Without health insurance, you face high medical costs and limited access to care. Uninsured individuals often delay or avoid treatment.

Health insurance provides financial protection against medical expenses. Without it, you risk paying out-of-pocket for doctor visits, hospital stays, and prescriptions. This can lead to significant debt, especially in emergencies or for chronic conditions. Lack of insurance also means limited access to preventive care, which can result in undiagnosed or untreated health issues.

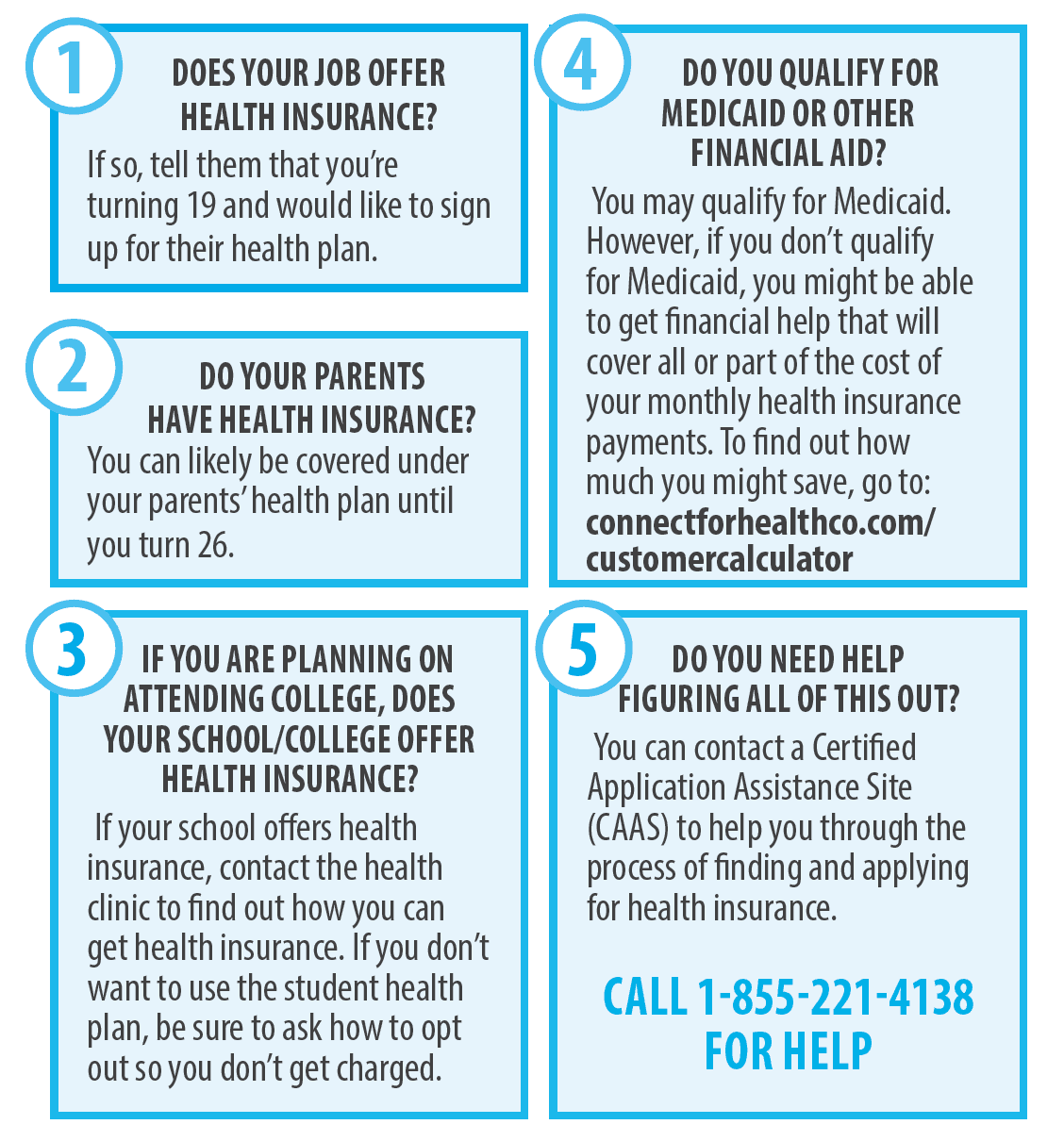

Many uninsured individuals delay seeking medical help, worsening their conditions. Affordable health plans are available through marketplaces or employer-provided options. Prioritizing health insurance is crucial for both financial stability and overall well-being.

Credit: sidecarhealth.com

Financial Consequences

Not having health insurance can lead to serious financial consequences. Medical costs in the United States are very high. Without insurance, you are responsible for all medical bills. This can quickly become overwhelming. Let’s explore the financial impact in more detail.

High Medical Bills

Medical treatments and procedures are very expensive. A single visit to the emergency room can cost thousands of dollars. Surgeries and specialized treatments can add up to tens of thousands. Without insurance, these costs must be paid out-of-pocket. Even a simple doctor’s visit can be costly.

