Payday loans carry high-interest rates and fees, leading to debt traps. Borrowers may struggle with repayment due to short-term due dates.

Payday loans, often seen as a quick fix for urgent financial needs, can turn into a precarious financial snare for many individuals. These loans are typically small in amount but come with exorbitant costs that can escalate rapidly if the loan is not repaid on time.

The allure of immediate cash can overshadow the potential downsides, leading borrowers into a cycle of debt that is difficult to break. The risks associated with payday loans are not just financial; they can also have significant effects on one’s credit score and overall financial stability. As these loans can become a recurring dependency, it’s crucial for potential borrowers to consider all alternatives and understand the long-term implications before opting for a payday loan.

Introduction To Payday Loans

Payday loans offer quick cash for those in need. They seem simple. But they carry risks. This post uncovers those risks.

Brief History

Payday loans started in the early 1900s. They were small, short-term loans. The aim was to help until payday. Now, they are a multi-billion-dollar industry.

How They Work

Lenders give a small loan to be paid back soon. The borrower writes a check for the loan plus fees. The lender holds the check until payday. Then, they cash it.

High Interest Rates Explained

High Interest Rates Explained show why payday loans can be risky. These loans have much higher rates than others. This makes them hard to pay back. Let’s dive into the details.

Comparisons With Other Loans

Payday loans stand out because of their high interest rates. Compared to personal or car loans, payday loans cost a lot more. Here’s a simple comparison:

- Personal Loan: 5% to 36%

- Car Loan: 3% to 15%

- Payday Loan: Could be up to 400% or more

This shows how much more you pay with a payday loan.

Calculating The True Cost

Understanding the true cost of a payday loan is key. You must look at the Annual Percentage Rate (APR). This tells you the real yearly cost. Let’s see an example:

| Loan Type | Amount | Interest Rate | Term | Total Cost |

|---|---|---|---|---|

| Payday Loan | $500 | 400% | 2 weeks | $615 |

This table makes it clear. You pay $115 extra on a $500 loan in just 2 weeks.

Debt Cycle Potential

Understanding the Debt Cycle Potential of payday loans is crucial. This type of loan seems like a quick fix for cash needs. Yet, it often leads to a deeper financial quagmire. Let’s explore the risks associated with this borrowing option.

