To file a health insurance claim, gather necessary documents and complete the claim form provided by your insurer. Submit the form and documents to the insurance company.

Filing a health insurance claim can seem daunting, but it’s a straightforward process. Start by collecting all required documents, such as medical bills, doctor’s notes, and your insurance ID. Make sure the claim form is filled out accurately to avoid delays.

Contact your insurance provider for any specific instructions or additional forms needed. Submit everything either online or via mail, based on your insurer’s preference. Follow up to ensure your claim is processed promptly. Understanding the process helps you get reimbursed quickly and efficiently.

Credit: www.amazon.com

Gather Necessary Documents

Filing a health insurance claim can be daunting. To smoothen this process, gather necessary documents. Each document plays a crucial role in validating your claim. Below are the essential documents you need.

Medical Records

Start by collecting all medical records. These include your diagnosis, treatment plans, and any prescriptions. Ensure that these documents are clear and accurate.

Medical records help the insurance company understand your medical history. They also show the necessity of the treatment you received. Organize these records chronologically for easier reference.

Proof Of Payment

Next, gather all proof of payment documents. This includes receipts, invoices, and bank statements. These documents prove that you have paid for the medical services.

Proof of payment is crucial for reimbursement claims. Make sure the amounts match the services listed in your medical records.

Below is a simple table to help you organize:

| Document Type | Description |

|---|---|

| Receipt | Proof of payment from the healthcare provider. |

| Invoice | Detailed list of services and their costs. |

| Bank Statement | Record of transactions showing payments made. |

Organizing your documents makes the claim process smoother. This helps in quick verification and processing of your claim.

Understand Your Policy

Knowing your health insurance policy is crucial. It helps in filing claims smoothly. Let’s break down the policy into key parts.

Coverage Details

Your policy will list what medical services it covers. This includes doctor visits, hospital stays, and prescription drugs. Always read these details carefully.

| Service | Coverage |

|---|---|

| Doctor Visits | Covered up to 80% |

| Hospital Stays | Covered up to 90% |

| Prescription Drugs | Covered up to 70% |

Check if your policy has any special conditions. Some policies cover only specific doctors or hospitals. Others may require pre-approval for treatments.

Exclusions

Policies also list what they do not cover. These are called exclusions. Knowing them helps you avoid surprises later.

- Cosmetic procedures

- Experimental treatments

- Over-the-counter medications

Review the exclusions section in your policy document. Understand what is not covered to plan accordingly.

By understanding your policy, you can file claims with confidence. This saves time and reduces stress.

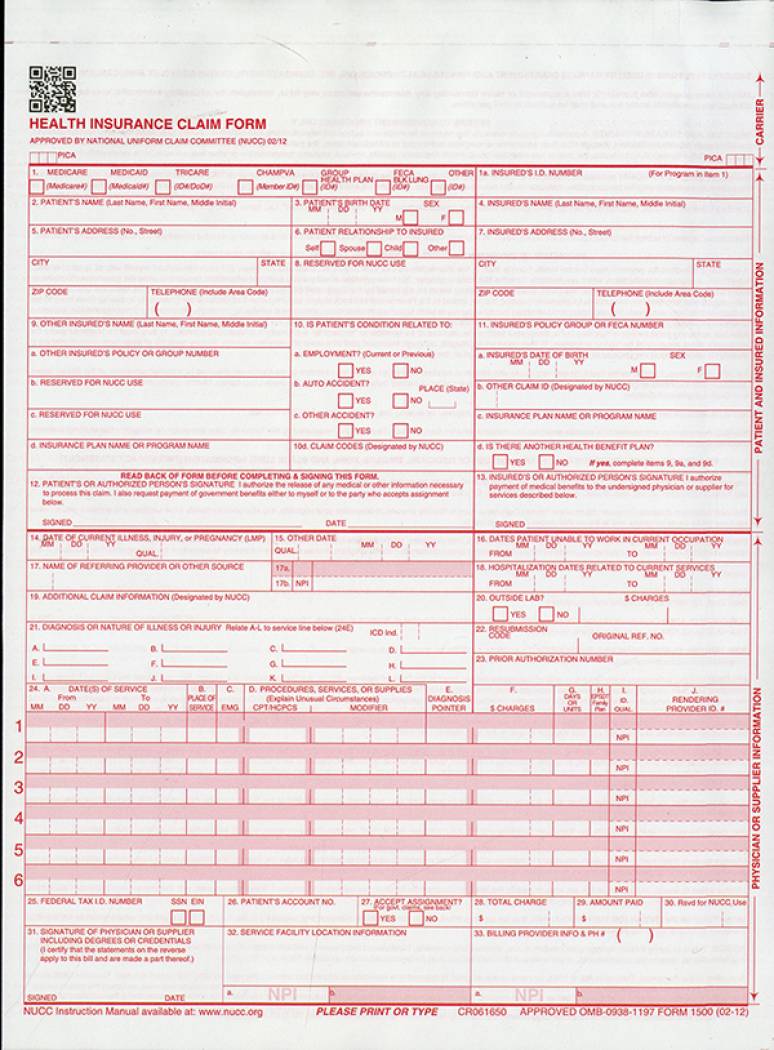

Fill Out Claim Form

Filing a health insurance claim can seem complex. But breaking it down makes it easier. One of the key steps is filling out the claim form. This form is crucial for processing your claim efficiently. To ensure accuracy, you must fill out each section carefully. Let’s dive into the essential parts of the claim form.

