Are you looking for a way to meet your financial needs without compromising your faith? An Islamic personal loan could be the answer you’ve been searching for.

Unlike conventional loans, these loans follow Shariah law, meaning they avoid interest and focus on fairness and transparency. Whether you need funds for education, medical expenses, or unexpected emergencies, understanding how an Islamic personal loan works can open doors to ethical financing.

Keep reading to discover how you can access this unique financial solution and make smart, faith-aligned choices for your money.

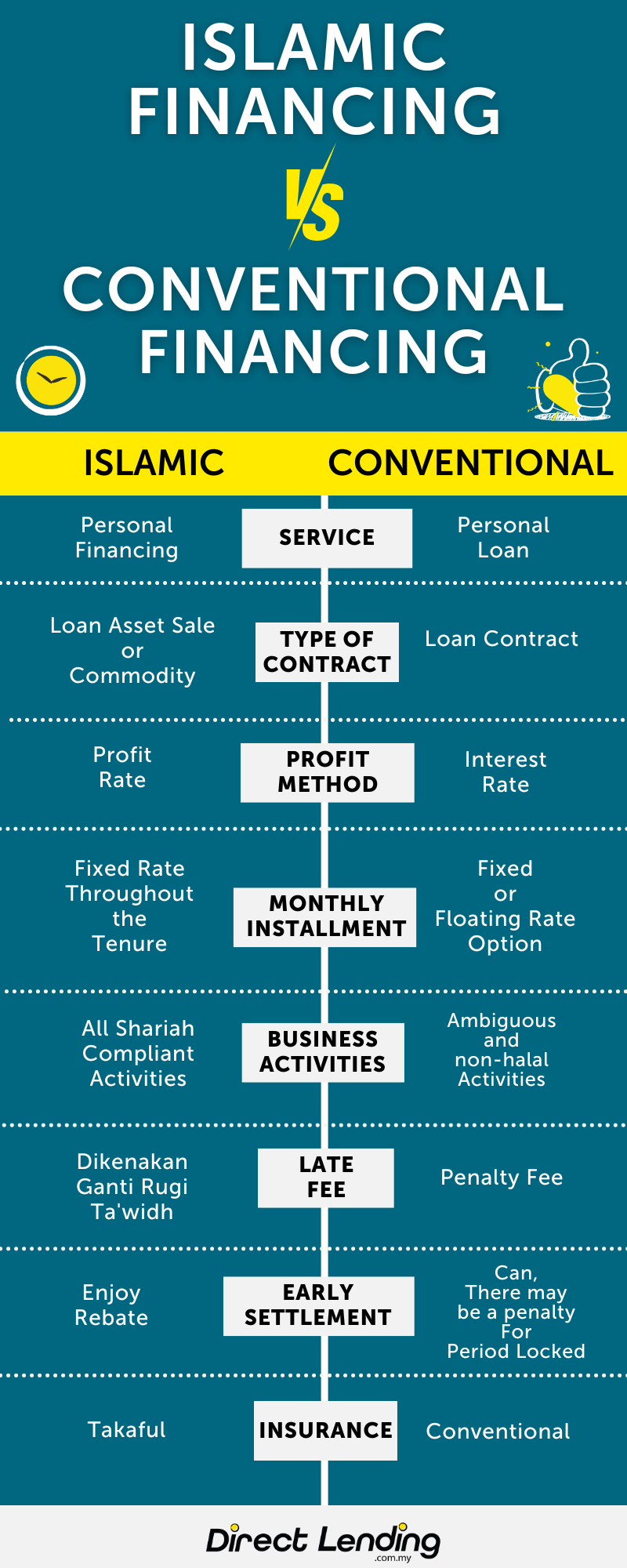

Credit: www.directlending.com.my

Principles Of Islamic Loans

Islamic personal loans follow clear rules based on Sharia law. These rules guide how money is lent and borrowed. The main goal is fairness and avoiding harm to any party. Islamic loans avoid common issues found in conventional lending. They focus on shared risk and ethical dealings. Understanding these principles helps borrowers and lenders act justly.

Prohibition Of Interest

Islamic loans do not allow interest or “riba”. Charging extra money on the loan amount is forbidden. This rule protects borrowers from unfair debt growth. Instead of interest, Islamic finance uses other methods to earn profit. This ensures loans stay fair and just for everyone.

Profit And Loss Sharing

Both lender and borrower share profits and losses. This principle makes the loan a partnership. Each party has a stake in the success of the venture. It reduces the risk only falling on the borrower. This system encourages careful investment and honest business practices.

Ethical Lending Practices

Islamic loans promote honesty and transparency. Lenders must clearly explain all terms and conditions. Loans should not fund harmful or unethical activities. Fair treatment and respect for all parties are essential. This approach builds trust and long-term relationships.

How Islamic Personal Loans Work

Islamic personal loans work differently from conventional loans to comply with Sharia law. They avoid interest (riba) and focus on ethical financing. These loans use trade-based contracts where the bank buys and sells goods to the borrower. This method ensures fairness and transparency in the transaction.

