To qualify for health insurance subsidies, your income must be between 100% and 400% of the federal poverty level. You must also purchase insurance through the Health Insurance Marketplace.

Health insurance subsidies can significantly reduce your monthly premiums, making coverage more affordable. These subsidies are designed to assist low to moderate-income individuals and families. Eligibility primarily depends on your household income and size. By understanding the criteria and how to apply, you can take full advantage of these financial aids.

The Health Insurance Marketplace is the primary platform to access these subsidies. It is crucial to review your income and family size to determine your eligibility accurately. This guide will help you navigate the process and ensure you get the support you need.

Eligibility Criteria

Understanding the eligibility criteria for health insurance subsidies is crucial. It helps you know if you qualify for financial aid. This aid can make health insurance more affordable. Below, we break down the key eligibility criteria.

Income Requirements

Your income plays a significant role in determining subsidy eligibility. Generally, your household income should fall between 100% and 400% of the Federal Poverty Level (FPL).

| Household Size | Minimum Income (100% FPL) | Maximum Income (400% FPL) |

|---|---|---|

| 1 Person | $12,880 | $51,520 |

| 2 People | $17,420 | $69,680 |

| 3 People | $21,960 | $87,840 |

| 4 People | $26,500 | $106,000 |

Make sure your income falls within these ranges. This ensures eligibility for subsidies.

Household Size

Your household size also affects eligibility. The more people in your household, the higher the income limit for subsidies.

- Single Person Household: Lower income limit.

- Family Household: Higher income limit.

Include all dependents when calculating household size. This includes children, elderly parents, and other dependents. Accurate household size can increase your chances of qualifying for subsidies.

Understanding these criteria can help you qualify for health insurance subsidies. Check your income and household size carefully.

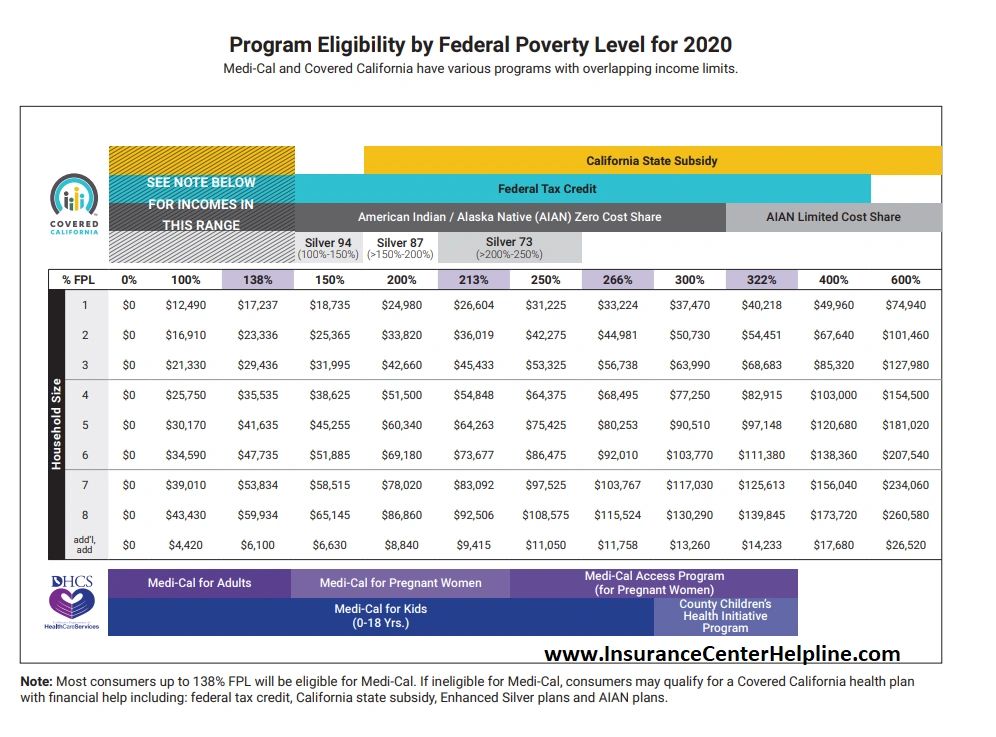

Credit: insurancecenterhelpline.com

Application Process

The application process for health insurance subsidies can seem daunting. But with the right steps, it becomes manageable. This guide will help you understand what documents you need. It also offers a simple step-by-step guide to complete your application.

Required Documents

Gathering the necessary documents is the first step. Here is a list of what you will need:

- Proof of Income: Recent pay stubs, tax returns, or a letter from your employer.

- Identification: Government-issued ID like a driver’s license or passport.

- Social Security Number: For all household members applying for the subsidy.

- Current Health Insurance Information: If you have existing coverage.

