Choosing between a fixed and variable rate loan hinges on your risk tolerance and financial stability. Fixed rates offer predictability, while variable rates provide potential savings.

In today’s economic landscape, understanding the nuances of loan types is crucial for financial planning. Fixed-rate loans lock in an interest rate, ensuring consistent monthly payments throughout the loan’s term. This stability makes budgeting easier and protects you from rising interest rates.

Conversely, variable-rate loans can be less expensive initially, as they often start with lower rates that adjust over time with market conditions. This option could be advantageous if rates decrease, but it also poses a risk if rates climb. Before deciding, consider your long-term financial goals, income stability, and comfort with the possibility of changing payments. A careful assessment of these factors will guide you in making an informed decision that aligns with your financial strategy.

Introduction To Fixed And Variable Rate Loans

Understanding loan interest rates is vital for financial decisions. Fixed and variable rate loans offer different benefits. Your choice affects your payments over time. Let’s explore these options to make an informed decision.

The Basics Of Loan Interest Rates

Interest rates influence the total cost of a loan. They represent the lender’s charge for borrowing money. Rates vary by loan type, borrower’s credit score, and market conditions. A lower rate means less paid over the loan’s life.

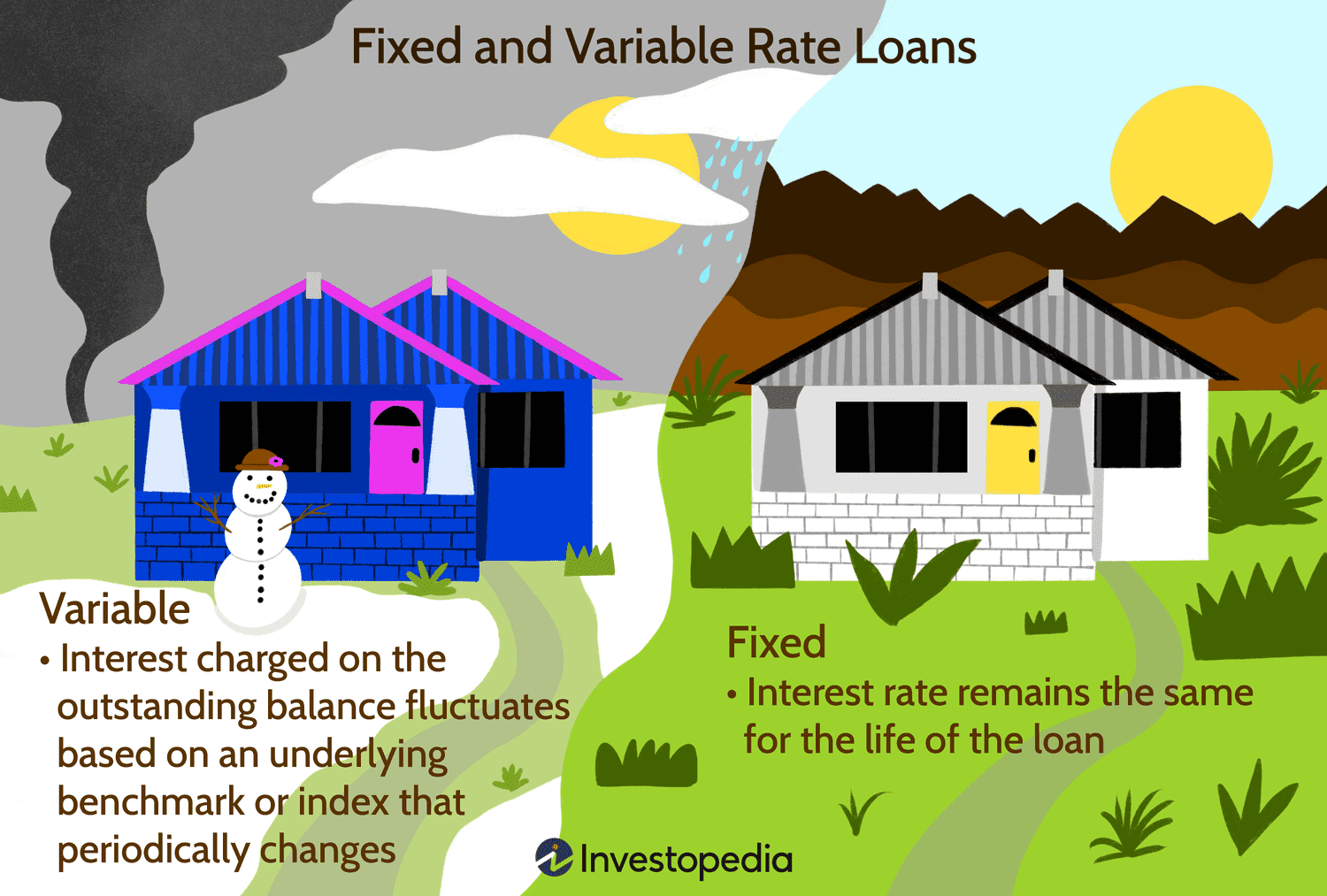

Fixed Vs. Variable: Key Differences

Fixed-rate loans have unchanging interest. They provide payment stability. Variable-rate loans have interest tied to an index. These rates can fluctuate, causing payment amounts to change.

- Fixed-rate loans:

- Consistent monthly payments

- Easier budgeting

- Protection against rising rates

- Variable-rate loans:

- Potential for lower initial rates

- Payments can increase or decrease

- Suitable for short-term borrowing

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Credit: www.investopedia.com

Evaluating Your Financial Situation

Choosing between a fixed and variable rate loan starts with understanding your own financial situation. This step is crucial to making a decision that aligns with your goals and needs. Let’s dive into how to evaluate your financial health effectively.

Assessing Your Cash Flow

Knowing your cash flow is key. It tells you how much money you have coming in and going out each month. To start, list all your income sources. Then, list your expenses. Subtract expenses from income to find your cash flow. A positive number means you have extra money each month. A negative number means you spend more than you earn.

Use a table to track this:

| Month | Income ($) | Expenses ($) | Cash Flow ($) |

|---|---|---|---|

| January | 3000 | 2500 | 500 |

| February | 3200 | 2700 | 500 |

Understanding Your Risk Tolerance

