To obtain a home loan without collateral, explore unsecured personal loans or government-backed programs. Consider options like VA or USDA loans, which do not require collateral.

Securing a home loan typically involves leveraging collateral, yet not everyone has the assets to do so. There are alternatives available that can help prospective homeowners secure a mortgage without the need for collateral. Understanding these options is crucial for those who seek to purchase a home but lack the traditional security lenders require.

Government programs often provide a pathway to homeownership with less stringent collateral requirements, making it possible for more individuals to achieve their dream of owning a home. These programs are designed to help various groups, including veterans and first-time homebuyers, by offering loans that are secured by the government rather than the individual’s assets. It’s essential for borrowers to research all available routes to find the one that best suits their financial situation and homeownership goals.

:max_bytes(150000):strip_icc()/mortgage-69f02f04cdae4863806bd0455255106e-f66e51c6b85445cf8e1aa396c1b56c50.png)

Credit: www.investopedia.com

Introduction To Unsecured Home Loans

Introduction to Unsecured Home Loans opens the door to homeownership for many. These loans do not require assets as security. Potential homeowners find this option attractive. It offers a chance to buy a home without risking other assets.

Rising Popularity Of Collateral-free Financing

The demand for collateral-free home financing is growing. People prefer not to tie up their assets. This trend reflects a shift in financial behavior. Borrowers now seek flexibility and minimal risk in loans.

What Constitutes a Home Loan Without Collateral?What Constitutes A Home Loan Without Collateral?

- An unsecured home loan requires no collateral.

- Lenders focus on income and credit history.

- Approval depends on financial stability and creditworthiness.

Eligibility Criteria For No-collateral Home Loans

Getting a home loan without collateral sounds great, right? You don’t need to pledge your property or assets. But, you must meet certain eligibility criteria. Let’s dive into what these are.

Credit Score Requirements

Your credit score tells banks how good you are with money. For no-collateral loans, this number needs to be high. Think of it as your financial report card. A score above 750 usually works.

Income And Employment Stability

Banks want to know you can pay back the loan. They look at your job and how much you earn. You need a steady job and a good income. This shows banks you’re reliable.

- Proof of employment: Job letter or business license

- Income proof: Bank statements or pay slips

Age And Residency Considerations

How old you are and where you live also matter. Usually, you should be between 18 and 65 years old. You must live in the country where you’re applying for the loan. Proof can be a passport or utility bill.

| Criteria | Requirements |

|---|---|

| Credit Score | 750+ |

| Employment | Stable job/income |

| Age | 18-65 years |

| Residency | Proof of living in the country |

Types Of Unsecured Home Loans

Understanding unsecured home loans opens doors to owning a home without collateral. Banks and lenders offer varied loan types without needing physical assets as security. Let’s delve into options that enable buying a home without the traditional collateral requirement.

Personal Loans For Home Purchase

Personal loans offer flexibility for homebuyers. They don’t require property as collateral. Borrowers enjoy fixed interest rates and predictable monthly payments. Eligibility depends on credit score, income, and financial history.

- Credit score: A high score can lead to lower interest rates.

- Income: Stable income assures lenders of repayment capability.

- Debt-to-income ratio: Lower ratios mean better loan terms.

Government-backed Loan Programs

Government programs support homebuyers without collateral. The U.S. government backs these loans, reducing lender risk. Borrowers benefit from lower down payments and easier qualification criteria.

| Program | Details |

|---|---|

| FHA Loans | Low down payments, flexible credit requirements. |

| VA Loans | No down payment, available to veterans and service members. |

| USDA Loans | No down payment, for rural and suburban homebuyers. |

Preparing Your Application

Embarking on the home loan journey without collateral can seem daunting. Yet, with the right preparation, your application can shine. Ensuring you have all the necessary documents in place and showing strong financial health are crucial steps. Let’s guide you through this process with some practical advice.

Document Checklist

Start with gathering your documents. A complete set of accurate documents can make or break your loan approval. Use this list to prepare:

- Proof of Identity: Passport, Driver’s License, or ID Card.

- Income Evidence: Recent pay stubs, tax returns, and W-2 forms.

- Bank Statements: Last three months’ statements to show savings and expenses.

- Credit Report: Obtain a copy and check for accuracy.