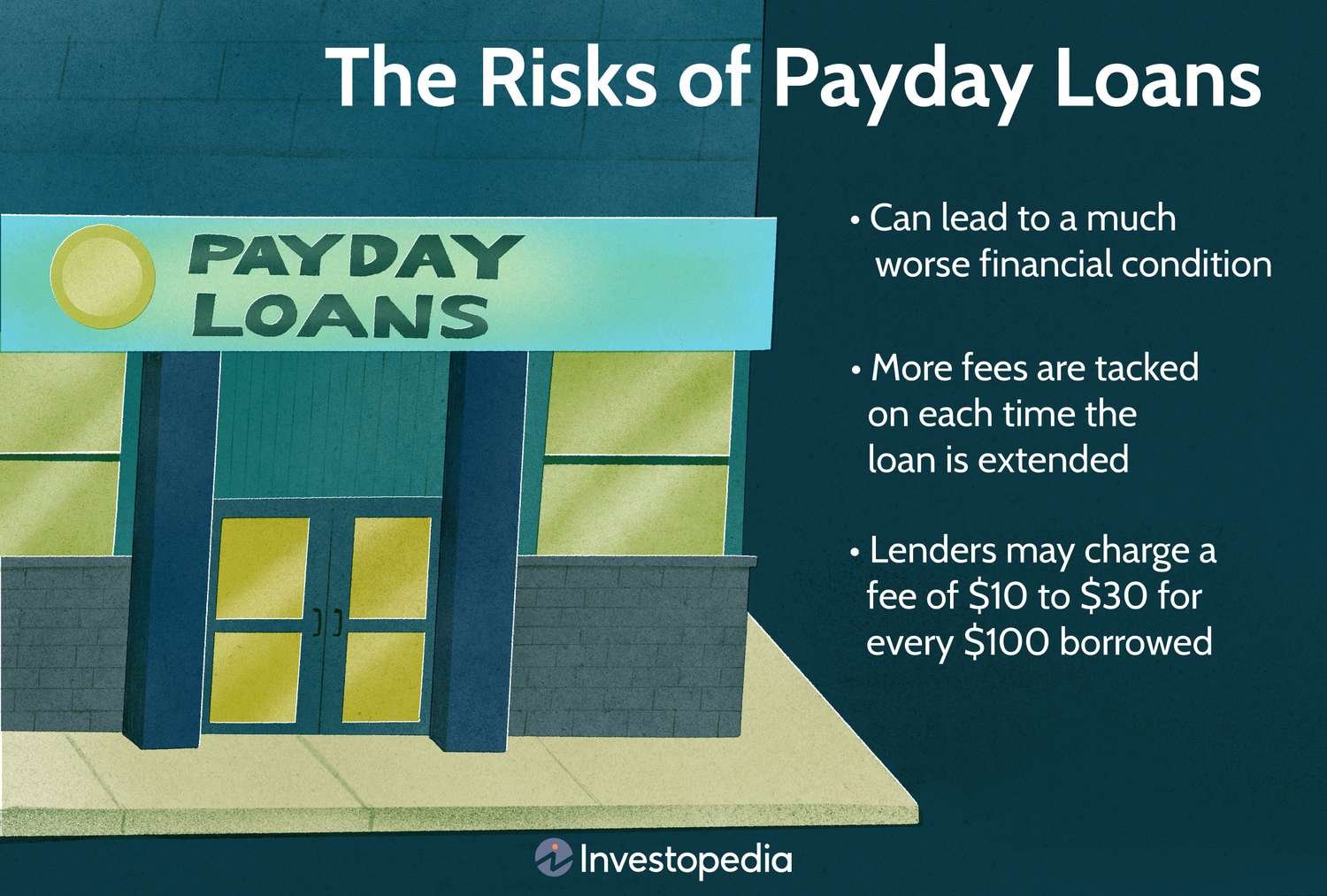

Roll-over Risks

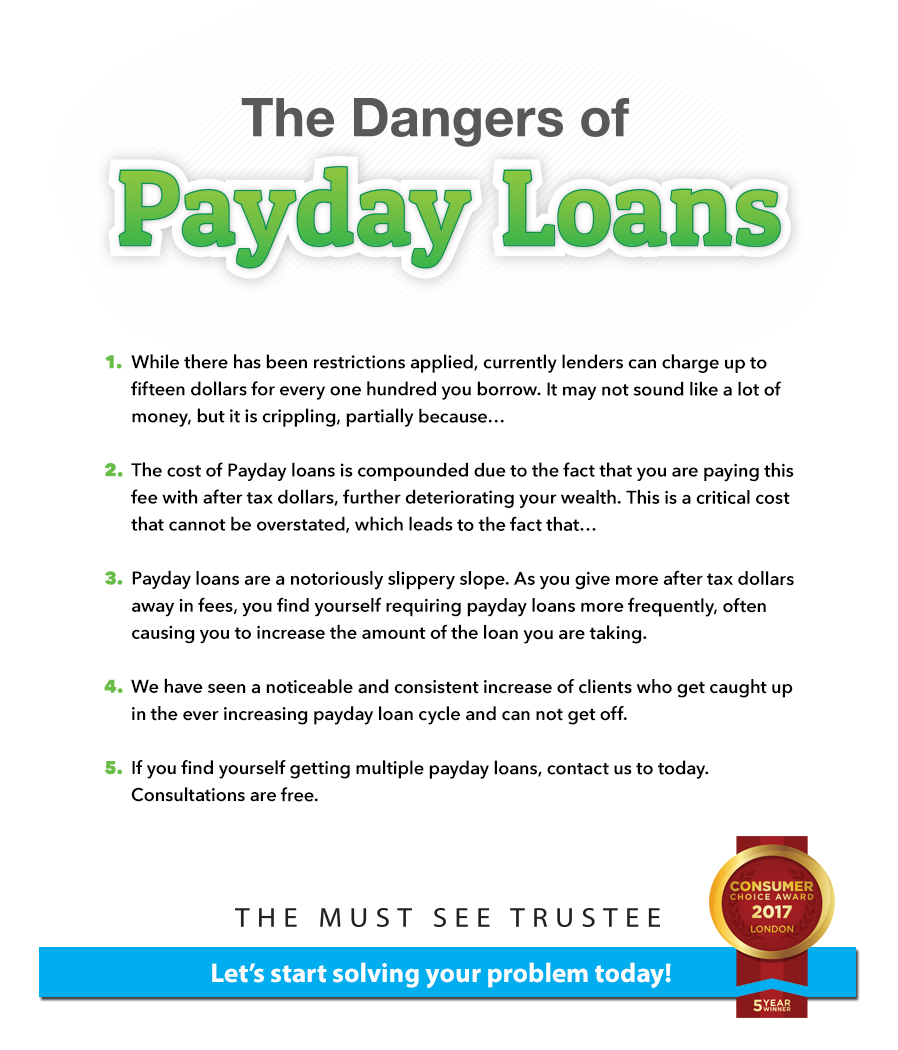

Payday loans tempt borrowers with easy access to funds. But they come with a catch. Many can’t repay these loans on time. This leads to a roll-over, where borrowers extend their loan. This results in additional fees. It’s a trap that can lead to recurring debt. Each roll-over digs a deeper financial hole.

Long-term Consequences

Long-term impacts of payday loans are often severe. Borrowers may face lasting financial scars. This includes credit score damage. It also includes an increased likelihood of bankruptcy. Ultimately, it can hinder future financial opportunities. Think carefully before choosing payday loans. The stakes are high.

Credit: mayocreditunion.org

Credit Score Implications

Understanding the credit score implications of payday loans is crucial. These loans can have lasting effects on your financial health. Let’s dive into how they might affect your credit score.

Short-term Impact

Payday loans can hurt your credit score quickly. If you fail to repay on time, lenders may report you to credit bureaus. This can lower your score. Here are key points:

- Late payments lead to negative marks on your credit report.

- Multiple payday loans can increase your debt-to-income ratio.

- A high ratio can reduce your credit score.

Future Financial Opportunities

The effects of payday loans extend beyond the immediate term. They can limit future financial opportunities. Consider these impacts:

- A lower credit score can block access to prime loans.

- It might increase interest rates on future loans and credit cards.

