Are you curious about how Islamic finance works in the United States? Whether you’re looking to buy a home, invest ethically, or understand alternatives to conventional banking, Islamic finance offers unique solutions designed to align with your values.

You might wonder how these principles, which forbid charging or paying interest, fit into the American financial system. This article will guide you through the core ideas behind Islamic finance, the common financing models available in the U. S. , and the key players making it accessible to you.

By the end, you’ll see why more people are turning to Sharia-compliant financial products—and how you can benefit from them too. Keep reading to discover how Islamic finance is quietly growing in the U. S. And what it could mean for your financial future.

Credit: academy.musaffa.com

Islamic Finance Principles

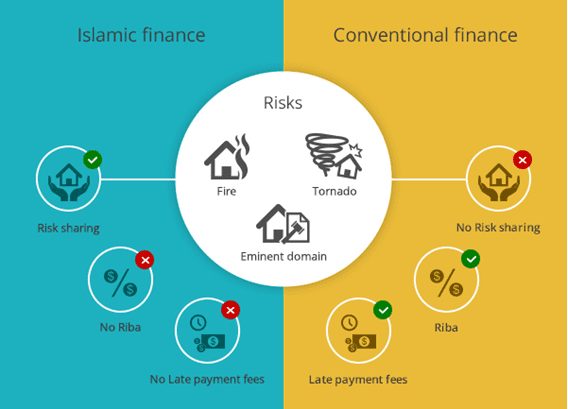

Islamic finance principles guide the way financial activities are conducted under Sharia law. These principles ensure fairness, transparency, and ethical behavior in all transactions. They provide a framework that avoids exploitation and promotes shared risk and reward.

In the United States, Islamic finance adapts these principles to fit local laws and regulations. This allows Muslim communities to access financial services that respect their religious beliefs.

Prohibition Of Interest

Charging or paying interest, known as riba, is strictly forbidden. Islamic finance replaces interest with profit-sharing or fees for services. This prevents unfair gain from loans and encourages equitable transactions.

Profit-and-loss Sharing

Financial dealings focus on sharing profits and losses. Both parties invest in a venture and share its outcome. This creates partnership-like relationships instead of simple lender-borrower roles.

Ethical Investment Focus

Investments must avoid harmful or unethical industries. Businesses involving alcohol, gambling, or tobacco are not allowed. Islamic finance promotes investments that benefit society and follow moral values.

Credit: www.youtube.com

Financing Models In The U.s.

Islamic finance in the U.S. uses unique financing models that follow Sharia law. These models avoid interest and focus on fairness. Islamic financial institutions in the U.S. create products that meet legal rules and religious principles. Understanding these models helps consumers find suitable financing options.

Murabaha Cost-plus Financing

Murabaha is a common method in the U.S. Here, the bank buys an asset. Then, it sells the asset to the customer at a higher price. This price includes a known profit margin. The customer pays in installments over time. This method avoids interest but allows the bank to earn a profit. It is clear and transparent for both parties.

Musharaka Partnership Models

Musharaka means partnership. The bank and customer share the cost of an asset. Both invest money and share ownership. Profits and losses are divided based on their shares. Over time, the customer buys the bank’s share step by step. This model supports joint risk and reward. It encourages cooperation and trust between bank and customer.

Ijara Leasing Agreements

Ijara works like a lease. The bank buys an asset and leases it to the customer. The customer pays rent for using the asset. At the end of the lease, the customer can buy the asset. This model avoids interest and rental fees are fixed. It suits those who want to use an asset without owning it first.

Key Market Players

Islamic finance in the USA has seen steady growth. Several key market players offer Sharia-compliant financial products. These institutions help meet the needs of Muslim communities. They follow Islamic law while complying with U.S. regulations. Their services range from home financing to investment funds. Here is a closer look at some of the main players.

Guidance Residential

Guidance Residential is a leading provider of Islamic home financing. It offers mortgage products that avoid interest payments. Instead, the company uses a lease-to-own structure. This model aligns with Islamic principles. Guidance Residential serves Muslim families across the United States. It aims to make homeownership accessible without compromising faith.

University Islamic Financial

University Islamic Financial specializes in Sharia-compliant mortgages. It focuses on ethical financing solutions. The company provides flexible payment plans and competitive terms. It also educates customers about Islamic finance principles. University Islamic Financial works with local banks to meet regulatory standards. Its approach supports community growth and financial inclusion.

Stearns Salaam Banking

Stearns Salaam Banking offers Sharia-compliant banking services. It provides deposit accounts, financing, and investment options. The bank avoids interest-based transactions in all its products. Stearns Salaam Banking partners with other financial institutions. This helps expand Islamic finance options in the U.S. market. The bank targets both individual and business customers.

Islamic Investment Funds

Islamic investment funds focus on ethical and Sharia-compliant investments. These funds avoid businesses involved in alcohol, gambling, and interest. They invest in sectors that meet Islamic values. Many funds follow strict screening processes. These investments appeal to Muslim investors seeking halal growth. Islamic investment funds contribute to the diversity of the U.S. financial market.

Regulatory Environment

The regulatory environment for Islamic finance in the USA is complex and evolving. Islamic financial products must comply with both U.S. laws and Sharia principles. This dual requirement creates unique challenges for institutions offering these services.

Understanding the legal landscape helps Islamic finance providers operate effectively. It also ensures customers receive compliant and secure financial solutions.

Federal And State Compliance

Islamic finance institutions must follow federal banking regulations. Agencies like the FDIC and OCC set rules for safety and soundness. These rules apply to all financial institutions, including those offering Sharia-compliant products.

