Choosing the best Islamic bank for your financial needs can feel overwhelming. You want a bank that not only follows Shariah principles but also offers reliable services, competitive products, and strong customer support.

How do you know which one truly fits your values and goals? This guide will help you cut through the confusion. By understanding key factors like Shariah compliance, reputation, product range, and customer experience, you’ll be able to make confident decisions that protect your money and align with your beliefs.

Keep reading to discover exactly what to look for and how to find the Islamic bank that’s right for you.

Credit: paperwallet.com

Shariah Compliance

Shariah compliance is the foundation of Islamic banking. It ensures all financial activities follow Islamic law. This principle separates Islamic banks from conventional ones. Customers must verify that a bank strictly adheres to Shariah rules. This guarantees their money is handled ethically and religiously correctly.

Core Principles

Islamic banks operate on clear core principles. They avoid interest (riba), which is forbidden in Islam. Profit and loss sharing is a key concept. Investments must avoid harmful or unethical industries. Transparency and fairness guide all transactions. These principles protect customers and promote trust.

Certification And Oversight

Islamic banks must have official Shariah certification. This certification comes from qualified scholars or boards. They review all products and services to ensure compliance. Regular audits and reviews maintain strict adherence. Customers should check if the bank displays this certification clearly. This oversight adds credibility and peace of mind.

Financial Stability

Financial stability is a key factor when choosing the best Islamic bank. It shows the bank’s ability to manage risks and protect your money. A financially stable bank can handle economic changes without major problems. This gives you peace of mind and trust in their services.

Credit Ratings

Credit ratings reflect a bank’s financial health. These ratings come from independent agencies. They assess how well the bank can repay its debts. High credit ratings mean low risk for depositors. Always check the credit rating before selecting a bank. It helps to avoid banks with poor financial standing.

Capital Adequacy

Capital adequacy measures a bank’s buffer against losses. It shows how much capital the bank holds compared to its risk. A strong capital adequacy ratio means the bank can absorb financial shocks. Islamic banks must maintain this ratio to comply with regulations. Choose banks with high capital adequacy for better security.

Product Range

The product range offered by an Islamic bank plays a key role in meeting your financial needs. Islamic banks provide various services designed to follow Shariah law. These products avoid interest and promote profit-sharing or asset-backed financing. Choosing a bank with a broad product range helps you find solutions for saving, investing, and financing.

Savings And Investment Options

Islamic banks offer savings accounts that comply with Shariah principles. These accounts usually work on profit-sharing instead of interest. You may find products like Mudarabah savings, where profits are shared between the bank and the customer.

Investment options include Sukuk, Islamic mutual funds, and other Shariah-compliant assets. These products let you grow money without violating Islamic rules. A good Islamic bank provides clear information about risks and returns.

Home And Business Financing

Home financing in Islamic banks often uses models like Murabaha or Ijara. These methods avoid interest by structuring transactions as sales or leases. You pay a fixed profit instead of interest, making it easier to plan your budget.

Business financing follows similar principles. Banks may offer partnership models such as Musharakah or profit-sharing agreements. These options support business growth while respecting Islamic finance laws. Choose a bank with flexible and transparent financing products that suit your needs.

Customer Service

Customer service is a key factor when choosing the best Islamic bank. Good service builds trust and ensures your needs are met quickly. It also reflects the bank’s commitment to its customers and Islamic principles.

Reputation And Reviews

Check the bank’s reputation among its clients. Read online reviews to see real experiences. Positive feedback shows reliable and respectful service. Pay attention to how the bank handles complaints and problems. A strong reputation often means better customer care.

Accessibility And Support

Easy access to support is vital for any bank. Look for multiple ways to contact customer service, such as phone, email, or live chat. Make sure support is available during convenient hours. Quick responses save time and reduce stress. Friendly and knowledgeable staff improve your banking experience.