The process involves specific models such as Murabaha and Tawarruq. Understanding these models helps explain how the loan amount is provided and repaid without interest. Ownership transfer is a key part of the process, ensuring the borrower gains full rights after repayment.

Murabaha Financing Model

Murabaha is a cost-plus-profit contract. The bank buys an asset requested by the borrower. Then, the bank sells this asset to the borrower at a higher price. The borrower pays this price in installments over a fixed period. The profit margin is agreed on before the sale. This model avoids interest by focusing on a real asset sale.

Tawarruq Explained

Tawarruq involves buying and selling a commodity to raise cash. The bank buys a commodity and sells it to the borrower at a marked-up price. The borrower then sells the commodity to a third party for cash. This process provides liquidity without charging interest. Tawarruq is widely used for personal finance needs in Islamic banking.

Ownership Transfer Process

Ownership transfer is essential in Islamic loans. The bank must own the asset before selling it to the borrower. The borrower gains full ownership only after paying the total price. This transfer ensures that the loan is backed by a tangible asset. It also protects both parties from unfair practices.

Benefits Of Islamic Personal Loans

Islamic personal loans offer unique advantages compared to conventional loans. They follow Islamic principles, ensuring the loan process respects religious beliefs. These loans provide ethical financing solutions that benefit borrowers and lenders alike. Understanding their benefits helps in making informed financial decisions.

Ethical And Religious Compliance

Islamic personal loans comply with Sharia law, avoiding interest or riba. They promote fairness by banning exploitative practices. Borrowers can access funds without conflicting with their faith. This compliance builds trust and peace of mind.

Affordable Financing Options

These loans often have lower or fixed fees instead of interest charges. This makes repayments more predictable and manageable. Borrowers avoid sudden cost increases common in traditional loans. Affordable terms help maintain financial stability over time.

Transparency And Fairness

Islamic loans emphasize clear terms and honest communication. All fees and costs are disclosed upfront. This transparency prevents hidden charges or surprises. Fairness ensures both parties benefit equally from the agreement.

Credit: shariabanking.com

Eligibility And Application Process

The eligibility and application process for an Islamic personal loan is straightforward. Knowing the criteria helps you prepare your documents and apply smoothly.

Islamic banks follow Sharia principles, so the process differs from conventional loans. They focus on fairness and transparency.

Income And Employment Criteria

Applicants must have a steady income source. Salaried employees, business owners, and professionals qualify.

Monthly income should meet the bank’s minimum threshold. This ensures loan repayment ability without hardship.

Employment must be stable. Usually, a minimum work period of six months or one year is required.

Documentation Requirements

Submit identity proof such as a passport or national ID card. Address proof like utility bills is necessary.

Provide salary slips or bank statements to show income. Business owners must supply financial statements or tax returns.

The bank may ask for a completed application form and photograph. Additional documents depend on the lender’s rules.

Approval Timeline

Application review typically takes 3 to 7 business days. The bank verifies documents and eligibility during this period.

Some banks offer quicker approval for existing customers. New applicants might face longer processing times.

Once approved, the loan agreement is signed. Funds or assets are then disbursed according to Islamic finance rules.

Common Uses Of Islamic Personal Loans

Islamic personal loans provide financial support following Shariah principles. These loans avoid interest and focus on fairness. Borrowers use them for many important life needs. Understanding their common uses helps you see how they fit daily expenses.

Islamic personal loans are popular for managing key financial moments. They offer a clear, ethical way to get funds without riba (interest). Many families and individuals turn to these loans for essential purposes. Here are some common uses.

Education Expenses

Many people use Islamic personal loans to pay for education. This includes tuition fees, books, and other learning materials. These loans help students and parents cover costs without extra financial pressure. They allow focus on studies rather than money problems.

Medical Emergencies

Medical bills can be unexpected and high. Islamic personal loans help cover hospital stays, treatments, and medicines. They provide quick access to funds without interest charges. This support eases stress during health crises and helps secure timely care.

Wedding And Family Needs

Weddings and family events often require large sums of money. Islamic personal loans help with wedding expenses, family gatherings, and celebrations. They allow families to plan special events without debt worries. Borrowers repay the loan fairly over time.

Islamic Loan Providers In The Us

Islamic personal loans provide an alternative to traditional lending, following Sharia principles. These loans avoid interest, ensuring compliance with Islamic law. In the US, several providers offer such loans. They serve various communities with ethical financing options.

Islamic Banks And Credit Unions

Islamic banks in the US operate under Sharia principles. They offer loans without interest, using profit-sharing and leasing models. Credit unions with Islamic financing options also serve local communities. These institutions focus on fairness and transparency in lending.

Halal Financing Platforms

Halal financing platforms provide online access to Sharia-compliant loans. They use technology to connect borrowers with ethical lenders. These platforms offer zero-interest loans or charge fixed fees instead. They simplify the process while maintaining Islamic finance rules.

