Are you looking for a way to get a loan that fits your values and keeps you Sharia-compliant? Finding a halal loan can seem tricky, especially when traditional loans often involve interest, which is not allowed in Islam.

But don’t worry—there are clear, practical options designed to help you finance your needs without compromising your beliefs. You’ll discover simple steps to secure a halal loan, understand what to look for, and learn how to avoid common pitfalls. Keep reading to take control of your finances while staying true to your faith.

Credit: www.youtube.com

Halal Loan Basics

Understanding the basics of halal loans is essential for anyone seeking Sharia-compliant financing. Halal loans follow Islamic law, which forbids interest and unethical investments. This guide explains the key principles, differences from conventional loans, and common types of halal loans.

Knowing these basics helps you choose the right loan and stay true to Islamic finance values.

Key Principles Of Halal Financing

Halal financing prohibits interest (riba) on loans. Instead, profit is earned through trade or shared risk. Transactions must involve real assets or services. Transparency and fairness are vital. Both lender and borrower share risks and rewards equally. Ethical investments avoid industries like alcohol, gambling, and pork.

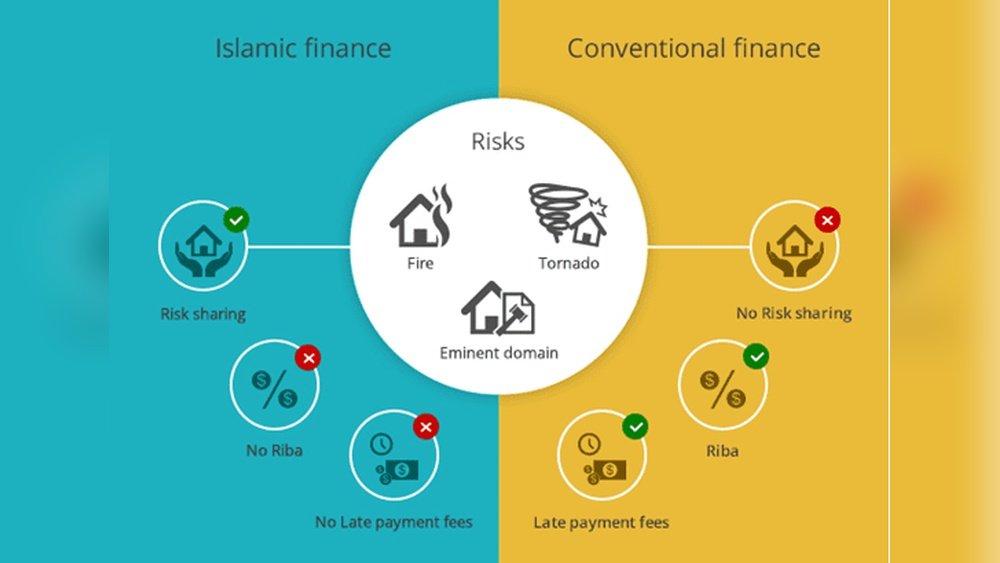

Differences From Conventional Loans

Conventional loans charge fixed or variable interest. Halal loans use profit-sharing or cost-plus methods. They avoid uncertainty and gambling (gharar). Collateral and contracts must follow Islamic ethics. Repayment terms focus on fairness and mutual benefit. This reduces exploitation and promotes social justice.

Common Types Of Halal Loans

Murabaha is a cost-plus financing method, where the lender buys an item and sells it to the borrower at a marked-up price. Ijara is a leasing agreement with an option to buy. Musharaka is a partnership where profits and losses are shared. These models help meet different needs without interest.

Eligibility Criteria

Understanding the eligibility criteria is essential before applying for a halal loan. These requirements ensure the loan aligns with Islamic principles and suits your financial situation. Meeting these criteria helps you qualify smoothly and avoid complications during the process.

Who Can Apply

Applicants must be adults, usually 18 years or older. They should follow Islamic finance rules and seek loans for permissible purposes. Some lenders require applicants to be residents or citizens of the country where the loan is offered. The loan must be used for halal activities, like buying a home or starting a business.

Income And Down Payment Requirements

Stable income is necessary to show repayment ability. Lenders often ask for proof of steady earnings from employment or business. A minimum income level may be set depending on the loan size. A down payment is usually required to reduce the loan amount. This down payment can range from 10% to 30% of the property or asset value. It helps ensure the borrower shares the risk, which is important in halal financing.

