Are you curious about how Islamic banking is shaping the financial world in Bangladesh? Whether you are a business owner, an investor, or simply someone interested in ethical finance, understanding Islamic banking can open new doors for your financial decisions.

Islamic banking in Bangladesh is not just a trend—it’s a growing system rooted in Shariah principles that offers unique benefits compared to conventional banks. You will discover how Islamic banks operate, why they are gaining popularity, and what opportunities they bring to you and the wider economy.

Keep reading to uncover the key facts and insights that could change the way you think about banking in Bangladesh.

Growth Of Islamic Banking

Islamic banking in Bangladesh has shown strong growth over the years. It offers financial services based on Shariah law. Many people prefer it for ethical and religious reasons.

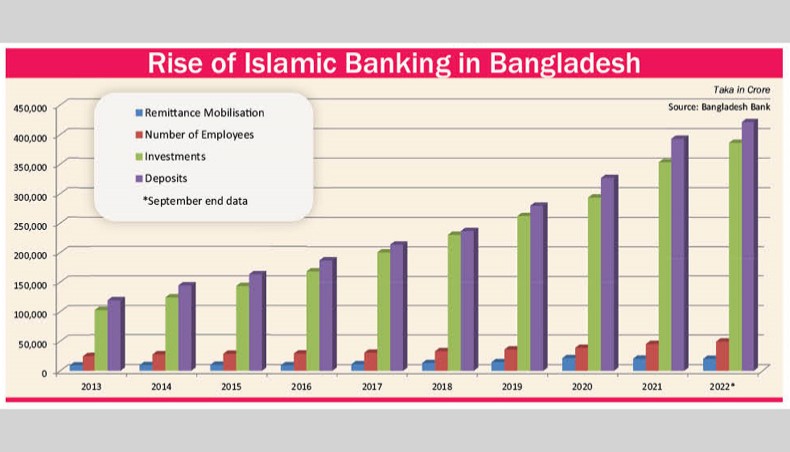

The sector has expanded steadily, contributing to the country’s financial landscape. It now holds a significant share in the banking industry.

Historical Development

The first Islamic bank, Islami Bank Bangladesh Ltd., started in 1983. It was the pioneer in offering Shariah-compliant banking services. This bank set the foundation for others to follow.

In the 1990s and 2000s, more Islamic banks and branches appeared. The government supported Islamic banking through policies and regulations. This helped the sector grow rapidly.

Current Market Size

Islamic banking now covers about 20% of the total banking assets in Bangladesh. The sector manages billions of dollars in deposits and investments. Its customer base includes individuals and businesses.

The growth rate remains high as more people trust Islamic financial products. Banks keep expanding their services and reach across the country.

Key Players

Islami Bank Bangladesh Ltd. is the largest and oldest Islamic bank. It leads in market share and customer trust. Other major banks include Al-Arafah Islami Bank and Social Islami Bank.

Some conventional banks also offer Islamic banking windows. Eastern Bank PLC and Standard Chartered Saadiq are examples. These players increase competition and variety in the market.

Credit: www.researchgate.net

Shariah Compliance In Finance

Shariah compliance in finance is the foundation of Islamic banking in Bangladesh. It ensures that all financial activities follow Islamic law, known as Shariah. This compliance builds trust and attracts customers who seek ethical and interest-free banking. Islamic banks strictly avoid interest (riba), gambling (maysir), and uncertainty (gharar). They promote fairness and transparency in all transactions. Understanding how Shariah compliance works helps explain the growth of Islamic banking in Bangladesh.

Principles Of Islamic Banking

Islamic banking follows core principles derived from Shariah law. The first principle is the prohibition of interest, which means banks cannot charge or pay interest. Profit and loss sharing is encouraged, where both the bank and customer share risks and rewards. Islamic banks also avoid investing in businesses that harm society, such as alcohol or gambling. Contracts must be clear and free from uncertainty to protect all parties involved. These principles guide every financial product and service offered.

