Car insurance is important. It helps protect you and your car. But, finding the best car insurance can be hard. This guide will help you compare car insurance rates. You will learn how to save money and get the best coverage.

Credit: www.valuepenguin.com

Why Compare Car Insurance Rates?

Comparing car insurance rates is important. It helps you find the best deal. Different companies offer different rates. By comparing, you can save money.

Credit: www.thezebra.com

Steps to Compare Car Insurance Rates

Follow these steps to compare car insurance rates easily.

1. Gather Your Information

You need some information to compare car insurance rates. Here is what you need:

- Your car’s make, model, and year

- Your driving history

- Your current insurance policy

- Your personal information

Having this information ready will make the process easier.

2. Decide On The Coverage You Need

Think about what coverage you need. There are different types of coverage:

- Liability Coverage: This covers damage to others if you are at fault.

- Collision Coverage: This covers damage to your car in an accident.

- Comprehensive Coverage: This covers damage to your car from things like fire, theft, or weather.

- Personal Injury Protection: This covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: This covers you if the other driver doesn’t have enough insurance.

Decide which types of coverage you need. This will help you compare rates.

3. Use Online Comparison Tools

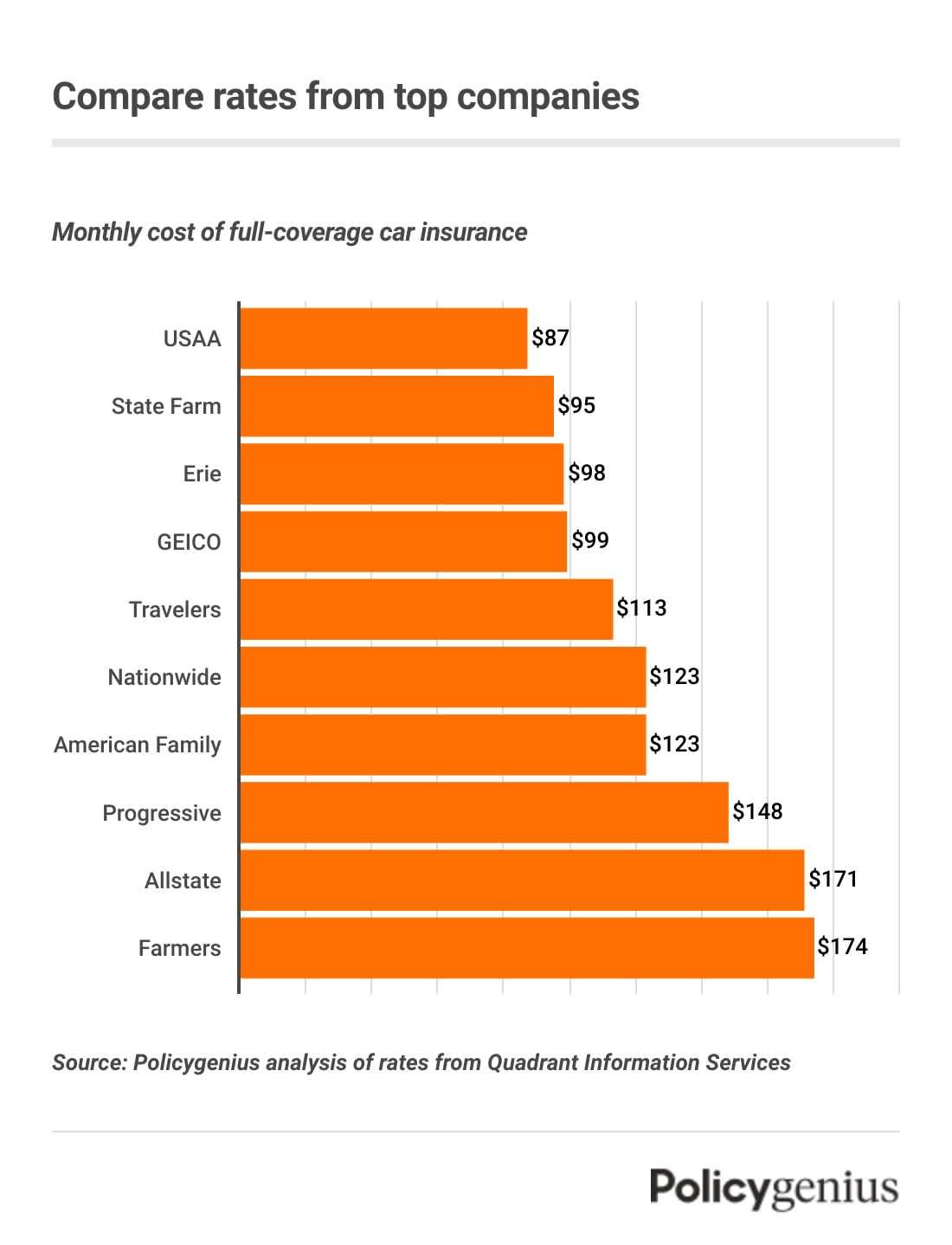

There are many online tools to compare car insurance rates. Here are some popular ones:

- Geico

- Progressive

- State Farm

- Esurance

- Allstate

These tools let you compare rates from different companies. Use them to find the best deal.

4. Get Quotes From Different Companies

Don’t just rely on online tools. Get quotes directly from insurance companies. Call them or visit their websites. This will give you more options to compare.

5. Compare The Quotes

Now you have quotes from different companies. Compare them to find the best one. Look at these factors:

- The price of the policy

- The coverage limits

- The deductibles

- Any discounts available

Make a table to compare these factors easily:

| Company | Price | Coverage Limits | Deductibles | Discounts |

|---|---|---|---|---|

| Geico | $500 | $100,000/$300,000 | $500 | Good driver, multi-policy |

| Progressive | $550 | $100,000/$300,000 | $500 | Safe driver, multi-car |

This table helps you see the differences. Choose the policy that offers the best value.

