Choosing between a personal loan and a credit card depends on your financial needs and repayment abilities. A personal loan is often better for large, one-time expenses with lower interest rates and fixed repayment terms.

Deciding on the best financial tool for your needs can be challenging. Personal loans and credit cards both offer access to funds, but their terms and uses vary significantly. Personal loans are ideal for larger investments, like home renovations or debt consolidation, providing the security of fixed rates and regular payment schedules.

On the other hand, credit cards offer flexibility and are perfect for day-to-day purchases or emergencies, with the added benefit of rewards. Your credit score, borrowing history, and repayment plan play crucial roles in determining which option aligns with your financial goals. It’s essential to assess interest rates, fees, and the potential impact on your financial health before making a decision.

Credit: www.citizensbank.com

Introduction To Personal Loans Vs. Credit Cards

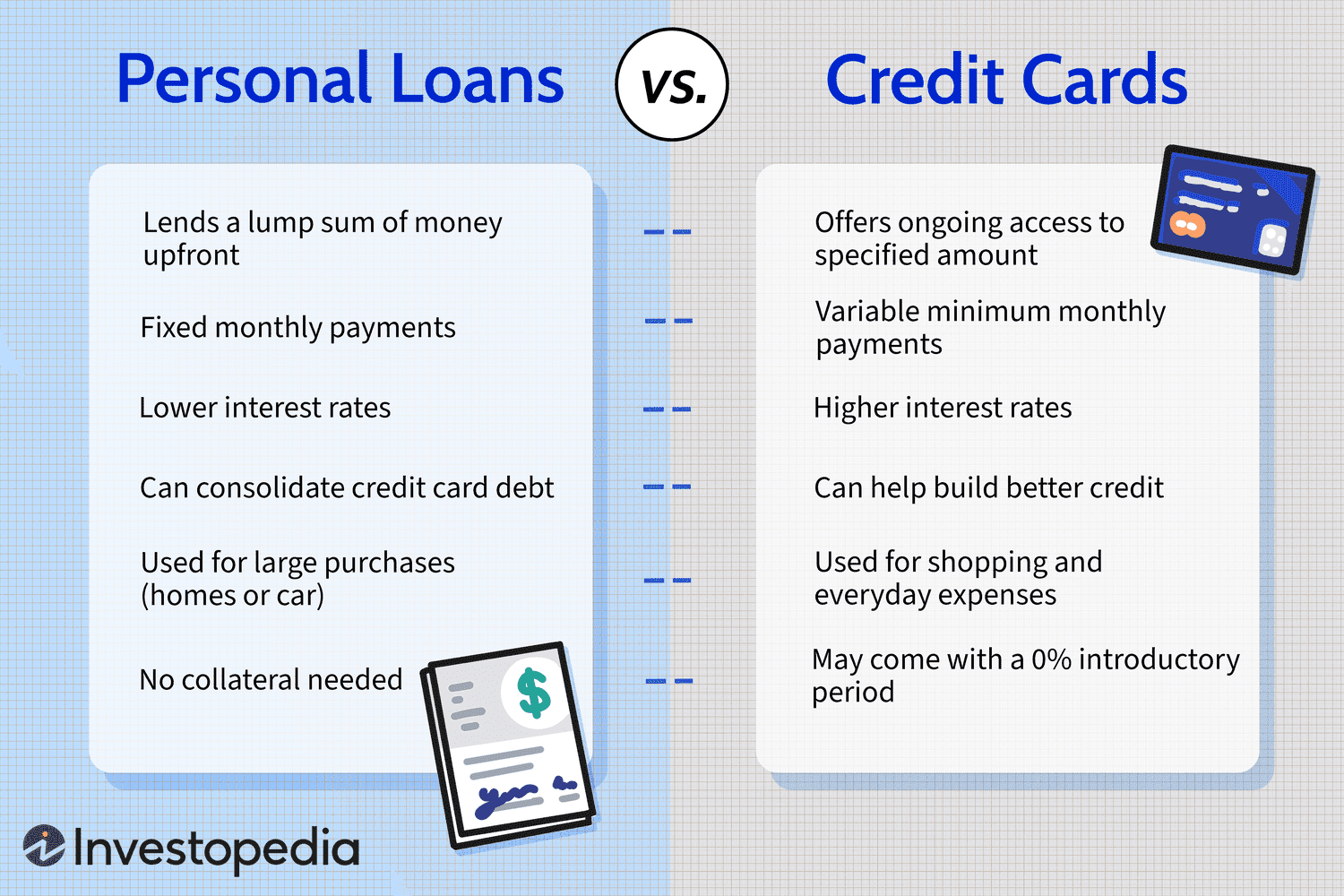

When considering borrowing options, understanding the differences between personal loans and credit cards is crucial. Personal loans offer a lump sum of money with a fixed interest rate, while credit cards provide a revolving line of credit with variable interest. Each has unique benefits depending on your financial needs.

Initial Comparison

Personal loans and credit cards serve distinct financial purposes. Personal loans are best for one-time expenses with predictable payments. Credit cards suit ongoing expenses with flexible payback terms.

