To get health insurance as a retiree, explore Medicare options and consider supplemental plans. Compare plans to find the best fit.

Retiring can be an exciting yet challenging phase of life. Securing health insurance is a crucial step to ensure peace of mind and financial stability. Medicare provides a primary option for retirees, typically available at age 65. It covers various medical needs but may not cover everything.

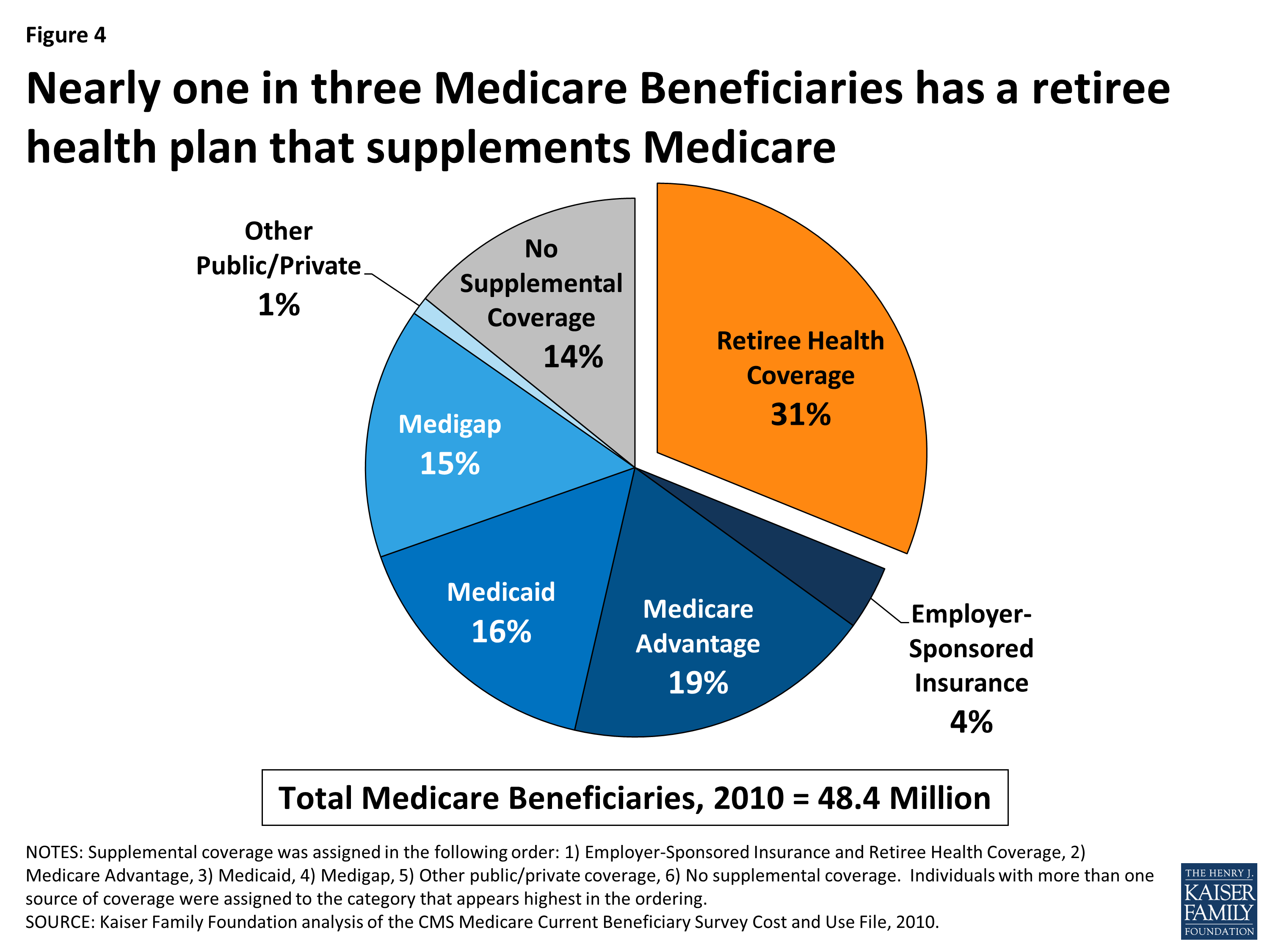

Supplemental plans, often called Medigap, can help fill the gaps. Some retirees might also have access to employer-sponsored retiree health plans or can explore options through the Health Insurance Marketplace. Understanding your healthcare needs and comparing available plans will help you make an informed decision, ensuring you have the coverage you need in your retirement years.

