The requirements for a car loan typically include a good credit score and proof of income. Lenders also look for a stable employment history and a debt-to-income ratio within acceptable limits.

Securing a car loan necessitates navigating through a series of financial checkpoints set by lenders. Potential borrowers must present evidence of their ability to repay the loan, which is often demonstrated through consistent income streams and a solid credit history.

A good credit score is crucial as it reflects the borrower’s past financial behaviors and repayment reliability. Lenders assess employment stability to ensure the borrower has a regular income source to cover the loan payments. The debt-to-income ratio is another critical factor, as it indicates the proportion of a borrower’s income that goes towards paying debts, with a lower ratio being more favorable. Lastly, a down payment may be required to reduce the loan-to-value ratio, thereby minimizing the lender’s risk. Each element plays a pivotal role in determining loan eligibility, crafting a clear path for consumers to follow when seeking vehicle financing.

Eligibility Criteria For Car Loans

Eligibility Criteria for Car Loans play a pivotal role in securing finance for a new vehicle. Understanding these requirements ensures a smooth application process. Below we outline the key criteria lenders look for.

Minimum Age Requirement

To apply for a car loan, age matters. Most lenders mandate a minimum age, typically 18 years. This is the legal age for entering into a contract. Some lenders may prefer borrowers over 21 years. Age caps often apply, usually around 65 to 70 years at the time of loan maturity. Check the specific age requirements of your lender.

Income Thresholds

Income levels are crucial for loan approval. Lenders assess your income to ensure you can repay the loan. A stable job or consistent income source is a must. The required minimum income can vary widely. It often depends on the loan amount and term. Self-employed individuals must show proof of stable business income. Below is a general guideline for income thresholds:

| Type of Employment | Minimum Income Required |

|---|---|

| Employed (Full-time) | $1,500 per month |

| Self-Employed | $2,000 per month |

| Part-time | Varies by lender |

Credit: www.bankrate.com

Credit Score Considerations

Let’s talk about Credit Score Considerations for a car loan. Your credit score is key. It tells banks how good you are at paying back money.

Importance Of Credit History

Your credit history is your money report card. Banks look at it to decide if they should give you a loan. A good score means lower interest rates. This can save you a lot of money.

- Good credit score: 700 or above

- Okay credit score: 600 to 699

- Bad credit score: Below 600

Improving Your Credit Score For Better Rates

To get better rates, you need a better score. Here’s how:

- Pay bills on time. It shows you’re reliable.

- Keep debt low. Too much debt is bad.

- Check your credit report. Fix any mistakes.

- Don’t open new credit cards if not needed. It can hurt your score.

Start early. Improving your score takes time. A higher score means a better loan for your dream car.

Employment And Income Verification

Employment and Income Verification is a key step in securing a car loan. Lenders require proof that you can afford monthly payments. This section covers what you need to show to satisfy lenders’ requirements for a steady income.

Proof Of Steady Income

To get a car loan, you must provide evidence of a reliable income source. Lenders typically ask for recent pay stubs or bank statements. These documents should show a consistent income over time. Here are the common forms of proof:

- Pay stubs from the last few months

- Bank statements highlighting direct deposits

- Employment letter confirming your salary and job stability

Self-employment And Car Loans

Self-employed individuals face unique challenges when applying for car loans. Without traditional paychecks, you need alternative documents to prove income. Tax returns, bank statements, and profit and loss statements become crucial. Below is a list of documents that may be required:

| Document | Purpose |

|---|---|

| Tax returns | Show annual income |

| Bank statements | Reflect business transactions |

| Profit and loss statements | Indicate financial health |

It’s important to have these documents organized and ready to present to lenders. Clear, detailed records improve your chances of loan approval.

Down Payment Details

Down Payment Details form a crucial part of car loan requirements. This upfront payment influences loan terms. Let’s break down the essentials of down payments.

Calculating The Down Payment

Calculating the down payment is simple. Use this formula:

Down Payment = Car Price x Percentage RequiredCar price varies by make, model, and features. Percentage required depends on the lender. It’s usually 10% to 20%.

Options For Low Down Payments

Car buyers with budget constraints can seek low down payment options. Here are some:

- Special financing programs: Aimed at first-time buyers or those with limited credit.

- Trade-ins: Your current vehicle’s value can contribute to the down payment.

- Manufacturer deals: Some offer low or no down payment deals. Keep an eye on these.

Remember, a lower down payment might mean higher monthly payments. Always consider the long-term financial impact.

