Collision car insurance is an important part of your auto insurance policy. This type of coverage helps you pay for repairs to your car if you hit another vehicle or object. Let’s dive into what collision car insurance covers and why it is important for you.

Credit: tgsinsurance.com

Understanding Collision Car Insurance

Collision car insurance helps protect your car. It covers damage to your car from accidents with other cars or objects. This can include accidents with trees, fences, or even potholes.

Why You Need Collision Car Insurance

- It helps pay for repairs to your car.

- It provides peace of mind in case of an accident.

- It can save you money on costly repairs.

What Collision Car Insurance Covers

Collision car insurance covers several types of accidents. Here are some examples:

| Type of Accident | Coverage |

|---|---|

| Accident with another car | Repairs to your car |

| Accident with a stationary object | Repairs to your car |

| Single-car accident (e.g., hitting a tree) | Repairs to your car |

| Accident due to potholes | Repairs to your car |

Accidents With Another Car

If you hit another car, collision insurance covers the cost of repairing your car. This is true even if you are at fault. Without this coverage, you would have to pay for repairs out of your own pocket.

Accidents With Stationary Objects

Collision insurance also covers accidents with stationary objects. This includes hitting a fence, wall, or even a mailbox. Again, this coverage helps you avoid paying for these repairs yourself.

Single-car Accidents

Single-car accidents are also covered. For example, if you lose control and hit a tree, collision insurance pays for the repairs. This is especially important because single-car accidents can cause significant damage.

Accidents Due To Potholes

Potholes can cause serious damage to your car. Collision insurance covers repairs if you hit a pothole. This is important because pothole damage can be very costly to fix.

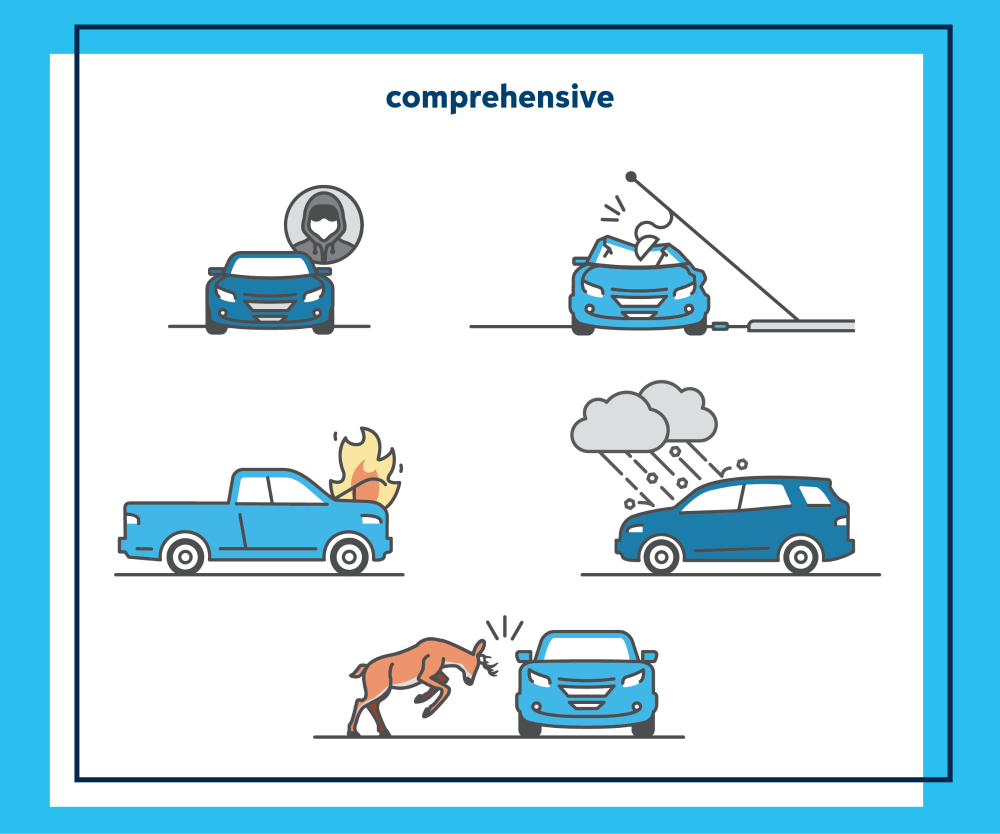

Credit: www.auto-owners.com

What Collision Car Insurance Does Not Cover

While collision insurance covers many types of accidents, it does not cover everything. Here are some examples of what it does not cover:

- Medical expenses

- Damage to other people’s cars

- Theft or vandalism

- Weather-related damage

Medical Expenses

Collision insurance does not cover medical expenses. You will need separate medical or personal injury protection for that. This is important to know so you can ensure you have the right coverage.

Damage To Other People’s Cars

Collision insurance only covers damage to your car. It does not cover damage to other people’s cars. For that, you need liability insurance.

Theft Or Vandalism

Collision insurance does not cover theft or vandalism. For these situations, you need comprehensive insurance. This type of insurance covers non-collision events.

Weather-related Damage

Weather-related damage is also not covered by collision insurance. This includes damage from hail, floods, or storms. Again, comprehensive insurance covers these types of damages.

How to File a Collision Insurance Claim

If you have an accident, you will need to file a claim. Here are the steps to take:

- Contact your insurance company.

- Provide details about the accident.

- Get a repair estimate.

- Submit the estimate to your insurance company.

- Wait for approval.

- Get your car repaired.

Contacting Your Insurance Company

The first step is to contact your insurance company. You can do this by phone or online. Be sure to provide all the details of the accident.

Getting A Repair Estimate

Next, you will need to get a repair estimate. You can do this at a repair shop. Once you have the estimate, submit it to your insurance company.

Waiting For Approval

After you submit the estimate, you will need to wait for approval. This can take a few days. Once approved, you can get your car repaired.

Frequently Asked Questions

What Is Collision Car Insurance?

Collision car insurance covers repairs for your car after a collision, regardless of fault.

Does Collision Insurance Cover All Damages?

No, it only covers damages from collisions, not other incidents like theft or natural disasters.

Is Collision Insurance Mandatory?

Collision insurance is not legally required, but it is often recommended for financial protection.

Does Collision Insurance Cover Rental Cars?

Yes, many policies include coverage for rental cars, but check your specific policy for details.

Can Collision Insurance Lower Repair Costs?

Yes, collision insurance helps reduce out-of-pocket repair costs after an accident.

Conclusion

Collision car insurance is important for protecting your car. It covers many types of accidents, including those with other cars and stationary objects. It does not cover medical expenses, damage to other people’s cars, theft, or weather-related damage. Knowing what is covered can help you choose the right insurance for your needs.