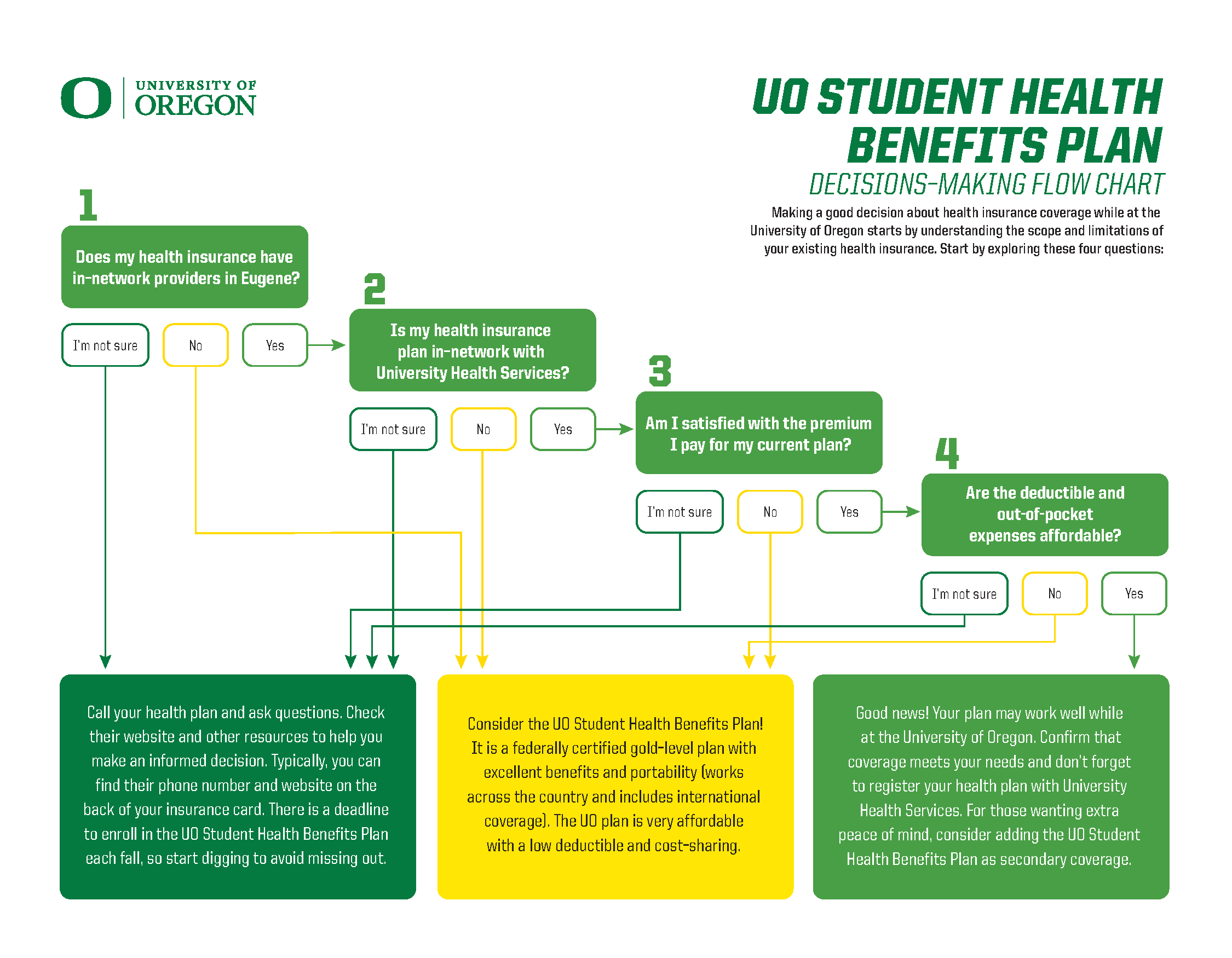

Credit: health.uoregon.edu

Review Your Policy Documents

Understanding your health insurance can be confusing. The first step is to review your policy documents. This helps you know what is covered and what is not. Let’s dive into the details.

Locate Essential Papers

Start by finding your health insurance documents. These papers include:

- Your insurance card

- Policy booklet

- Benefits summary

- Any recent updates or amendments

Keep these documents in a safe place. You may need them often. You can store them in a folder or a digital file for quick access.

Understand Key Terms

Health insurance documents have many terms. Knowing these can help you understand your coverage better. Here are some important terms:

| Term | Definition |

|---|---|

| Premium | The monthly fee you pay for insurance. |

| Deductible | The amount you pay before insurance starts covering costs. |

| Copayment | A fixed fee you pay for specific services. |

| Coinsurance | Your share of costs, usually a percentage. |

| Out-of-Pocket Maximum | The most you will pay in a year. |

Understanding these terms can save you money. It can also help you avoid unexpected bills.