- Some employers check credit scores before hiring. A low score can cost you job opportunities.

Hidden Fees And Fine Print

Payday loans seem simple but have risks. Hidden fees and fine print can trap you. Let’s uncover these secrets.

Administrative Charges

Payday loans come with extra costs. These are not always clear.

- Application fees can be high.

- Processing fees add more to your loan.

- Some lenders charge for document preparation.

These charges can make your loan much more expensive.

Late Payment Penalties

If you pay late, penalties can be huge. Know these risks:

| Days Late | Penalty |

|---|---|

| 1-3 days | $15 |

| 4-7 days | $30 |

| Over 7 days | $50 or more |

Penalties grow with time. They can double your debt.

Predatory Lending Practices

Payday loans can trap borrowers in debt. Lenders often use unfair tactics. This post highlights the risks of such practices.

Identifying Red Flags

Beware of lenders who:

- Don’t check your credit. They may not care about your ability to pay.

- Rush you into signing. They avoid giving you time to read the terms.

- Hide fees and rates. They make loans appear cheaper than they are.

- Offer rollovers. They let you extend the loan for more fees.

Spot these signs to avoid bad loans.

Legal Protections Against Predatory Lenders

Many laws protect consumers:

| Law | Purpose |

|---|---|

| Truth in Lending Act (TILA) | Makes lenders show all loan costs. |

| Fair Debt Collection Practices Act (FDCPA) | Stops abuse by debt collectors. |

| State Regulations | Set loan limits and ban unfair terms. |

Know your rights and report bad lenders.

