To obtain an unsecured loan without a credit check, explore payday or title loan options, or seek lenders that consider income and employment instead. Peer-to-peer lending platforms may also offer solutions without traditional credit inquiries.

Securing an unsecured loan without a credit check can be challenging but not impossible. Many people need access to personal loans but face obstacles due to a lack of credit history or a low credit score. Fortunately, certain lenders cater to this demographic by focusing on factors other than credit reports, such as stable income and employment history.

These alternative loans typically come with higher interest rates and fees due to the increased risk to the lender. It’s essential for borrowers to thoroughly research and compare lenders, ensuring they understand the terms and conditions of the loan. This proactive approach can lead to finding a loan with the most favorable terms and avoiding potential financial pitfalls associated with high-cost borrowing.

Introduction To Unsecured Loans

An unsecured loan is a loan without collateral. Borrowers sign a contract to repay. Lenders trust the borrower’s creditworthiness. No assets back the loan. This type of loan includes personal loans and credit cards.

The Basics Of Borrowing Without Collateral

Unsecured loans offer quick funds. You promise to pay without offering assets. Lenders focus on your income and credit history. They decide your loan terms based on trust.

- No collateral required

- Credit and income determine eligibility

- Flexible use of funds

Why Credit Checks Are Usually Necessary

Credit checks help lenders assess risk. A credit score reflects your payment history. Lenders predict your future payments. They use this info to approve or deny loans.

| Credit Score Range | Risk Level |

|---|---|

| 300-579 | High Risk |

| 580-669 | Medium Risk |

| 670-739 | Low Risk |

| 740+ | Very Low Risk |

Lenders use scores to set loan terms. Higher scores can mean lower interest rates. No credit check loans may have higher rates.

Credit Scores And Loan Eligibility

Understanding credit scores is key to getting a loan. Let’s explore how these scores affect your chances of securing an unsecured loan, especially when a credit check is not part of the process.