Popular Uses For Each Option

- Personal Loans:

- Debt consolidation

- Home renovations

- Medical bills

- Credit Cards:

- Everyday purchases

- Travel expenses

- Emergency funds

Interest Rates: Comparing Costs

Choosing between a personal loan and a credit card? Let’s dive into the Interest Rates: Comparing Costs. This section helps you understand which option might be cheaper for you.

Average Rates For Personal Loans

Personal loans often have fixed interest rates. This means your rate stays the same over time. On average, personal loan rates can range from 6% to 36%. Your credit score plays a big role here. A higher credit score can get you a lower rate.

- Fixed rates make budgeting easier.

- Rates depend on your credit score.

- Lower rates for better credit scores.

Credit Card Interest Rates

Credit cards usually have variable interest rates. This means your rate can change. The average credit card interest rate is around 16% to 24%. But, some cards have rates as high as 29.99% for those with lower credit scores.

- Variable rates can increase costs.

- Average rates are higher than personal loans.

- High rates for low credit scores.

Now, let’s compare the costs with a table.

| Type | Average Interest Rate | Rate Type |

|---|---|---|

| Personal Loan | 6% – 36% | Fixed |

| Credit Card | 16% – 24% | Variable |

In short, personal loans often offer lower fixed rates compared to the higher variable rates of credit cards. This makes personal loans a cheaper option for many people.

