To file a health insurance appeal, gather all necessary documents and submit a formal written appeal to your insurer. Follow your insurer’s specific appeal process and deadlines.

Health insurance claims can sometimes be denied, leaving you with unexpected medical bills. Understanding how to file an appeal can make a big difference. Start by reviewing the denial letter to understand the reason behind it. Collect all relevant medical records, bills, and correspondence.

Write a clear and concise appeal letter explaining why the claim should be approved. Be sure to follow your insurer’s guidelines for submitting appeals, including deadlines. This proactive approach can increase your chances of a successful appeal and ensure you receive the coverage you deserve.

Credit: www.triagehealth.org

Understanding Health Insurance Appeals

Filing a health insurance appeal can seem difficult. Knowing the steps helps. An appeal is a request to review a denied claim. Understanding why a claim gets denied is key. Let’s dive into common reasons for denial and the importance of an appeal.

Common Reasons For Denial

Understanding why your claim was denied helps you appeal effectively. Here are some common reasons:

- Coverage Issues: The treatment may not be covered by your plan.

- Incorrect Information: Errors in your claim form can lead to denial.

- Medical Necessity: The insurance company may not see the treatment as necessary.

- Out-of-Network Providers: Using doctors outside your network can result in denial.

Importance Of An Appeal

An appeal can change the outcome of your claim. Here’s why it’s important:

- Fair Review: Appeals ensure your claim gets a second look.

- Right to Coverage: You have a right to the coverage you paid for.

- Correct Errors: An appeal lets you fix any mistakes in your claim.

- Access to Care: Winning an appeal can help you get the care you need.

Understanding the appeal process is vital. It ensures you get the coverage you deserve.

Gathering Necessary Information

Filing a health insurance appeal can seem daunting. The first step is gathering necessary information. This ensures you have everything needed to support your case.

Collecting Medical Records

Start by collecting your medical records. These include doctor’s notes, test results, and treatment plans. Ensure all documents are up-to-date and relevant.

- Doctor’s notes

- Test results

- Treatment plans

Organize these documents in a folder. This makes it easier to find what you need.

Understanding Policy Terms

Next, read through your insurance policy terms. Understand what is covered and what is not. Look for terms related to your specific situation.

| Policy Section | Key Points |

|---|---|

| Coverage Details | What treatments are covered? |

| Exclusions | What is not covered? |

| Appeal Process | Steps to file an appeal |

Highlight important sections. This helps you reference them quickly during your appeal.

Preparing Your Appeal Letter

Filing a health insurance appeal can feel overwhelming. A well-prepared appeal letter is crucial. It helps present your case clearly and effectively. This section will guide you through preparing your appeal letter step by step.

Writing A Strong Appeal

Start your letter with a clear subject line. For example, “Health Insurance Appeal for [Your Name]”. In the first paragraph, state your intention to appeal. Mention the specific claim and the date it was denied.

In the body, explain why you believe the decision was wrong. Use simple and clear language. Avoid jargon and technical terms. Mention any conversations you had with customer service. Include dates and names if possible.

End your letter with a strong closing. Request a review of your claim. Provide your contact information. Sign the letter to make it formal.

Including Supporting Documents

Supporting documents strengthen your appeal. Include a copy of the denial letter. Attach medical records that support your claim. Provide a letter from your doctor explaining the necessity of the treatment.

Other useful documents may include:

- Receipts of related expenses

- Prescriptions

- Insurance policy documents

Make sure all documents are clear and readable. Organize them in the order mentioned in the letter. This helps the reviewer follow along easily.

Sample Appeal Letter Template

| Section | Details |

|---|---|

| Subject Line | Health Insurance Appeal for [Your Name] |

| First Paragraph | State your intention to appeal. Mention the denied claim. |

| Body | Explain why the decision was wrong. Use simple language. Include any conversations with customer service. |

| Closing | Request a review. Provide contact info. Sign the letter. |

Following these steps will help you write a strong appeal letter. Good preparation increases your chances of a successful appeal.

Credit: www.dougterrylaw.com

Submitting Your Appeal

Filing a health insurance appeal can be daunting. Understanding the steps can make the process smoother. The key is to follow the correct methods and track your submission.

Filing Methods

There are several ways to submit your health insurance appeal. Choose the method that works best for you.

- Online Portal: Many insurance companies have online portals. You can submit your appeal directly through their website. This method is quick and efficient.

- Mail: You can send a physical letter to your insurance company. Include all necessary documents. Use certified mail to ensure it gets delivered.

- Fax: Some companies accept appeals via fax. Check your insurance company’s guidelines. Ensure you keep a copy of the fax confirmation.

