To reduce health insurance premiums, consider increasing your deductible and maintaining a healthy lifestyle. Shopping around for different policies also helps.

Health insurance premiums can take a significant chunk out of your budget. Finding ways to reduce these costs is crucial for financial well-being. Increasing your deductible can lower your premium. A higher deductible means you pay more out-of-pocket expenses before the insurance kicks in, but it reduces your monthly cost.

Leading a healthy lifestyle can also contribute to lower premiums. Insurers often offer discounts to individuals who maintain a healthy weight, exercise regularly, and avoid smoking. Shopping around for different insurance plans can help you find the best deal. Comparing policies allows you to choose one that fits your needs and budget, ultimately saving money.

Credit: www.greenbushfinancial.com

Choose High-deductible Plans

Choosing high-deductible plans can significantly reduce health insurance premiums. This option might be right for many people seeking to save money on healthcare costs. Understanding the benefits and drawbacks of high-deductible plans is crucial.

Benefits Of High-deductible Plans

- Lower Premiums: High-deductible plans usually have lower monthly premiums. This can make them more affordable.

- Health Savings Account (HSA) Eligibility: Many high-deductible plans qualify you for an HSA. An HSA allows you to save money tax-free for medical expenses.

- Preventive Care Coverage: These plans often cover preventive care at 100%. Routine check-ups and screenings can be free.

Potential Drawbacks

High-deductible plans also come with potential drawbacks. It’s important to be aware of these before making a decision.

- High Out-of-Pocket Costs: You might pay more out-of-pocket before insurance kicks in. This can be challenging if you have frequent medical needs.

- Unexpected Expenses: An unexpected illness or injury can lead to high costs. This could strain your finances.

- Complexity: Understanding how high-deductible plans work can be complex. It’s important to educate yourself to avoid surprises.

Weighing the benefits and drawbacks can help you decide if a high-deductible plan suits your needs. Always consider your health situation and financial capacity before making a choice.

Utilize Wellness Programs

Wellness programs can help you save on health insurance premiums. These programs focus on improving health and reducing costs. Many insurers offer wellness programs as part of their plans. Participating can lead to lower premiums. Let’s explore the types of wellness programs and the incentives for participation.

Types Of Wellness Programs

Wellness programs come in various forms. Here are some common types:

- Fitness Challenges: Encourages regular exercise through group activities and competitions.

- Health Screenings: Offers free or discounted medical tests like blood pressure checks.

- Nutrition Plans: Provides healthy eating guidelines and meal planning tools.

- Smoking Cessation: Helps participants quit smoking with support and resources.

- Stress Management: Teaches techniques to reduce stress through workshops and classes.

Incentives For Participation

Insurers often offer incentives to join wellness programs. These incentives can help you save money. Here are some common incentives:

| Incentive Type | Description |

|---|---|

| Premium Discounts | Lower monthly premiums for active participation. |

| Cash Rewards | Gift cards or cash bonuses for completing activities. |

| Gym Memberships | Discounted or free access to fitness centers. |

| Health Savings Account (HSA) Contributions | Extra contributions to your HSA for meeting goals. |

Participating in wellness programs benefits your health and wallet. It’s a win-win situation. Take advantage of these programs to reduce your health insurance premiums today.

Shop Around For Providers

Reducing health insurance premiums can save you a lot of money. One effective way is to shop around for providers. Different providers offer different plans, so compare them.

Comparing Plans

Comparing plans helps you find the best deal. Look at the coverage each plan offers. Check the deductibles and co-pays. See if your preferred doctors are in-network. Use a table to compare key features:

| Provider | Monthly Premium | Deductible | Co-Pay | In-Network Doctors |

|---|---|---|---|---|

| Provider A | $200 | $1,000 | $20 | Yes |

| Provider B | $250 | $1,500 | $25 | No |

| Provider C | $180 | $1,200 | $15 | Yes |

Using Online Tools

Online tools can help you compare plans easily. Many websites offer comparison tools. These tools list plans based on your needs. Some features to look for:

- Cost Estimator: Estimates your monthly and yearly costs.

- Coverage Details: Shows what each plan covers.

- Provider Networks: Lists doctors and hospitals in the network.

- User Reviews: Read reviews from other users.

Using these tools, you can find the best plan for you. This can save you money and reduce your premiums.

