Are you curious about the terms that shape the world of Islamic finance? Whether you’re new to this field or looking to deepen your understanding, knowing the right vocabulary is essential.

Islamic finance has its own unique concepts and principles that set it apart from conventional banking. This glossary is designed with you in mind—to make complex terms simple and clear. By exploring this guide, you’ll gain confidence and insight, empowering you to navigate Islamic finance conversations with ease.

Ready to unlock the meaning behind key terms and transform your knowledge? Keep reading and discover the essential words every learner should know.

Key Concepts

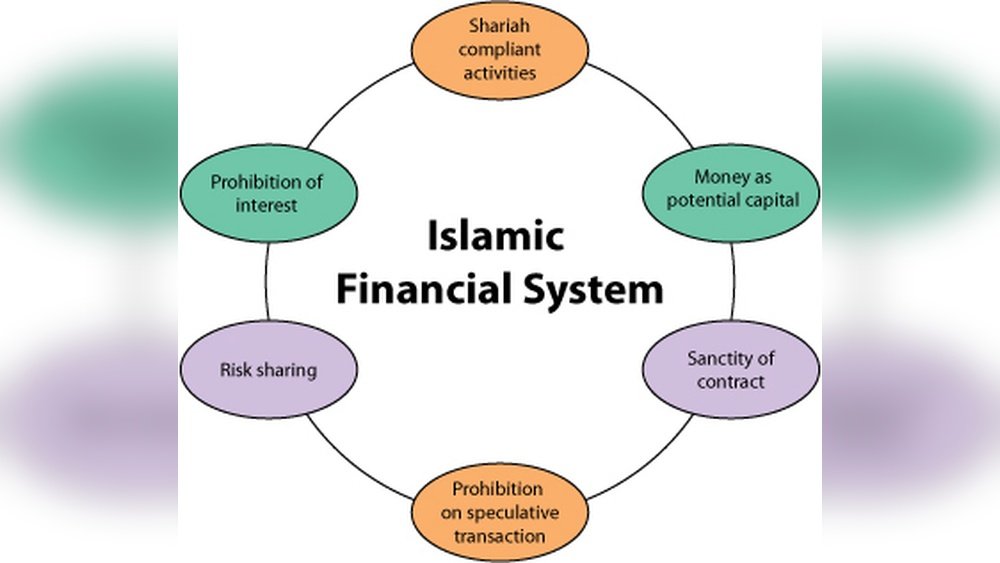

Understanding the key concepts of Islamic finance helps grasp its unique approach. These ideas guide financial transactions to comply with Islamic law. Each concept ensures fairness, transparency, and shared responsibility in finance.

Profit And Loss Sharing

Profit and loss sharing means partners share both gains and losses. It removes fixed interest and promotes joint investment. This concept encourages cooperation and trust between parties. Both parties work towards common financial goals. It aligns risk with reward fairly for all involved.

Asset-backed Financing

Asset-backed financing ties financial transactions to tangible assets. It avoids speculation and ensures real economic activity. The value of the asset supports the financial contract. This method protects against uncertainty and unfair gains. It fosters stability and trust in financial dealings.

Risk Sharing Principles

Risk sharing principles spread financial risks between all parties. It prevents one party from bearing all the losses alone. These principles encourage responsible behavior and careful decision-making. Risk sharing builds a balanced and ethical financial system. Everyone involved accepts their share of risk and reward.

Credit: devonislamic.com

Common Contracts

Islamic finance uses specific contracts to ensure financial activities comply with Shariah law. These contracts form the foundation of transactions in Islamic banking and finance. Understanding them helps grasp how Islamic finance works without interest or uncertainty. Below are some common contracts used widely in the industry.

Murabaha

Murabaha is a cost-plus-sale contract. The seller discloses the cost and profit margin to the buyer. It is commonly used for asset purchases. The buyer pays in installments or a lump sum. This contract avoids interest by agreeing on a fixed profit.

Mudarabah

Mudarabah is a profit-sharing partnership. One party provides capital, and the other manages the project. Profits are shared as agreed, but losses are borne only by the capital provider. It encourages investment without guaranteed returns.

Musharakah

Musharakah means joint partnership. All partners contribute capital and share profits and losses. It is used for business ventures or large investments. This contract promotes risk-sharing and cooperation.

Ijarah

Ijarah refers to leasing or renting. The owner leases an asset to a user for a fixed rent. Ownership remains with the lessor during the contract. This contract is common for equipment or property leasing.

Istisna

Istisna is a contract for manufacturing or construction. The buyer orders a specific item to be made. Payment can be made in stages or after completion. It suits customized products or infrastructure projects.

Tawarruq

Tawarruq is a way to obtain cash without interest. It involves buying and selling commodities through intermediaries. The buyer sells the commodity to get cash immediately. This contract helps with liquidity while following Islamic rules.

Important Terms

Understanding key terms is vital to grasp Islamic finance principles clearly. This section explains important words used in Islamic finance. Each term plays a unique role in the system. Knowing these terms helps in following the rules and practices correctly.