Role Of Shariah Boards

Shariah boards play a critical role in Islamic banking. These boards consist of scholars who are experts in Islamic law and finance. They review and approve all banking products to ensure they comply with Shariah. Shariah boards also monitor daily operations and provide guidance to management. Their approval reassures customers that the bank follows Islamic ethics strictly. Without these boards, Islamic banks cannot claim to be truly Shariah-compliant.

Product Offerings

Islamic banks in Bangladesh offer a variety of Shariah-compliant products. These include mudarabah (profit-sharing accounts), murabaha (cost-plus financing), and ijara (leasing). Each product avoids interest and promotes risk-sharing. For example, in murabaha, the bank buys an item and sells it to the customer at a profit. In mudarabah, the bank provides capital, and the customer manages the business, sharing profits. These products meet the financial needs of Muslims while respecting Islamic law.

Major Islamic Banks

Islamic banking in Bangladesh has grown steadily, shaping the country’s financial landscape. Major Islamic banks offer Shariah-compliant products that meet the needs of many customers. These banks follow Islamic principles, avoiding interest and promoting ethical investments. The following are some key players in this sector.

Islami Bank Bangladesh Plc

Islami Bank Bangladesh PLC is the pioneer of Islamic banking in the country. Established in 1983, it set the foundation for Shariah-based banking. The bank offers various services like savings accounts, investment schemes, and financing options. It has a wide network of branches across Bangladesh. Islami Bank focuses on ethical banking and social welfare projects.

Eastern Bank Plc Islamic Window

Eastern Bank PLC operates an Islamic banking window alongside its conventional services. This window allows customers to access Shariah-compliant products without opening a separate account. It provides financing, deposits, and investment products following Islamic laws. The bank ensures transparency and customer satisfaction in its Islamic banking operations.

Standard Chartered Saadiq

Standard Chartered Saadiq is the Islamic banking division of Standard Chartered Bank. It offers tailored Islamic banking solutions for individuals and businesses. The bank provides savings accounts, home financing, and investment products. Standard Chartered Saadiq follows strict Shariah guidelines, ensuring all products comply with Islamic finance principles.

Credit: www.newagebd.net

Regulatory Framework

The regulatory framework shapes the growth of Islamic banking in Bangladesh. It ensures banks follow Islamic principles and maintain financial stability.

This framework involves various authorities and guidelines that oversee operations. It helps build trust among customers and investors.

Central Shariah Board For Islamic Banks

The Central Shariah Board for Islamic Banks guides all Islamic banks in Bangladesh. It reviews and approves Shariah compliance policies. The board ensures banking products meet Islamic law requirements. This body plays a vital role in maintaining religious and financial integrity.

Bangladesh Bank Guidelines

Bangladesh Bank issues specific rules for Islamic banking. These guidelines cover capital requirements, risk management, and reporting standards. The central bank promotes transparency and sound practices. It supports the growth of Islamic finance while protecting depositors.

Compliance Challenges

Islamic banks face challenges in fully complying with rules. Differences in interpretation of Shariah law cause uncertainty. Banks must balance religious principles with modern banking needs. Training staff and updating systems remain ongoing tasks. Overcoming these challenges is key for sustainable growth.

Impact On Bangladesh Economy

Islamic banking plays a vital role in shaping Bangladesh’s economy. It offers financial services based on Shariah principles. This banking system supports economic growth by promoting ethical investments and risk-sharing. It also reaches sectors often ignored by conventional banks. The positive effects of Islamic banking spread widely, improving the overall economy of Bangladesh.

Financial Inclusion

Islamic banking brings financial services to many unbanked people. It respects religious beliefs, attracting those who avoid conventional banks. Many rural and low-income groups now access banking facilities. This inclusion helps reduce poverty and supports small businesses. More people saving and investing boosts the country’s economic strength.

Employment Generation

The Islamic banking sector creates many job opportunities. It hires staff for branches, customer service, and Shariah advisory roles. New banks and branches increase demand for skilled workers. This growth helps lower unemployment and improves living standards. It also encourages entrepreneurship through Islamic finance products.

