Are you looking for a banking experience that respects your values while offering the convenience of modern technology? Islamic digital banking might be exactly what you need.

It blends the trusted principles of Shariah law with the ease of digital services, giving you financial solutions that are both ethical and accessible. Imagine managing your money without worrying about interest or uncertain deals, all through a seamless app or online platform designed just for you.

Curious how this new wave of banking can change the way you save, invest, and spend? Keep reading to discover how Islamic digital banking is reshaping finance and why it could be the perfect fit for your financial journey.

Credit: ibsintelligence.com

Shariah Principles In Digital Banking

Islamic digital banking merges technology with Islamic finance rules. It offers services that follow Shariah law to Muslim customers online. These banks avoid practices against Islamic teachings. They create financial products that respect religious values and ethical standards. Understanding Shariah principles is key to grasping Islamic digital banking.

Prohibition Of Interest And Uncertainty

Islamic banking strictly bans interest, called riba. Charging or paying interest is not allowed in any transaction. Digital banks avoid interest to comply with Shariah law. They provide profit-sharing or fee-based services instead. Uncertainty or gharar is also forbidden. Contracts must be clear without hidden risks. Transparency is essential in all digital banking dealings.

Maqasid Al-shariah And Financial Ethics

Maqasid al-Shariah means the goals of Islamic law. It aims to protect wealth, fairness, and social justice. Digital banking supports these goals by promoting ethical finance. It encourages risk sharing and avoids exploitation. Services focus on real economic activity, not speculation. Ethical behavior builds trust between banks and customers. This approach leads to sustainable and responsible finance.

Role Of Shariah Committees And Audits

Shariah committees guide digital banks on Islamic compliance. They review products and services regularly. These experts ensure all offerings follow Islamic rules. Shariah audits check transactions and operations for conformity. They protect customers and maintain the bank’s integrity. Continuous monitoring helps prevent violations of Islamic law. This system guarantees trust and faithfulness in Islamic digital banking.

Technological Innovations In Islamic Banking

Technological innovations have reshaped Islamic banking, making it more accessible and efficient. These advances align banking services with Shariah principles while embracing modern digital tools. Islamic banks now use technology to offer better products and improve customer experience. The industry blends tradition with innovation for a unique banking experience.

Digital-first Banking Models

Islamic banks adopt digital-first models to reach more customers. These models focus on mobile apps and online platforms. Customers can open accounts, apply for finance, and make payments online. This reduces the need for physical branches and speeds up services. Digital-first banking also supports financial inclusion in Muslim communities.

Core Banking Systems For Shariah Compliance

Core banking systems now include features to ensure Shariah compliance. These systems automatically check transactions against Islamic laws. They avoid interest (riba) and risky contracts (gharar). Shariah boards review these systems regularly for accuracy. This technology helps banks maintain trust and follow Islamic ethics.

User Experience And Convenience Features

Islamic digital banks focus on easy-to-use interfaces for all users. Simple design and clear language help non-experts navigate banking tasks. Features include instant notifications, quick transfers, and secure login methods. Customer support is available via chat and phone. Convenience encourages more people to use Shariah-compliant banking services.

Global Growth And Regional Leaders

Islamic digital banking is growing rapidly across the world. It blends modern technology with Islamic finance principles. This growth shows a shift in how Muslims and others manage money digitally. Various regions lead this expansion by adopting unique strategies and innovations. These regional leaders set examples for new markets and customers worldwide. The rise of Islamic digital banking supports financial inclusion and ethical banking globally.

Malaysia’s Role In Islamic Digital Banking

Malaysia stands as a pioneer in Islamic digital banking. The country has strong government support and clear regulations. It hosts many Islamic fintech startups and digital banks. Malaysia’s Islamic banking sector is mature and trusted. This maturity helps attract international partnerships and investments. The nation also focuses on educating people about Shariah-compliant finance. Malaysia shows how digital banking can grow while following Islamic rules.

Expansion In The Middle East And Southeast Asia

The Middle East leads with vast investments in Islamic digital banking. Countries like the UAE and Saudi Arabia promote fintech innovation. They develop digital platforms that follow Islamic finance laws. Southeast Asia, besides Malaysia, sees fast growth in Indonesia and Brunei. These regions serve large Muslim populations eager for Shariah-compliant services. Digital banking in these areas improves access to finance. It also supports economic growth and financial inclusion.

Emerging Markets And Community Impact

Emerging markets adopt Islamic digital banking to boost local economies. Africa and South Asia show increasing interest in these services. Islamic digital banks offer loans, savings, and investments without interest. This approach suits communities that seek ethical and fair finance. It encourages small businesses and helps reduce poverty. Digital tools make banking easier for rural and low-income people. The social impact of Islamic digital banking grows stronger every day.

Challenges In Islamic Digital Finance

Islamic digital finance faces many challenges. These challenges impact its growth and acceptance worldwide.

