Thinking about refinancing your Islamic mortgage but unsure where to start? You’re not alone.

Navigating the unique rules of Islamic finance can feel tricky, especially when it comes to refinancing. But what if you could lower your monthly payments, shorten your mortgage term, or even access cash—all while staying true to your faith’s principles?

This guide will walk you through the simple steps to refinance your Islamic mortgage the right way. By the end, you’ll feel confident making decisions that protect your financial future and honor your beliefs. Ready to unlock the benefits of halal refinancing? Let’s dive in.

Credit: www.youtube.com

Credit: www.guidanceresidential.com

Frequently Asked Questions

Can You Refinance A Halal Mortgage?

Yes, you can refinance a halal mortgage using Shariah-compliant refinancing options that avoid interest and follow Islamic finance principles.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits debt to 30% of a company’s total assets to ensure financial stability and avoid excessive risk.

Do Muslims Get 0% Interest?

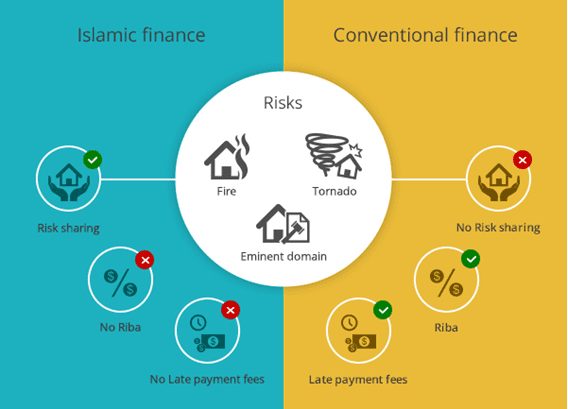

Muslims avoid paying or earning interest (riba) due to Islamic law. They use profit-based, interest-free financing instead.

What Are The Disadvantages Of Islamic Mortgage?

Islamic mortgages often involve higher upfront costs and limited lender options. Lenders share property ownership, complicating resale or refinancing. They may require larger down payments and offer less flexibility compared to conventional loans. These factors can restrict borrower choices and increase financial commitments.

Conclusion

Refinancing an Islamic mortgage helps manage your home finance better. Choose options that follow Islamic rules carefully. Compare different lenders and their terms before deciding. Make sure your new plan lowers monthly payments or shortens loan time. Keep documents ready and understand all contract details well.

This keeps your mortgage halal and financially smart. Stay informed and ask experts for guidance if needed. Your home financing can stay ethical and affordable.