Credit Union Membership And Other Conditions

Some halal loans require membership in specific credit unions or Islamic finance institutions. These groups follow Sharia principles strictly and offer compliant financial products. Other conditions may include no involvement in interest-based transactions. The loan contract should avoid interest and use profit-sharing or cost-plus models. Borrowers must agree to these terms to keep the loan halal.

Finding Halal Loan Providers

Finding halal loan providers is key to securing a loan that aligns with Islamic principles. These providers offer financial products without interest, ensuring compliance with Sharia law. Knowing where to find trustworthy halal lenders makes the process easier and more transparent.

Islamic Banks And Financial Institutions

Islamic banks specialize in Sharia-compliant financial services. They offer loans based on profit-sharing, leasing, or cost-plus models. These banks avoid interest and focus on ethical investments. Many large cities have Islamic banks with branches or online services. Visit their websites or contact them directly to learn about halal loan options.

Credit Unions Offering Halal Loans

Some credit unions provide halal loans tailored for Muslim members. They follow Islamic finance rules and avoid charging interest. These credit unions often require membership but offer fair terms and community support. Check local credit unions for halal loan programs and application details.

Online Platforms And Community Resources

Online platforms connect borrowers with halal lenders easily. These platforms list various Sharia-compliant loan options and explain the terms clearly. Community centers and mosques sometimes provide guidance or referrals to halal loan providers. Use these resources to find trusted lenders and compare offers.

Application Process

The application process for a halal loan is straightforward but requires careful attention. Each step ensures the loan complies with Islamic principles. Following these steps helps avoid delays and misunderstandings. Below is a clear guide to help you through the process.

Gathering Required Documents

Start by collecting all necessary documents. These usually include proof of identity, income statements, and residence details. Some lenders may also ask for bank statements or employment verification. Having these documents ready speeds up your application.

Filling Out The Application

Complete the application form carefully. Provide accurate information about your financial status and loan purpose. Double-check all fields to avoid errors. Some lenders offer online forms, while others require paper submissions.

Understanding Terms And Conditions

Read the loan terms thoroughly before agreeing. Understand the repayment schedule, profit rates, and any fees involved. Make sure the contract follows Islamic finance rules, avoiding interest or unjust practices. Clarify doubts with the lender to ensure transparency.

Types Of Halal Financing

Halal financing follows Islamic law to avoid interest and unethical practices. It offers several models that fit different financial needs. Each type ensures fairness and shared risk between parties. Understanding these types helps in choosing the right halal loan option.

Murabaha (cost-plus Financing)

Murabaha is a common halal financing method. The lender buys an item and sells it to the borrower at a fixed profit. The borrower pays in installments without any interest. This model is transparent with clear cost and profit details. It suits buying goods or property without involving interest.

Ijara (leasing Model)

Ijara works like a lease agreement. The financier buys an asset and leases it to the client. The client pays rent for using the asset over a set time. At the end, ownership may transfer to the client. This method avoids interest and focuses on actual use and benefit.

Musharaka (partnership Model)

Musharaka means partnership between lender and borrower. Both parties invest capital and share profits or losses. This model shares risk fairly and encourages cooperation. It is often used for business projects or large investments. Profit depends on the business success, not fixed interest.

Calculating Costs

Calculating costs is a key step in getting a halal loan. It helps you understand what you will pay over time. Transparent cost calculation avoids surprises. It also ensures your loan stays Sharia-compliant.

Profit Rate Vs Interest Rate

Halal loans use a profit rate, not an interest rate. Interest involves paying extra just for borrowing money. Profit rate is a fair return on the actual sale or lease. This difference keeps the loan halal. Knowing this helps you compare loans properly.

Using Calculators For Transparency

Online calculators show clear cost details. They break down monthly payments and total profit. Calculators help you see how much you owe. Use them to check if the loan fits your budget. They make cost comparison easy and fair.

Comparing Offers

Compare profit rates from different lenders. Look at fees, payment terms, and penalties too. Check if the loan follows Islamic finance rules. Choose the offer with the best balance of cost and compliance. This saves money and ensures peace of mind.

Maintaining Sharia Compliance

Maintaining Sharia compliance is essential when seeking a halal loan. It ensures that the loan respects Islamic laws and ethical standards. This helps Muslims avoid financial practices that are not allowed in Islam.