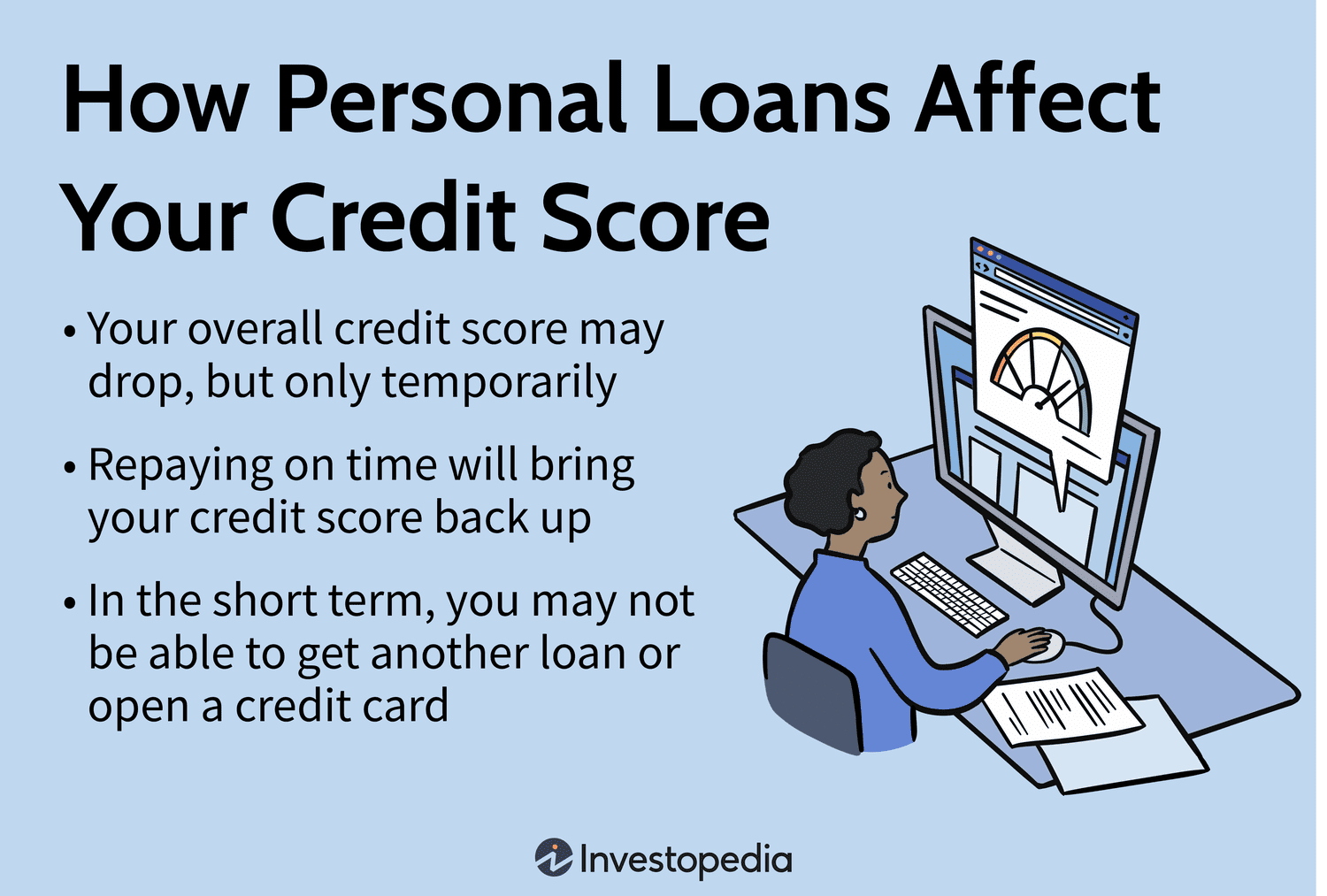

Impact Of Credit History On Borrowing

Your credit history tells lenders how you handle money. A good history means you pay bills on time. A bad one means you might not. This history affects if you can get a loan and how much.

- Good credit score: Easier loan approval, lower interest rates.

- Poor credit score: Harder loan approval, higher interest rates.

Lenders look at your history to decide. No history can be just as tricky as a bad one.

When Lenders Skip The Credit Check

Some lenders do not check your credit score. They look at other things.

- Income

- Employment

- Bank statements

This means you might still get a loan without a good credit score. But, know these loans can have high costs.

| Type of Loan | Interest Rate |

|---|---|

| Without credit check | Higher |

| With credit check | Lower |

Choosing a loan without a credit check requires careful thought. Always check the terms and costs.

Types Of No-credit-check Unsecured Loans

Getting a loan can be tough without credit checks. But, some options exist. Here are two types of unsecured loans that don’t need a credit check.

Payday Loans: A Quick Fix With High Risks

Payday loans offer fast cash. You repay them with your next paycheck. They are easy to get. Yet, they come with high fees and interest rates. This can lead to debt cycles. Be cautious with these loans.

Personal Installment Loans: Longer Terms, Better Plans

Personal installment loans provide larger amounts. They have longer repayment terms. Monthly payments are fixed. This makes budgeting easier. The interest rates are often lower than payday loans. Choose these for more financial stability.

Lenders Offering No-credit-check Loans

Many seek loans without a credit check. It can be hard. Some lenders offer these. Here’s a guide to find them.

Online Lenders: Convenience At Your Fingertips

Online lenders provide easy access to funds. They offer various loan options. Users enjoy quick application processes. Funds often arrive swiftly. Many online platforms cater to those with poor credit. They focus on income rather than credit history. Borrowers should read terms carefully. Interest rates may be higher. Always check lender credibility before proceeding.

- Fast application

- Quick funding

- Options for bad credit

Credit Unions: Member-oriented Borrowing Options

Credit unions offer personal touch. They are not-for-profit. Members benefit from this. They may overlook credit scores. They consider membership history. They look at current relationship. Personal loans can be more affordable. Rates are often lower. Approval may be easier. They serve members, not investors. Always check eligibility requirements.

| Feature | Advantage |

|---|---|

| Not-for-profit | Lower rates |

| Membership-based | Personal consideration |

| Relationship focus | Easier approval |

Qualifying For A Loan Without Credit Check

Finding a loan without a credit check can seem hard. Yet, it’s possible. This part talks about how to qualify for such a loan.