Contribution To Gdp

Islamic banks contribute significantly to Bangladesh’s GDP. Their investments support industries like agriculture, trade, and manufacturing. Profits are shared fairly, promoting economic stability. The expanding Islamic finance sector attracts both local and foreign investors. This steady growth helps strengthen Bangladesh’s financial system and economy.

Technological Integration

Technological integration plays a vital role in the growth of Islamic banking in Bangladesh. Banks are adopting modern technology to serve customers better and faster. This shift helps Islamic banks meet the needs of a digital-savvy population. It also ensures compliance with Shariah principles while embracing innovation.

Islamic banks in Bangladesh use technology to offer seamless and secure banking solutions. These tools make banking accessible anytime and anywhere. They improve customer satisfaction and expand the reach of Islamic finance across the country.

Digital Banking Solutions

Islamic banks provide online platforms for easy account management. Customers can open accounts, transfer funds, and pay bills from home. These digital services ensure transactions follow Islamic rules without interest or uncertainty. Banks use strong security measures to protect user data and funds. Digital banking removes many traditional barriers for customers in remote areas.

Mobile Banking In Islamic Finance

Mobile banking apps are popular in Bangladesh’s Islamic banking sector. They offer quick access to financial products and services. Users can check balances, deposit money, and get financing approvals on their phones. Mobile solutions support cashless payments and zakat calculations. This technology makes banking more inclusive, especially for young and rural users.

Future Tech Trends

Islamic banks in Bangladesh are exploring blockchain for transparent and trustworthy transactions. Artificial intelligence helps in risk assessment and personalized services. Cloud computing enables flexible and scalable banking operations. These technologies promise to enhance efficiency and customer experience. The future of Islamic banking lies in smart technology integration to meet evolving demands.

Challenges And Opportunities

Islamic banking in Bangladesh faces a mix of challenges and opportunities. These factors influence its development and acceptance in the market. Understanding these elements helps to grasp the current state and future potential.

Market Competition

Islamic banks compete with conventional banks offering similar services. Many conventional banks now provide Islamic banking windows. This increases competition and pressures Islamic banks to innovate. Maintaining unique Shariah-compliant products is vital. Competition drives quality improvement and customer service.

Public Awareness

Many people still lack full understanding of Islamic banking principles. Misconceptions about profit-sharing and risk remain common. Awareness programs and education can improve trust. Clear communication about benefits helps attract more customers. Public knowledge is key to wider acceptance.

Potential For Growth

Bangladesh has a large Muslim population eager for Shariah-compliant finance. This creates strong demand for Islamic banking services. Government support and regulatory frameworks encourage growth. Digital banking offers new opportunities to reach more people. The sector can expand rapidly with the right strategies.

Credit: www.researchgate.net

Frequently Asked Questions

How Many Islamic Banks Are There In Bangladesh?

Bangladesh has 10 full-fledged Islamic banks operating under Shariah principles. These banks offer various Islamic financial products and services.

Which Banks Offer Islamic Banking In Bangladesh?

Islami Bank Bangladesh, Al-Arafah Islami Bank, Social Islami Bank, EXIM Bank, and Standard Chartered Saadiq offer Islamic banking in Bangladesh. Many conventional banks also provide Shariah-compliant services through dedicated Islamic banking windows.

Is Bangladesh Ready For Islamic Banking?

Bangladesh has steadily developed Islamic banking since 1983, with growing demand and regulatory support. It is well-prepared to expand this sector further.

When Did Islamic Banking Start In Bangladesh?

Islamic banking started in Bangladesh in 1983 with the establishment of Islami Bank Bangladesh Limited. It marked the country’s first Shariah-based banking system.

Conclusion

Islamic banking in Bangladesh shows steady growth and strong demand. It offers financial options that follow Shariah law. Many banks now provide Islamic services to meet this need. People appreciate ethical banking and interest-free finance. The sector helps support economic development and social welfare.

Challenges remain, but progress continues with clear focus. Islamic banking plays an important role in Bangladesh’s future finance. It brings trust and new opportunities for many customers. The journey of Islamic banking is just beginning here.