- Proof of Citizenship or Legal Residency: Birth certificate, green card, or naturalization papers.

Step-by-step Guide

Follow these steps to complete your application:

- Create an Account: Visit the health insurance marketplace website. Create an account by providing basic information.

- Fill Out the Application: Enter your personal details, income information, and household members.

- Upload Required Documents: Use the list above to upload the necessary documents.

- Review Your Application: Double-check all the information to ensure accuracy.

- Submit the Application: Once everything is correct, submit your application.

- Wait for Confirmation: You will receive a notification about your subsidy eligibility.

Remember to keep copies of all submitted documents. This will help if you need to reference them later.

Types Of Subsidies

Understanding the types of subsidies available can help you save money on health insurance. These subsidies reduce the cost of premiums and out-of-pocket expenses.

Premium Tax Credits

Premium Tax Credits help lower the amount you pay for your monthly insurance premium. They are based on your household income and family size.

- Available to those with an income between 100% and 400% of the Federal Poverty Level (FPL).

- You can choose to apply the credit in advance to lower your monthly premium.

- Any remaining credit can be claimed when you file your taxes.

Cost-sharing Reductions

Cost-Sharing Reductions (CSRs) help lower out-of-pocket costs like copayments, coinsurance, and deductibles.

- Available to those with an income between 100% and 250% of the Federal Poverty Level (FPL).

- You must enroll in a Silver plan to qualify for CSRs.

- CSRs can significantly reduce your out-of-pocket expenses.

Credit: tritonhealthplans.com

Special Enrollment Periods

Special Enrollment Periods (SEPs) allow you to apply for health insurance outside the usual open enrollment period. SEPs are triggered by certain life events, giving you a chance to get coverage when you need it most.

Life Events

Several life events qualify you for a Special Enrollment Period:

- Marriage: Getting married opens an SEP.

- Birth or Adoption: Adding a child qualifies you.

- Job Loss: Losing your job-based coverage triggers an SEP.

- Moving: Relocating to a new area can qualify you.

- Divorce or Legal Separation: This may trigger an SEP.

- Death: Losing a dependent or policyholder qualifies.

Documentation Needed

To qualify for an SEP, you need proper documentation. Here’s what you might need:

| Life Event | Required Documentation |

|---|---|

| Marriage | Marriage certificate |

| Birth or Adoption | Birth certificate or adoption papers |

| Job Loss | Termination notice or proof of loss of coverage |

| Moving | Proof of new address |

| Divorce or Legal Separation | Divorce decree or legal separation papers |

| Death | Death certificate |

Ensure your documentation is accurate and up-to-date. This helps speed up your application process. Keep copies of everything you submit.

Common Mistakes

Applying for health insurance subsidies can be tricky. Many people make common mistakes that delay their coverage or lead to rejection. Understanding and avoiding these mistakes can help you qualify faster and easier.

Incomplete Applications

An incomplete application is a common error. Missing or incorrect information can delay your approval. Ensure all fields are filled out correctly. Double-check your personal details, such as:

- Name

- Address

- Social Security Number

Submit all required documents. These may include:

- Income Proof

- Citizenship Proof

- Tax Returns

Review your application before submission. This reduces the chance of mistakes.

Misreporting Income

Misreporting income is another frequent mistake. Accurate income reporting is crucial for determining your subsidy. Make sure to:

- Include all sources of income

- Report income changes promptly

- Use the correct income type

Income includes wages, tips, and other earnings. Report any changes in your income as soon as possible. This ensures your subsidy amount is accurate.

Using the correct income type is essential. Different types of income affect your subsidy differently. Be honest and precise when reporting.

By avoiding these common mistakes, you can improve your chances of qualifying for health insurance subsidies. Ensure your application is complete and your income is reported accurately.

Post-approval Steps

After qualifying for health insurance subsidies, the journey continues. There are crucial steps to follow post-approval. These steps ensure you make the most of your benefits. Understanding your plan options and maintaining eligibility is key.

Plan Selection

Choosing the right health insurance plan is essential. Compare different plans based on your needs. Look at the coverage and benefits each plan offers.

- Check if your doctors are in the network.

- Review the prescription drug coverage.

- Consider the monthly premiums and out-of-pocket costs.

- Look at the plan’s deductibles and co-payments.

Use online tools provided by the marketplace. These tools can help you compare plans side-by-side. Choose a plan that fits your health needs and budget.

Ongoing Eligibility

Keeping your subsidy requires meeting ongoing eligibility criteria. Update your information regularly to avoid issues.

- Report any changes in income promptly.

- Notify the marketplace if you move to a new address.

- Update your family size changes, like a new baby.

Annual renewal is necessary. Each year, confirm your information to renew your subsidies. Stay informed about deadlines and requirements.

