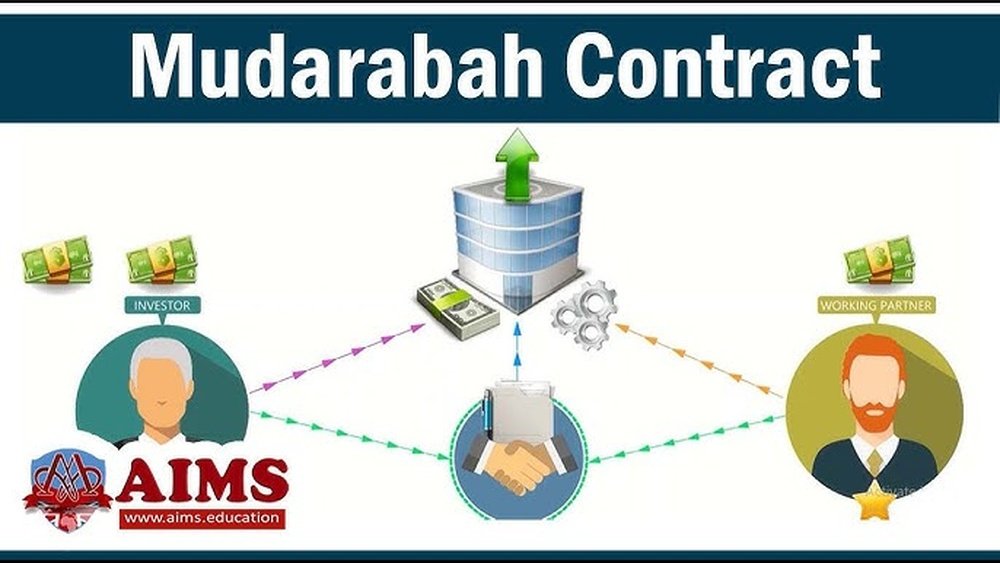

If you’re curious about how Islamic finance works or want to explore ethical investment options, understanding Mudarabah is essential. Imagine a partnership where you provide the money, and someone else uses their skills and effort to grow it — and together, you share the profits.

Sounds fair, right? But what if things don’t go as planned? How are losses handled? You’ll discover exactly what Mudarabah means, how it operates, and why it could be a smart, Sharia-compliant way to invest your money. Keep reading to uncover the simple yet powerful principles behind Mudarabah and see how it might fit into your financial goals.

Basics Of Mudarabah

Mudarabah has different types based on the terms set by the partners. These types define the freedom given to the working partner in managing the business. Understanding these types helps in choosing the right Mudarabah contract for specific needs.

Restricted Mudarabah

In restricted Mudarabah, the capital provider limits the working partner’s activities. The worker must follow specific instructions about the business. The working partner cannot change the business plan without permission. This type reduces risk for the capital provider. It ensures the business stays within agreed boundaries.

Unrestricted Mudarabah

Unrestricted Mudarabah allows the working partner full control over the business. The capital provider only provides funds and waits for results. The working partner can make all decisions about the business. This type gives more freedom to use skills and expertise. It suits situations where trust is high between partners.

Key Features

Investing through Mudarabah offers unique benefits that attract many investors. It blends financial opportunity with risk management. This makes it an appealing choice for those seeking a balance between safety and profit.

Investors can enjoy advantages that are not always found in traditional investments. These benefits align well with ethical and responsible investing principles.

Limited Financial Risk

In Mudarabah, investors face limited financial risk. They provide the capital but do not handle daily operations. Losses affect only the invested capital, not personal assets. The manager, or mudarib, takes care of the business work. This separation helps protect investors from further financial harm.

Profit Potential

Profit sharing in Mudarabah is clear and fair. Investors earn a share of the profits based on a pre-agreed ratio. There is no fixed return, so earnings can grow with the business success. This model encourages both parties to work towards higher profits. Investors benefit directly from the business’s positive performance.

Ethical Investment

Mudarabah follows Islamic finance rules, focusing on ethical business practices. Investments avoid industries that conflict with religious principles. Transparency and fairness are central to the contract. This creates a trustworthy environment for investors. It appeals to those seeking investments aligned with their values.

Types Of Mudarabah

Mudarabah offers several advantages for managers who act as the working partners. These benefits make it easier for skilled individuals to start and run businesses without heavy financial burdens. Managers can focus on their expertise and business growth while sharing profits with the capital providers.

No Capital Requirement

Managers do not need to invest any money to start the business. They provide effort and skills instead of capital. This lowers the entry barrier for entrepreneurs who lack funds but have the right knowledge.

Profit-based Earnings

Managers earn profits based on a pre-agreed ratio. Their income depends on the business success. This motivates them to work hard and improve the company’s performance. They share the rewards fairly with the investors.

Business Control

Managers have full control over daily operations and decision-making. They use their expertise to run the business effectively. This independence allows them to implement strategies and manage risks directly.