- Employment Verification: A letter from your employer can help.

- Rental History: Proof of on-time rent payments can be beneficial.

Improving Your Financial Profile

Strong finances can offset the lack of collateral. Here’s how to polish your financial profile:

- Boost Credit Score: Pay bills on time, reduce debt, and avoid new credit lines.

- Stabilize Employment: A steady job indicates reliable income.

- Lower Debt-to-Income Ratio: Pay down debts to improve this key metric.

- Save for a Larger Down Payment: More savings can lead to better loan terms.

Presenting a strong application is your goal. Focus on these areas to increase approval chances.

Shopping For The Best Lender

Finding the right lender is key to getting a home loan without collateral. You want a lender who offers great terms and cares about you. Let’s dive into how to find the best one.

Comparing Interest Rates And Terms

Start by looking at what lenders offer. Focus on interest rates and loan terms. Lower rates mean you pay less over time. Better terms can make payments easier to manage.

| Lender | Interest Rate | Loan Term |

|---|---|---|

| Lender A | 5% | 20 years |

| Lender B | 4.5% | 15 years |

| Lender C | 4.8% | 30 years |

Use this table to compare. Pick the best for you.

Evaluating Lender Reputation And Service

Next, check the lender’s reputation and service. A good lender cares about their customers. Read reviews and talk to others.

- Look for online reviews.

- Ask friends about their experiences.

- See how lenders solve problems.

Finding a lender with good rates and service makes loan getting easier.

:max_bytes(150000):strip_icc()/collateral-9d1d0360292b4a06989957c5e3239fb5.jpg)

Credit: www.investopedia.com

Understanding The Fine Print

Understanding the fine print is key to a smooth home loan process without collateral. It involves meticulous review of terms and conditions. This ensures clarity on repayments and obligations.

Reading The Loan Agreement

The loan agreement holds all details about the loan. Read each section carefully. Look for interest rates, repayment terms, and loan tenure. Spot any clauses that could affect your financial health.

Hidden Charges And Loan Fees

Hidden fees can surprise borrowers. Scrutinize the agreement for application fees, processing charges, and prepayment penalties. A table may help summarize these costs:

| Type of Charge | Explanation |

|---|---|

| Application Fee | Non-refundable fee to process application |

| Processing Charge | Cost for loan approval and disbursement |

| Prepayment Penalty | Fee for paying off loan early |

Understand these charges to avoid unexpected costs. This ensures a transparent loan experience. Stay informed, stay secure.

Loan Approval Process

Embarking on the journey to secure a home loan without collateral may seem daunting, yet understanding the loan approval process can make this path smoother. Knowledge of this process is crucial. Let’s dive into the key phases.

The Application Review

Lenders scrutinize applications to assess eligibility. This review is the first step. Expect lenders to verify income, employment history, and financial stability. Be ready with all necessary documents to speed up the process.

What To Expect During The Underwriting Phase

In the underwriting phase, expect a thorough check. Underwriters assess risk meticulously. They confirm the details you provided. They use credit scores, debt-to-income ratios, and other financial indicators. Their goal is to ensure you can repay the loan without default.

Managing Your Loan Post-approval

Getting a home loan without collateral is just the first step. Next comes managing the loan. It’s vital to stay on top of payments and understand your options.

Meeting Repayment Obligations

Regular payments keep you on track. Set up automatic deductions from your bank account. This ensures you never miss a due date. Plan a budget that factors in your loan repayments. Keep emergency funds to cover unforeseen circumstances. Check your loan account regularly. This helps spot any issues early.

Options For Loan Restructuring Or Refinancing

Sometimes, financial situations change. You might find your current repayment plan challenging. Don’t worry. Explore loan restructuring with your lender. This can mean lower monthly payments. Also, consider refinancing your loan. This could get you a better interest rate. Compare different lenders’ offers. Choose the best deal that suits your financial health.

Remember, always communicate with your lender. They can help you navigate through tough times. Understanding these options can save you stress. It can also save money in the long run.

