Are you looking for a banking option that respects your values and follows Islamic principles? Islamic banking in the UK is designed just for you.

It offers financial services that avoid interest and promote ethical investments, aligning perfectly with Sharia law. Whether you want to save money, buy a home, or run a business, Islamic banks in the UK provide solutions tailored to your needs.

Curious about how these banks work and which ones lead the market? Keep reading to discover everything you need to know about Islamic banking in the UK—and how it can benefit your financial journey.

Credit: www.mordorintelligence.com

Islamic Finance Principles

Islamic finance is based on unique principles that guide all banking and financial activities. These principles focus on fairness, transparency, and social responsibility. They aim to create a system that benefits everyone without causing harm.

The principles also ensure that money is used in ethical ways. This approach attracts many in the UK who want banking options aligned with their beliefs.

Core Ethical Values

Islamic finance rests on strong ethical values. Honesty and justice are key to all dealings. Financial transactions must avoid harm and promote good for society.

Businesses and banks must act with integrity. They should support economic fairness and avoid exploitation. Respect for human dignity guides every decision.

Prohibition Of Interest

Charging or paying interest, called riba, is not allowed. It is seen as unfair gain from money alone. This rule stops exploitation and unfair wealth accumulation.

Instead of interest, Islamic banks earn profit by sharing real business risks. This creates a fairer system for all parties involved.

Risk Sharing Concepts

Sharing risk is central to Islamic finance. Both the bank and customer share profits and losses. This encourages cooperation and trust.

Investments must be backed by real assets or services. This avoids speculative or uncertain transactions. Risk sharing leads to more stable and ethical financial growth.

Credit: soerenkern.com

Islamic Banks In The Uk

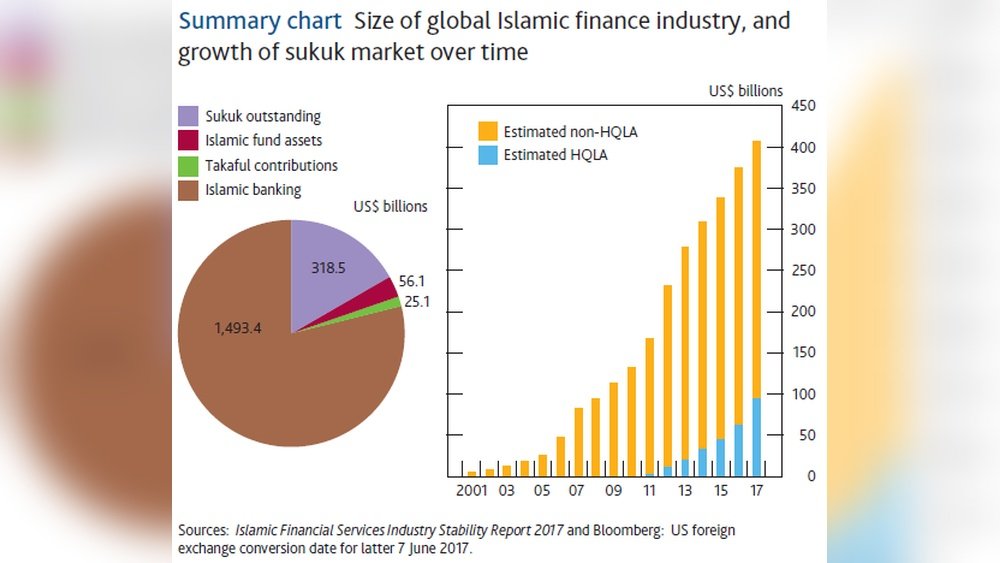

Islamic banks in the UK provide financial services that follow Sharia law. These banks avoid interest and invest in ethical projects. The UK market for Islamic banking is growing steadily. It offers Muslims and others a chance to use financial products that fit their beliefs.

The sector includes several banks and financial institutions. Each offers unique products like savings accounts, home purchase plans, and business finance. This growth shows the rising demand for Sharia-compliant banking in the UK.

Leading Sharia-compliant Banks

Al Rayan Bank is the largest Islamic bank in the UK. It started in 2004 and offers savings, home finance, and business accounts. Another key player is QIB UK, which focuses on personal and commercial finance. These banks have built strong reputations in the market.

Range Of Financial Institutions

The UK has various Islamic financial firms, including banks, building societies, and finance companies. Some provide home purchase plans instead of traditional mortgages. Others offer savings and investment products that comply with Islamic rules. This range helps meet different financial needs.

Market Presence And Growth

Islamic banking in the UK has expanded over the last decade. More people seek ethical and interest-free financial options. The government supports this growth by regulating and promoting fairness. Market data shows steady increases in account holders and assets managed by these banks.

Sharia-compliant Products

Sharia-compliant products in the UK offer financial solutions that follow Islamic law. These products avoid interest and unethical investments. They provide ethical, transparent options for Muslims and non-Muslims alike. Islamic banking in the UK has grown, offering diverse services that meet religious requirements and modern needs.

Islamic Mortgages Explained

Islamic mortgages work differently from conventional loans. They avoid charging interest, which is prohibited in Islam. Instead, banks use a home purchase plan. The bank buys the property and sells it to the buyer at a higher price. The buyer pays in installments over time. This method makes home ownership possible without interest. It is a popular choice for many in the UK.

