Securing a home loan with bad credit is challenging but possible. Start by improving your credit score and seeking lenders with flexible criteria.

Navigating the complex world of home loans can be daunting, especially with a less-than-perfect credit history. Yet, a low credit score doesn’t mean homeownership is out of reach. Key strategies include focusing on credit repair, exploring various lending options, and understanding that some lenders specialize in bad credit home loans.

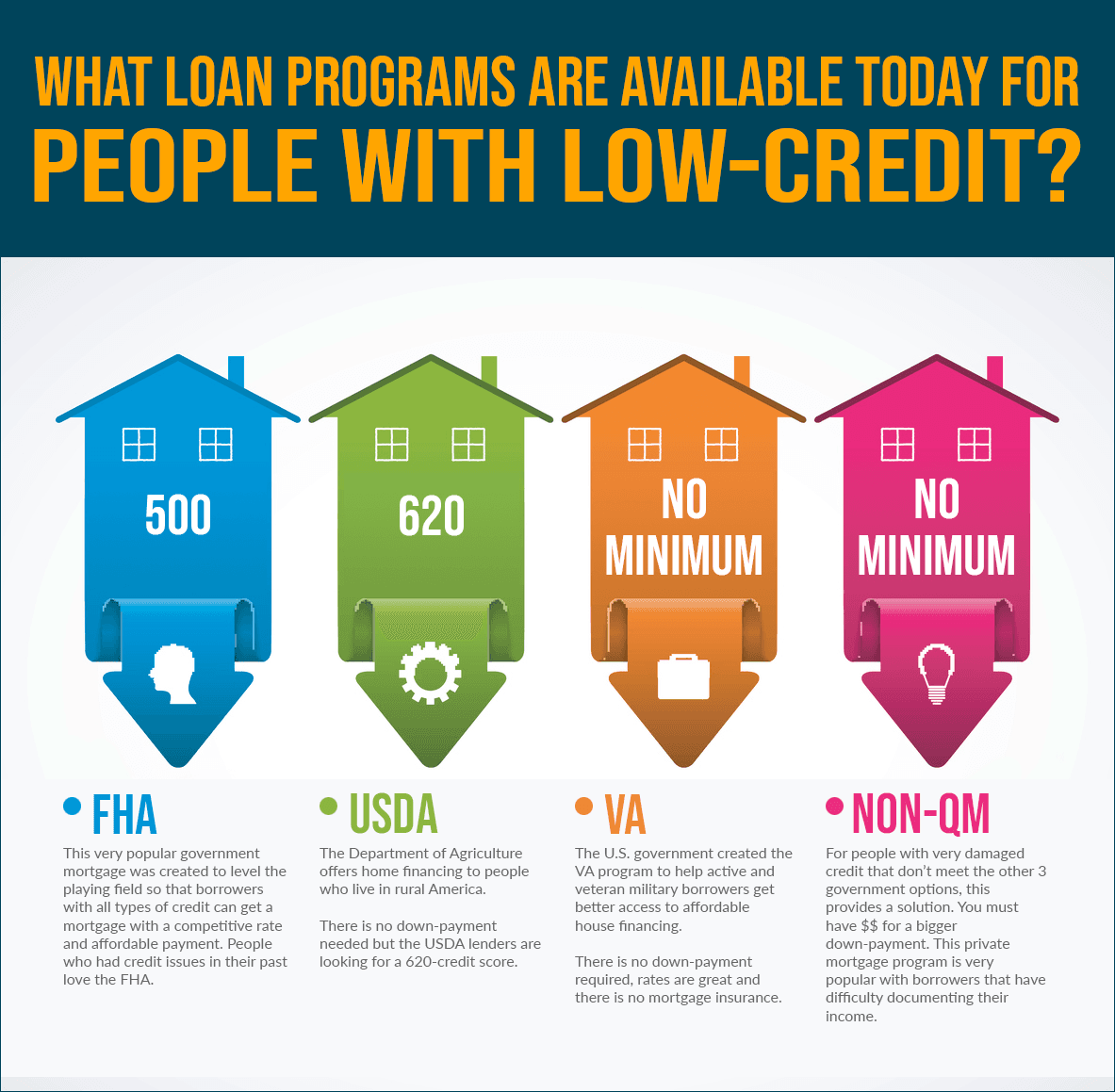

It’s essential to be prepared for higher interest rates and perhaps a larger down payment. By researching government-backed loans, like FHA loans, and considering credit unions or local banks, borrowers with bad credit can find avenues to secure a mortgage. Demonstrating a reliable income and reducing existing debt levels can also strengthen your loan application significantly.