:max_bytes(150000):strip_icc()/Murabaha-FINAL-0d5a19c514774b8589be11cab8204aa3.png)

Credit: www.investopedia.com

Benefits For Investors

Mudarabah presents unique challenges and risks for both partners. Understanding these factors helps manage expectations and protect investments. Risks arise from the nature of profit sharing and the trust required between parties.

Both the capital provider and the manager face uncertainties. Risks may affect business operations and financial outcomes. Addressing these issues early is crucial for a smooth partnership.

Risk Of Negligence

The manager controls the business and its daily operations. Negligence by the manager can lead to financial losses. The capital provider relies heavily on the manager’s honesty and skills. If the manager acts carelessly or dishonestly, the capital provider may suffer losses. This risk highlights the need for trust and clear accountability in Mudarabah.

Profit Uncertainty

Profits depend on the success of the business venture. No fixed return exists for the capital provider. Both parties share profits according to the pre-agreed ratio. Profit uncertainty means income can vary greatly. The manager’s efforts may not always generate expected profits. This risk makes Mudarabah less predictable compared to fixed-income investments.

Contract Enforcement

Enforcing Mudarabah contracts can be difficult in some regions. Legal systems may lack specific rules for Islamic finance contracts. Disputes between partners can delay or complicate resolution. Clear, detailed contracts help reduce misunderstandings. Proper documentation and legal advice protect both parties. Effective enforcement ensures fairness and trust in the partnership.

Advantages For Managers

Mudarabah plays a vital role in Islamic finance. It offers a partnership model where one party invests money, and the other manages the business. This structure supports various financial activities while complying with Shariah law. The following sections explain its main applications.

Savings And Deposit Accounts

Islamic banks use Mudarabah for savings accounts. Customers deposit money, acting as investors. The bank manages the funds, investing in Shariah-compliant projects. Profits from these investments share between the bank and the account holder. If losses happen, depositors bear them, not the bank. This method avoids interest, which Islam forbids.

Project Financing

Mudarabah finances many projects without interest. Investors provide capital, while entrepreneurs manage the work. Both agree on profit-sharing before starting. Profits split according to this agreement. If the project loses money, investors take the loss. Entrepreneurs lose time and effort but no capital. This system encourages ethical investment and risk-sharing.

Entrepreneurship Support

Startups and small businesses benefit from Mudarabah. Entrepreneurs get funds without debt pressure. Investors support business ideas and share profits. This partnership helps new ventures grow with less financial risk. It promotes innovation while following Islamic principles. Entrepreneurs focus on work, while investors provide needed capital.

Credit: www.wallstreetmojo.com

Challenges And Risks

Mudarabah offers a unique approach to finance, differing significantly from conventional methods. It operates on principles rooted in Islamic law, emphasizing fairness and shared responsibility. Understanding its key differences helps clarify why it appeals to many seeking ethical financial solutions.

Interest-free Model

Mudarabah does not involve interest, unlike conventional loans. The capital provider earns profits only if the business succeeds. No fixed interest means no guaranteed returns. This eliminates the burden of debt repayments. The model supports a fairer financial system without exploitation.

Risk Sharing Mechanism

In Mudarabah, both parties share profits but losses fall on the capital provider. The manager loses time and effort but not money. This differs from conventional finance, where borrowers must repay loans regardless of outcomes. Risk sharing motivates better cooperation and trust between partners.

Ethical Restrictions

Mudarabah prohibits investments in harmful or unethical industries. It avoids businesses related to alcohol, gambling, and other forbidden activities. Conventional finance often lacks such restrictions. This ethical focus aligns investments with moral values, attracting socially conscious investors.

Credit: www.youtube.com

Frequently Asked Questions

What Is Mudarabah In Simple Words?

Mudarabah is a partnership where one party provides capital, and the other manages the business. Profits share by agreement. Losses affect only the capital provider unless caused by the manager’s negligence. It follows Islamic finance rules and avoids prohibited activities like alcohol or gambling.

What Is An Example Of A Mudharabah?

An example of mudharabah is an investor funding a car showroom while a partner manages daily operations. Profits share is pre-agreed. Losses fall on the investor unless the manager is negligent.

Is Mudarabah Prohibited In Islam?

Mudarabah is not prohibited in Islam. It is a Sharia-compliant profit-sharing contract between capital provider and entrepreneur.

What Are The Benefits Of Mudarabah?

Mudarabah offers profit-sharing without financial loss risk for the working partner. It promotes Sharia-compliant investments and aligns interests. It enables capital providers to earn returns while experts manage operations efficiently. This partnership fosters trust and encourages ethical business growth.

Conclusion

Mudarabah offers a clear way to share profits and risks fairly. One partner provides the money, while the other manages the work. Both agree on how to divide any profits before starting. If the business loses money, only the investor loses capital.

The manager does not lose money unless they act carelessly. This system follows Islamic rules and avoids forbidden activities. Mudarabah helps build trust and cooperation between partners. It suits people wanting to invest without managing daily tasks. Understanding Mudarabah can guide better financial decisions.

Simple, fair, and ethical—this model supports shared success.