Are you curious about how technology is reshaping Islamic finance? Imagine having access to financial services that not only meet your needs but also align perfectly with your values.

From AI-driven risk management to seamless Shariah-compliant digital banking, Islamic finance technology trends are opening doors you might not have expected. You’ll discover the latest innovations transforming Islamic finance, how they affect your financial choices, and why staying updated can give you an edge in managing your money ethically and efficiently.

Keep reading to unlock the future of Islamic finance right at your fingertips.

Credit: www.worldfinance.com

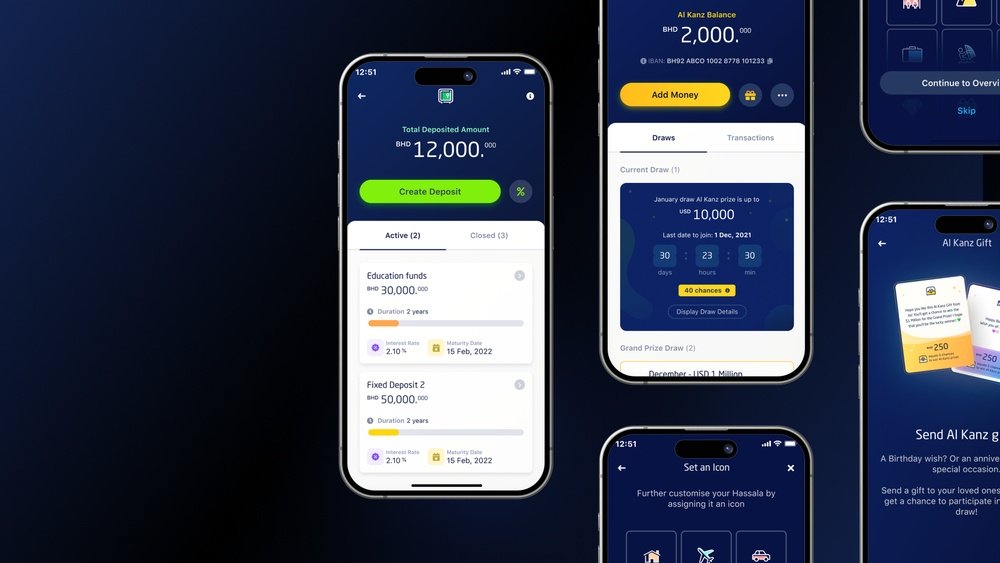

Shariah-compliant Digital Banking

Shariah-compliant digital banking is reshaping Islamic finance. It offers banking solutions that follow Islamic law. These banks avoid interest and invest in ethical projects. Digital platforms make these services easier to access and use. The rise of Shariah-compliant digital banks shows strong growth globally.

Growth Of Digital Islamic Banks

Digital Islamic banks are expanding rapidly worldwide. They provide full banking services through online platforms. This growth meets the demand for ethical and accessible banking. New players enter the market, offering Shariah-compliant products. These banks attract young and tech-savvy customers. They also reach underserved Muslim communities in many countries.

Mobile Banking Innovations

Mobile apps are central to Islamic digital banking. Banks develop apps that follow Shariah rules strictly. Features like quick account opening and easy fund transfers lead the way. Some apps include Islamic financial education for users. Security measures protect user data and transactions. These innovations improve convenience and trust.

User Experience Enhancements

User experience is a key focus for digital Islamic banks. Simple interfaces help users of all ages and tech levels. Multilingual support makes banking accessible to diverse communities. Personalization offers tailored financial advice without breaking Shariah laws. Customer service is available 24/7 through chatbots and live agents. These enhancements build loyalty and satisfaction.

Artificial Intelligence In Islamic Finance

Artificial Intelligence (AI) is reshaping Islamic finance by making processes smarter and faster. It helps banks and financial institutions follow Islamic law while improving service quality. AI tools analyze large data sets quickly, ensuring decisions comply with Shariah principles. This technology supports better risk control and customer experience in Islamic finance.

Automating Compliance

AI automates the monitoring of financial activities to ensure Shariah compliance. It scans contracts and transactions for any prohibited elements. This reduces human error and speeds up approval processes. Automated compliance helps Islamic banks maintain trust and meet regulatory requirements easily.

Risk Management Improvements

AI improves risk assessment by predicting potential financial issues early. It uses historical data to identify patterns that may signal risk. Islamic finance benefits because AI respects unique risk factors under Shariah law. Faster risk detection protects both banks and customers from losses.

Fraud Detection Systems

AI detects unusual patterns that may indicate fraud or money laundering. It continuously monitors transactions for suspicious activities. These systems alert banks to threats before they cause harm. Fraud detection using AI strengthens security and maintains confidence in Islamic finance.

Personalized Financial Services

AI enables tailored financial products based on individual needs and preferences. It analyzes customer behavior and suggests suitable investment options. Personalized services improve customer satisfaction and loyalty. Islamic finance uses AI to offer products that align with ethical and religious values.