Repayment Flexibility And Terms

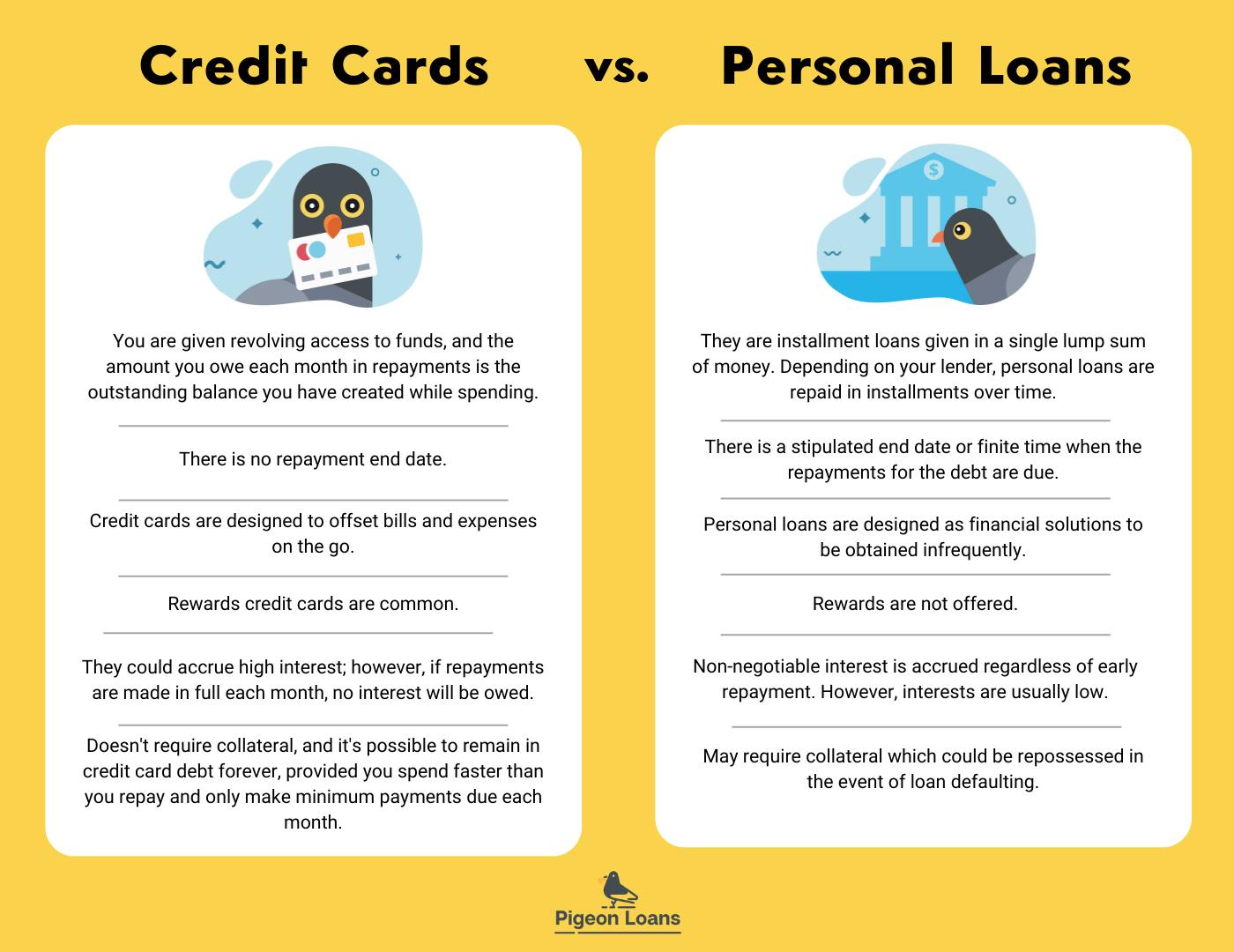

Personal loans often offer structured repayment plans, setting clear terms for financial planning. Credit card debts lack such predictability, potentially leading to prolonged indebtedness and higher interest costs.

When deciding between a personal loan and a credit card, understanding the differences in repayment terms is crucial. Both options offer unique flexibility and terms that can impact your finances. Let’s delve into the specifics of each to help you make an informed choice.Loan Repayment Schedules

Personal loans feature structured repayment plans. Lenders outline these plans at the loan’s outset. You receive a clear schedule stating your monthly payment amount and the loan’s duration. This approach simplifies budgeting. You can see your progress as you make consistent payments toward the loan balance.Personal loan terms typically range from one to seven years. Longer terms mean smaller monthly payments but more interest over time. Shorter terms lead to higher monthly payments, yet you pay less interest. You must honor the agreed-upon schedule to avoid penalties.Credit Card Minimum Payments

Credit cards offer more payment flexibility. Each month, you must make at least the minimum payment. This amount is a small percentage of your total balance. Making only minimum payments can lead to prolonged debt and higher interest costs.Unlike personal loans, credit cards come with a revolving credit line. You can borrow repeatedly up to your credit limit. There’s no end date by which you must repay the entire balance. However, carrying a high balance impacts your credit score and can lead to financial strain.With credit cards, you have the option to pay more than the minimum. Doing so reduces your balance faster and decreases interest costs. Yet, there’s no set schedule pushing you to pay off the debt quickly.In summary, personal loans offer predictable repayment schedules. Credit cards allow for more flexible payments. Your choice should align with your financial goals and habits. Consider which option offers the structure or flexibility you need to manage your debt successfully.

Credit: www.usepigeon.io

Impact On Credit Score

Your credit score is key to financial opportunities. It opens doors to loans and credit lines. Understanding how personal loans and credit cards affect this score is crucial. Let’s explore.

