Are you looking for a financial system that aligns with your values and offers ethical alternatives to conventional banking? Islamic finance in the UK is growing rapidly, providing you with options that follow Shariah principles—meaning no interest, no uncertainty, and no unethical investments.

Whether you want to buy a home, invest, or save, understanding how Islamic finance works in the UK can open doors to financial solutions designed just for you. Keep reading to discover how this unique approach to finance can empower your financial decisions and help you build wealth responsibly.

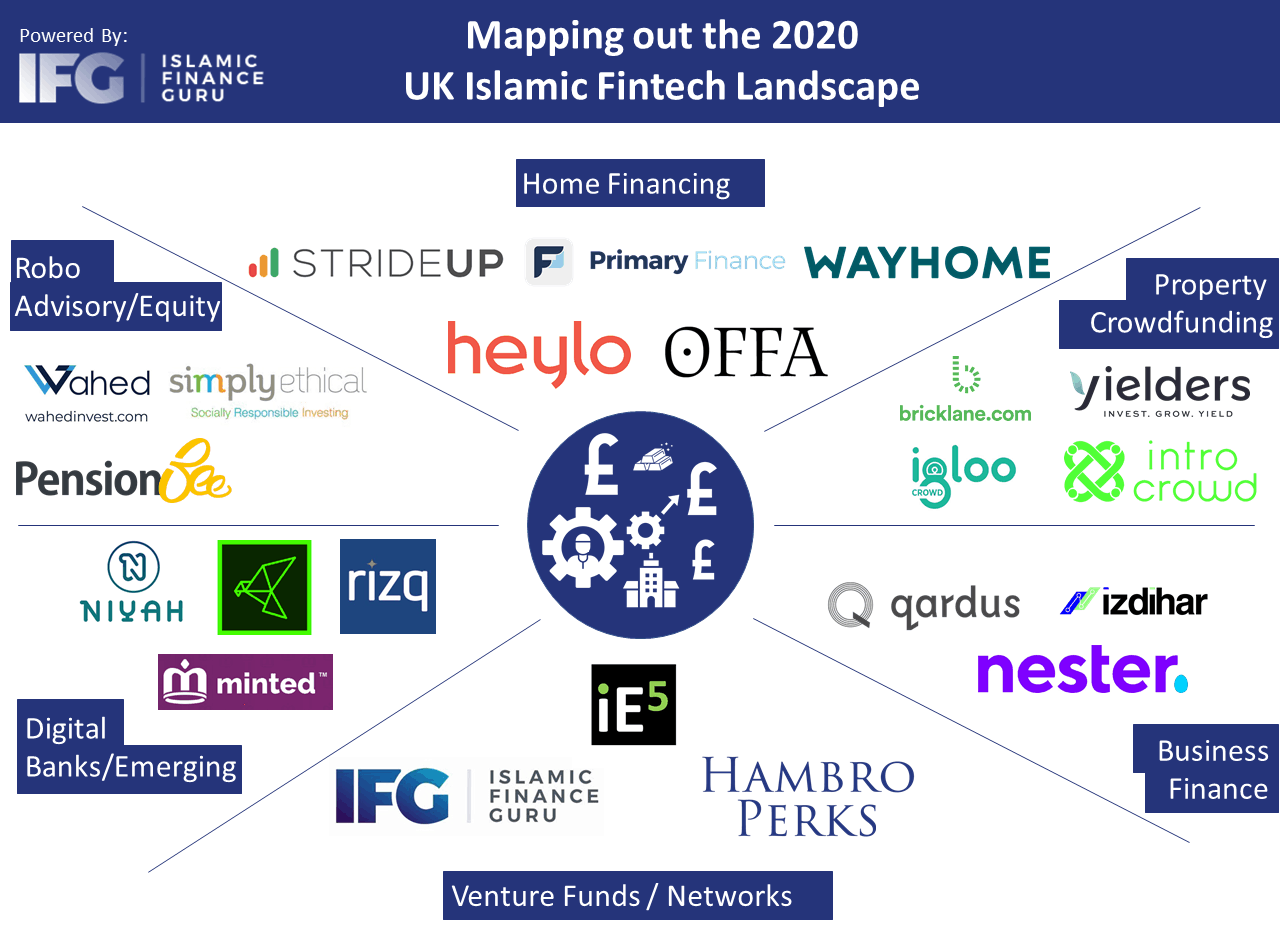

Credit: www.islamicfinanceguru.com

Islamic Finance Basics

Islamic finance offers a unique approach to banking and investment. It follows rules from Islamic law, called Sharia. These rules guide how money should be handled. The focus is on fairness and ethical practices. Islamic finance grows steadily in the UK, serving many who want to follow these principles.

This system is different from conventional finance. It avoids certain activities seen as unfair or harmful. Instead, it promotes sharing risks and rewards fairly. Understanding its basics helps grasp why Islamic finance appeals to many people.

Core Principles

Islamic finance rests on key principles that shape all transactions. Justice and fairness are at the heart. Money should not create money by itself. Business and trade must be backed by real assets. Transparency and honesty are required in all deals. These rules ensure financial activities benefit society.