Personal Information

Start with your personal information. This section includes:

- Your full name

- Date of birth

- Policy number

- Contact details

Ensure all details match your insurance records. Incorrect information can delay the process.

Treatment Details

Next, provide the treatment details. This section requires:

- Date of treatment

- Type of treatment

- Doctor’s name

- Hospital or clinic name

Include a brief summary of the treatment received. Attach any relevant documents like bills and prescriptions.

Here’s a sample table for clear presentation:

| Information | Details |

|---|---|

| Date of Treatment | 01/01/2023 |

| Type of Treatment | General Checkup |

| Doctor’s Name | Dr. John Doe |

| Hospital/Clinic Name | City Health Clinic |

Review all information before submission. Accurate and complete forms speed up your claim process.

Credit: www.tops-products.com

Submit Your Claim

Filing a health insurance claim can seem daunting. Knowing how to submit your claim makes the process smoother. This section will guide you through the steps of submitting your claim.

Online Submission

Submitting your claim online is quick and easy. Many insurance companies provide a dedicated online portal.

- Log in to your insurance account.

- Navigate to the claims section.

- Fill out the claim form.

- Upload required documents.

- Submit your claim.

Make sure to save the confirmation number. This helps track your claim status.

Mail Submission

For those who prefer traditional methods, mail submission is an option. Follow these steps to mail your claim:

- Download and print the claim form from your insurer’s website.

- Fill out the form completely.

- Attach all necessary documents.

- Place everything in an envelope.

- Mail it to the provided address.

Ensure to use certified mail. This provides proof of submission.

| Online Submission | Mail Submission |

|---|---|

| Fast and convenient | Good for those who prefer paper |

| Immediate confirmation | Proof of submission via certified mail |

Both methods are effective. Choose the one that suits you best.

Track Your Claim

Filing a health insurance claim can be overwhelming. It’s important to track the claim. This ensures you get the benefits you deserve. Tracking helps you stay informed and prepared.

Claim Status

After filing your claim, check its status regularly. Most insurance companies offer online tracking. Use their website or mobile app to stay updated. Look for a section labeled “Claim Status” or “Track Claim.”

- Log in to your insurance account.

- Navigate to the claims section.

- Enter your claim ID or policy number.

- Check the current status of your claim.

You might see different statuses like “Processing,” “Approved,” or “Denied.” If it’s processing, give it some time. If it’s approved, expect your payment soon. If it’s denied, prepare for the next steps.

Follow-up

If your claim status hasn’t changed, follow up. Contact your insurance company for updates. Have your claim ID and policy number ready. This helps the representative find your information quickly.

| Contact Method | Details |

|---|---|

| Phone | Call the customer service number on your insurance card. |

| Send an email with your claim details and questions. | |

| Online Chat | Use the chat feature on the insurance company’s website. |

Keep a record of all follow-ups. Note down dates, times, and names of representatives. This information is helpful if you need to escalate the issue.

Handle Claim Denials

Handling a claim denial can be frustrating. Knowing what to do next is crucial. This section will guide you through common reasons for denials and the appeal process.

Common Reasons

Health insurance claims get denied for many reasons. Knowing the common reasons helps you avoid mistakes.

- Incomplete Forms: Make sure all forms are filled out correctly.

- Non-Covered Services: Check if the service is covered by your plan.

- Out-of-Network Provider: Ensure your provider is within your insurance network.

- Lack of Pre-Authorization: Some procedures need pre-approval from your insurer.

Appeal Process

If your claim gets denied, you can appeal. Follow these steps to ensure a successful appeal.

- Review the Denial Letter: Understand why your claim was denied. The letter will provide specific reasons.

- Gather Documentation: Collect all necessary documents. This includes medical records and receipts.

- Write an Appeal Letter: Explain why the claim should be approved. Be clear and concise.

- Submit Your Appeal: Send your appeal to the insurance company. Use certified mail for tracking.

- Follow Up: Keep track of your appeal status. Contact the insurer if you do not hear back within a few weeks.

Handling claim denials can be stressful. Knowing the common reasons for denial and the appeal process can make it easier.

Credit: bookstore.gpo.gov

Frequently Asked Questions

What Documents Are Needed For A Health Insurance Claim?

You need medical bills, doctor’s prescription, and insurance policy documents.

How Long Does It Take To Process A Claim?

Processing a claim usually takes 2-4 weeks.

Can I File A Claim Online?

Yes, most insurers offer online claim filing options.

What If My Claim Gets Rejected?

Contact your insurer for clarification and resubmit with necessary corrections.

Is There A Deadline To File A Claim?

Yes, claims must be filed within 30-90 days after treatment.

Conclusion

Filing a health insurance claim doesn’t have to be complicated. Follow the steps outlined in this guide. By staying organized and keeping track of your documents, you can ensure a smooth process. Understanding your policy and knowing your rights can make a big difference.

Take charge of your health insurance today.