Transparency

Transparency plays a key role in choosing the best Islamic bank. It builds trust and ensures the bank follows Islamic principles clearly. A transparent bank shares all necessary information openly with its customers. This helps clients make informed decisions about their money.

Fee Structures

Clear fee structures matter in Islamic banking. Fees should be easy to find and understand. The bank must explain all charges, including account maintenance and transaction fees. Hidden fees can cause confusion and distrust. Transparent fee disclosure ensures fairness and honesty.

Governance And Reporting

Islamic banks must follow strict governance rules. They should have a Shariah board that supervises all financial activities. Regular reporting on the bank’s operations and financial health is essential. These reports show how the bank complies with Islamic law. Transparency in governance and reporting helps customers trust the institution fully.

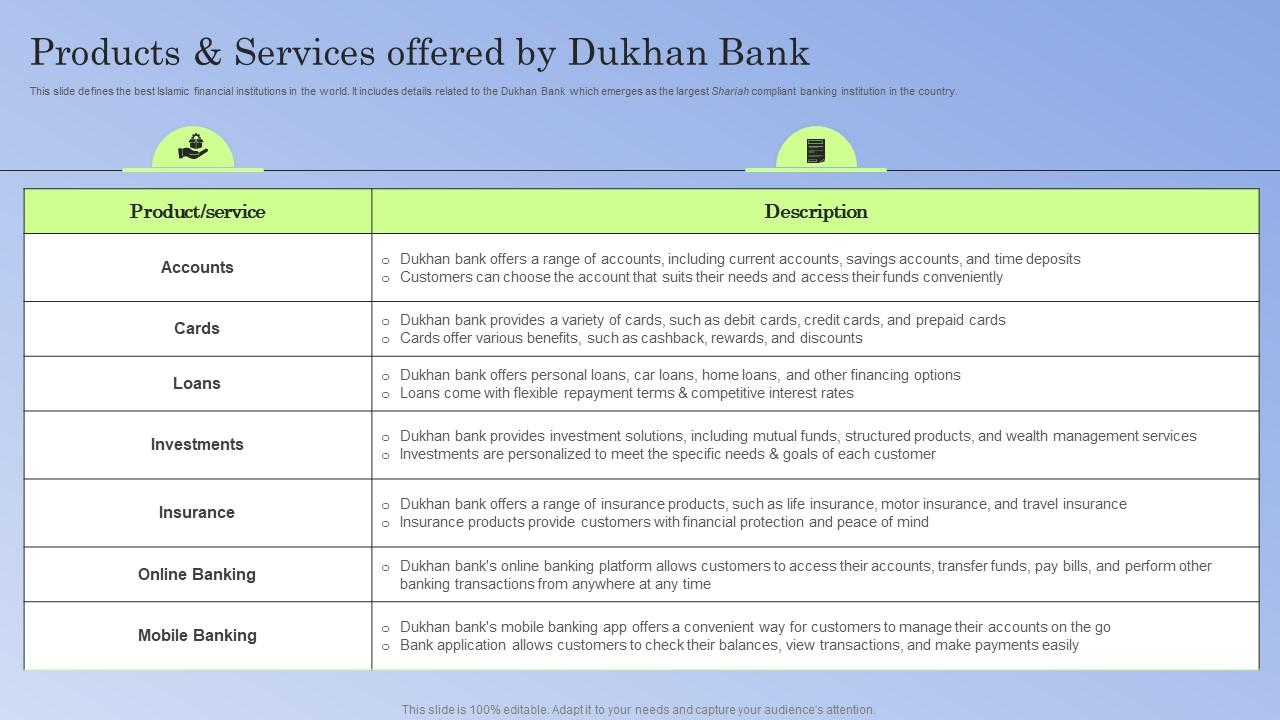

Credit: www.slideteam.net

Technology And Innovation

Technology and innovation play a key role in choosing the best Islamic bank. Modern banks use advanced tools to offer smooth and fast services. These banks provide secure ways to handle finances while respecting Islamic principles. A bank that invests in technology can improve your banking experience. It saves time, reduces errors, and offers convenience. Understanding the digital features of an Islamic bank helps you make a smart choice.