Your risk tolerance is about how much risk you can handle. Some people are okay with ups and downs in their loan rates. Others prefer knowing exactly what they will pay every month. Knowing where you stand will help you choose the right loan.

- High risk tolerance: You’re okay with rates changing. You might save money if rates drop.

- Low risk tolerance: You prefer steady payments. A fixed rate might be better for you.

To sum up, understanding your cash flow and risk tolerance will guide you in choosing between a fixed and variable rate loan. These steps ensure you pick a loan that fits your financial situation.

The Pros And Cons Of Fixed Rate Loans

Choosing the right type of loan can be a tough decision. Fixed rate loans offer both benefits and limitations. Here’s what to consider when looking at fixed rate options.

Stability And Predictability

- Consistent payments make budgeting simpler.

- Interest rates remain unchanged, even if market rates rise.

- Long-term planning becomes easier with set rates.

Potential Drawbacks To Consider

- Higher initial rates than variable loans can occur.

- Miss out on savings if interest rates fall.

- Refinancing required to adjust loan terms.

The Pros And Cons Of Variable Rate Loans

The Pros and Cons of Variable Rate Loans spark lively debates among borrowers. Understanding these can guide informed decisions.

The Attraction Of Lower Initial Rates

Variable rate loans often start with tempting low rates. These appealing rates can lead to smaller monthly payments. This is a major draw for borrowers seeking immediate savings.

The Risks Of Interest Rate Fluctuations

Interest rates on variable loans can change. This means monthly payments can vary. A rate hike can increase the cost of borrowing. It is vital to assess financial stability when considering a variable rate loan.

- Pros:

- Lower initial rates reduce early payments.

- Potential savings if interest rates drop.

- Flexibility with market changes.

- Cons:

- Uncertainty in monthly payment amounts.

- Potential for higher costs if rates rise.

- Difficult to budget long-term.

Interest Rate Trends And Market Predictions

Choosing the right loan depends on interest rate trends and market predictions. Understanding these can help you decide between a fixed and variable rate loan. Let’s dive into how to analyze these factors.

Analyzing Economic Indicators

Economic indicators are like clues about future interest rates. They help us guess if rates will go up or down. Here are key indicators to watch:

- Inflation rates: High inflation often leads to higher interest rates.

- Employment data: More jobs usually mean higher rates soon.

- GDP growth: Strong growth can push rates up.

By keeping an eye on these, you can make smarter loan choices.

Expert Predictions And Historical Data

Experts often predict interest rates by looking at past trends. Here’s why historical data is important:

- It shows how rates changed in similar economic conditions.