Understanding these issues helps improve services and reach more people. The main challenges include regulatory compliance, innovation balance, and financial inclusion.

Regulatory Compliance Across Jurisdictions

Islamic digital banks must follow different laws in each country. Regulations vary widely, making compliance complex. Some countries lack clear rules for Islamic finance. This uncertainty slows digital banking growth. Banks need to adapt to local laws quickly. Maintaining Shariah compliance alongside legal rules adds extra layers of difficulty. Strong coordination with regulators is essential for success.

Balancing Innovation With Shariah Rules

Islamic digital finance must respect Shariah principles strictly. New technologies and products must not violate these rules. Innovation can clash with traditional Islamic finance values. Banks must design solutions that are both modern and Shariah-compliant. This limits some types of digital services. Experts and Shariah scholars must work closely during development. The challenge is to stay competitive while being faithful to Islamic law.

Addressing Financial Inclusion

Many Muslims still lack access to Islamic banking services. Digital platforms can help reach remote and underserved populations. However, limited internet access and digital literacy pose barriers. Banks must create easy-to-use apps and platforms. Educating users about Islamic digital finance is vital. Financial inclusion supports economic growth and social equity. Overcoming these barriers will expand the market and serve more people.

Future Trends And Opportunities

The future of Islamic digital banking holds many promising trends and opportunities. Advancements in technology drive new ways to serve customers better. These innovations align with Shariah principles, ensuring ethical and transparent financial services.

Islamic banks continue to adopt digital tools to improve user experience. This shift creates more accessible and convenient banking options worldwide. Exploring these future trends helps understand how Islamic digital banking will evolve.

Fintech Integration And Ai Applications

Fintech integration transforms Islamic banking services. It automates routine tasks and reduces costs. Artificial intelligence (AI) enhances customer support with chatbots and personalized advice.

AI also detects fraud and monitors compliance with Shariah rules. This technology enables faster decision-making and improves risk management. Fintech helps reach unbanked populations by offering digital-only services.

Blockchain For Transparency And Trust

Blockchain technology increases transparency in Islamic banking. It records transactions in a secure and unchangeable way. This builds trust among customers and regulators.

Smart contracts on blockchain enforce Shariah rules automatically. This reduces errors and speeds up contract execution. Blockchain also supports cross-border payments with lower fees and faster processing.

Expanding Product Portfolios

Islamic banks are broadening their product offerings. They develop new Shariah-compliant investment and financing solutions. These products meet diverse customer needs and preferences.

Digital platforms allow easier access to takaful, sukuk, and halal investment funds. Customized products help attract younger and tech-savvy clients. This expansion strengthens the competitive position of Islamic banks.