Understanding these key principles makes the loan process clear and trustworthy. It also protects borrowers from unknowingly engaging in forbidden financial activities.

Avoiding Interest (riba)

Islam strictly forbids charging or paying interest, known as riba. A halal loan must not include any interest payments. Instead, the lender and borrower agree on a fixed profit or fee. This fee is not linked to the loan amount over time.

This approach prevents exploitation and promotes fairness in the loan agreement. Borrowers repay only the agreed amount without additional interest charges.

Ethical Investment Restrictions

Sharia law prohibits investing in certain industries. These include alcohol, gambling, pork products, and weapons. A halal loan must not fund businesses involved in these areas. The loan proceeds should support only halal and ethical activities.

This restriction ensures that the loan aligns with Islamic values. Borrowers should verify how the funds will be used before accepting the loan.

Shared Risk Principles

Islamic finance promotes shared risk between lender and borrower. Both parties share profits and losses from the investment or project. This principle avoids unfair burden on one side.

Halal loans often use contracts like mudarabah or musharakah. These contracts clearly define profit-sharing and risk responsibilities. Sharing risk creates a balanced and just financial relationship.

Credit: www.guidanceresidential.com

Common Challenges

Getting a halal loan can be a valuable option for many people. Yet, several common challenges make the process difficult. Understanding these challenges helps prepare for the journey. It also makes it easier to find the right solution that fits your needs.

Limited Availability In Certain Areas

Halal loans are not offered everywhere. Many banks and lenders do not provide Sharia-compliant financing. This creates a challenge for people living in smaller towns or rural areas. Finding a halal loan provider may require travel or online research. Availability often depends on local demand and community size.

Higher Upfront Costs

Halal loans may come with higher initial fees. These costs cover legal, administrative, and compliance work. Compared to conventional loans, upfront charges can be more expensive. Borrowers should plan their budget carefully. Understanding all fees helps avoid surprises during the application process.

Navigating Legal And Regulatory Issues

Islamic finance rules differ from conventional finance laws. This can create confusion for borrowers and lenders. Some areas lack clear regulations for halal loans. Legal frameworks may not fully support Sharia-compliant contracts. It takes time and effort to ensure all documents follow both religious and legal standards.

Tips For Success

Getting a halal loan requires careful steps to ensure compliance and ease in the process. Success depends on understanding Islamic finance principles and preparing well. Follow these tips to improve your chances of approval and satisfaction.

Consulting With Islamic Finance Experts

Seek advice from professionals who specialize in Islamic finance. They understand Sharia-compliant loan structures and can guide you effectively. Experts help clarify terms and identify suitable lenders. Their knowledge can prevent costly mistakes and delays.

Preparing Financially Before Applying

Organize your financial documents and check your credit status. A stable income and clear records increase your loan approval chances. Save for any required down payment or fees. Financial readiness shows responsibility and commitment to lenders.

Reviewing Contracts Carefully

Read all loan documents thoroughly before signing. Pay close attention to profit rates, repayment terms, and any hidden charges. Ensure the contract aligns with Islamic finance rules. Ask questions if any part seems unclear or unfair.

:max_bytes(150000):strip_icc()/islamicbanking.asp-FINAL-a44177c529d24b97a0a4e857d65253cf.png)

Credit: www.investopedia.com

Frequently Asked Questions

What Is The Halal Way To Get A Loan?

The halal way to get a loan avoids interest and involves profit-sharing or cost-plus financing, like Murabaha or Ijara contracts.

What Are The Requirements For A Halal Loan?

A halal loan requires no interest, shared risk, and investment in Sharia-compliant businesses only. The borrower must follow Islamic finance principles.

How To Apply For A Halal Loan?

To apply for a halal loan, choose a Sharia-compliant lender. Submit required documents and complete the application. Review and accept terms, then await approval.

Who Qualifies For A Halal Mortgage?

Anyone meeting income and down payment criteria qualifies for a halal mortgage. The loan must follow Sharia principles, avoiding interest and unethical investments.

Conclusion

Getting a halal loan supports your faith and financial needs. Choose lenders that follow Sharia rules carefully. Understand terms clearly before signing any agreement. Share risks fairly between parties involved in the loan. Avoid loans with interest or unethical investments.

Following these steps helps you find a loan that fits. Stay patient and ask questions if unsure. A halal loan can provide peace of mind and support. Your financial journey can be both ethical and practical.