Debt-to-income Ratio

One key factor in securing a car loan is your Debt-to-Income Ratio (DTI). This number shows lenders how much debt you have compared to your income. A lower DTI makes getting a loan easier.

Understanding Your Dti

To find your DTI, divide your monthly debt payments by your monthly income. Multiply the result by 100 to get a percentage. Lenders prefer a DTI under 36%. This includes your future car payment.

- Calculate all monthly debt payments.

- Add these payments together.

- Divide this total by your monthly income.

- Multiply by 100 to find your DTI percentage.

Reducing Debt Before Applying

To improve your chances of approval, lower your DTI. Pay off small debts first. Avoid taking on new debt before applying for a car loan.

- Pay off credit cards and small loans.

- Avoid new credit applications.

- Consider extra income sources to increase your monthly earnings.

Lowering your DTI not only helps with car loan approval. It also leads to better loan terms. Aim for a DTI below 36% for the best results.

Necessary Documentation

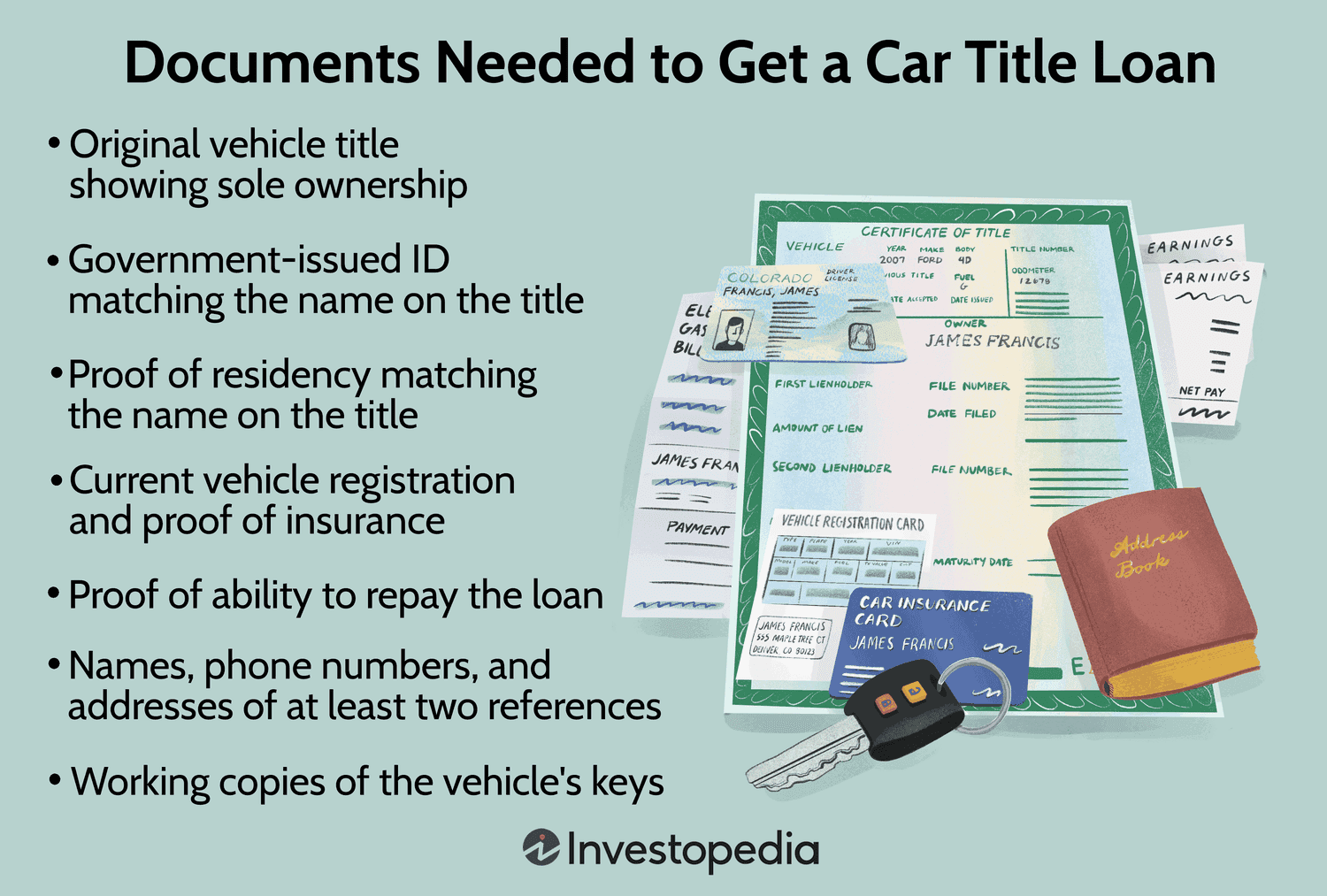

Securing a car loan requires a stack of documents. Lenders need proof that you can repay the loan. Know what papers to bring to the table. This can fast-track the approval process. Let’s delve into the essential paperwork.