By reviewing your policy documents, you can know what to expect. This helps you make informed decisions about your health care.

Access Your Insurance Portal

Accessing your insurance portal is vital. It helps you manage your health coverage. This section will guide you through the steps.

Login Procedures

First, visit your insurance company’s website. Look for the login button. Click on it to proceed.

- Enter your username.

- Type in your password.

- Click the login button.

If you forget your password, use the “Forgot Password” link. Follow the steps to reset it.

Navigating The Dashboard

Once logged in, you’ll see the dashboard. This is your main control center. It shows important information about your health insurance.

The dashboard usually has several sections:

- Policy Details: Shows your coverage plan.

- Claims: View past and current claims.

- Benefits: Check what services are covered.

- Payments: See your payment history.

Click on each section to get detailed information. For example, click on “Claims” to see the status of your claims.

Use the search bar to find specific information quickly. This helps you save time.

Check your messages for updates from your insurance provider. They might send important notifications here.

Contact Customer Service

Contacting customer service is a great way to check your health insurance coverage. Customer service representatives can provide detailed information and answer any questions. There are various ways to reach them, including phone support, email, and live chat options.

Phone Support

One of the quickest ways to get information is through phone support. Most insurance companies have a dedicated customer service number. Here’s how you can make the most of it:

- Dial the customer service number listed on your insurance card.

- Have your insurance ID number ready.

- Prepare a list of questions beforehand.

Phone support allows you to speak directly with a representative. This can help resolve issues promptly.

Email And Live Chat Options

If you prefer written communication, email and live chat are good alternatives. These methods can be convenient and leave a written record of your conversation.

| Method | Benefits |

|---|---|

| Detailed responses, can attach documents | |

| Live Chat | Instant responses, easy to use |

Using email, you can send your queries to the insurance company’s customer service email address. Make sure to include:

- Your name and insurance ID number

- Clear and concise questions

Live chat options are available on most insurance company websites. Simply click the live chat icon and start typing your questions.

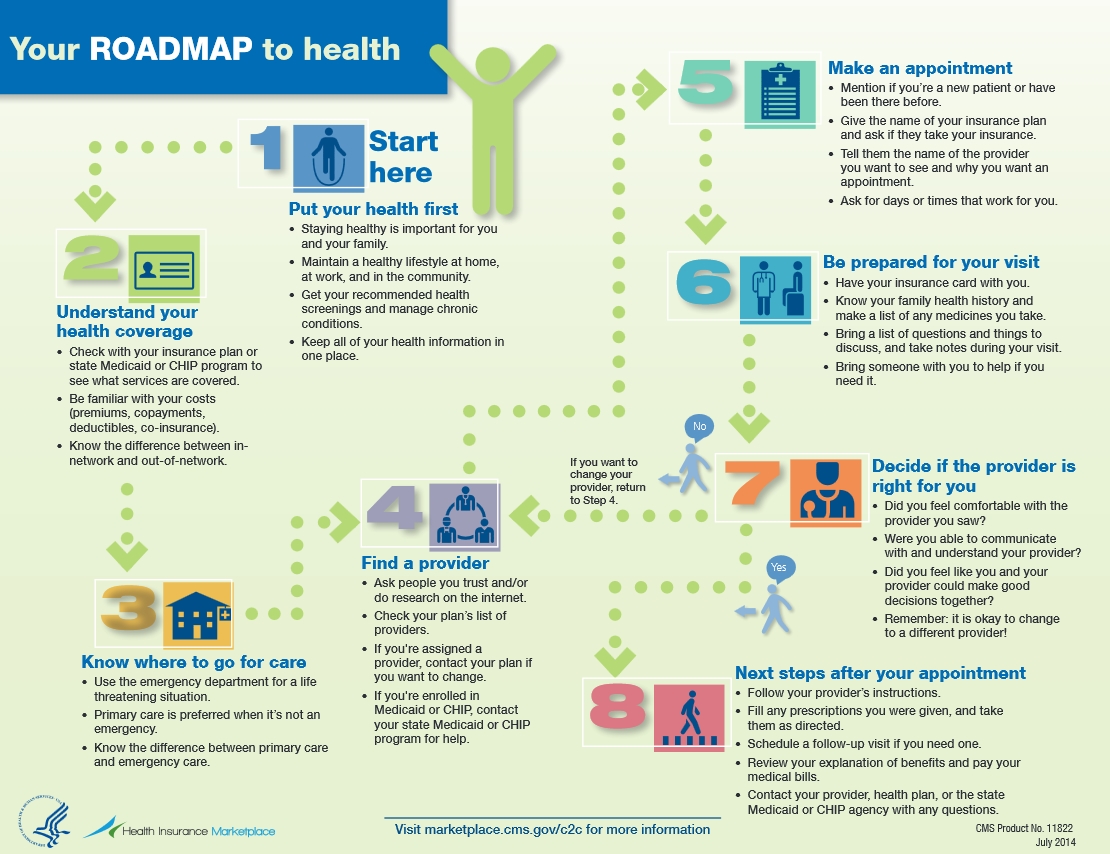

Credit: www.newsweek.com

Verify Covered Services

Understanding what services your health insurance covers can save you money. It also helps avoid unexpected medical bills. Begin by verifying the specific services included in your plan.