Alternatives To Unsecured Home Loans

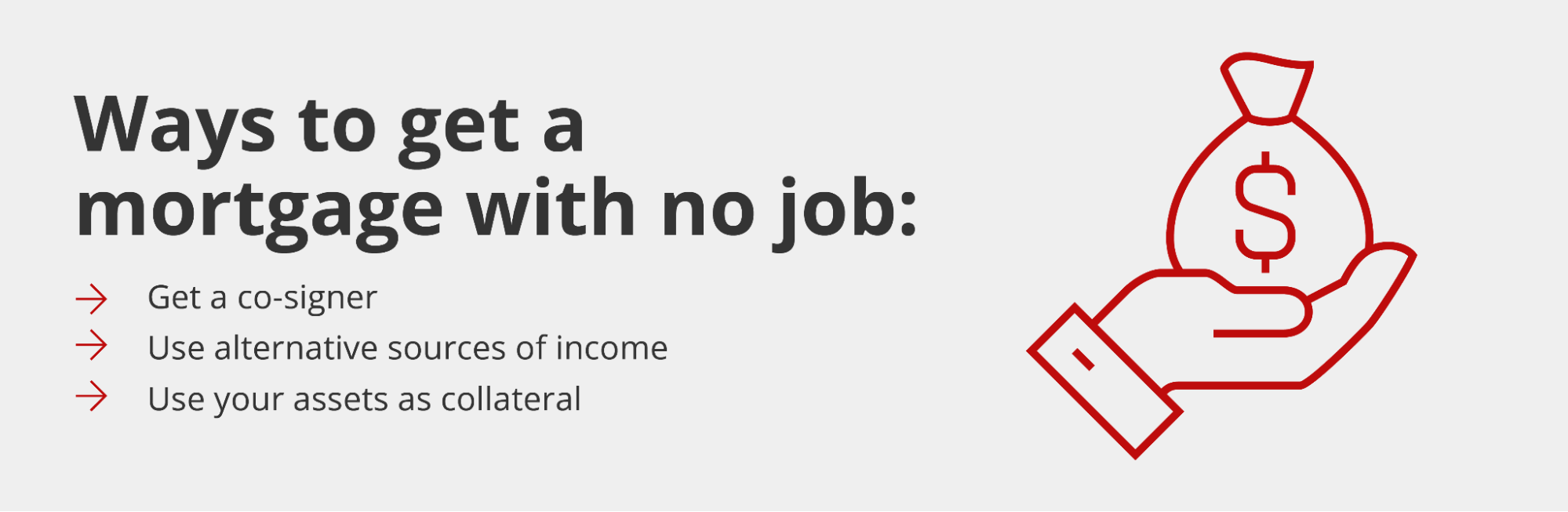

Getting a home loan can be tricky without collateral. Yet, options exist. These alternatives don’t need assets upfront. They can help secure a loan for your dream home.

Home Equity Lines Of Credit (helocs)

A HELOC is a flexible loan option. It lets homeowners borrow against their home’s equity. Think of it as a credit card for your house. You get a credit limit based on your home’s value. You can borrow as needed. Interest rates are often lower than unsecured loans.

Co-signing With A Guarantor

Co-signing involves another person. This person is your guarantor. They promise to pay the loan if you can’t. Lenders feel safer with a guarantor. This can lead to better loan terms. Both your credit scores matter in this case.

Credit: www.mac-alum.com

Frequently Asked Questions

Can You Get A Home Loan Without Collateral?

Yes, it’s possible to secure a home loan without collateral through unsecured loan options. Lenders may consider your credit score, income stability, and employment history instead.

What Are Unsecured Home Loans?

Unsecured home loans don’t require collateral. They rely on the borrower’s creditworthiness. Rates might be higher due to the increased lender risk.

How Does Credit Score Affect No-collateral Loans?

A high credit score can help you qualify for a no-collateral home loan. It demonstrates to lenders that you have a history of responsible credit management.

Are There Alternatives To Collateral For Home Loans?

Yes, alternatives include having a co-signer, opting for government-backed loans, or showing strong financial credentials like a high income or credit score.

Conclusion

Securing a home loan without collateral might seem daunting at first. Yet, with the right approach and knowledge, it’s entirely possible. Explore your options, maintain a healthy credit score, and don’t hesitate to seek professional advice. Remember, your dream home doesn’t have to remain just a dream.

Start your journey today and open the door to homeownership with confidence.