Here is a breakdown of common medical expenses:

| Medical Service | Average Cost |

|---|---|

| Emergency Room Visit | $1,389 |

| X-Ray | $260 |

| Blood Test | $150 |

| Hospital Stay (per day) | $2,517 |

Debt And Bankruptcy

High medical bills can quickly lead to debt. Many people use credit cards or loans to pay medical costs. This can result in high-interest debt. Medical debt is a leading cause of bankruptcy in the United States. Even with savings, medical bills can drain your finances.

Here are some impacts of medical debt:

- Difficulty paying other bills

- Increased stress and anxiety

- Lower credit score

- Risk of losing assets like your home

Without insurance, the financial burden can be devastating. It is important to consider the risks and plan accordingly. Protect your finances and your health.

Limited Access To Care

Not having health insurance can lead to limited access to care. This means you may not receive the medical attention you need. There are several ways this can affect you.

Delayed Treatment

Without health insurance, people often delay seeking treatment. They worry about the cost. Delayed treatment can make health problems worse.

Here are some reasons for delayed treatment:

- High costs of doctor visits

- Expensive medications

- Fear of medical bills

Lack Of Preventive Services

People without insurance miss out on preventive services. These services help catch health issues early. Early detection can save lives.

Examples of preventive services:

| Service | Importance |

|---|---|

| Regular check-ups | Monitor overall health |

| Vaccinations | Prevent diseases |

| Screenings | Detect problems early |

Without these services, small issues can become big problems. Access to preventive care is crucial for long-term health.

Impact On Health

Without health insurance, the impact on your health can be severe. Many people avoid necessary medical care due to high costs. This can lead to worsening conditions and more serious issues. Let’s explore specific areas affected by lack of health insurance.

Chronic Conditions

Chronic conditions like diabetes and hypertension need regular monitoring. Without insurance, many can’t afford regular check-ups or medications. This can lead to complications and even hospitalizations.

A study showed uninsured individuals with chronic illnesses are less likely to receive necessary care. They often skip doctor visits and essential tests. This neglect can lead to severe health problems.

Emergency Situations

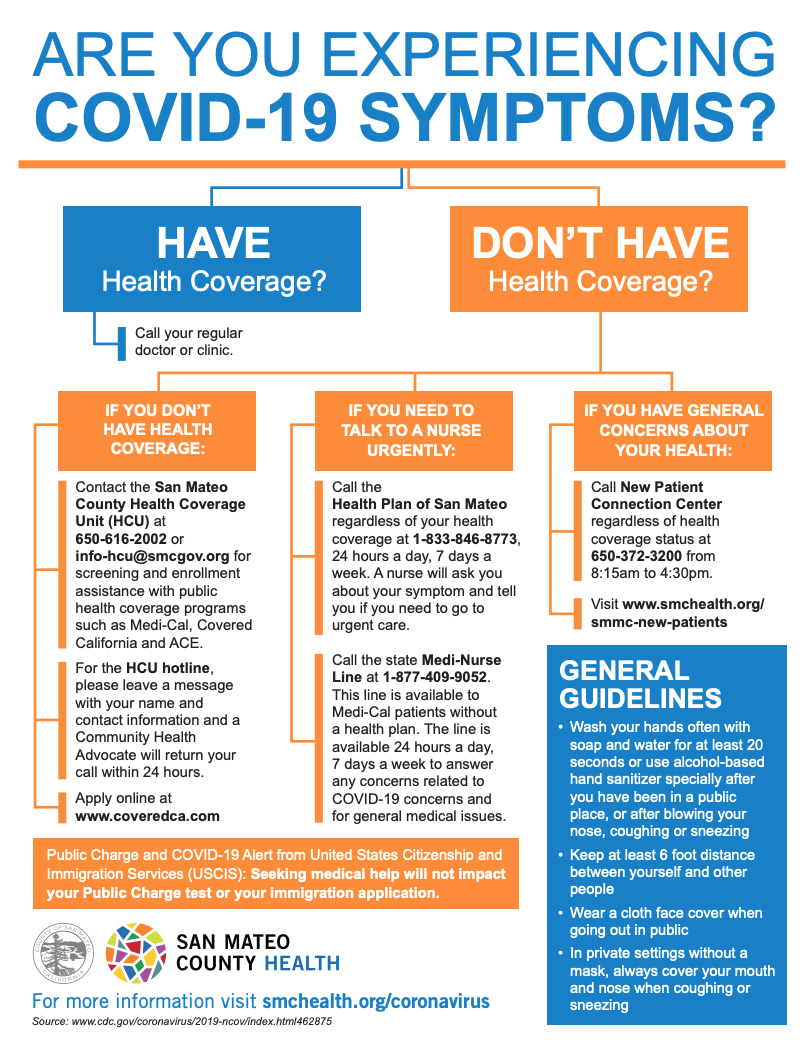

Emergency situations can be life-threatening without health insurance. People may delay seeking urgent care due to cost concerns. This delay can result in worse outcomes or even death.