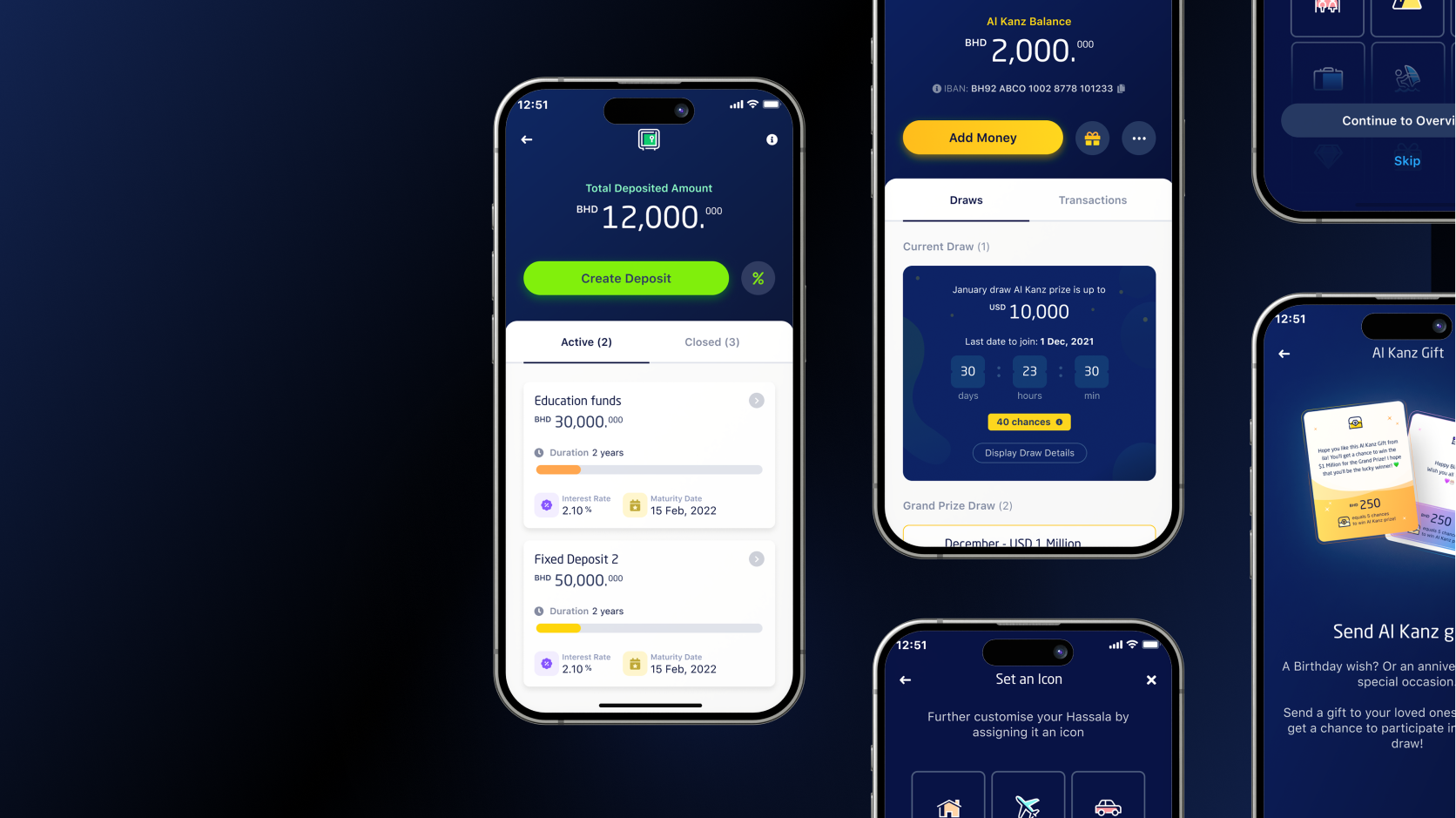

Credit: qubstudio.com

Case Studies Of Leading Islamic Digital Banks

Islamic digital banking is reshaping financial services with Shariah-compliant solutions. Leading banks show how technology meets Islamic finance principles. Their digital platforms offer easy access, transparency, and ethical banking to users worldwide.

These case studies highlight innovations and customer-focused services. Each bank uses digital tools to serve Muslim communities while following Islamic law. Their successes offer valuable insights into the future of Islamic digital banking.

Mashreq Al Islami’s Digital Leadership

Mashreq Al Islami leads in digital banking in the Middle East. It offers a fully digital account opening process. Customers enjoy instant approvals and paperless transactions.

The bank uses smart apps to provide Shariah-compliant products. It ensures transparency and ease in managing finances. Mashreq’s digital platform supports mobile payments and online financing.

Its focus on user experience attracts young, tech-savvy customers. The bank combines Islamic values with modern technology effectively.

Aeon Bank’s Shariah-compliant Services

AEON Bank in Asia delivers simple, Shariah-compliant banking services. It provides digital financing options for personal and business needs. The bank avoids interest-based transactions strictly.

AEON’s digital system allows quick access to accounts and funds. Customers can apply for loans through a smooth online process. The bank’s services emphasize ethical investment and profit-sharing.

It builds trust by following strict Shariah guidelines. AEON Bank supports financial inclusion in Muslim communities.

Boubyan Bank’s Award-winning Innovations

Boubyan Bank, based in Kuwait, wins awards for digital banking innovation. It offers a full range of Islamic digital banking solutions. The bank’s app features biometric security and real-time notifications.

Boubyan uses AI to enhance customer service and personalized offerings. It provides digital wallets, instant transfers, and seamless online payments. The bank focuses on speed, convenience, and Shariah compliance.

Its innovative approach sets a benchmark for Islamic digital banking. Boubyan’s success proves that technology and Islamic finance can blend well.

Credit: www.consultancy-me.com

Frequently Asked Questions

What Is An Islamic Digital Bank?

An Islamic digital bank offers Shariah-compliant financial services online. It avoids interest, promotes profit-sharing, and ensures ethical banking digitally.

Is Islamic Banking Allowed In The Usa?

Islamic banking operates legally in the USA under state and federal laws. It offers Shariah-compliant financial products without interest.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits debt to 30% of a company’s total capital. This ensures financial stability and Shariah compliance.

Do Muslims Get 0% Interest?

Muslims avoid paying or earning interest (riba) as it is prohibited by Shariah law. They use profit-sharing or fee-based financing instead. Islamic banks offer 0% interest alternatives to comply with religious principles while providing financial services.

Conclusion

Islamic digital banking offers a new way to manage money. It follows clear rules from Shariah law, avoiding interest and unfair risks. This type of banking grows fast, especially in places with many Muslim customers. Digital tools make banking easier, faster, and more accessible for users.

Trust and transparency remain key to success in this field. As technology improves, Islamic digital banks will meet more people’s needs worldwide. The future looks promising for ethical and digital financial services.