In-network Vs Out-of-network

Your health insurance plan likely has a network of preferred providers. These are called in-network providers. Using these providers usually costs less. On the other hand, out-of-network providers can be more expensive.

Check your insurance website for a list of in-network doctors and hospitals. You can also call customer service to confirm a provider’s status. Always verify if a new doctor is in-network before your visit.

Preventive Care And Special Treatments

Most insurance plans cover preventive care. This includes services like vaccinations, screenings, and yearly check-ups. Preventive care is usually free or low-cost.

For special treatments, coverage can vary. This includes therapies, surgeries, and specialist visits. Always check your policy for details on these services. You may need pre-approval for some treatments.

| Service Type | Typical Coverage |

|---|---|

| Vaccinations | Usually Covered |

| Annual Check-Up | Usually Covered |

| Specialist Visits | Varies, Check Policy |

| Surgeries | Pre-Approval Needed |

To avoid surprises, always verify your coverage for any upcoming medical services. This ensures you know what costs to expect.

Check Your Benefits Summary

Understanding your health insurance coverage is crucial. One key document is your Benefits Summary. It provides detailed information about what your plan covers. This helps you avoid unexpected costs. Let’s break down the important sections.

Deductibles And Co-payments

The deductible is the amount you must pay before your insurance starts to pay. Check how much this is. It varies by plan.

Co-payments are fixed fees you pay for services. For example, visiting a doctor might cost $20. Make sure you know these amounts.

| Service | Co-Payment | Deductible |

|---|---|---|

| Doctor Visit | $20 | $500 |

| Emergency Room | $100 | $1000 |

| Prescription Drugs | $10 | $0 |

Annual Limits And Exclusions

Your plan may have annual limits on certain services. This means there is a cap on how much the insurance will pay in a year. Check these limits carefully.

Also, be aware of exclusions. These are services not covered by your plan. Knowing these can save you from unexpected bills.

- Annual Limit for Physical Therapy: $3,000

- Annual Limit for Prescription Drugs: $2,000

- Exclusions: Cosmetic Surgery, Non-Essential Treatments

Understanding your Benefits Summary is essential. It helps you make informed healthcare decisions. Always review this document carefully.

Credit: info.nystateofhealth.ny.gov

Review Claims And Statements

Understanding your health insurance coverage is crucial. Reviewing your claims and statements helps you know what your insurance covers. This guide explains how to review your claims and statements step-by-step.

Pending And Processed Claims

Check your insurance portal for pending and processed claims. This gives you a clear picture of your current status.

- Pending Claims: These are claims not yet processed.

- Processed Claims: These are claims already reviewed by your insurer.

Pending claims might need more information. Processed claims show what was covered and what you owe.

Explanation Of Benefits (eob)

An Explanation of Benefits (EOB) is a statement from your insurer. It details what costs they will cover.

Look for these key points on your EOB:

- Service Description: What medical service was provided.

- Date of Service: When the service was given.

- Amount Billed: The total cost of the service.

- Insurance Payment: What your insurance will pay.

- Your Responsibility: What you need to pay.

Understanding your EOB helps you track your medical expenses. It also ensures you are not overcharged.

| Term | Definition |

|---|---|

| Pending Claims | Claims waiting for review. |

| Processed Claims | Claims reviewed and decided upon. |

| Explanation of Benefits (EOB) | A summary of what your insurance covers and what you owe. |

Frequently Asked Questions

How Can I Check My Health Insurance Coverage?

You can check your health insurance coverage by reviewing your policy documents or contacting your insurance provider.

What Does My Health Insurance Cover?

Your health insurance typically covers doctor visits, hospital stays, prescription medications, and preventive services. Check your policy for specifics.

Where Can I Find My Policy Details?

You can find your policy details in your insurance documents or on your insurer’s online portal.

Can I Check My Coverage Online?

Yes, most insurance providers offer an online portal where you can check your coverage details and benefits.

How Do I Know If A Procedure Is Covered?

Contact your insurance provider or review your policy documents to confirm if a specific procedure is covered.

Conclusion

Regularly reviewing your health insurance coverage ensures you stay informed and protected. Use online tools and resources for accuracy. Contact your insurance provider with questions. Staying proactive helps avoid unexpected costs. Understanding your policy empowers you to make better healthcare decisions.

Keep your health and finances secure by staying updated.