Are you tired of traditional banking systems? Peer-to-peer (P2P) financing is the answer!

If you’re looking for a convenient way to borrow or invest money, P2P platforms offer a revolutionary alternative.

What is Peer-To-Peer Financing?

Peer-to-peer financing connects borrowers with investors without involving traditional financial institutions.

Through online platforms, individuals can borrow directly from other individuals or invest in loans for potential returns.

The Benefits Of Peer-to-peer Financing

Discover the advantages of embracing P2P financing as a modern financial tool:

- Flexibility: Borrowers can access funds quickly without the bureaucracy of traditional banks.

- Lower Rates: P2P platforms often offer competitive interest rates compared to banks.

- Diversification: Investors can diversify their portfolios by funding different loans.

- Transparency: P2P platforms provide transparent information on borrowers and investments.

Credit: www.fundthrough.com

How P2P Financing Works

Let’s explore the simple process of peer-to-peer financing:

| Borrower | Investor |

|---|---|

| 1. Apply for a loan on a P2P platform. | 1. Browse through loan listings and choose an investment. |

| 2. Wait for approval and receive funds once funded. | 2. Invest funds in selected loans. |

| 3. Repay the loan according to the agreed terms. | 3. Earn returns based on the success of the loans. |

Important Considerations For Users

Before diving into the world of peer-to-peer financing, here are some key factors to keep in mind:

- Research the platform’s reputation and reviews.

- Understand the risks associated with lending or borrowing.

- Diversify your investments to reduce potential losses.

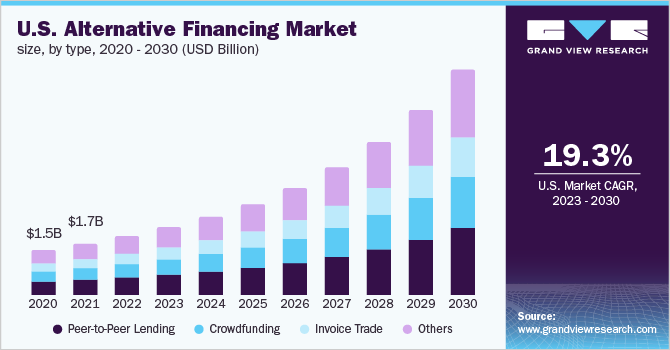

Credit: www.grandviewresearch.com

Future Trends in Peer-to-Peer Financing

As technology continues to advance, the future of P2P financing looks promising:

- Blockchain Integration: Enhanced security and transparency through blockchain technology.

- Global Expansion: P2P platforms crossing borders for international lending and investing.

- Improved Regulations: Stricter regulations to protect users and promote trust in P2P financing.

Conclusion

Embrace the future of finance with peer-to-peer financing – a modern alternative for borrowers and investors!

Take advantage of the flexibility, transparency, and lower rates offered by P2P platforms.

Make informed decisions, diversify your investments, and enjoy a seamless financial experience with peer-to-peer financing!

Frequently Asked Questions On Peer-to-peer Financing Alternative

What Is Peer-to-peer Financing?

Peer-to-peer financing, also known as P2P financing, is a lending method that allows individuals to borrow and lend money directly without involving traditional financial institutions.

How Does Peer-to-peer Financing Work?

In peer-to-peer financing, borrowers create loan listings with specific loan amounts and interest rates. Lenders then review these listings and choose the ones they want to invest in. Once funded, borrowers receive the loan, and repayments are made directly to the lenders.

What Are The Benefits Of Peer-to-peer Financing?

Peer-to-peer financing offers several benefits, such as lower interest rates compared to traditional loans, a simplified loan application process, and the opportunity for investors to diversify their portfolios. It also provides an alternative source of funding for borrowers who may not qualify for traditional bank loans.

Is Peer-to-peer Financing Safe?

While peer-to-peer financing carries some risks, platforms often have measures in place to mitigate them. These can include borrower credit checks, transparent loan information, and investor protection funds. However, it is essential for investors and borrowers to conduct due diligence and assess the risks involved before participating.