In emergencies, uninsured patients often face huge medical bills. These financial burdens can lead to debt and financial ruin. Having no insurance can turn a medical emergency into a financial disaster.

Credit: www.smchealth.org

Mental Health Struggles

Not having health insurance can lead to many mental health struggles. One major issue is how it affects your mental well-being. Let’s explore how the lack of health insurance impacts your mental health.

Stress And Anxiety

Without health insurance, you may face high medical bills. This can cause a lot of stress and anxiety. You might worry about how to pay for doctor visits. The fear of unexpected medical costs can keep you awake at night. Over time, this stress can affect your overall mental health.

Stress and anxiety can also worsen if you need regular medication. Paying for mental health meds without insurance is very costly. This financial burden can lead to even more stress and anxiety.

Mental Health Services

Mental health services are essential for a healthy mind. Without insurance, accessing these services becomes challenging. You might not afford therapy or counseling sessions. This can delay or prevent you from getting the help you need.

Many people rely on regular visits to a therapist. These visits help them manage their mental health. Without insurance, these visits become less frequent or stop altogether. This lack of support can lead to worsening mental health conditions.

Here is a quick look at the costs of mental health services without insurance:

| Service | Average Cost Without Insurance |

|---|---|

| Therapy Session | $100 – $200 per hour |

| Psychiatrist Visit | $300 – $500 per visit |

| Mental Health Medications | $50 – $200 per month |

These costs can be overwhelming without insurance. They can lead to avoiding necessary mental health care.

Legal Implications

Not having health insurance can lead to serious legal consequences. These include penalties and fines, as well as state-specific regulations. Understanding these implications is crucial. This can help you avoid unexpected costs and legal troubles.

Penalties And Fines

In the past, the Affordable Care Act (ACA) imposed a penalty. This was for not having health insurance. The penalty was a fee added to your annual taxes. Though the federal penalty has been removed, some states still impose fines.

States like California and Massachusetts have their own individual mandate. This means residents must have health insurance or pay a penalty. The fine can be substantial, affecting your financial stability.

State-specific Regulations

Different states have different rules. Understanding these is essential. California, New Jersey, and Massachusetts have state mandates. They require residents to have health insurance.

California residents face a penalty if they are uninsured. The penalty is based on income and family size. New Jersey also has a similar mandate. Residents without insurance pay a fine when filing state taxes.

Massachusetts has the oldest state mandate. Residents must have health insurance. The state calculates the penalty based on income. It also considers the cost of insurance plans.

Here is a table summarizing state-specific penalties:

| State | Penalty |

|---|---|

| California | Based on income and family size |

| New Jersey | Based on income |

| Massachusetts | Calculated based on income and plan costs |

Societal Impact

Not having health insurance affects more than just the individual. It has significant impacts on society. These impacts can strain resources and affect everyone.

Strain On Healthcare System

Without health insurance, people often delay seeking care. This delay can make conditions worse. It can lead to more severe health issues.

Hospitals and clinics experience an increased burden. They provide care for uninsured people. This often results in overcrowded emergency rooms. Staff members become overwhelmed.

Hospitals must treat everyone, regardless of insurance. This requirement can lead to financial strain. It can reduce the quality of care for all patients.

Economic Burden

Uninsured people often cannot pay for their treatment. This inability creates a significant economic burden. The costs are often passed on to taxpayers and insured patients.

The government may need to allocate more funds. This allocation can divert resources from other essential services. It affects the overall economy.

Businesses may also feel the impact. Increased healthcare costs can lead to higher insurance premiums. Employers may struggle to provide affordable health benefits to their workers.

| Impact Area | Description |

|---|---|

| Healthcare System | Overcrowded emergency rooms and strained resources |

| Economic Burden | Higher costs for taxpayers and insured patients |

| Businesses | Higher insurance premiums and financial strain |

Credit: www.keenandirect.com

Frequently Asked Questions

What Are The Risks Of No Health Insurance?

Without health insurance, you face high medical costs and limited access to care.

Can You Go To Jail For Not Having Health Insurance?

No, you cannot be jailed for lacking health insurance.

How Do You Pay Medical Bills Without Insurance?

You can pay out-of-pocket, set up payment plans, or seek financial aid.

What If I Get Sick Without Health Insurance?

You may face expensive treatment costs and limited options for care.

Are There Penalties For Not Having Health Insurance?

In some places, there are penalties for not having health insurance, but it varies by location.

Conclusion

Navigating life without health insurance can lead to significant financial and health risks. Protecting your well-being is crucial. Ensure you explore affordable insurance options to avoid unexpected medical costs. Investing in health coverage today can prevent future financial burdens and ensure access to necessary medical care.

Prioritize your health and financial stability.