Blockchain And Asset Securitization

Blockchain technology is reshaping Islamic finance by enabling new ways to securitize assets. It offers a modern approach that aligns with Shariah principles. This technology helps create transparent, secure, and efficient financial products.

Asset securitization using blockchain makes it easier to divide and trade ownership of real assets. This trend supports Islamic finance by enhancing liquidity and market access without compromising ethical standards.

Shariah-compliant Blockchain Applications

Blockchain solutions tailored for Islamic finance follow strict Shariah rules. These applications avoid interest (riba) and uncertainty (gharar). Smart contracts enforce agreements automatically, ensuring compliance with Islamic law.

Such platforms allow banks and investors to operate transparently. They reduce the need for intermediaries, lowering costs and increasing trust. This technology also supports ethical financing and profit-sharing models.

Sukuk And Tokenization

Sukuk, or Islamic bonds, benefit greatly from tokenization on blockchain. Tokenization breaks down sukuk into digital tokens that represent ownership shares. This process makes sukuk more accessible and easier to trade.

Blockchain ensures accurate record-keeping and faster settlement. Investors can buy or sell tokens securely without delays. This innovation helps expand the sukuk market globally.

Transparency And Security Benefits

Blockchain’s decentralized ledger increases transparency in Islamic finance transactions. Every transaction is recorded openly and cannot be altered. This feature builds confidence among investors and regulators.

Security is enhanced by cryptographic methods that protect data from fraud or hacking. Asset securitization on blockchain reduces risks tied to fraud and errors. This trustworthiness supports wider adoption of Islamic finance products.

Credit: www.worldfinance.com

Fintech Startups And Innovation

Fintech startups are reshaping the Islamic finance landscape. These young companies bring fresh ideas and new technology. They aim to meet the unique needs of Muslim customers. Innovation in this sector helps improve access, transparency, and efficiency. Islamic fintech startups focus on compliant financial solutions under Shariah law. They push boundaries and create tools that traditional finance often lacks. Their work is vital for the growth of ethical finance worldwide.

Emerging Islamic Fintech Hubs

New fintech hubs are appearing in key global cities. Places like Kuala Lumpur, Dubai, and London are leading. These hubs attract talent, investors, and entrepreneurs focused on Islamic finance. The environment supports startups with resources and networking. Local governments often back these hubs with favorable policies. This support helps startups grow and launch innovative products. Emerging hubs become centers for knowledge and technology sharing.

Collaboration With Traditional Banks

Many fintech startups partner with established banks. These banks seek to expand their digital Islamic finance services. Collaborations combine fintech agility with banks’ experience and trust. Banks gain access to new customer segments through fintech partners. Startups benefit from banks’ regulatory knowledge and infrastructure. Together, they develop compliant and efficient financial products. This teamwork accelerates innovation and broadens service reach.

New Financial Products And Services

Islamic fintech startups introduce diverse new products. These include mobile wallets, peer-to-peer lending, and robo-advisors. Each product follows Shariah principles like profit-sharing and prohibition of interest. Startups also create digital platforms for zakat and charity giving. These services increase financial inclusion for underserved communities. They offer simpler, faster, and transparent ways to manage money. New products meet modern needs without compromising Islamic values.

Ethical Investments And Sustainability

Ethical investments and sustainability are vital in Islamic finance technology trends. Islamic finance combines profit with social responsibility. It supports investments that respect moral values and protect the environment. This focus helps attract more investors who care about the planet and society. New technologies make it easier to apply ethical standards and track sustainable projects.

Integration Of Esg Principles

Islamic finance increasingly adopts Environmental, Social, and Governance (ESG) principles. These guide investors to choose companies that care for the environment and treat people fairly. Islamic banks use ESG criteria to screen investments. This ensures they align with Shariah law and ethical values. Technology aids in collecting ESG data and reporting it clearly. This transparency builds trust and encourages more ethical investing.

Green Sukuk Initiatives

Green sukuk are Islamic bonds that fund eco-friendly projects. They support renewable energy, clean water, and green buildings. These sukuk attract investors who want both profit and positive impact. Blockchain and digital platforms help issue green sukuk efficiently. They ensure clear tracking of funds and project results. Green sukuk promote sustainability and open new markets in Islamic finance.

Impact On Global Markets

Ethical investments in Islamic finance influence global markets. They create demand for sustainable products and services worldwide. Investors from different countries join to support green projects. This growth pushes companies to improve their environmental and social standards. Technology connects markets and investors faster than before. Islamic finance’s focus on ethics helps shape a more responsible global economy.

Financial Inclusion And Microfinance

Financial inclusion and microfinance play a vital role in expanding access to Islamic finance. Many people around the world lack access to formal banking services. Islamic finance technology helps bridge this gap by offering tailored financial products for these underbanked communities. Microfinance supports small businesses and individuals with limited resources. It aligns well with Islamic finance principles by focusing on ethical lending and shared risk.