Savings And Investment Accounts

Sharia-compliant savings accounts do not pay interest. Instead, profits come from business activities that follow Islamic principles. Investment accounts focus on ethical ventures, avoiding industries like alcohol or gambling. These accounts offer a safe way to grow money while respecting religious values. They appeal to customers seeking ethical financial growth.

Business And Commercial Finance

Islamic business finance supports companies without interest charges. It uses profit-sharing or leasing models. This means banks and businesses share risks and rewards. These products help startups and established firms follow Islamic rules. They encourage ethical business practices and community growth. Many UK businesses benefit from these finance options.

Regulatory Environment

The regulatory environment shapes how Islamic banking operates in the UK. It ensures banks meet legal standards and follow Sharia principles. This creates trust for customers and investors. Clear rules help Islamic banks compete fairly with conventional banks. The UK’s financial system supports growth in Islamic finance through robust oversight and guidance.

Uk Financial Regulations

Islamic banks in the UK follow the same financial laws as other banks. The Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) oversee their operations. These regulators ensure banks are stable and protect customers. They monitor risk, capital, and transparency. Islamic banks must also submit regular reports and audits. This keeps the banking sector safe and sound.

Compliance With Sharia Law

Islamic banks must follow Sharia law, which forbids interest and risky investments. Instead, they use profit-sharing and asset-backed financing. Each product is reviewed by a Sharia board to ensure it meets Islamic rules. This board includes scholars trained in Islamic finance and law. Their approval builds confidence among Muslim customers. Banks must balance Sharia compliance with UK regulations carefully.

Role Of The Islamic Finance Council Uk

The Islamic Finance Council UK supports the industry’s growth and development. It offers advice on best practices and regulatory matters. The council works with government bodies and financial institutions. They promote awareness and education about Islamic finance. Their efforts help shape policies that respect both UK law and Sharia principles. This collaboration strengthens the Islamic banking sector in the UK.

Ethical Finance Opportunities

Islamic banking in the UK offers unique ethical finance opportunities. These options follow Islamic principles that focus on fairness and social responsibility. Ethical finance avoids interest and harmful investments. Instead, it promotes transparency, trust, and community well-being. The UK market is growing, providing new chances for investors and customers to support positive change.

Sustainable And Responsible Investing

Sustainable investing is at the heart of Islamic finance. It avoids businesses that harm the environment or society. Investments go to projects that protect nature and support human rights. Islamic banks in the UK promote green energy and eco-friendly ventures. This approach helps build a better future for all. Responsible investing also means fair treatment for workers and honest business practices.

Community Development Projects

Islamic banks support local community development in the UK. They fund affordable housing and small businesses. These projects create jobs and improve living conditions. The focus is on helping people grow without exploiting them. Community projects often include education and health services. This support strengthens social bonds and promotes economic stability.

Innovations In Islamic Finance

New ideas in Islamic finance are emerging in the UK. Technology enhances transparency and customer experience. Digital platforms offer easy access to Sharia-compliant products. Innovations include halal investment funds and ethical insurance solutions. These tools attract younger generations and diverse communities. Islamic finance continues to evolve, blending tradition with modern needs.

Credit: www.cityam.com

Challenges And Future Outlook

The Islamic banking sector in the UK faces several challenges. These obstacles shape its future growth and development. Understanding these issues helps predict how this market will evolve.

Market Awareness And Education

Many people in the UK do not fully understand Islamic banking. The concept is new to some, and myths exist. Raising awareness is essential for growth. Banks and communities must work together to educate the public. Clear information about benefits and rules can build trust. Education programs can also help professionals in finance and law.

Product Development Hurdles

Creating Sharia-compliant products is complex. Islamic finance rules limit certain types of transactions. This makes product design harder than in conventional banking. Banks must innovate while following strict guidelines. This slows the launch of new products. More research and expert input are needed. Collaboration with scholars can improve product offerings.

Potential For Expansion

The UK market holds strong potential for Islamic banking. The Muslim population continues to grow steadily. Interest from non-Muslims also increases. Expanding services to meet diverse needs is possible. Digital banking offers new ways to reach customers. Partnerships with global Islamic banks can help. The future depends on overcoming current challenges carefully.

Frequently Asked Questions

Is Islamic Banking Available In The Uk?

Yes, Islamic banking is available in the UK. Al Rayan Bank and Gatehouse Bank offer Sharia-compliant financial products and services.

What Is The Largest Islamic Bank In The Uk?

Al Rayan Bank is the largest Islamic bank in the UK. It is the oldest and most successful Sharia-compliant bank.

How Many Islamic Banks Are There In The Uk?

There are around 20 Islamic banks operating in the UK. Al Rayan Bank is the largest and oldest. Gatehouse Bank is another key player.

Are Mortgages Halal In The Uk?

Traditional UK mortgages charge interest and are considered Haram in Islam. Islamic mortgages, like home purchase plans, follow Sharia law and are halal alternatives.

Conclusion

Islamic banking in the UK offers ethical and Sharia-compliant financial options. It serves diverse communities seeking interest-free products. Banks like AlRayan and Gatehouse lead in providing these services. Customers benefit from transparent, fair, and community-focused banking. Understanding Islamic banking helps make informed financial choices.

This sector continues to grow steadily across the UK. Exploring these options supports financial inclusion and respect for religious values. The future of Islamic banking in the UK looks promising and stable.