Credit: www.azasrs.gov

Medicare Basics

Understanding Medicare is crucial for retirees. It helps cover medical costs. This section explains the basics of Medicare.

Eligibility

Most people become eligible for Medicare at age 65. You can qualify if you’re younger with certain disabilities. You may also qualify if you have End-Stage Renal Disease.

| Criteria | Details |

|---|---|

| Age | 65 or older |

| Disability | Qualify if under 65 |

| Medical Condition | End-Stage Renal Disease |

Enrollment Process

Enrolling in Medicare is simple. Follow these steps to get started.

- Initial Enrollment Period (IEP): This lasts seven months. It starts three months before your 65th birthday. It ends three months after.

- General Enrollment Period (GEP): January 1 to March 31 each year. Coverage starts July 1.

- Special Enrollment Period (SEP): For specific situations. Example: if you delayed Medicare due to employer coverage.

Be aware of late enrollment penalties. Avoid delays to save money.

For more details, visit the official Medicare website. Always seek advice from a professional if uncertain.

Credit: www.insurancefortexans.com

Medicare Advantage Plans

As a retiree, navigating health insurance options is crucial. One popular choice is Medicare Advantage Plans. These plans, also known as Medicare Part C, offer comprehensive coverage. They bundle together Medicare Parts A, B, and often D. Understanding their benefits and how to choose the right plan is essential.

Benefits

Medicare Advantage Plans provide numerous benefits. They often include:

- Lower out-of-pocket costs

- Extra services like dental, vision, and hearing

- Wellness programs and gym memberships

- Prescription drug coverage

These plans can be more cost-effective. They may offer additional services not covered by Original Medicare.

Choosing The Right Plan

Choosing the right Medicare Advantage Plan can be daunting. Here are some steps to simplify the process:

- Assess Your Health Needs: Determine what services you need most.

- Compare Plans: Use the Medicare Plan Finder to compare options in your area.

- Check Network Providers: Ensure your doctors are in-network.

- Review Costs: Look at premiums, deductibles, and co-pays.

- Read Reviews: Check ratings and reviews from other beneficiaries.

Evaluating these factors helps find a plan that fits your needs and budget.

| Feature | Original Medicare | Medicare Advantage |

|---|---|---|

| Coverage | Parts A and B | Parts A, B, and often D |

| Additional Benefits | Few | Many (e.g., dental, vision) |

| Out-of-Pocket Costs | Higher | Lower |

Supplemental Insurance

As a retiree, finding the right health insurance is crucial. Supplemental Insurance helps fill gaps in your primary health coverage. This ensures that you have complete protection against unexpected medical expenses.

Medigap Policies

Medigap Policies are designed to cover costs not included in Medicare. These include deductibles, copayments, and coinsurance. Medigap can be purchased from private insurance companies. They offer different plans labeled A through N. Each plan offers a different level of coverage.

Medigap Policies are standardized. This means Plan A from one company offers the same benefits as Plan A from another. Prices, however, can vary. It’s important to compare different providers. Some Medigap policies also cover services that Original Medicare does not. This can include emergency care abroad.

Coverage Options

Understanding your Coverage Options is key to selecting the right plan. Medigap plans offer different levels of coverage. Below is a table that summarizes the key benefits of each plan:

| Medigap Plan | Part A Coinsurance | Part B Coinsurance | Blood (First 3 Pints) | Foreign Travel Emergency |

|---|---|---|---|---|

| Plan A | Yes | Yes | Yes | No |

| Plan B | Yes | Yes | Yes | No |

| Plan C | Yes | Yes | Yes | Yes |

| Plan D | Yes | Yes | Yes | Yes |

Choosing the right Medigap plan depends on your needs. Here are a few tips:

- Assess your current health status.

- Consider your future health needs.

- Compare different plans and their costs.

These steps will help you find the best coverage for you. Medigap policies can greatly reduce your out-of-pocket expenses.

Prescription Drug Coverage

As a retiree, understanding Prescription Drug Coverage is crucial. This coverage helps pay for your medications. It can save you money and provide peace of mind.

Part D Plans

Part D Plans are designed to cover prescription drugs. They are offered by private insurance companies. You need to enroll in a Part D plan.

