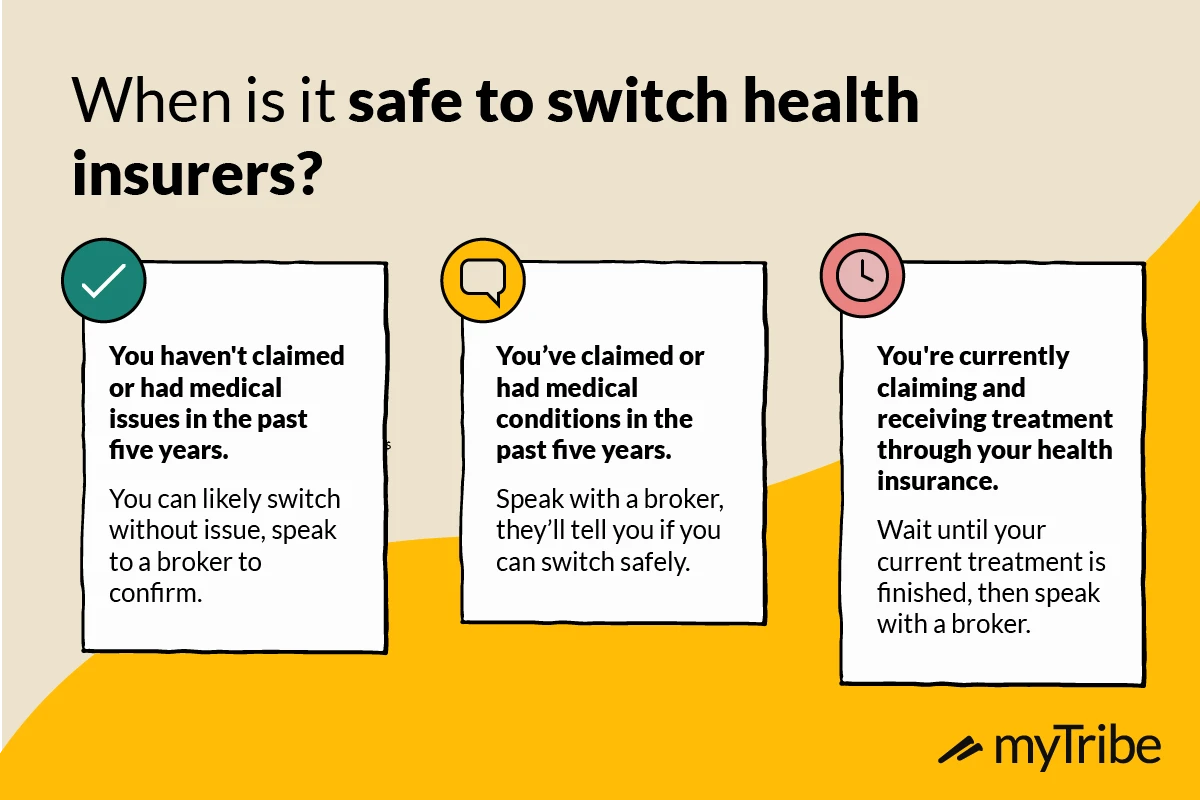

To switch health insurance providers, first review your current plan and compare new options. Then, enroll in the new plan during the open enrollment period.

Switching health insurance providers can seem daunting, but it’s crucial for ensuring you have the best coverage. Reviewing your current plan helps identify gaps or areas for improvement. Comparing new options allows you to find a plan that better suits your needs and budget.

It’s essential to make this change during the open enrollment period to avoid any lapse in coverage. Taking these steps ensures you maintain continuous health insurance that meets your healthcare needs. By following a structured approach, you can smoothly transition to a new health insurance provider.

Credit: www.justworks.com

Assess Current Coverage

Switching health insurance providers can be a daunting task. To make a smooth transition, assessing your current coverage is crucial. This step ensures you understand your existing plan’s strengths and weaknesses. Let’s dive into how to effectively evaluate your current health insurance coverage.

Evaluate Benefits

First, list all the benefits your current plan offers. These could include:

- Doctor visits

- Prescription drugs

- Emergency services

- Preventive care

- Mental health services

Next, check if these benefits meet your healthcare needs. For example, if you frequently visit the doctor, ensure your plan covers those visits adequately.

Identify Gaps

Identifying gaps in your coverage is equally important. Ask yourself the following questions:

- Are there any services you need that are not covered?

- Are your out-of-pocket costs too high?

- Is the network of doctors sufficient?

If you notice any gaps, make a list. This will help you find a new plan that fills these gaps. Also, consider any upcoming healthcare needs. If you plan to start a family, ensure maternity care is covered.

| Current Coverage | New Needs |

|---|---|

| Doctor visits | More frequent visits |

| Prescription drugs | Additional medication |

| Emergency services | More comprehensive coverage |

In summary, assessing your current coverage involves evaluating benefits and identifying gaps. This helps you switch to a new provider that better meets your needs.

Credit: www.obesityaction.org

Research New Providers

Switching health insurance providers can seem daunting. Start by researching new providers. This step ensures you find a plan that fits your needs.

Compare Plans

List your healthcare needs. Use this list to compare plans. Key areas to review include:

- Premiums: Monthly cost you pay.

- Deductibles: Amount you pay before insurance kicks in.

- Co-pays: Fixed fee for doctor visits.

- Networks: Which doctors and hospitals are covered.

- Coverage: Services included, like prescriptions and wellness visits.