6. Read The Fine Print

Before you buy a policy, read the fine print. Make sure you understand the terms and conditions. Look for any hidden fees or exclusions.

7. Ask About Discounts

Many insurance companies offer discounts. Ask about them when you get quotes. Some common discounts are:

- Good driver discount

- Multi-car discount

- Safe driver discount

- Good student discount

These discounts can save you money. Make sure to ask about them.

8. Choose The Best Policy

Now you have all the information. Compare the quotes, read the fine print, and ask about discounts. Choose the best policy for your needs.

Frequently Asked Questions

How To Find The Best Car Insurance Rates?

Compare quotes from multiple insurers online. Check for discounts and coverage options to get the best rates.

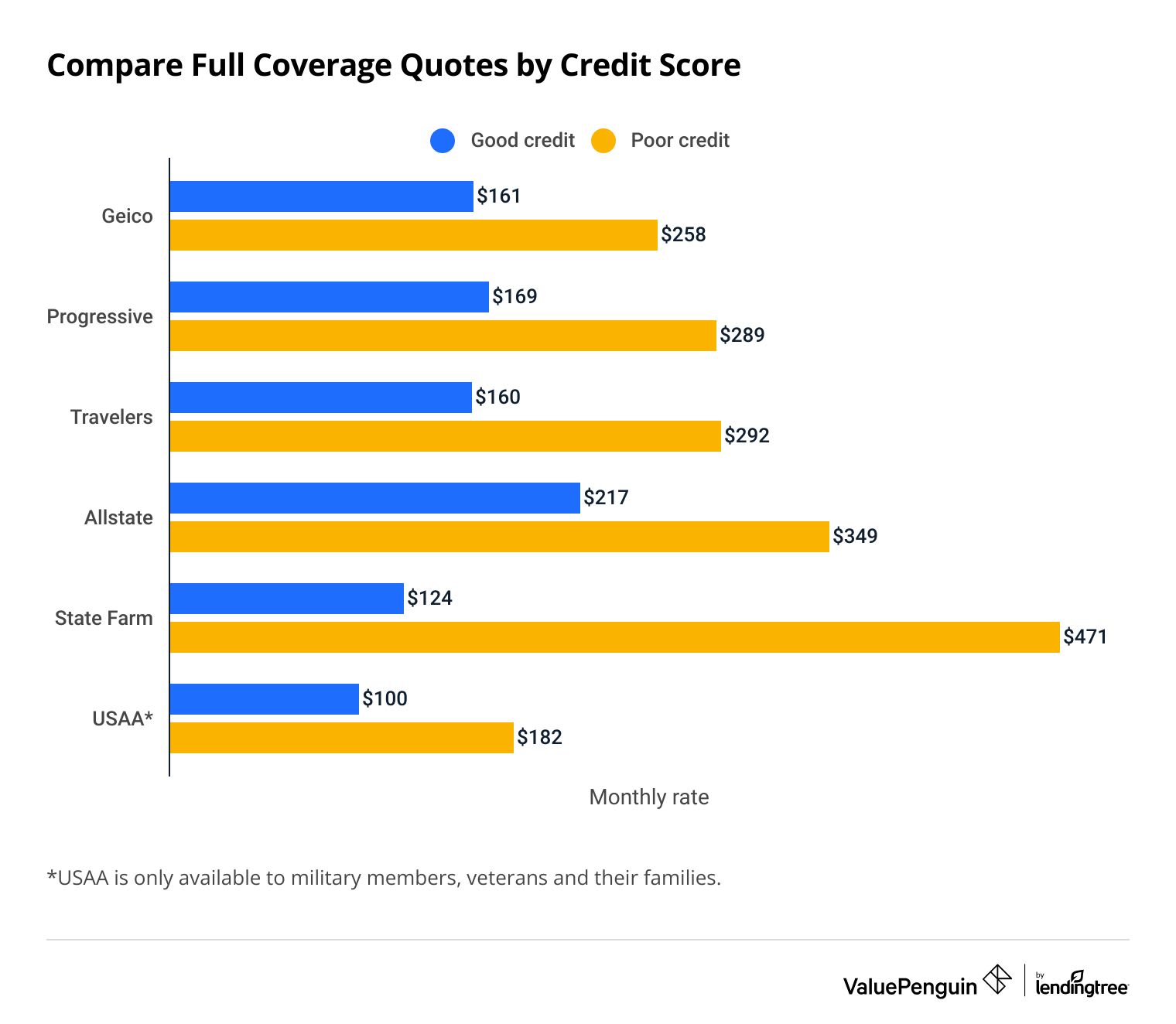

What Affects Car Insurance Rates?

Driving history, vehicle type, location, and coverage level significantly impact car insurance rates. Maintain a clean record for lower rates.

Can I Get Cheaper Car Insurance Online?

Yes, online comparison tools help find cheaper car insurance. They offer multiple quotes and discounts from various providers.

Is Bundling Insurance Policies Beneficial?

Bundling car and home insurance often reduces premiums. Many insurers offer discounts for combining multiple policies.

How Often Should I Compare Car Insurance Rates?

Compare car insurance rates annually. Regular comparisons help ensure you’re getting the best deal and saving money.

Conclusion

Comparing car insurance rates is easy. Follow the steps in this guide. Gather your information, decide on coverage, use online tools, get quotes, compare them, read the fine print, ask about discounts, and choose the best policy. This will help you save money and get the best coverage for your car.

Remember, it’s important to review your car insurance policy every year. Your needs may change, and you might find better rates. Stay informed and make smart choices to protect yourself and your car.