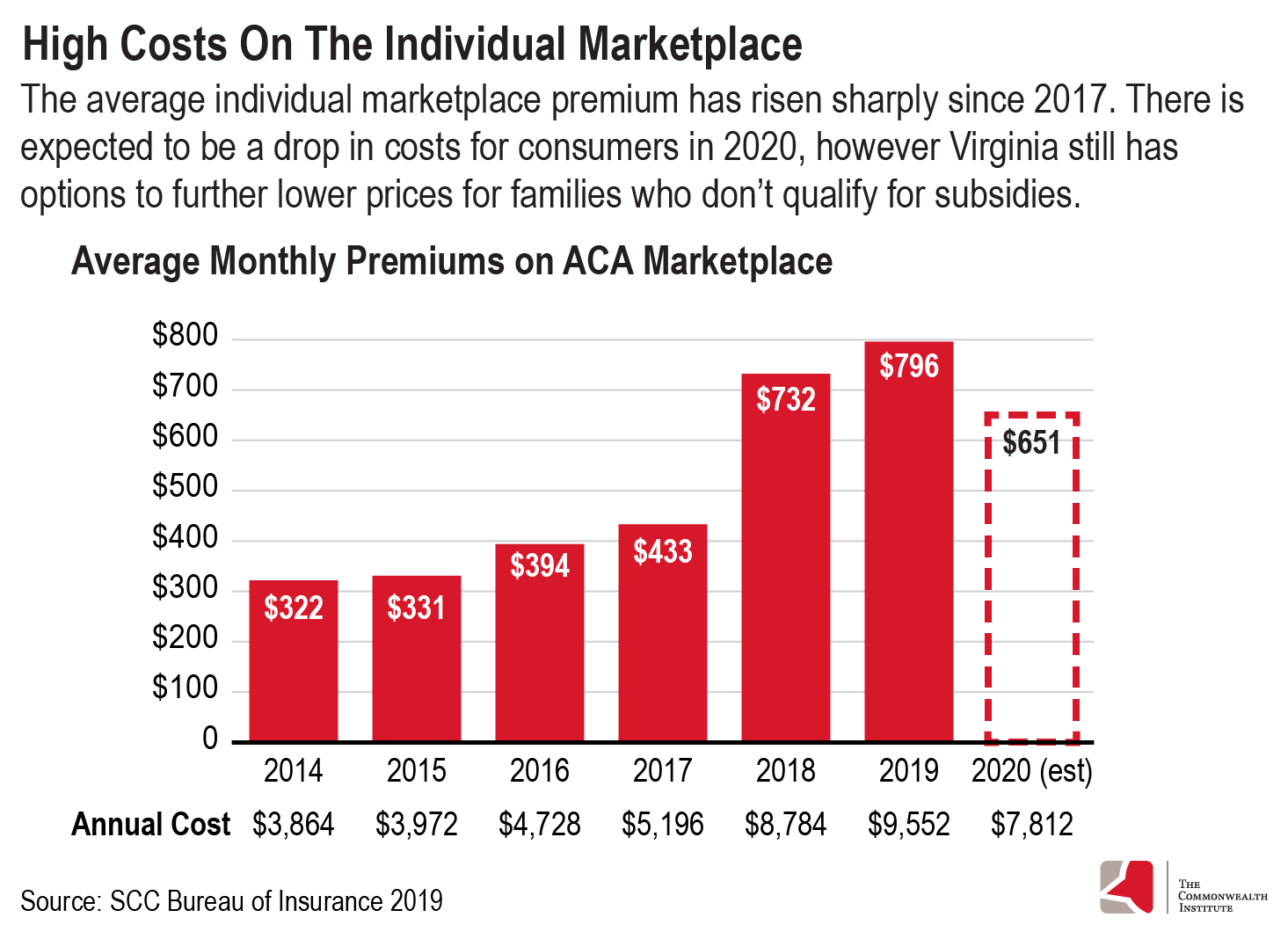

Credit: thecommonwealthinstitute.org

Take Advantage Of Discounts

Reducing health insurance premiums can be challenging. One effective way is to take advantage of discounts. Many health insurance providers offer various discounts that can lower your costs. Below, we explore two types of discounts: Employer-Sponsored Discounts and Membership Discounts.

Employer-sponsored Discounts

Many employers provide health insurance discounts. These discounts can significantly reduce your premium. Employers often negotiate better rates with insurance companies. This helps lower the overall cost for employees.