States also have their own regulations. Licensing requirements and consumer protection laws differ from state to state. Islamic finance providers must navigate these varying rules carefully.

Challenges Without Specific Laws

The USA has no specific laws for Islamic finance. This absence creates uncertainty for banks and customers. Institutions must adapt conventional laws to fit Islamic principles.

Without clear guidelines, some products face delays in approval. Compliance officers spend extra time ensuring no conflicts with Sharia. This slows growth and raises costs for Islamic financial services.

Navigating U.s. Financial Regulations

Islamic finance companies work closely with legal experts. They review contracts to avoid interest and prohibited activities. Profit-and-loss sharing models must meet U.S. securities laws.

Collaboration with regulators is key. Many institutions educate regulators about Islamic finance principles. This builds trust and opens doors for product development.

Overall, regulatory navigation demands care and expertise. Success depends on balancing U.S. law and Sharia compliance.

Growth Opportunities

The Islamic finance sector in the USA shows promising growth opportunities. This growth is driven by several key factors. These factors create a strong foundation for expanding Islamic financial services across the country. Understanding these opportunities helps businesses and investors tap into this emerging market.

Rising Muslim Demographics

The Muslim population in the USA is growing steadily each year. This increase boosts demand for financial products that follow Islamic law. More Muslims seek banking and investment options aligned with their faith. This demographic trend supports the expansion of Islamic finance services nationwide.

Increasing Demand For Ethical Finance

Many Americans want ethical and socially responsible financial choices. Islamic finance offers a clear alternative by avoiding interest and unethical investments. This appeals not only to Muslims but also to ethical investors. The demand for transparency and fairness in finance drives this growth.

Expansion Into New Financial Products

Islamic finance in the USA is developing new products beyond traditional offerings. These include home financing, investment funds, and insurance solutions. Financial institutions design products that comply with both Sharia law and U.S. regulations. This innovation attracts a wider customer base and supports market growth.

Challenges And Criticisms

Islamic finance in the USA faces several challenges and criticisms. These obstacles impact its growth and acceptance among both Muslims and non-Muslims. Understanding these issues helps clarify why Islamic finance remains a niche sector in America.

Interest Vs. Profit Debate

Islamic finance forbids charging interest, known as riba. Instead, it promotes profit-sharing or trade-based earnings. Some critics argue that many Islamic financial products still resemble traditional interest-based loans. This similarity creates confusion and skepticism about true compliance with Islamic law. It also raises questions about whether Islamic finance offers real alternatives or just repackaged conventional products.

Authenticity Of Sharia Compliance

Ensuring strict Sharia compliance is complex in the U.S. financial system. Different scholars and institutions interpret Islamic rules differently. This variation leads to inconsistent standards across financial products. Some products claim to be Sharia-compliant but lack proper certification. This inconsistency undermines consumer trust and slows industry growth. Clear and unified certification processes are needed for stronger credibility.

Market Awareness And Education

Many Americans have limited knowledge of Islamic finance principles. This lack of awareness restricts demand and market expansion. Muslim consumers may not understand the available options or their benefits. Non-Muslims often view Islamic finance as irrelevant or complicated. Educational efforts are essential to improve understanding. Better knowledge can increase acceptance and encourage more institutions to offer compliant products.

Ethical Investment Impact

Ethical investment impact plays a key role in Islamic finance in the USA. It guides where and how money is invested, ensuring fairness and social good. Islamic finance avoids activities harmful to society or the environment. This approach supports positive change in communities and businesses.

Socially Responsible Investing

Socially responsible investing means choosing investments that help society. Islamic finance focuses on projects that do not harm people or animals. It avoids industries like gambling, alcohol, and tobacco. Investors support companies that treat workers well and follow ethical rules. This creates trust and long-term value for everyone.

Community Development Financing

Community development financing helps build strong neighborhoods. Islamic finance provides funds for affordable housing and small businesses. It supports education and healthcare projects in local areas. This type of financing improves lives and creates job opportunities. The goal is to uplift communities without exploiting them.

Sustainability And Esg Alignment

Islamic finance aligns closely with sustainability and ESG (Environmental, Social, Governance) principles. Investments focus on protecting the environment and promoting social justice. Companies must follow good governance and ethical management. This creates a balance between profit and responsibility. Sustainable choices lead to healthier economies and ecosystems.

Credit: www.guidanceresidential.com

Frequently Asked Questions

Is Islamic Banking Allowed In The Usa?

Islamic banking operates legally in the USA, offering Sharia-compliant financial products. Several institutions provide interest-free, ethical financing options. These services comply with federal and state regulations while following Islamic principles. Islamic finance remains a growing sector, especially within Muslim communities across the country.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits debt to 30% of a company’s total capital. This ensures financial stability and compliance with Sharia law.

Which Banks Offer Islamic Finance?

Banks offering Islamic finance include Guidance Residential, UIF Corporation, Stearns Salaam Banking, Ahil United Bank, Al Rayan Bank, BLME, and Gatehouse Bank. These institutions provide Sharia-compliant products like home financing, savings accounts, and investment funds adhering to Islamic principles.

Do Muslims Pay Interest On Loans In The Usa?

Muslims in the USA avoid paying interest (riba) on loans due to Islamic law. They use Sharia-compliant financing like Murabaha or profit-sharing models instead. These methods comply with U. S. regulations while adhering to Islamic principles. Many donate any accidental interest earned to charity.

Conclusion

Islamic finance in the USA is steadily growing and adapting. It respects both U. S. Laws and Sharia principles. Many communities seek ethical, interest-free financial options. Banks and firms now offer products that fit these needs. This sector still remains small but shows promise.

Understanding Islamic finance can help more people benefit. The future looks positive for its wider acceptance.