Each plan has its list of covered drugs. This list is called a formulary. Check if your medications are on the formulary.

Plans can vary in cost and coverage. Compare different plans to find the best one. Consider premiums, deductibles, and co-pays.

Cost Management

Managing costs is essential for retirees. Here are some tips:

- Use generic drugs instead of brand-name drugs.

- Ask your doctor for cheaper alternatives.

- Use mail-order pharmacies for long-term medications.

Some plans offer discounts on certain drugs. Check for these options.

Keep an eye on the coverage gap, also known as the “donut hole”. This is a temporary limit on what your drug plan will cover. Plan your expenses to avoid surprises.

| Cost Management Tips |

|---|

| Use generic drugs |

| Ask for cheaper alternatives |

| Use mail-order pharmacies |

Retiree Health Benefits

Retiring can be exciting but also daunting, especially regarding health insurance. Understanding retiree health benefits is crucial. This section will help you navigate through different options.

Employer-sponsored Plans

Many companies offer health benefits to retired employees. These are known as employer-sponsored plans. Here are some important points:

- Check if your previous employer offers retiree health benefits.

- Employer-sponsored plans often cover a portion of your premiums.

- These plans may include medical, dental, and vision coverage.

Not all employers offer such plans. So, it’s good to verify the details before retirement.

Cobra Continuation

Another option to consider is COBRA continuation. COBRA allows you to continue your existing health insurance. Here are some key points:

- COBRA usually lasts up to 18 months after retirement.

- It can extend up to 36 months in special cases.

- You pay the full premium, which includes both your share and the employer’s share.

COBRA is often more expensive but provides continuity of care with your existing providers.

| Option | Duration | Cost |

|---|---|---|

| Employer-Sponsored Plans | Varies | Usually lower |

| COBRA Continuation | 18-36 months | Higher |

Budgeting For Healthcare

As a retiree, budgeting for healthcare is essential. Healthcare costs can be unpredictable and high. Planning ahead ensures financial security and peace of mind.

Estimating Costs

Understanding potential healthcare expenses helps in budgeting effectively.

- Premiums: Monthly payments for health insurance coverage.

- Deductibles: Amount paid out-of-pocket before insurance kicks in.

- Co-payments: Fixed amounts paid for specific services.

- Co-insurance: Percentage of costs shared after meeting the deductible.

- Out-of-pocket maximum: The most you will pay in a year.

| Category | Estimated Annual Cost |

|---|---|

| Premiums | $4,000 – $7,000 |

| Deductibles | $1,000 – $3,000 |

| Co-payments | $500 – $1,000 |

| Co-insurance | $1,000 – $2,000 |

| Out-of-pocket maximum | $6,000 – $8,000 |

Saving Strategies

Adopt smart strategies to save money on healthcare costs.

- Health Savings Accounts (HSAs): Save pre-tax dollars for medical expenses.

- Medicare Advantage Plans: Compare plans for the best coverage and cost.

- Preventive Care: Use preventive services to avoid high costs later.

- Generic Medications: Choose generic drugs to save on prescriptions.

- Healthy Lifestyle: Maintain a healthy lifestyle to reduce medical needs.

Budgeting for healthcare as a retiree requires careful planning. By estimating costs and using saving strategies, you can manage expenses effectively.

Credit: www.kff.org

Frequently Asked Questions

What Is The Best Health Insurance For Retirees?

The best health insurance depends on individual needs, budget, and medical conditions. Medicare is a popular option.

How Do Retirees Get Health Insurance?

Retirees can get health insurance through Medicare, employer benefits, or private health insurance plans.

Can Retirees Get Medicare At 62?

Medicare eligibility starts at 65. Retirees under 65 may need private insurance or employer plans.

Is Health Insurance Expensive For Retirees?

Costs vary by plan, coverage, and location. Medicare is generally affordable, but supplemental plans can add costs.

Do Retirees Need Supplemental Insurance?

Supplemental insurance, like Medigap, helps cover costs not included in standard Medicare. Many retirees find it beneficial.

Conclusion

Securing health insurance as a retiree requires careful planning. Explore various options and choose what suits your needs best. Consider Medicare, supplemental plans, or private insurance. Make informed decisions to ensure peace of mind. Staying covered will help you enjoy retirement without worries.

Always review and update your health insurance regularly.