Digital Banking Features

Look for Islamic banks with easy-to-use digital platforms. These platforms should allow you to check your account, transfer money, and pay bills online. Security is important. The bank must protect your data with strong encryption. Some banks offer features like instant notifications for transactions. Others provide tools to help manage your budget. A good digital banking system saves you trips to the branch.

Mobile And Online Services

Mobile apps and online services are vital today. Choose an Islamic bank with a reliable mobile app. The app should work smoothly on different devices. It must support key functions like deposits, withdrawals, and loan applications. Online customer support is helpful for quick problem solving. Check if the bank updates its app regularly to fix bugs and add features. Good mobile services mean banking is available anytime, anywhere.

Social Responsibility

Social responsibility is a key factor when choosing the best Islamic bank. Islamic banks must follow ethical principles that go beyond profit. Their duties include supporting society and protecting the environment. A socially responsible bank builds trust and promotes a positive impact. This section explores how to evaluate Islamic banks based on their social responsibility.

Community Engagement

A good Islamic bank actively supports local communities. It funds education, health, and welfare projects. The bank encourages charity and helps the poor. Look for banks that partner with community organizations. Their programs should reflect Islamic values of kindness and justice. Strong community engagement shows the bank cares about its social role.

Environmental Practices

Environmental care is important for Islamic banks. They avoid financing projects that harm nature. Check if the bank invests in green energy and sustainable businesses. Banks should reduce their own carbon footprint. Simple steps like paperless banking show commitment. A bank with good environmental practices respects creation and future generations.

Credit: www.threads.com

Global Presence

Global presence plays a crucial role in choosing the best Islamic bank. It shows how well the bank serves customers beyond its home country. A strong global presence means easy access to banking services worldwide. This is important for people who travel or do business internationally. It also reflects the bank’s stability and reputation.

International Reach

Look for Islamic banks with branches in multiple countries. This helps customers access services no matter where they are. A wide international reach means the bank understands different markets and cultures. It can offer tailored products that meet local needs. Banks with strong global networks often have better support for their clients.

Cross-border Services

Cross-border services are key for international banking needs. These services include money transfers, trade financing, and currency exchange. The best Islamic banks offer smooth and fast cross-border transactions. They follow Shariah rules while handling international operations. This ensures compliance and trust for customers worldwide.

Frequently Asked Questions

Which Islamic Bank Is Best?

Kuwait Finance House, Standard Chartered Saadiq, and Abu Dhabi Islamic Bank rank among the best Islamic banks globally. Al Rajhi Bank and ADIB are also highly trusted for Shariah-compliant services. Choose based on reputation, customer service, and Shariah compliance.

Which Bank Is Best For Muslims?

Kuwait Finance House, Al Rajhi Bank, Abu Dhabi Islamic Bank, and Standard Chartered Saadiq are top Islamic banks. ADIB wins annual awards for excellence. Choose based on Shariah compliance, customer service, and financial stability to meet Muslim banking needs.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits non-permissible income or debt exposure to 30% of a company’s total revenue or assets. This ensures Shariah compliance by minimizing involvement in prohibited activities like interest or excessive debt.

Which Is The Safest Islamic Bank?

Al Rajhi Bank, Abu Dhabi Islamic Bank, and Qatar Islamic Bank rank among the safest Islamic banks globally. They ensure strong Shariah compliance and financial stability.

Conclusion

Choosing the best Islamic bank takes careful thought and research. Focus on Shariah compliance and customer service. Check the bank’s reputation and financial stability. Compare products and fees to fit your needs. Trust and transparency matter most for peace of mind.

Take your time to find the right fit. This helps ensure your money grows safely and ethically.