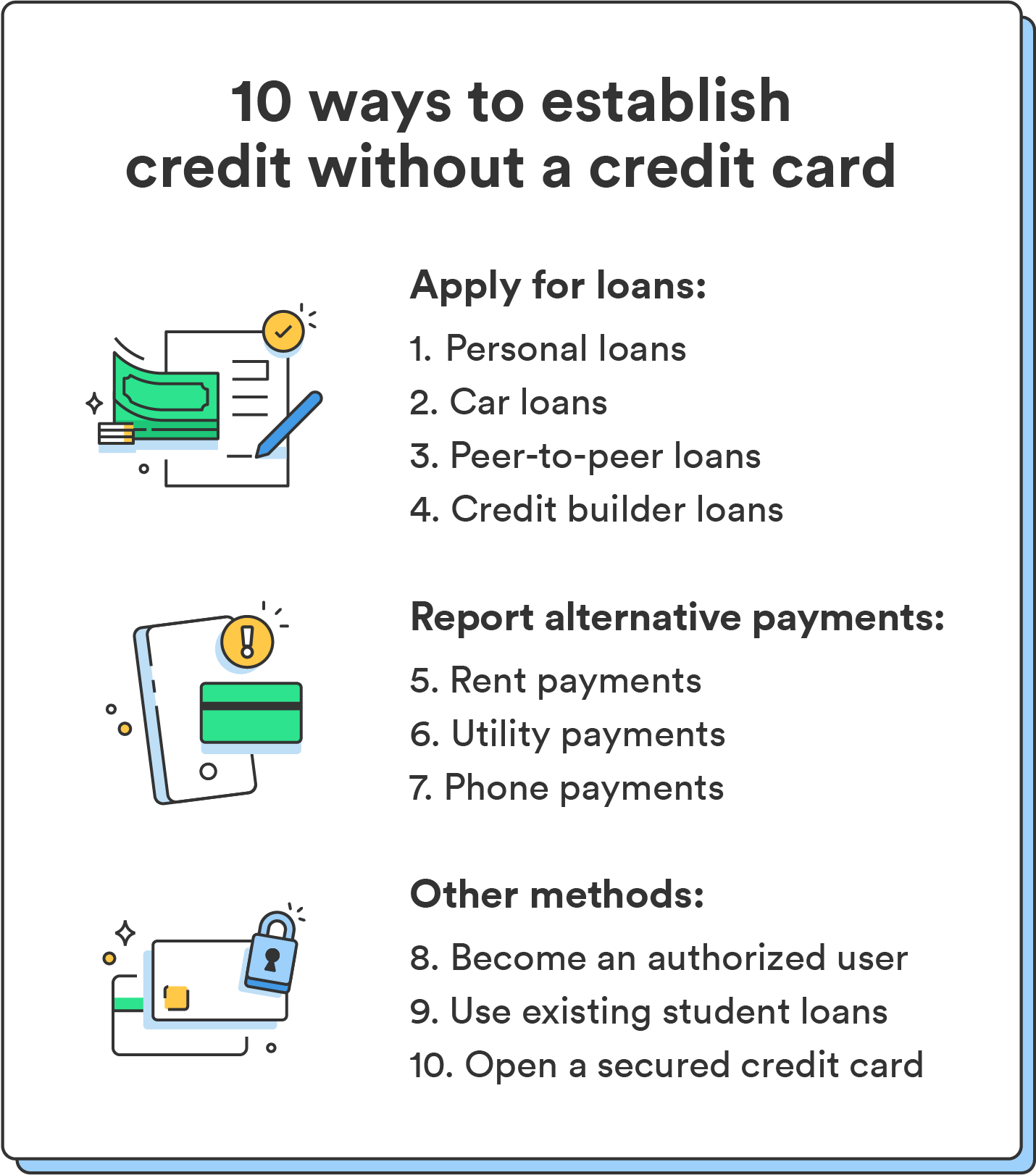

Alternative Credit Data: What Lenders May Consider

Lenders want to know you can pay back the loan. They may not check your credit score. Instead, they look at other things. These are called alternative credit data.

- Rent payments – If you pay rent on time, it shows responsibility.

- Utility bills – Paying electricity or water bills on time is good.

- Bank account behavior – How you manage your bank account matters.

These things help lenders trust you more. Even without a credit check.

Proof Of Income: Showing Your Ability To Repay

Lenders need to see you can pay the loan back. This means showing how much money you make. You can show this in many ways.

- Pay stubs – These show how much you earn regularly.

- Bank statements – These show your money coming in and going out.

- Tax returns – These show your yearly earnings.

Showing you have steady income is key. It makes lenders feel safe to give you money.

The Application Process Simplified

The Application Process Simplified can seem daunting at first glance. But fear not, getting an unsecured loan without a credit check is a straightforward journey. Let’s break it down into easy steps and outline exactly what you’ll need to begin.

Step-by-step Guide To Applying

- Research Lenders: Find lenders offering no credit check loans.

- Compare Offers: Look for the best terms and rates.

- Check Eligibility: Confirm you meet the lender’s criteria.

- Submit Application: Fill out the online form with your details.

- Get Approval: Wait for the lender’s decision.

- Receive Funds: If approved, the money gets deposited into your account.

Documents You Will Need

- Identification: A government-issued ID is necessary.