- It helps experts make educated guesses about future rates.

Check out this simple table that compares past and predicted interest rates:

| Year | Past Rate (%) | Predicted Rate (%) |

|---|---|---|

| 2020 | 3.5 | 3.0 |

| 2021 | 2.8 | 3.2 |

| 2022 | 3.1 | 3.5 |

Seeing the trends helps you choose the right loan type. Remember, no one can predict rates perfectly. But these tools can help you make a good guess.

Credit: www.salliemae.com

Strategies For Long-term Planning

Planning for the long haul in finance is key. A loan is a big commitment. You want it to fit your life goals. It’s not just about the rates. Think about your future. And choose wisely between fixed and variable rate loans.

Aligning Loan Choice With Future Goals

Life goals affect loan choices. Your goals could be buying a home, starting a business, or saving for retirement. Each goal demands a different financial approach. Choose a loan type that supports your timeline and risk tolerance.

- Fixed-rate loans offer stability. Your payments stay the same.

- Variable-rate loans can be lower at first. But they can change with the market.

Think about your career path. A stable job might mean a fixed rate is better. An uncertain future? A variable rate could save you money.

Refinancing Options Down The Line

Refinancing can change your loan’s terms later. This can help if your financial situation changes. You can switch from variable to fixed, or vice versa.

| Current Loan Type | Refinance to | Why Consider |

|---|---|---|

| Fixed | Variable | For lower rates when market rates drop |

| Variable | Fixed | To lock in a rate if you expect rates to rise |

Keep in mind refinance costs. These include appraisal fees and closing costs. They can add up. Make sure refinancing makes financial sense.

Real-life Scenarios: Making The Right Choice

Choosing the right loan type is crucial. Real-life scenarios help us understand the impact of this decision. Let’s explore how borrowers make the best choice between fixed and variable rate loans.

Case Studies Of Borrowers’ Decisions

Borrower A opted for a fixed-rate loan. Interest rates were increasing. Budget certainty was a priority for them.

Borrower B chose a variable rate. They planned to pay off the loan quickly. They took advantage of low initial rates.

Lessons Learned From Past Borrowers

- Review financial goals before choosing a loan type.

- Consider market trends to predict interest rate changes.

- Assess risk tolerance. Fixed rates offer stability. Variable rates can change.

Final Thoughts: Making An Informed Decision

Final Thoughts: Making an Informed Decision on whether to choose a fixed or variable rate loan can seem daunting. But with the right information and a clear understanding of your financial situation, you can make a choice that serves your long-term interests.

Checklist For Choosing The Right Loan

- Assess your risk tolerance: Are you comfortable with rates changing?

- Review your financial goals: Short-term savings or long-term stability?

- Understand rate trends: Is the market suggesting hikes or drops?

- Examine loan features: Do you need flexibility like extra repayments?

- Calculate the total cost: Compare the lifetime cost of both loan types.

When To Seek Professional Financial Advice

Seek a financial advisor’s help:

- If you’re unsure about the loan’s impact on your finances.

- When the market is volatile and difficult to predict.

- If you have complex financial needs or debt structures.

A professional can provide tailored advice to secure your financial future.

Credit: www.forbes.com

Frequently Asked Questions

What Determines Fixed Versus Variable Loan Rates?

Fixed rates are determined by the lender’s set interest rate at the loan’s inception. Variable rates fluctuate with market conditions or an index rate. Both rates depend on the lender’s terms and the borrower’s creditworthiness.

Which Is Safer: Fixed Or Variable Rate Loans?

Fixed rate loans are generally safer for borrowers seeking consistent payments. They protect against interest rate increases. Variable rate loans can be less predictable but may offer lower initial rates.

How Do Rate Changes Affect Variable Loans?

Variable loan rates change based on the market or an index. When rates rise, so do the payments on a variable loan, increasing the cost over time. Conversely, if rates fall, payments may decrease.

When Should I Choose A Fixed Rate Loan?

Choose a fixed rate loan if you prefer stable monthly payments and want to avoid the risk of rising interest rates. It’s ideal for budgeting and long-term planning.

Conclusion

Deciding between a fixed and variable rate loan can significantly impact your financial future. It’s essential to weigh the pros and cons of each option, considering your financial stability and risk tolerance. Seek advice from financial experts and use online calculators to make an informed choice.

Remember, the right loan type will align with your long-term financial goals.