Amanah

Amanah means trust or responsibility. It refers to the duty to safeguard and manage money or property honestly. In Islamic finance, Amanah ensures all parties act with integrity and fairness.

Qard

Qard is a loan given without interest. It is a benevolent loan to help others. The borrower must repay only the original amount, without extra charges.

Gharar

Gharar means uncertainty or ambiguity. Islamic finance forbids transactions with excessive risk or unknown outcomes. Avoiding Gharar protects all parties from unfair loss.

Riba

Riba means interest or usury. It is strictly prohibited in Islamic finance. Charging or paying interest is seen as exploitative and unfair.

Takaful

Takaful is Islamic insurance based on mutual help. Participants contribute money to a shared fund. It covers losses or damages through cooperation and shared responsibility.

Tabarru

Tabarru means donation or gift. In Takaful, it refers to contributions made voluntarily. These donations help support others in need within the community.

Credit: issuu.com

Regulatory Bodies

Regulatory bodies play a key role in shaping Islamic finance. They ensure all activities follow Islamic law and ethical standards. These organizations set rules that protect customers and maintain trust in the market. They also help institutions stay transparent and accountable. Understanding these bodies helps grasp the structure behind Islamic finance.

Islamic Financial Services Board

The Islamic Financial Services Board (IFSB) sets global standards for Islamic finance. It issues guidelines on banking, insurance, and capital markets. The IFSB works with regulators and institutions worldwide. Its goal is to promote stability and sound practices. The board’s standards ensure products comply with Shariah principles. This helps build confidence among investors and customers.

Shariah Supervisory Boards

Shariah Supervisory Boards (SSBs) review financial products and services. They verify that these follow Islamic law correctly. Each Islamic financial institution usually has its own SSB. The board consists of Islamic scholars and experts. They provide rulings and guidance on contracts and transactions. Their approval is crucial for product legitimacy and customer trust.

Financial Instruments

Financial instruments in Islamic finance differ from conventional tools. They comply with Shariah, which prohibits interest and uncertainty. These instruments promote fairness and risk-sharing among parties.

Understanding these tools helps investors and businesses make informed decisions. Here are key financial instruments commonly used in Islamic finance.

Sukuk

Sukuk are Islamic bonds that represent ownership in an asset. Unlike conventional bonds, they do not pay interest. Investors earn returns from the asset’s profit instead. Sukuk financing supports infrastructure, real estate, and business projects. They provide a halal way to invest and raise capital.

Islamic Funds

Islamic funds pool money from investors to invest in Shariah-compliant assets. They avoid businesses involved in alcohol, gambling, and interest-based finance. These funds focus on ethical investments, following Islamic principles. Investors share profits and losses based on fund performance. Islamic funds offer diversification and religious compliance.

Capital Contributions

Capital contributions are funds provided by investors to finance a project or business. In Islamic finance, these contributions are often part of a partnership. Investors share risks and rewards according to their share. This encourages cooperation and fairness in business ventures. Capital contributions help grow Islamic businesses responsibly.

Credit: coredo.eu

Operational Terms

Operational terms in Islamic finance describe key concepts used in daily transactions and contracts. They ensure fairness, trust, and clarity in financial dealings. Understanding these terms helps grasp how Islamic finance operates within its ethical framework.

Amana

Amana means trust or safekeeping. It involves holding money or assets for someone else. The party holding the item must return it in full without loss. Amana creates a strong bond of responsibility and honesty in financial dealings.

Ta’widh

Ta’widh refers to compensation for loss or damage. It applies when one party causes harm to another. The compensation aims to restore fairness and justice. Ta’widh is important to protect rights and prevent disputes in contracts.

Voluntary Contributions

Voluntary contributions are donations given freely without obligation. They support charitable causes or community projects. These contributions promote social welfare and help those in need. Islam encourages giving as a way to purify wealth and show kindness.

Frequently Asked Questions

What Is Islamic Finance Glossary?

An Islamic Finance Glossary explains key terms used in Islamic banking. It helps readers understand specific concepts and principles unique to Sharia-compliant finance.

Why Is Islamic Finance Glossary Important?

It clarifies complex Islamic finance terms, aiding investors and customers. This promotes transparency and informed decision-making in Sharia-compliant financial dealings.

What Are Common Terms In Islamic Finance Glossary?

Terms like Murabaha, Ijarah, Sukuk, and Takaful are common. Each defines unique financial contracts and practices in Islamic banking systems.

How Does Islamic Finance Glossary Aid Beginners?

It simplifies Islamic finance language, making it accessible. Beginners can grasp essential concepts without confusion or misinterpretation.

Conclusion

Understanding key Islamic finance terms helps you navigate this unique field better. This glossary simplifies complex ideas into easy words. It builds your confidence when discussing Islamic banking or investing. Keep this guide handy as a quick reference tool. Learning these terms opens doors to ethical financial choices.

Explore more to deepen your knowledge and make informed decisions. Islamic finance offers different principles but clear opportunities. Stay curious and keep exploring this growing financial world.