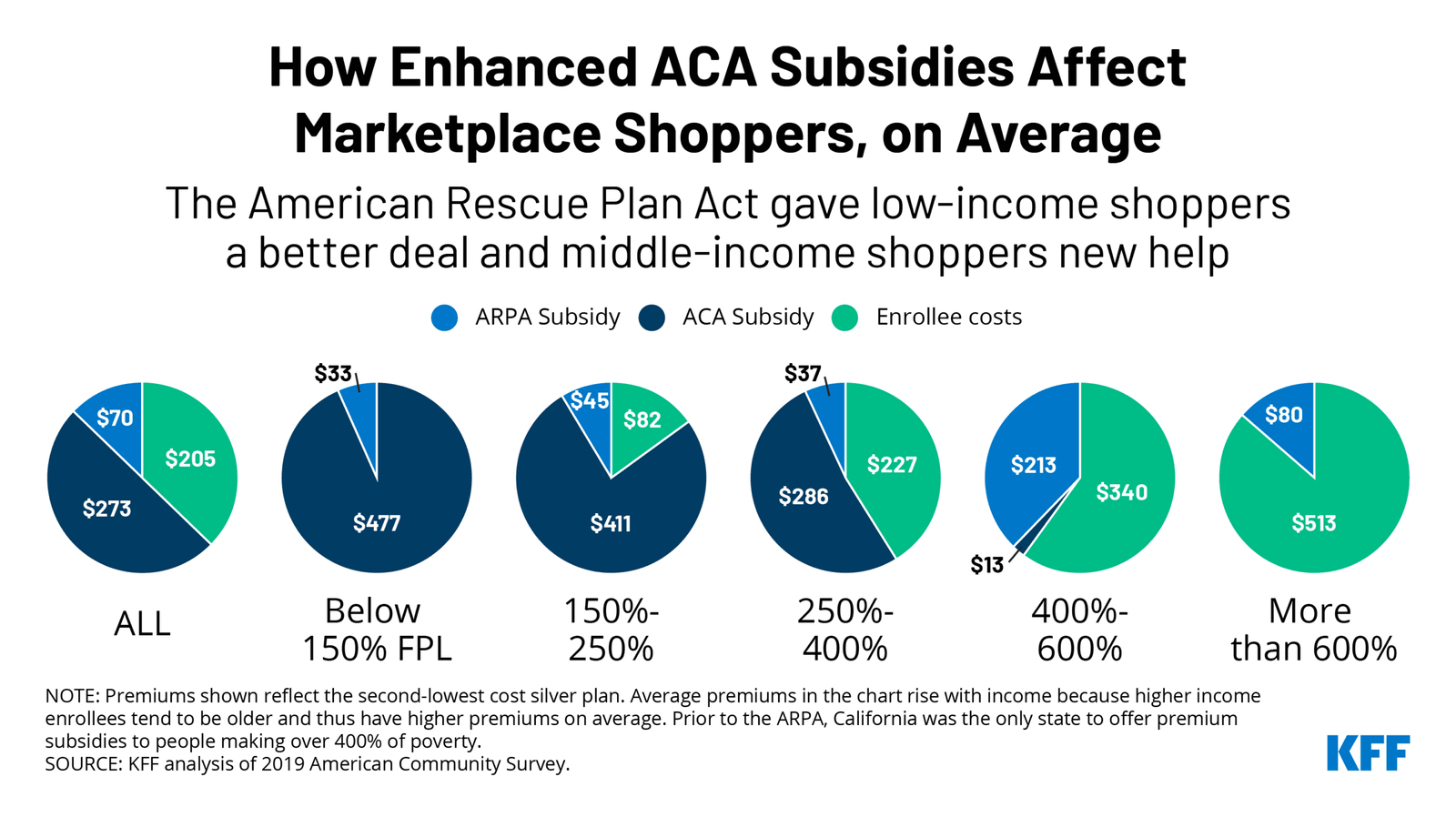

Credit: www.kff.org

Frequently Asked Questions

What Are Health Insurance Subsidies?

Health insurance subsidies are financial aids to lower the cost of health coverage.

Who Qualifies For Health Insurance Subsidies?

Individuals with income between 100% and 400% of the federal poverty level qualify.

How Do I Apply For Health Insurance Subsidies?

You can apply through the Health Insurance Marketplace during open enrollment.

Can I Get Subsidies With Employer Insurance?

No, subsidies are for those without affordable employer-provided health insurance.

What Documents Are Needed For Subsidy Application?

Income proof, tax returns, and personal identification documents are required.

Conclusion

Understanding how to qualify for health insurance subsidies is crucial. Follow the steps outlined to maximize your benefits. Stay informed about income requirements and application deadlines. Regularly review your eligibility to ensure you receive the best coverage. Health insurance subsidies can significantly reduce your healthcare costs.

Take action today to secure your financial future.