- Phone: In some cases, you can file an appeal over the phone. Take detailed notes during the call. Get the representative’s name and a reference number.

Tracking Your Submission

Tracking your appeal submission is crucial. It ensures your appeal is received and processed.

| Method | Tracking Tips |

|---|---|

| Online Portal | Check for email confirmations. Log in to track the status. |

| Use certified mail. Keep the receipt and tracking number. | |

| Fax | Save the fax confirmation. Follow up with a phone call. |

| Phone | Record the reference number. Note the representative’s name. |

Always keep copies of all documents submitted. Follow up regularly to check the status. Stay organized to ensure a smooth appeal process.

Following Up On Your Appeal

Filing a health insurance appeal can be a complex process. After submitting your appeal, it’s important to follow up. This ensures that your appeal is processed correctly and timely.

Contacting The Insurance Company

After submitting your appeal, contact the insurance company. Reach out to the customer service department. Have your appeal reference number ready. This helps them locate your appeal quickly.

Ask for the current status of your appeal. Note down the name of the representative. Also, record the date and time of the call. This information is useful for future references.

If the representative provides additional information, write it down. This may include required documents or next steps in the process. Make sure to follow these instructions carefully.

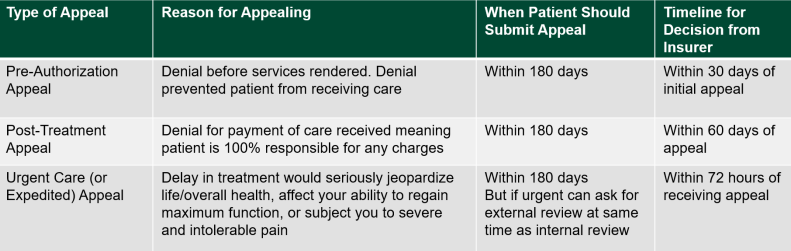

Understanding Appeal Timelines

Understand the timelines associated with your appeal. Insurance companies have set periods for processing appeals. These timelines can vary.

| Appeal Type | Typical Timeframe |

|---|---|

| Standard Appeal | 30 to 60 days |

| Expedited Appeal | 72 hours |

Check your policy documents for specific timelines. If your appeal exceeds the timeframe, contact the insurance company again. Ask for an update and the reason for the delay.

Keep all communication records. This includes emails, letters, and call logs. These are essential if you need to escalate the appeal.

Following up on your appeal ensures that your health insurance claim is addressed. It helps to keep the process transparent and accountable.

Credit: www.dougterrylaw.com

What To Do If Your Appeal Is Denied

Facing a denied health insurance appeal can be frustrating and daunting. But don’t lose hope. There are still actions you can take to pursue coverage and receive the care you need.

Exploring Alternative Options

If your health insurance appeal is denied, consider exploring alternative options. Sometimes, a different treatment or medication might be covered. Speak with your doctor about other possible treatments. They might suggest an alternative that your insurance will approve.

Another option is to check if there are any financial assistance programs available. Some hospitals and clinics offer programs to help patients cover medical expenses. You can also look into non-profit organizations that provide support for specific health conditions.

Seeking Legal Advice

If you believe your appeal was wrongly denied, it may be time to seek legal advice. A lawyer specializing in health insurance cases can provide valuable guidance. They can help you understand your rights and the next steps to take.

Here are some steps to follow:

- Research lawyers who specialize in health insurance appeals.

- Schedule a consultation to discuss your case.

- Provide all relevant documents and information about your case.

- Follow their advice on how to proceed with your denied appeal.

Remember, having a legal expert on your side can make a significant difference. They can navigate the complexities of health insurance laws and work towards a favorable outcome for you.

Frequently Asked Questions

How To Start A Health Insurance Appeal?

Begin by reviewing your denial letter. Gather necessary documents and contact your insurance company’s customer service for guidance.

What Documents Are Needed For An Appeal?

You’ll need your denial letter, medical records, doctor’s notes, and any other supporting documents that justify your claim.

How Long Does An Appeal Take?

The time frame varies but typically ranges from 30 to 60 days. Check with your insurance provider for specifics.

Can I Appeal A Denied Claim Online?

Many insurance companies allow online appeals. Visit your provider’s website for instructions and online forms.

What If My Appeal Is Denied?

You can request an external review from an independent third party. This decision is usually final and binding.

Conclusion

Filing a health insurance appeal can be a straightforward process. Follow the steps outlined to increase your chances. Stay organized, keep detailed records, and don’t hesitate to seek help. Understanding your rights is essential. With patience and persistence, you can navigate the system and secure the coverage you deserve.