Community-based Lending

Community-based lending groups support members with Sharia-compliant loans. These groups often rely on trust and shared values. They provide personal loans without charging interest. This method strengthens community ties and promotes financial inclusion.

Comparing Islamic Loans With Conventional Loans

Comparing Islamic loans with conventional loans reveals key differences in structure and ethics. Islamic loans follow Sharia principles, avoiding interest and promoting fairness. Conventional loans rely on interest charges and fixed repayment plans. Understanding these differences helps borrowers choose what suits their needs best.

Cost Differences

Islamic loans do not charge interest. Instead, they use profit-sharing or fixed fees. This can reduce the overall cost for borrowers. Conventional loans add interest to the principal. This interest increases the total amount paid. Sometimes, Islamic loans have higher upfront fees to cover bank costs. Both types vary depending on the lender and loan terms.

Risk And Liability

In Islamic loans, risk is shared between the bank and borrower. The bank often owns the asset during the loan period. This protects the borrower from some financial risks. Conventional loans place all risk on the borrower. The borrower must repay the loan even if the asset loses value. This difference can impact how safe borrowers feel.

Customer Experience

Islamic banks emphasize ethical service and transparency. Customers often find clear terms and respectful treatment. Conventional banks may offer faster approval and more flexible options. Islamic loans require adherence to religious rules, which some customers value. The choice depends on personal beliefs and financial goals.

Credit: shariabanking.com

Challenges And Misconceptions

Islamic personal loans follow specific rules based on Sharia law. These rules avoid interest and promote fairness. Despite their benefits, these loans face many challenges. Many people also have wrong ideas about how they work. Understanding these challenges and misconceptions helps borrowers make better choices.

Availability In Non-muslim Countries

Finding Islamic personal loans outside Muslim countries can be hard. Few banks offer Sharia-compliant products in these places. This limits options for Muslims living abroad. Some institutions try to provide services online. Still, access remains limited for many people.

Misunderstandings About Markup

Many confuse markup with interest. Islamic loans use markup instead of interest. Markup is a fixed extra cost added to the loan. It covers the bank’s profit and risk. This markup is agreed upon upfront and does not change. Unlike interest, it does not increase over time.

Navigating Regulatory Issues

Regulations vary greatly between countries. Some countries do not recognize Islamic finance rules. This creates legal challenges for banks and borrowers. Banks must balance Sharia law with local laws. This can delay loan approvals and increase costs. Borrowers should check local rules before applying.

Tips For Choosing The Right Islamic Loan

Choosing the right Islamic personal loan needs careful thought. This helps ensure the loan fits your financial needs and follows Islamic rules. Consider key aspects before deciding. These tips will guide you to make a wise choice.

Understanding each part of the loan offer helps avoid surprises later. Focus on fees, compliance, and lender trust. This keeps your borrowing safe and fair.

Evaluating Fees And Charges

Islamic loans do not charge interest. Still, fees exist. Look closely at all fees before signing. Origination fees and service charges can add up. Ask for a clear list of costs. Compare these fees with other lenders. Choose loans with fair, transparent charges.

Checking Shariah Compliance

Shariah compliance is vital for Islamic loans. The loan must avoid interest and unethical practices. Check if the lender has a Shariah board. This board ensures all products follow Islamic law. Request proof of compliance. This confirms the loan meets Islamic principles.

Assessing Lender Reputation

A lender’s reputation shows trustworthiness. Read reviews from other customers. Check how the lender handles complaints. Good customer service matters. Also, see how long the lender has been in business. Reliable lenders stand by their promises and follow rules.

Frequently Asked Questions

Is There Halal Personal Loan?

Yes, halal personal loans exist and comply with Sharia law by avoiding interest. They use profit-sharing or fee-based structures instead.

Can I Take A Personal Loan In Islam?

Islamic law prohibits interest (riba) on loans. You can take a personal loan only if it follows Sharia principles, like profit-sharing or fee-based structures without interest. Many Islamic banks offer such halal loans that comply with these rules.

How Do Islamic Personal Loans Work?

Islamic personal loans avoid interest by using Sharia-compliant methods like Murabaha. The bank buys an item, sells it to you at a higher price, and you repay in installments. This structure ensures loans follow Islamic law without charging interest.

What Is The Minimum Salary For A Bank Islam Loan?

The minimum salary for a Bank Islam loan typically starts from RM2,000 per month. Exact requirements may vary by loan type.

Conclusion

Islamic personal loans offer a way to borrow money without paying interest. They follow Shariah rules, making them suitable for many Muslims. These loans focus on fairness and transparency in every step. People use them for education, weddings, or emergencies.

Choosing the right Islamic loan can help manage finances responsibly. Understanding the terms is key before applying. This option supports financial needs while respecting religious beliefs. Consider Islamic personal loans as a clear and ethical choice for borrowing money.