Access For Underbanked Communities

Underbanked communities often face barriers like lack of documentation or distance from banks. Islamic finance technology offers mobile and online platforms to overcome these challenges. These platforms provide easy account opening and transactions. They also ensure compliance with Shariah law, which builds trust among users. This approach opens new opportunities for people to save, invest, and grow their income.

Microfinance Platforms

Microfinance platforms designed for Islamic finance combine technology and faith-based rules. They offer small loans without interest, using profit-sharing models instead. These platforms use digital tools to assess creditworthiness and manage risk. They reduce costs and speed up loan approval. Borrowers get transparent terms and support throughout their loan period, fostering financial stability and growth.

Role Of Technology In Inclusion

Technology is crucial for enhancing financial inclusion in Islamic finance. It enables digital wallets, blockchain, and AI-driven credit scoring. These tools lower entry barriers and reduce fraud. They also provide financial education and personalized services. Technology ensures that more people can participate in the financial system fairly and securely. This helps build stronger and more inclusive economies.

Takaful And Insurtech Advances

Takaful and Insurtech are shaping the future of Islamic finance. These fields combine Islamic insurance principles with modern technology. The goal is to offer safer, faster, and fairer insurance options. Digital tools help takaful providers serve customers better. They also reduce costs and improve transparency. Technology plays a key role in automating processes and customizing products. This makes Islamic insurance more accessible and efficient.

Digital Takaful Solutions

Digital takaful platforms allow users to buy coverage online. Customers can compare plans and get quotes instantly. Mobile apps provide easy access to policy details. These platforms follow Shariah rules strictly. They also use smart contracts for better trust and accuracy. Digital takaful removes many middlemen, lowering fees. It reaches a wider audience, including younger people. This boosts financial inclusion in Muslim communities.

Automated Claims Processing

Automation speeds up the claims process in takaful. Artificial intelligence checks claims for accuracy and compliance. It flags suspicious or incomplete claims automatically. This reduces fraud and errors significantly. Customers get faster claim approvals and payments. Automated systems work 24/7 without delays. This improves customer trust and satisfaction. It also lowers the workload for staff.

Customer-centric Insurance Models

New takaful models focus on customer needs and preferences. Personalized plans adjust coverage based on individual risks. Data analytics help design fairer pricing and benefits. Customers can track their policies easily through apps. Feedback systems allow quick responses to complaints. These models build stronger relationships with policyholders. They reflect the ethical values of Islamic finance. Transparency and fairness remain top priorities.

Governance And Regulatory Tech

Governance and regulatory technology play a vital role in Islamic finance. These technologies ensure that financial services comply with Shariah law. They also help maintain trust and transparency in the market. Islamic finance needs strong governance to meet ethical and legal standards. New tech tools make this process easier and more accurate.

Shariah Governance Automation

Shariah governance automation uses software to monitor compliance. It checks contracts and financial products against Islamic rules. This reduces human errors and speeds up approval processes. Automation helps financial firms stay consistent with Shariah principles. It also supports auditors by providing clear records and reports.

Regtech Tools For Compliance

Regulatory technology, or RegTech, helps Islamic banks follow laws. These tools track changes in regulations and apply them automatically. They alert firms to risks and ensure timely reporting. RegTech reduces costs by cutting manual compliance work. It also improves accuracy in anti-money laundering and fraud detection.

Enhancing Transparency And Trust

Transparency is key in Islamic finance. Technology increases openness by sharing real-time data with stakeholders. Blockchain and digital ledgers create secure, unchangeable records. This builds trust between banks, clients, and regulators. Transparent systems help avoid conflicts and strengthen ethical finance practices.

Credit: www.ltimindtree.com

Frequently Asked Questions

What Are The Trending Topics In Islamic Finance?

Trending topics in Islamic finance include Shariah-compliant banking, sukuk, fintech integration, ethical investment, takaful, financial inclusion, sustainability, and AI-driven risk management.

What Are The Emerging Trends In Islamic Banking?

Emerging trends in Islamic banking include fintech integration, AI-driven compliance, digital banking, ethical investments, financial inclusion, blockchain use, and Shariah-compliant innovation.

What Is The Islamic Finance Trend In 2025?

Islamic finance in 2025 focuses on fintech integration, AI, blockchain, ethical investments, and expanding Shariah-compliant digital banking services globally.

What Is The Technology In Islamic Banking?

Islamic banking technology uses fintech, AI, blockchain, and digital platforms to ensure Shariah compliance, enhance customer experience, and improve efficiency. It supports risk management, ethical investing, and broadens financial inclusion while reducing operational costs.

Conclusion

Islamic finance technology grows fast with new digital tools. These tools help banks follow Shariah rules and serve more people. AI and blockchain improve safety and speed. Mobile apps make banking easier for everyone. Ethical investing gains more attention worldwide.

Islamic finance stays strong by mixing faith and tech. This trend will shape how finance works in the future. Stay aware and explore these changes to understand the market better. The blend of tradition and innovation offers many opportunities ahead.