Alternatives To Payday Loans

Payday loans can trap you in high interest rates. Smart alternatives save you money and stress. Let’s explore options.

Credit Union Loans

Credit unions offer loans at lower rates. They are member-focused. Their loans often have friendly terms.

- Interest rates are competitive.

- Repayment terms are flexible.

- Members get personalized service.

Payment Plans And Negotiations

Talk to creditors before you borrow. They may offer payment plans to help you.

- Explain your financial situation.

- Ask for an extended payment period.

- Seek reduced interest options.

Remember, clear communication can lead to manageable solutions.

Credit: www.paulpickering.com

Strategies To Avoid Payday Loans

Payday loans can trap you in a cycle of debt. It’s crucial to explore other options to manage your finances effectively. Strategies to avoid these high-cost loans can save you from financial stress. Let’s delve into some smart moves.

Building An Emergency Fund

Saving money may prevent the need for a payday loan. Start small and increase your savings over time. Aim for a fund that covers three to six months of expenses. Here are steps to build your emergency savings:

- Set a monthly savings goal – Even a small amount can add up.

- Cut unnecessary expenses – More money can go into your savings.

- Automate savings – Transfer funds to savings without thinking about it.

- Use a high-interest savings account – Your money will grow faster.

Seeking Financial Advice

Professional advice can guide you to financial stability. Certified financial counselors can help create a budget and find ways to avoid payday loans. They can also suggest strategies to tackle debt. Consider these points:

- Free counseling services – Many nonprofits offer them.

- Debt management plans – They can consolidate payments.

- Financial education workshops – Learn to manage money better.

- Online resources – Use them for tips and budgeting tools.

Consumer Stories And Warnings

Exploring the world of payday loans reveals both heartbreaking and cautionary tales. This section delves into real experiences that highlight the potential pitfalls of these high-interest, short-term loans. Consumer stories serve as stark warnings for others considering this financial path.

Case Studies

John’s Debt Spiral: John, a retail worker, needed quick cash for an emergency car repair. He took out a $500 payday loan with a two-week term. With an APR of 400%, he couldn’t repay on time. He took more loans to cover the first. In months, he owed $2,000.

Sarah’s Credit Damage: Sarah borrowed $300 to pay for medical bills. She planned to repay it in full. Yet, unexpected charges and high interest led to late payments. Her credit score plummeted. She struggled to qualify for future loans.

| Name | Loan Amount | Consequence |

|---|---|---|

| John | $500 | Debt increased to $2,000 |

| Sarah | $300 | Credit score dropped |

Expert Insights

Financial experts often criticize payday loans. They warn about high interest rates and fees. Experts argue that such loans can trap consumers in endless cycles of debt. They suggest alternative solutions like budgeting, emergency funds, or credit counseling.

- High Interest Rates: Can exceed 400% APR

- Debt Cycle: Borrowers often need new loans to pay the old

- Alternative Solutions: Experts advise exploring other options

Credit: fastercapital.com

Frequently Asked Questions

Are Payday Loans High Risk?

Payday loans can be high risk due to their high interest rates and short repayment periods. Borrowers may struggle to repay on time, leading to debt cycles.

What Fees Are Associated With Payday Loans?

Payday loans often have substantial fees, including origination fees, late payment fees, and rollover charges, which can significantly increase the total debt owed.

Can Payday Loans Impact Credit Score?

Yes, payday loans can impact your credit score negatively if you fail to repay them on time. Missed payments may be reported to credit bureaus, lowering your score.

How Do Payday Loans Work?

Payday loans provide quick cash, typically due on your next payday. They require minimal credit checks, but come with high interest rates and fees.

Conclusion

Exploring the landscape of payday loans reveals significant risks, from spiraling debts to high interest rates. It’s crucial to weigh these factors carefully before diving in. Opting for alternatives or seeking financial advice can offer safer pathways. Remember, informed decisions pave the way for financial health and stability.