The Challenge Of Bad Credit

The Challenge of Bad Credit can seem daunting. A low credit score may feel like a barrier to homeownership. Yet, understanding the hurdles and how to navigate them can empower you. This guide aims to shed light on the impact of bad credit and what it means for loan eligibility.

Impact On Loan Eligibility

Bad credit directly affects your ability to secure a home loan. Lenders view credit scores as a measure of risk. A low score can signal a high-risk borrower. This perception can lead to loan rejections or high-interest rates. In some cases, lenders might require a larger down payment.

Credit Score Ranges And Their Significance

Credit scores typically range from 300 to 850. Scores are often categorized as follows:

- Excellent: 750 and above

- Good: 700 – 749

- Fair: 650 – 699

- Poor: 550 – 649

- Bad: 549 and below

Each range impacts your loan terms. Higher scores attract better terms. Lower scores may require more effort to secure a loan.

Credit: migonline.com

Credit Score Deep Dive

Let’s dive deep into what a credit score is all about. Understanding your credit score is key to unlocking the door to a home loan, even with bad credit.

Factors Affecting Your Credit Score

Your credit score is like a financial report card. It shows how well you manage money. Many things can change your score. Here are the most important ones:

- Payment History: Making payments on time boosts your score.

- Credit Utilization: This is how much credit you use. Less is better.

- Length of Credit History: A longer history helps your score.

- New Credit: Opening many new accounts can lower your score.

- Types of Credit: Having a mix of credit types is good.

How Lenders View Your Credit History

Lenders look at your credit history to decide if they can give you a loan. They want to know if you are a safe bet. Here’s what they consider:

| Score Range | View |

|---|---|

| 750 and above | Excellent |

| 700 – 749 | Good |

| 650 – 699 | Fair |

| 600 – 649 | Poor |

| Below 600 | Bad |

Lenders use this table to decide. A higher score means a better chance at a loan. A low score means you may need to improve your credit first.

Preparing To Apply For A Home Loan

Embarking on the journey to homeownership can be daunting, especially with a less-than-stellar credit history. Yet, preparing effectively for a home loan can turn the tide in your favor. This segment delves into vital steps to enhance your chances of loan approval.

Improving Your Credit Score

A higher credit score can significantly increase loan approval odds. Start by obtaining your credit report from major bureaus. Scrutinize for any inaccuracies and dispute them promptly. Focus on paying down existing debt, particularly high-interest credit cards. Maintain a record of timely payments as these positively impact your score. Limit new credit inquiries; each check can reduce your score slightly.

Assembling Necessary Documentation

Lenders need proof of your financial stability. Prepare recent pay stubs, tax returns, and bank statements. Include a detailed list of debts and assets. This documentation offers lenders a clear picture of your financial health.

- Employment Verification: Letters or forms confirming your employment status.

- Income Proof: Pay stubs, W-2s, or tax returns showing your earnings.

- Debt Summary: Statements for current loans and credit cards.

- Asset Documentation: Bank statements and investment accounts.

- Credit Report: Your credit history and score.

Strategic Financial Moves

Embarking on the journey to homeownership can be daunting with a less-than-stellar credit score. Yet, strategic financial moves can turn the tide in your favor. These actions aim to strengthen your financial standing and appeal to lenders. Let’s explore practical steps to enhance your eligibility for a home loan, even with bad credit.

Reducing Debt-to-income Ratio

One crucial step is lowering your debt-to-income (DTI) ratio. This ratio measures monthly debt against income. A lower DTI signals better financial health. Focus on paying off debts, particularly high-interest ones. Consider these points:

- Create a budget to track expenses and find savings.

- Prioritize debt payments, targeting high-interest debts first.

- Increase income through side jobs or overtime work.

- Limit new debt to avoid raising your DTI.

Exploring Secured Credit Options

Secured credit options can also improve your credit score. These require an asset as collateral. Secured credit cards and loans are typical examples. They offer a controlled way to build credit. Remember:

- Choose a secured credit card with low fees.

- Use the card for small, regular purchases.

- Pay the balance in full each month to avoid interest.

- Ensure the lender reports to all three credit bureaus.

Home Loan Options For Bad Credit

Finding a home loan with bad credit can seem tough. But, options exist for those who need them. This part of our blog explores two main options. Let’s dive in.

Fha Loans: A Viable Path

The Federal Housing Administration (FHA) offers loans for bad credit scores. These loans require a lower minimum credit score than most. A score of 580 might get you a nice deal. With 10% down, even a 500 score works.

- Low down payments: as little as 3.5%.

- Flexible credit requirements.

FHA loans come with insurance premiums. These cover the lender if a borrower fails to repay.