Participating in wellness programs offered by your employer can also lead to discounts. These programs encourage healthy living. They include activities like fitness challenges and health screenings. Completing these activities can earn you premium reductions.

Here are some common employer-sponsored discounts:

- Fitness program participation

- Non-smoker discounts

- Annual health screenings

Membership Discounts

Many organizations offer health insurance discounts for their members. These can include professional associations, alumni groups, and even warehouse clubs. Membership discounts can provide substantial savings on your health insurance premiums.

Professional associations often have partnerships with insurance providers. This allows members to access exclusive rates. Alumni groups from colleges and universities may also offer similar benefits.

Here are some types of memberships that might offer discounts:

- Professional associations

- Alumni groups

- Warehouse clubs

Check with organizations you belong to. They might offer health insurance discounts. Taking advantage of these can help reduce your premiums.

Consider Health Savings Accounts

Considering a Health Savings Account (HSA) is a smart way to reduce your health insurance premiums. An HSA allows you to save money for medical expenses while enjoying tax benefits. Below, we explore the benefits of HSAs and how to open one.

Hsa Benefits

HSAs offer multiple benefits. Here are some key advantages:

- Tax Savings: Contributions to an HSA are tax-deductible.

- Growth: Funds in the account grow tax-free.

- Flexibility: You can use the funds for various medical expenses.

- Portability: The account stays with you, even if you change jobs.

These benefits make HSAs a valuable tool. They help lower your health insurance costs.

How To Open An Hsa

Opening an HSA is straightforward. Follow these steps:

- Choose an HSA provider. Compare fees and features.

- Ensure you have a High-Deductible Health Plan (HDHP).

- Fill out the application form from your chosen provider.

- Make an initial deposit to activate your account.

Once opened, regularly contribute to your HSA. This will maximize your savings and reduce health insurance premiums.

| Step | Description |

|---|---|

| 1 | Choose an HSA provider. Compare fees and features. |

| 2 | Ensure you have a High-Deductible Health Plan (HDHP). |

| 3 | Fill out the application form from your chosen provider. |

| 4 | Make an initial deposit to activate your account. |

Remember, HSAs are a great way to save on medical costs. They also help reduce your health insurance premiums.

Maintain A Healthy Lifestyle

Maintaining a healthy lifestyle can significantly reduce your health insurance premiums. By focusing on your diet, exercise, and regular health screenings, you can stay fit and lower your healthcare costs.

Diet And Exercise

Eating a balanced diet is crucial for good health. Include fruits, vegetables, lean proteins, and whole grains in your meals. Avoid processed foods and sugary drinks.

- Eat more fruits and vegetables

- Choose whole grains over refined grains

- Limit sugary snacks and drinks

Regular exercise keeps your body strong and fit. Aim for at least 30 minutes of physical activity every day. You can try activities like:

- Walking or jogging

- Swimming

- Cycling

- Yoga

Regular Health Screenings

Regular health screenings help detect issues early. Early detection can lead to more effective treatment and lower medical costs.

| Age Group | Recommended Screenings |

|---|---|

| 20-30 years | Blood pressure, cholesterol, dental check-up |

| 31-40 years | Blood pressure, cholesterol, diabetes |

| 41-50 years | Blood pressure, cholesterol, diabetes, cancer screenings |

Keep track of your medical history. This helps your doctor provide the best care.

- Record your screenings and results

- Share updates with your healthcare provider

Credit: www.linkedin.com

Frequently Asked Questions

How Can I Lower My Health Insurance Premiums?

Shop around for different plans, increase your deductible, and maintain a healthy lifestyle to reduce costs.

Does A Higher Deductible Reduce Premiums?

Yes, choosing a higher deductible usually results in lower monthly premiums. It means you’ll pay more out-of-pocket initially.

Are There Discounts For Healthy Lifestyles?

Many insurers offer discounts for non-smokers, regular exercisers, and those with healthy eating habits.

Can I Save By Bundling Insurance Policies?

Yes, bundling health insurance with other policies like auto or home can lead to significant savings.

Is It Cheaper To Pay Annually?

Paying your premium annually can sometimes be cheaper than monthly payments due to fewer processing fees.

Conclusion

Lowering health insurance premiums is achievable with smart strategies. Shop around, maintain a healthy lifestyle, and consider higher deductibles. Utilize employer benefits and explore government programs. These steps will help you save money while ensuring adequate coverage. Stay proactive and informed to keep your health insurance costs manageable.