Prohibition Of Interest

One main rule is the ban on interest, called riba. Charging or paying interest is seen as unjust. Instead, profits come from actual business activities. This prevents exploitative lending and protects borrowers. Islamic banks use other methods to earn returns without interest.

Profit And Loss Sharing

Profit and loss sharing is a key feature. Investors and entrepreneurs share gains and risks. This creates a partnership where both sides are involved. It encourages careful decision-making and fairness. This way, finance supports real economic growth and shared success.

Islamic Finance Growth In Uk

Islamic finance in the UK has seen steady growth over recent years. This growth reflects rising demand for ethical and Sharia-compliant financial products. More individuals and businesses seek alternatives to conventional banking. The UK government supports this sector by providing a regulatory framework. This helps Islamic finance firms operate transparently and fairly. The expanding market brings new opportunities for investors and consumers alike.

Historical Development

The journey of Islamic finance in the UK began in the 1980s. Early efforts focused on creating Sharia-compliant banking options. In 2004, the first fully Islamic bank, the Islamic Bank of Britain, was launched. This marked a milestone for the industry. Since then, the sector has steadily gained recognition. Legal and regulatory adjustments made Islamic finance more accessible. These changes encouraged more financial institutions to join the market.

Key Institutions

Several key institutions drive Islamic finance growth in the UK. The Islamic Bank of Britain paved the way for others. Gatehouse Bank and Al Rayan Bank followed with innovative products. The UK Islamic Finance Council plays an important role in advocacy. It works to promote best practices and education. These institutions build trust and credibility among consumers. They also ensure compliance with both UK law and Sharia principles.

Market Expansion

The UK Islamic finance market continues to expand across various sectors. Islamic mortgages and savings accounts attract growing customer bases. Investment products such as Sukuk bonds and Sharia-compliant funds gain popularity. The government supports market growth through tax incentives and clear guidelines. New fintech solutions also improve access and convenience. Expansion into corporate and asset financing shows strong potential. The sector aims to serve a broader audience beyond the Muslim community.

Sharia-compliant Products

Sharia-compliant products form the core of Islamic finance in the UK. These products follow Islamic law, which forbids interest and encourages ethical investments. They offer Muslims options to manage money without breaking religious rules.

Financial institutions in the UK now provide various Sharia-compliant services. These services include home financing, investment opportunities, and saving plans. All respect the principles of fairness and shared risk.

Islamic Mortgages

Islamic mortgages avoid interest payments by using profit-sharing models. The bank buys the property and sells it to the buyer at a higher price. The buyer pays in installments, which include the bank’s profit.

This method complies with Sharia by avoiding riba, or interest. It provides a clear and fair way to own a home. Many UK banks and lenders now offer these mortgages to Muslim clients.

Investment Funds

Sharia-compliant investment funds avoid businesses involved in alcohol, gambling, or pork. These funds invest in ethical and socially responsible companies. They also reject interest-based earnings.

Investors receive returns based on profit and loss sharing. This approach reduces risk and aligns with Islamic values. UK-based funds make it easy to invest according to faith.

Savings Accounts

Islamic savings accounts do not pay interest. Instead, they offer profit-sharing based on the bank’s earnings. This system avoids guaranteed returns, which are not allowed in Sharia law.

Customers can save money safely and ethically. Many UK Islamic banks provide these accounts with clear terms. They ensure transparency and fairness for all savers.

Regulatory Landscape

The regulatory landscape shapes the growth of Islamic finance in the UK. It sets clear rules to ensure fairness and transparency. Understanding these regulations helps businesses and customers trust Islamic financial products. The UK aims to support ethical finance while maintaining legal standards. The framework must balance Sharia compliance with conventional financial laws.

Uk Financial Regulations

The UK financial system follows strict laws to protect consumers and markets. Islamic finance firms must meet the same rules as other banks and lenders. The Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) oversee these regulations. They ensure firms operate safely and treat customers fairly. Islamic finance products also need to follow anti-money laundering rules.

Compliance Challenges

Islamic finance faces unique challenges in meeting UK regulations. Some rules are based on interest, which Islamic finance forbids. Firms must carefully design products to avoid interest payments. They also need Sharia scholars to approve contracts and practices. This dual compliance can increase costs and slow growth. Education and clear guidelines are essential to reduce these challenges.

Role Of The Islamic Finance Council

The Islamic Finance Council (UK) supports the sector’s development and compliance. It offers guidance on Sharia standards and regulatory matters. The council helps firms navigate complex rules while staying true to Islamic principles. It also works with regulators to improve understanding of Islamic finance. Through training and research, the council promotes growth and trust in the UK market.

Ethical Wealth Opportunities

Ethical wealth opportunities in UK Islamic finance offer more than profit. They focus on fairness, transparency, and social good. Investors seek ways to grow wealth that also benefit society and the environment. This approach aligns with Islamic principles and appeals to those valuing ethics in money matters.

Sustainable Investing

Sustainable investing supports projects that protect the environment. It avoids businesses harming nature or causing pollution. UK Islamic finance channels funds into renewable energy and green technology. This helps build a cleaner, healthier future. Investors gain returns while promoting planet-friendly practices.