Subprime Mortgages: Risks And Rewards

Subprime mortgages are for those with lower credit scores. These loans often have higher interest rates. This is because lenders see these borrowers as higher risk.

Benefits include:

- Access to home loans not available otherwise.

- Potential to refinance later as credit improves.

Risks involve:

- Higher interest rates mean more money paid over time.

- Possible prepayment penalties.

Subprime mortgages require careful consideration. They can be a stepping stone to better credit and loan terms in the future.

Credit: www.quickenloans.com

Navigating Interest Rates And Fees

Bad credit can make getting a home loan challenging. It’s crucial to understand interest rates and fees. Higher rates can result from lower credit scores. Extra fees may apply. Knowledge is power in this situation. Let’s explore how to navigate these factors effectively.

Comparing Loan Offers

Start by gathering loan offers from various lenders. Each lender has different criteria. Rates and fees can vary widely. Compare these carefully.

| Lender | Interest Rate | Fees |

|---|---|---|

| Lender A | 5.5% | $2,000 |

| Lender B | 6.0% | $1,500 |

| Lender C | 5.8% | $2,500 |

Use this table to weigh options. Look beyond the interest rate. Fees impact the loan’s total cost.

Understanding The True Cost Of Borrowing

The true cost of a loan combines interest and fees. Calculate the Annual Percentage Rate (APR). APR gives a clearer cost picture.

- Interest rate determines monthly payments.

- Fees include processing, application, and origination fees.

- APR includes both, showing the yearly cost.

Use an online APR calculator. Enter interest rate and fees. Get the APR. Compare this number across all loan offers.

Expert Assistance And Counseling

Struggling with bad credit can feel like a roadblock when applying for a home loan. Expert assistance and counseling can pave the way to mortgage approval. Professionals guide you through this process.

Role Of Mortgage Brokers

Mortgage brokers act as a bridge between you and lenders. They have access to multiple loan sources. This means they can find loans that fit your unique situation. Here’s how they help:

- Assess your financial situation: They look at your income, debt, and credit.

- Find suitable loans: Brokers search for loans that cater to bad credit profiles.

- Negotiate terms: They talk to lenders on your behalf to secure favorable terms.

Benefits Of Credit Counseling Services

Credit counseling services offer expert advice to improve your credit. With these services, you gain:

| Service | Benefit |

|---|---|

| Budgeting Help | Creates a plan to manage debts and expenses. |

| Debt Management | Advises on reducing debts to improve credit scores. |

| Credit Education | Teaches about credit reports and scores. |

Such services also often negotiate with creditors to lower your debt. This can help you to qualify for better loan terms. They make the journey to homeownership clearer.

Closing The Deal

Closing the deal on a home loan with bad credit may seem daunting. Yet, it’s possible with the right approach. Your dream house need not be out of reach. Let’s explore how to secure that final handshake, even with a less-than-perfect credit score.

Negotiating With Lenders

Negotiations are crucial in the home loan process. Begin by presenting a strong case for why you’re a good investment, despite your credit. Highlight any improvements in your financial situation. Show lenders your debt-to-income ratio has improved. Offer a larger down payment to ease lender concerns. Remember, bold persistence often pays off in negotiations.

Finalizing Your Home Purchase

After negotiating terms, it’s time to finalize your home purchase. Start by reviewing the loan agreement thoroughly. Check for any hidden fees or clauses. Understand your monthly payment, interest rate, and loan term. Ensure all paperwork is complete and accurate before signing. Celebrate, as you’re now a homeowner, even with bad credit!

Credit: www.bankrate.com

Frequently Asked Questions

Can Bad Credit Affect Home Loan Approval?

Bad credit can impact home loan approval, as lenders use credit scores to evaluate risk. However, some lenders specialize in loans for those with poor credit, though they may charge higher interest rates.

What Is The Minimum Credit Score For Home Loans?

The minimum credit score required for a conventional home loan is typically around 620. For government-backed loans like FHA, the minimum can be as low as 500 with a 10% down payment.

How To Improve Credit Score For A Mortgage?

Improving your credit score involves paying bills on time, reducing debt, and not opening new credit accounts. Consistently managing your finances well over time will gradually improve your credit score.

Are There Home Loans Designed For Bad Credit?

Yes, there are home loans specifically designed for individuals with bad credit. These include FHA loans, VA loans, and certain subprime mortgages, but they often come with higher interest rates.

Conclusion

Securing a home loan with bad credit is challenging, but not impossible. By exploring various lenders, improving your credit score, and considering government-backed loans, you can increase your chances. Remember, each step taken towards bettering your financial standing brings you closer to owning your dream home.

Start your journey today and open the door to new possibilities.