Effects Of Loan Utilization

Personal loans can influence your credit score. They do so through credit utilization. This term refers to the amount of credit you use. It’s a large part of your credit score.

Low utilization is good. It means you’re not using much credit. This can boost your score. A personal loan is an installment debt. It has a fixed repayment term. This differs from credit cards. They are revolving debts with no set repayment period.

When you get a personal loan, your overall credit mix improves. This can positively affect your score. Keeping loan balances low is key. It shows you manage debt well.

Credit Card Debt And Credit Rating

Credit cards have a major impact on your score. High balances are risky. They signal potential over-leverage to lenders. This can harm your credit rating.

Paying off credit card debt is vital. It reduces your credit utilization ratio. This is better for your score. On-time payments are crucial too. They demonstrate financial responsibility.

Each credit card application can trigger a hard inquiry. This can lower your score slightly. It’s temporary but worth noting. Diverse credit types are beneficial. Yet, managing them well is more important.

Borrowing Limits And Funding

When choosing between a personal loan and a credit card, understanding borrowing limits and funding is key. These factors can greatly influence your decision. Let’s dive into the specifics of each option.

Maximum Personal Loan Amounts

Personal loans offer a wide range of borrowing amounts. Generally, lenders provide loans from $1,000 to $50,000. Some may even offer up to $100,000 based on creditworthiness. This makes personal loans suitable for larger expenses. For example, home renovations or consolidating high-interest debt.

Credit Card Limits

Credit card limits vary significantly. They depend on your credit score and income. Typically, limits range from $300 to $30,000. Higher limits are often reserved for those with excellent credit. Credit cards are ideal for smaller, ongoing expenses. Think of daily purchases or minor emergencies.

| Type | Minimum Amount | Maximum Amount |

|---|---|---|

| Personal Loan | $1,000 | $50,000 – $100,000 |

| Credit Card | $300 | $30,000 |

Funding speed is another critical factor. Personal loans often provide funds within a week. Some lenders even offer next-day funding. Credit cards, on the other hand, give immediate access to funds once approved. This makes credit cards a faster option for urgent needs.

- Personal loans offer larger amounts for big expenses.

- Credit cards are better for smaller, recurring costs.

- Funding speed varies between the two, with credit cards often providing quicker access to funds.

Choosing the right option depends on your financial needs. Consider both borrowing limits and funding speed. This will help you make an informed decision.

Credit: www.lendingpoint.com

The Convenience Factor

When choosing between a personal loan and a credit card, convenience plays a big role. Each option offers unique benefits. Understanding these can help make a smart financial decision.

Ease Of Using Credit Cards

Credit cards offer quick access to funds. They are perfect for daily purchases. Swipe or tap your card and the payment is done. Online shopping is a breeze too. Just enter your card details and buy what you need. Keep track of your spending with monthly statements. For urgent buys, credit cards are fast and efficient.

- Pay at stores with a simple swipe

- Shop online with card information

- Get monthly spending summaries

Accessibility Of Personal Loans

Personal loans provide larger amounts of money. They often have lower interest rates than credit cards. Apply with a bank or online lender. Once approved, get the cash in your account. This money can cover big expenses or consolidate debt. Personal loans are easy to manage with fixed payments.

| Step | Process |

|---|---|

| 1 | Fill out an application |

| 2 | Wait for approval |

| 3 | Receive funds directly |

Personal loans suit planned, larger expenses. Credit cards handle everyday purchases well. Consider your needs to choose the right option. The right choice makes your financial life easier.

Rewards And Perks

Rewards and Perks often tip the scales in the debate between personal loans and credit cards. These incentives can sweeten the deal, making one option more appealing than the other. Let’s explore the rewards programs and incentives offered by each.

Credit Card Reward Programs

Credit cards are famous for their reward programs. These programs offer points, cash back, or miles for purchases. The more you spend, the more you earn. Here are key points of credit card rewards:

- Points can be redeemed for goods, travel, or gift cards.

- Cash back gives a percentage of spending back to the cardholder.

- Travel miles can be used for flights, hotels, or car rentals.