Standard Paperwork Required

The basics for any car loan application include:

- Identification: Passport or driver’s license.

- Income Proof: Recent pay stubs or W-2 forms.

- Residence Proof: Utility bill or lease agreement.

- Credit History: Credit score and reports.

- Insurance Documents: Proof of valid auto insurance.

Additional Documentation For Self-employed Individuals

Self-employed? Your lender will ask for more:

- Tax Returns: Two years’ worth.

- Bank Statements: To show income stability.

- Business Proof: License or registration.

- Profit and Loss Statements: If applicable.

Interest Rates And Loan Terms

Understanding interest rates and loan terms is crucial when applying for a car loan. These factors determine your monthly payments and the total cost of your loan. Let’s explore how rates are set and ways to choose the best loan term for your budget.

How Rates Are Determined

Several key factors influence your car loan’s interest rate:

- Credit Score: A higher score often means a lower rate.

- Loan Amount: Larger loans may have higher rates.

- Down Payment: More money down can reduce your rate.

- Loan Term: Shorter terms usually offer lower rates.

- Vehicle Age: Newer cars often qualify for better rates.

- Lender: Rates vary between financial institutions.

Choosing The Right Loan Term

Select a term that balances affordable payments with total interest costs. Shorter loan terms usually have higher monthly payments but lead to less paid in interest. Longer terms lower monthly payments but increase the total interest paid. Compare options using the table below:

| Loan Term | Monthly Payment | Total Interest |

|---|---|---|

| 36 Months | Higher | Lower |

| 60 Months | Lower | Higher |

Consider your monthly budget and long-term financial goals. Shorter terms save money over time. Longer terms ease your monthly budget. Always compare offers and negotiate terms that suit your needs.