Socially Responsible Finance

Socially responsible finance avoids industries like alcohol, gambling, and weapons. It promotes businesses that serve communities and uphold human dignity. UK Islamic finance encourages ethical business models with positive social impact. Investors choose companies that treat workers fairly and respect rights.

Community Impact

Community impact means funding local projects and small businesses. UK Islamic finance supports affordable housing, education, and healthcare initiatives. These efforts improve lives and create jobs. Investors see their money making real changes in neighborhoods. This builds trust and strengthens social bonds.

Credit: ukifc.com

Technology And Innovation

Technology shapes the future of Islamic finance in the UK. Innovation drives new solutions that meet Shariah rules. These advances help more people access ethical financial products. Digital tools improve transparency and customer experience. The Islamic finance sector benefits from growing tech trends.

Fintech In Islamic Finance

Fintech companies create smart financial services for Muslims. They design apps that follow Islamic laws on money. These platforms offer easy access to halal investment and banking. Fintech helps reduce costs and speeds up transactions. It also brings financial education to a wider audience.

Digital Platforms

Digital platforms support online Islamic banking and finance. Users manage their accounts and investments from smartphones. Platforms use secure technology to protect customer data. They offer products like halal savings, mortgages, and investments. These services provide convenience and comply with Shariah principles.

Future Trends

Artificial intelligence and blockchain will impact Islamic finance soon. AI can improve risk assessment and customer service. Blockchain offers transparent and tamper-proof records for contracts. Green finance and sustainable investing will grow in importance. Technology will continue to make Islamic finance more accessible and efficient.

Challenges And Solutions

Islamic finance in the UK faces several challenges. These obstacles slow its growth and limit access for many people. Understanding these issues helps find effective solutions. The following sections explore key challenges and possible ways to overcome them.

Market Awareness

Many people in the UK do not fully understand Islamic finance. They confuse it with conventional banking or think it is only for Muslims. This lack of knowledge reduces trust and interest in Islamic financial products. Education campaigns and clear information can raise awareness. Promoting success stories builds confidence among potential customers.

Product Accessibility

Islamic finance products remain limited in variety and availability. Few banks offer Sharia-compliant accounts, mortgages, or investment options. This restricts choices for consumers seeking ethical alternatives. Expanding product ranges and improving distribution channels can improve accessibility. Partnerships between Islamic and conventional financial institutions help reach wider audiences.

Regulatory Barriers

The UK’s financial regulations were not designed with Islamic finance in mind. This creates hurdles for Sharia-compliant product approval and market entry. Regulatory bodies need to adapt rules to accommodate Islamic principles. Clear guidelines and supportive policies encourage innovation and growth. Collaboration between regulators and Islamic finance experts is essential for progress.

Credit: bloommoney.co

Case Studies

Case studies show how Islamic finance thrives in the UK. They highlight real examples of success and innovation. These stories help understand the impact of Islamic financial principles in practice.

Successful Uk Islamic Banks

Several UK Islamic banks have grown steadily. They offer Sharia-compliant savings, financing, and investment services. Gatehouse Bank is a prime example. It provides home finance without interest, following Islamic rules. Another is Al Rayan Bank, known for ethical banking products. These banks serve diverse communities while maintaining compliance with UK regulations.

Innovative Investment Platforms

New investment platforms focus on halal, ethical options. They use technology to reach wider audiences. One platform offers Sharia-compliant stocks and funds. It allows investors to avoid interest and unethical sectors. These platforms make Islamic finance accessible and straightforward. They attract young investors seeking ethical growth opportunities.

Entrepreneurial Initiatives

Entrepreneurs in the UK create businesses based on Islamic finance principles. They develop fintech solutions tailored to Muslim consumers. Some start crowdfunding platforms for halal projects. Others launch advisory firms specializing in Sharia compliance. These initiatives boost financial inclusion and support community development. They also encourage innovation in finance and technology.

Frequently Asked Questions

Is Islamic Banking Available In The Uk?

Yes, Islamic banking is available in the UK. Several banks offer Sharia-compliant accounts and financing options without interest.

Do Muslims Pay Interest On Loans In The Uk?

Muslims in the UK avoid paying interest on loans to comply with Shariah law. They use Islamic finance alternatives like profit-sharing or lease-based agreements. Islamic banks offer interest-free products such as Shariah-compliant mortgages and current accounts, ensuring ethical, interest-free financial services.

What Is The Best Halal Investment In The Uk?

The best halal investment in the UK is a Sharia-compliant ETF like IGDA. It offers ethical, interest-free growth with moderate fees.

Do Muslims Get 0% Interest?

Muslims avoid paying or receiving interest due to Islamic law. They use profit-based, Shariah-compliant financial products instead.

Conclusion

Islamic finance in the UK offers ethical and interest-free banking options. It supports people who want to follow Shariah rules. Many banks now provide products that meet these needs. This finance system helps communities grow with fairness and trust. Understanding its benefits can guide better financial choices.

The UK’s market for Islamic finance continues to expand steadily. More people are exploring its alternatives to conventional banking. This shift shows a growing interest in responsible finance solutions.