- Proof of Income: Bank statements or pay stubs show you can repay.

- Residency Proof: A utility bill or lease can prove where you live.

- Bank Details: Needed for the deposit of loan funds.

Risks And Considerations

Risks and Considerations are crucial when seeking an unsecured loan without a credit check. These loans may seem like a quick fix. Yet, they often come with pitfalls. Borrowers must stay aware of the potential downsides.

Understanding The High-interest Trap

Unsecured loans without credit checks often carry high interest rates. This is because lenders view these loans as high risk. The interest compounds quickly, making repayment difficult. Borrowers can end up paying much more than the original amount.

Avoiding Predatory Lenders

Finding a trustworthy lender is essential. Some lenders exploit those in need. They offer loans with terms that are hard to meet. These can include balloon payments or very high fees. Look for lenders with clear terms and fair practices.

Here are some tips to avoid predatory lenders:

- Research the lender’s reputation.

- Check for hidden fees in the loan agreement.

- Understand the payment schedule.

- Ensure the lender is registered with state agencies.

:max_bytes(150000):strip_icc()/how-to-get-personal-loans-with-no-income-verification-7153103-final-4a9099bdba6e4405a5615bc6cd0fd0a9.jpg)

Credit: www.investopedia.com

Improving Your Financial Health For The Future

Improving your financial health is crucial for a stable future.

It sets the stage for securing loans without credit checks.

Building Your Credit Score

A strong credit score opens many financial doors.

It’s essential for loan approval and favorable terms.

- Pay bills on time.

- Keep credit card balances low.

- Monitor credit reports regularly.

These steps gradually increase your score.

Responsible Borrowing Habits

Responsible borrowing is key to financial wellness.

It ensures you can manage loans effectively.

- Borrow only what you need.

- Plan repayments ahead of time.

- Choose loans with the best terms.

Adopting these habits prevents debt accumulation.

Alternatives To Unsecured No-credit-check Loans

Finding a loan without a credit check might seem tough. But there are options. Let’s explore some reliable alternatives to unsecured no-credit-check loans.

Secured Loans: Leveraging Assets For Better Rates

Secured loans require collateral. This could be a car, house, or savings account. By offering assets, lenders may give you a loan even with no credit check. Your rates could also be more favorable.

Credit Builder Loans: A Stepping Stone To Better Credit

Credit builder loans are unique. They help you grow your credit. The lender sets aside a loan amount in a savings account. You make payments towards this amount. After paying it off, you get access to the funds and a better credit score.

These alternatives require careful consideration. Remember, timely payments are key. They ensure your financial health and build your credit over time.

Credit: www.chime.com

Conclusion: Making An Informed Decision

Making the right choice about an unsecured loan without a credit check is crucial. This decision impacts your financial health. Let’s explore how to make a well-informed choice.

Weighing Pros And Cons

Every financial decision has its good and bad sides. Understanding these aspects is key. Let’s break them down:

- Pros: Quick access to funds, no credit history needed.

- Cons: Higher interest rates, potential for debt traps.

Reflect on these points. They help in deciding if such a loan suits you.

Planning Your Financial Journey

A smart plan for your money matters a lot. Here’s how to start:

- Assess your current financial state. Know your income and expenses.

- Set clear goals. What do you need the loan for?

- Research options. Not all loans are the same.

- Create a repayment plan. This step avoids future stress.

Planning keeps you on track. It leads to smarter, safer borrowing.

Credit: www.experian.com

Frequently Asked Questions

Can I Obtain A Loan Without A Credit Check?

Absolutely, it is possible to obtain an unsecured loan without a credit check. Lenders may focus on your income or employ alternative methods to assess your creditworthiness. However, these loans might come with higher interest rates.

What Are No-credit-check Loan Options?

Options for no-credit-check loans include payday loans, title loans, and some online personal loans. These options typically rely on your income or assets rather than credit history. Be wary of high fees and rates.

How To Apply For A No-credit-check Loan?

To apply for a no-credit-check loan, find a lender offering this service, provide proof of income, and complete their application process. Ensure you understand the terms and are capable of repaying the loan.

Are No-credit-check Loans Expensive?

Yes, no-credit-check loans can be more expensive due to higher interest rates and fees. Lenders charge more to offset the risk of lending without a credit history assessment.

Conclusion

Securing an unsecured loan without a credit check is possible with the right approach. Explore various lenders, consider credit unions, and don’t overlook online platforms. Remember, transparency about your financial situation can open doors to favorable terms. Start your journey today and unlock financial flexibility for your needs.