- Some cards offer bonus rewards in specific categories.

- Sign-up bonuses provide a large points boost early on.

Personal Loan Incentives

Personal loans may not come with traditional rewards, but they have their own incentives. Personal loans are often chosen for their straightforward terms and potential savings. Here’s how they can be rewarding:

- Lower interest rates compared to credit cards save money over time.

- Fixed payments make budgeting easier.

- Using a personal loan for debt consolidation can improve credit scores.

- No-fee loans eliminate extra costs.

- Some lenders offer rate discounts for autopay enrolment.

Situations Suited For Personal Loans

Choosing between a personal loan and a credit card depends on your financial needs. Personal loans fit certain situations better than credit cards. Let’s explore scenarios where a personal loan shines.

Debt Consolidation Scenarios

Combining multiple debts into one can simplify your finances. Here’s why personal loans work well:

- Fixed interest rates: Personal loans often offer lower rates than credit cards.

- Single monthly payment: You pay one lender, making budgeting easier.

- Defined payoff period: You know exactly when you’ll be debt-free.

Large, One-time Purchases

For big buys, personal loans can be the smarter choice. Consider these points:

- Lower costs: Personal loans usually have lower interest rates for big-ticket items.

- Fixed repayment: You have a set schedule to pay back, with no surprises.

- No collateral: Unsecured personal loans don’t risk your assets.

When To Choose A Credit Card

Deciding between a personal loan and a credit card can be tricky. Credit cards shine for certain types of expenses. Let’s explore when it’s best to reach for the plastic.

Regular, Small Purchases

Credit cards are ideal for everyday spending. Convenience and accessibility stand out. Pay for groceries, gas, or coffee effortlessly. Track expenses with ease.

- Quick transactions

- Simple tracking

- Online or in-store use

Benefiting From Grace Periods

Credit cards offer grace periods; a time when no interest accrues. Pay balances within this period to avoid extra charges. It’s a smart move for short-term borrowing.

| Feature | Benefit |

|---|---|

| Grace Period | Interest-free borrowing |

| Repayment Flexibility | Pay full or minimum due |

The Verdict: Making An Informed Decision

The Verdict: Making an Informed Decision is crucial. Choosing between a personal loan and a credit card depends on your needs. Each option suits different financial situations. Understanding your habits and goals helps make the right choice.

Assessing Personal Financial Habits

Know your spending and repayment habits. This knowledge is key.

- Credit cards offer flexibility but tempt overspending.

- Personal loans provide a fixed amount with a set repayment schedule.

Ask yourself: Can I control my spending? Will I pay on time? Your answers help decide.

Long-term Financial Goals

Think about your future money plans. This step is important.

| Goal Type | Credit Card | Personal Loan |

|---|---|---|

| Short-term purchases | Good | Not ideal |

| Large, one-time expenses | Limited | Excellent |

| Debt consolidation | Possible | Recommended |

Match your goal with the right option. This match ensures success.

Frequently Asked Questions

What Factors Affect Personal Loan Interest Rates?

Personal loan interest rates are influenced by credit score, income, debt-to-income ratio, and the lender’s policies. A higher credit score and stable income can lead to lower rates.

Is Paying Off Credit Cards With A Personal Loan Wise?

Using a personal loan to pay off credit cards can be smart if the loan’s interest rate is lower than the cards’. It can simplify payments and potentially save on interest costs.

How Do Personal Loans And Credit Cards Impact Credit Scores?

Both personal loans and credit cards can affect credit scores through credit utilization, payment history, and credit mix. Timely payments and low credit card balances generally improve scores.

Can Personal Loans Be Paid Off Early Without Penalty?

Many personal loans allow early repayment without penalty, but it’s important to check the lender’s specific terms. Some may charge prepayment fees, which could affect the decision.

Conclusion

Deciding between a personal loan and a credit card depends on your financial needs. Personal loans offer structured payments and lower interest rates, ideal for large, planned expenses. Credit cards provide flexibility and rewards for everyday spending. Assess your financial situation and goals to make the best choice.

Remember, responsible management is key to benefiting from either option.