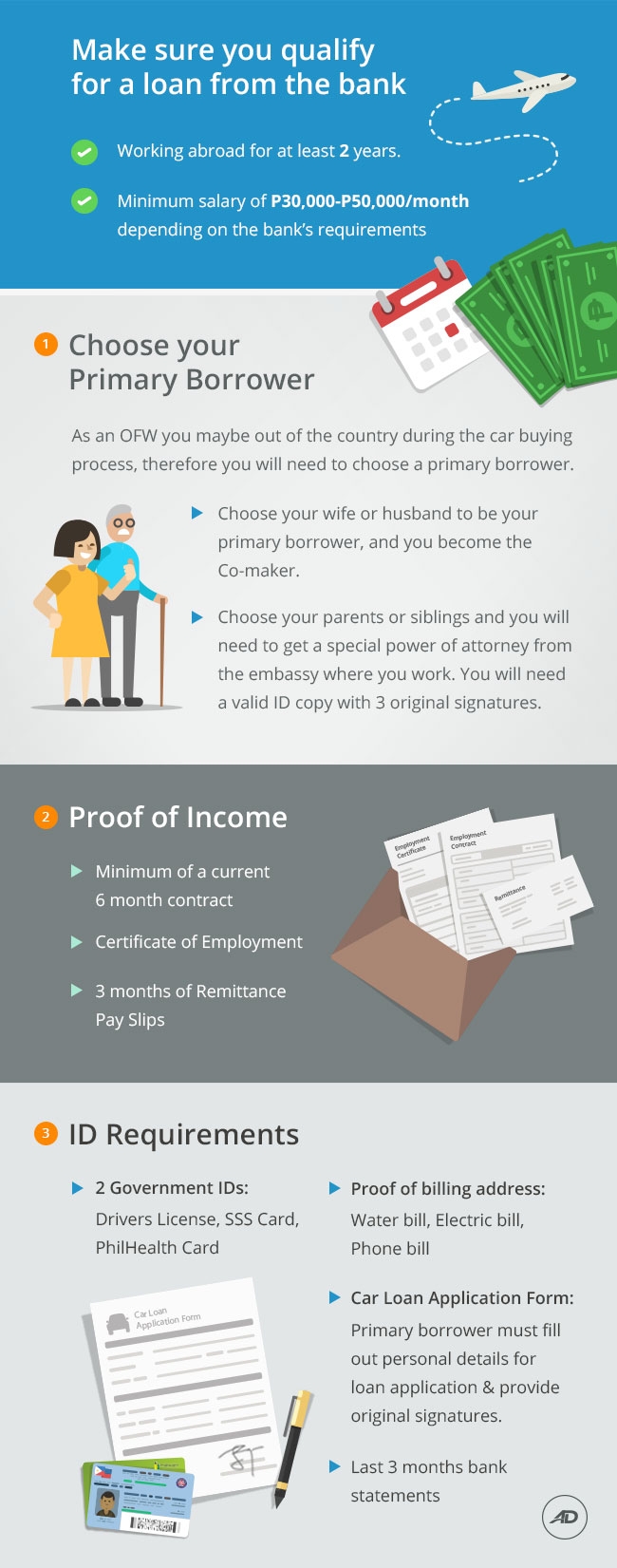

Credit: www.autodeal.com.ph

Insurance And Other Considerations

Securing a car loan requires more than just proof of income and a good credit score. Insurance and other factors play a crucial role. Let’s dive into what you need to know.

Vehicle Insurance Requirements

Vehicle insurance is a must when financing a car. Lenders insist on comprehensive and collision coverage. This insurance protects the car against theft, damage, and accidents.

- Liability coverage covers costs for injury and property damage.

- Collision insurance pays for car repair after an accident.

- Comprehensive insurance covers non-collision-related damage.

Understanding Gap Insurance

Gap insurance is an additional layer of protection. It covers the ‘gap’ between the car’s value and the loan balance if the car is totaled or stolen.

| Car Value | Loan Balance | Gap Coverage |

|---|---|---|

| $20,000 | $25,000 | $5,000 |

This insurance is optional but recommended for new cars or those with a high rate of depreciation.

Finalizing Your Car Loan

Getting your dream car is exciting. Before you drive off, you need to finalize your car loan. This step is crucial. It sets the terms for your purchase. Let’s walk through the final steps.

Loan Approval Process

The loan approval process can be smooth. Lenders check credit scores and history. They confirm your income and debts. They ensure you can repay the loan. Your loan terms depend on this process. A good credit score means better rates. Remember to compare offers. Choose the best deal for you.

Closing The Deal At The Dealership

At the dealership, review the contract carefully. Check the interest rate and terms. Ensure the loan details match what you agreed upon. Sign the papers only when satisfied. Ask questions if unclear. The dealer will then finalize the sale. You will get the keys to your new car.

Post-approval Actions

After getting your car loan approved, what comes next is crucial. This part helps you manage your loan well. Let’s dive into the steps you need to take.

Setting Up Automatic Payments

Setting up automatic payments is a smart move. It ensures you never miss a payment. This is how you do it:

- Log in to your loan account online.

- Find the payment section.

- Choose automatic payments.

- Link your bank account.

- Set the payment amount and date.

This way, your payment is always on time. Plus, some lenders might lower your interest rate for setting this up.

Managing Your Loan Responsibly

Managing your loan wisely is key to financial health. Here are tips:

- Always pay on time.

- Check your loan balance regularly.

- If possible, pay more than the minimum to reduce interest.

- Keep your loan documents safe.

By following these steps, you save money and avoid stress.

Credit: www.autodeal.com.ph

Frequently Asked Questions

What Credit Score Is Needed For A Car Loan?

A credit score of 660 or higher is generally preferred for car loan approval. However, some lenders may accept lower scores with potentially higher interest rates.

How Much Income Is Required For A Car Loan?

Lenders typically require a minimum annual income of $20,000 for a car loan. Higher incomes can result in more favorable loan terms.

Can I Get A Car Loan With No Credit History?

Yes, obtaining a car loan with no credit history is possible. Some lenders offer programs for first-time buyers, though they may require a higher down payment or a co-signer.

What Is The Minimum Down Payment For A Car Loan?

The minimum down payment for a car loan varies, but 10% of the car’s price is commonly expected. Some lenders might offer loans with lower down payments.

Conclusion

Securing a car loan requires meeting specific criteria, including a stable income, good credit score, and a manageable debt-to-income ratio. Remember, every lender has different requirements, so it’s crucial to shop around. Armed with the right information and preparation, you’re set to navigate the car loan process successfully.