Use a table to compare the main features of each plan:

| Plan Name | Premium | Deductible | Co-pays | Network | Coverage |

|---|---|---|---|---|---|

| Plan A | $200 | $1,000 | $20 | Wide | Comprehensive |

| Plan B | $150 | $1,500 | $25 | Moderate | Basic |

Read Reviews

Read reviews from current customers. Look for feedback on:

- Customer Service: How well they handle issues.

- Claims Process: Speed and ease of claims.

- Network Satisfaction: Quality of doctors and hospitals.

- Cost Transparency: Clear information on costs.

- Coverage Satisfaction: How well the plan meets needs.

Reviews can reveal hidden issues. They provide insights into real-world experiences.

Check Network Compatibility

Switching health insurance providers can seem daunting. One key step is to check network compatibility. This ensures that your preferred doctors and hospitals are covered.

Verify Doctors

First, make a list of your current doctors. Include primary care physicians and specialists. Use your new provider’s website to verify if these doctors are in-network.

Most insurance websites have a provider search tool. Enter your doctor’s name and check their network status. If your doctor is out-of-network, you may face higher costs or need to switch doctors.

Confirm Hospitals

Next, confirm that your preferred hospitals are covered. This is crucial for emergency situations and planned procedures.

Make a list of nearby hospitals. Use the new provider’s hospital search tool. Check each hospital’s network status.

Here is a simple table to help you track your findings:

| Doctor/Hospital | In-Network Status |

|---|---|

| Dr. Smith | In-Network |

| City Hospital | Out-of-Network |

Using this table, you can easily see which providers are in-network. This helps you make an informed decision when switching health insurance providers.

Credit: blog.idahoreports.idahoptv.org

Understand Costs

Switching health insurance providers can be complex. To make an informed decision, it is vital to understand costs. This includes knowing your premiums and out-of-pocket expenses. By mastering these elements, you can choose a plan that fits your budget.

Premiums

Premiums are the monthly payments you make to keep your health insurance active. These payments are necessary regardless of whether you use medical services. Premiums can vary based on the plan type and coverage level.

Here’s a table showing different premiums for various plans:

| Plan Type | Monthly Premium |

|---|---|

| Basic Plan | $200 |

| Standard Plan | $300 |

| Premium Plan | $500 |

Compare these premiums to find the best option for you. Lower premiums often mean higher out-of-pocket costs, so balance is essential.

Out-of-pocket Expenses

Out-of-pocket expenses are what you pay for medical services beyond your premiums. These include deductibles, copayments, and coinsurance.

- Deductibles: The amount you pay before your insurance starts covering costs.

- Copayments: Fixed fees you pay for specific services like doctor visits.

- Coinsurance: A percentage of costs you share with your insurance after meeting your deductible.

Here’s a table summarizing these out-of-pocket expenses:

| Expense Type | Average Cost |

|---|---|

| Deductible | $1,000 |

| Copayment | $30 per visit |

| Coinsurance | 20% of service cost |

Understanding these expenses helps you estimate your total healthcare costs. This helps in choosing the right plan.

Gather Necessary Documents

Switching health insurance providers can seem overwhelming. One key step is to gather necessary documents. This helps streamline the process and ensures you have everything ready. Below, we break down the essential documents you need under two main categories.

Personal Information

Having your personal information handy is crucial. This includes basic details like your full name, date of birth, and Social Security Number. You will also need your current address and contact information.

Ensure you have the following:

- Full Name

- Date of Birth

- Social Security Number

- Current Address

- Contact Information

Having this information ready will make the application process smoother and quicker.

Medical Records

Your medical records are another critical set of documents. These include details of your medical history, current medications, and any ongoing treatments. Make sure you have recent copies of your medical reports.

Gather the following documents:

- Medical History

- Current Medications

- Ongoing Treatments

- Recent Medical Reports

Having these records can help your new provider understand your health needs better.

Complete Enrollment

Switching health insurance providers can be a simple process. The last step is the Complete Enrollment phase. This step ensures you are fully covered and ready to use your new insurance.

Submit Application

First, fill out the application form. Provide accurate personal and health information. Double-check all details before submission.

Submit your application online or via mail. Ensure you receive a confirmation of receipt.

Review Confirmation

After submission, you will get a confirmation notice. This notice is vital.

- Check your personal details.

- Verify your coverage start date.

- Ensure your chosen plan is correct.

If you spot any errors, contact the insurance provider immediately.

Make First Payment

Your coverage starts after the first payment. Make this payment promptly.

- Choose your preferred payment method.

- Follow the payment instructions.

- Get a receipt for your records.

Receive Insurance Card

Once everything is confirmed, you will receive your insurance card. Carry this card with you at all times.

| Card Details | Importance |

|---|---|

| Policy Number | Essential for claims |

| Provider Contact | Needed for assistance |

Switching health insurance may seem complex, but following these steps makes it easy.

Frequently Asked Questions

How To Choose A New Health Insurance Provider?

Compare coverage options, costs, and network availability. Check customer reviews and satisfaction ratings.

Can I Switch Health Insurance Anytime?

Typically, you can switch during open enrollment or a qualifying life event.

What Documents Are Needed To Switch Providers?

You may need identification, current policy details, and any relevant medical history.

How Long Does It Take To Switch?

Switching usually takes a few weeks, depending on the provider and circumstances.

Will I Lose Coverage During The Switch?

No, continuous coverage is maintained if you switch properly within enrollment periods.

Conclusion

Switching health insurance providers can seem challenging, but it doesn’t have to be. By following the steps outlined, you can find a plan that better suits your needs. Take your time, compare options, and make an informed decision. Your health and peace of mind are worth the effort.